Data under the lens | 2025-04-14

Finding our bearings:tracking circumvention of EU dual-use sanctions on Russia

Bartłomiej Pierzchała

Sanctions under the lens offers a high-level analysis of the European Union’s response to the embargo on dual-use item exports to Russia. Using tapered roller bearings—a critical dual-use component—as a case study, it demonstrates that indicators of potential sanctions circumvention can be detected through publicly available data.

Key insights:

- The EU has successfully stopped exporting dual-use items to Russia following the introduction of the embargo.

- The general value of EUs dual-use export has grown by 23% since 2021, whilst its volume decreased by 7%.

- The case of tapered roller bearings shows that EU dual-use sanctions on Russia caused rapid changes in trade patterns, opening numerous sanction circumvention channels.

- It is possible to find and track suspicious export phenomena using publicly available data, and inexpensive methods.

How and why do we track sanctions circumvention?

This analysis focuses on a critical subset of sanctions—export embargoes on dual-use items imposed by the Global Export Control Coalition (GECC), analysed from the European Union’s perspective. These items – categorized under the Common High- Priority Items (CHPI) list*, ** – target sensitive sectors of Russia’s military industry and aim to weaken its warfighting capabilities.

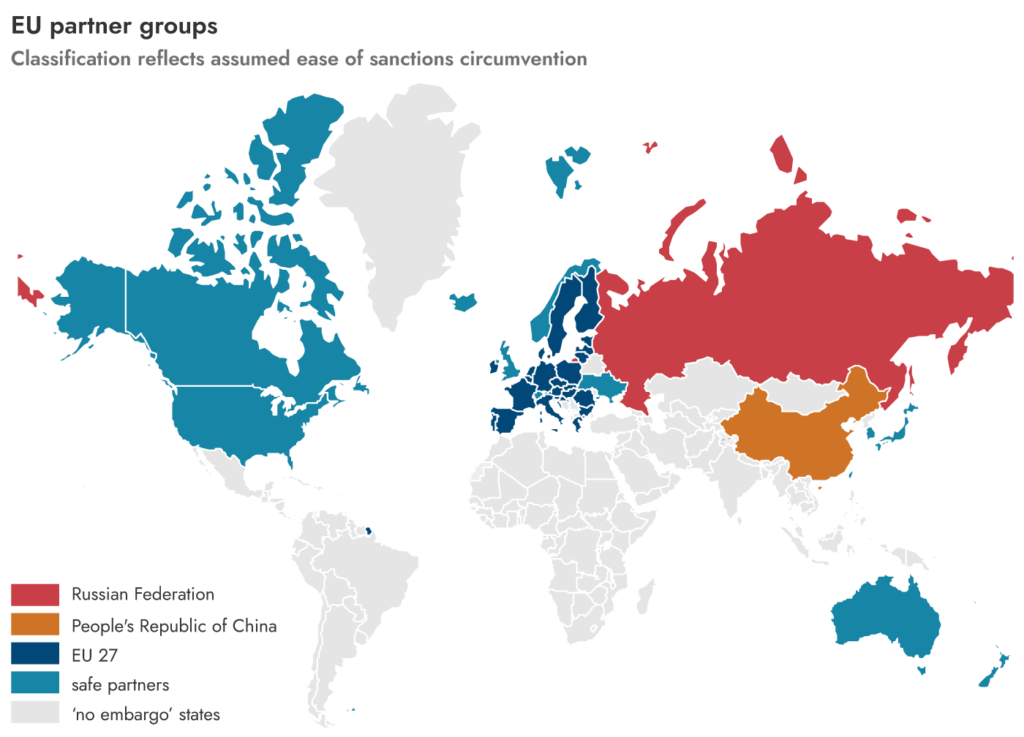

In 2024, EU exports of CHPI were valued at €132 billion, accounting for approximately 4% of the total EU export value. The scale of these trade flows creates opportunities for sanctions circumvention, often through complex networks of shell companies operating across multiple borders. To refine our analysis, we categorized the EU’s global trade partners into distinct groups, applying specific analytical assumptions.

Safe Partners: We consider EU exports to GECC and Ukraine relatively safe, as they are signatories of the CHPI embargo. While some small-scale circumvention may occur, we assume this group to be unlikely to re-export CHPI to Russia

Russia: As the sanctioned entity, the Russian Federation remains the key trade partner to monitor.

China: We treat China as a separate category. While reports indicate its role in facilitating Russian sanctions circumvention, the sheer scale of EU-China trade makes tracking specific upticks related to Russia extremely difficult. Given this challenge, we place less emphasis on China in this analysis.

The “No Embargo” states – Our Main Focus: This diverse set of third countries—those not listed in the previous categories, including many small, non-trading nations—is our primary area of scrutiny. Post-2022 trade surges in these countries are easier to detect but are nonetheless significant in volume.

*February 2024 version is used in this presentation, which contains 50 items. In 2022 World Customs Organisation introduced changes to the Harmonised Trade system, making it impossible to track 5 of those items over time.

**The list is periodically adjusted (see regulation 833/2014).

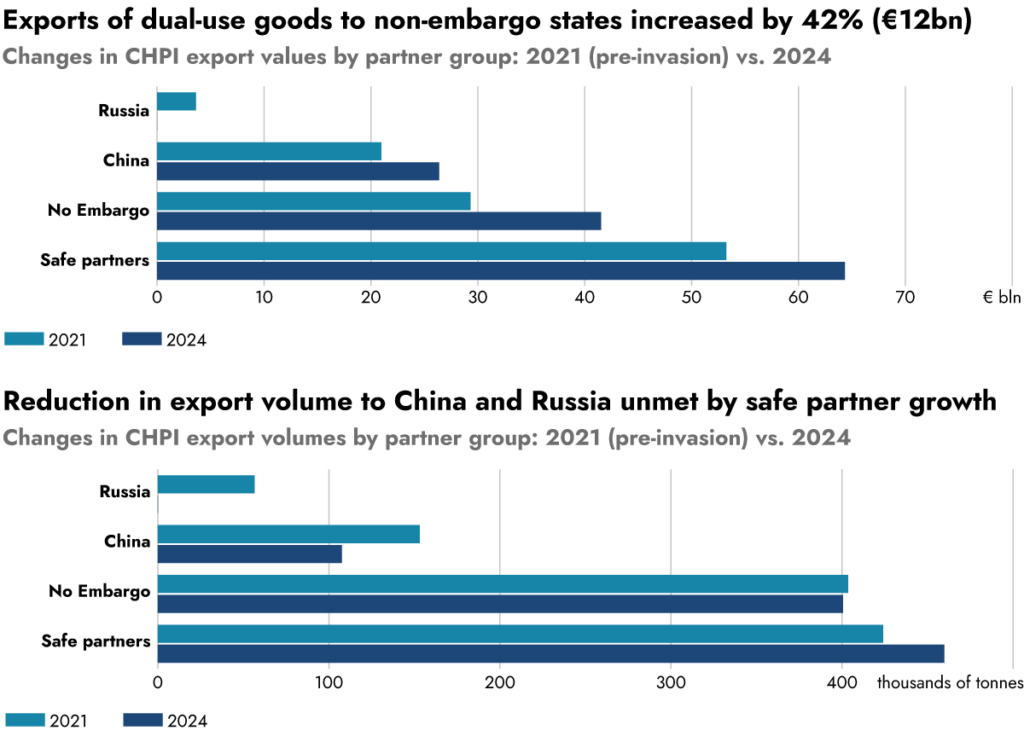

How did the EU export of dual-use items change?

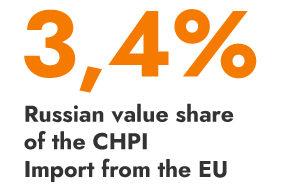

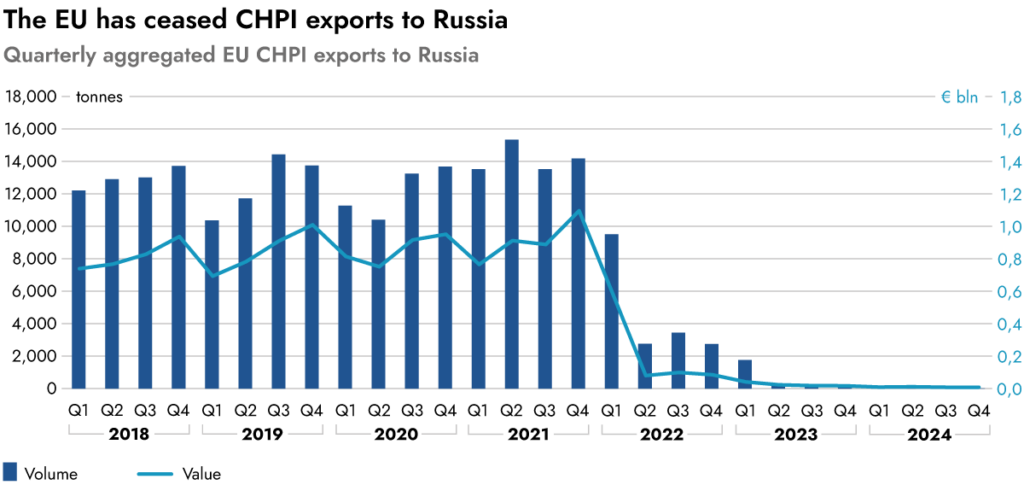

The Russian Federation played a minor role in the EU’s CHPI exports, accounting for 3.4% of total export value in 2021—a share nearly identical to Switzerland’s. Following Russia’s invasion of Ukraine, the EU in collaboration with GECC imposed an embargo on certain dual-use goods. However, EU exports of all CHPI declined in the first half of 2022.

A key milestone came in February 2023 with the expansion of the CHPI list by 21 items (from 18), after which total exports plummeted to negligible levels (0.02% of Q4 2021 value in Q4 2024).

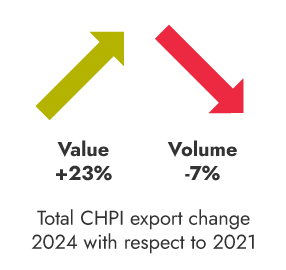

Despite restricted access to the Russian market, the total value of EU exports increased by 23%, while export volume declined by 7% compared to 2021. Export volume to China declined by 30%, while its value rose by 26%, possibly due to U.S. export controls. The drop in Chinese demand, combined with the closure of the Russian market, has been the main driver of the EU’s overall export volume decrease.

The value of EU exports increased across all possible partner groups, with the steepest rise seen in No Embargo States. There, most item categories experienced a rise in value alongside a slight drop in volume. This could indicate either sanctions circumvention—where higher export prices reflect restricted supply—or a shift in the import profile toward more advanced, high-value items.

Going granular: the curious case of tapered roller bearings

Working at aggregate levels of trade data – even within the fairly narrowly defined dual-use goods – can be often misleading. Small scale sanction circumvention transactions can easily hide in large trade flows, often reflecting real and legitimate trade.

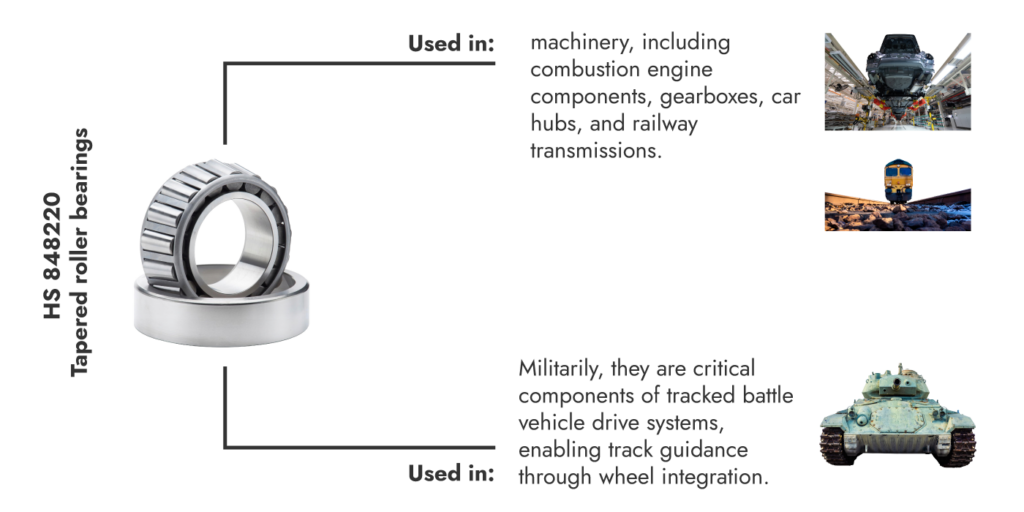

We picked one example of a crucial dual-use industrial component – tapered roller bearings – to go more granular with trade data analysis. As it turns out, highly suspicious activities are fairly easy to track.

Tapered roller bearings provide a valuable case study for two main reasons. First, they are essential in a wide range of machinery, including combustion engine components, gearboxes, car hubs, and railway transmissions. In 2023, imports met about 80% of Russia’s demand for these bearings. Second, their high demand makes any trade upticks easily detectable. Sanctions on this item came into effect in April 2022.

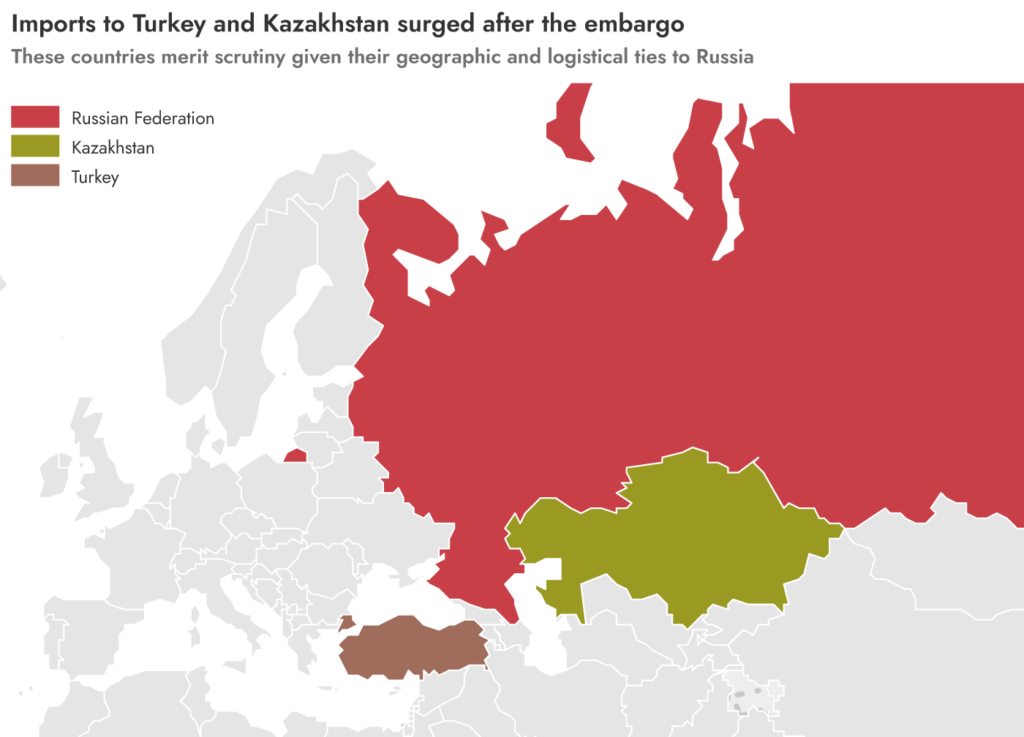

Looking for proxies: Turkey and Kazakhstan

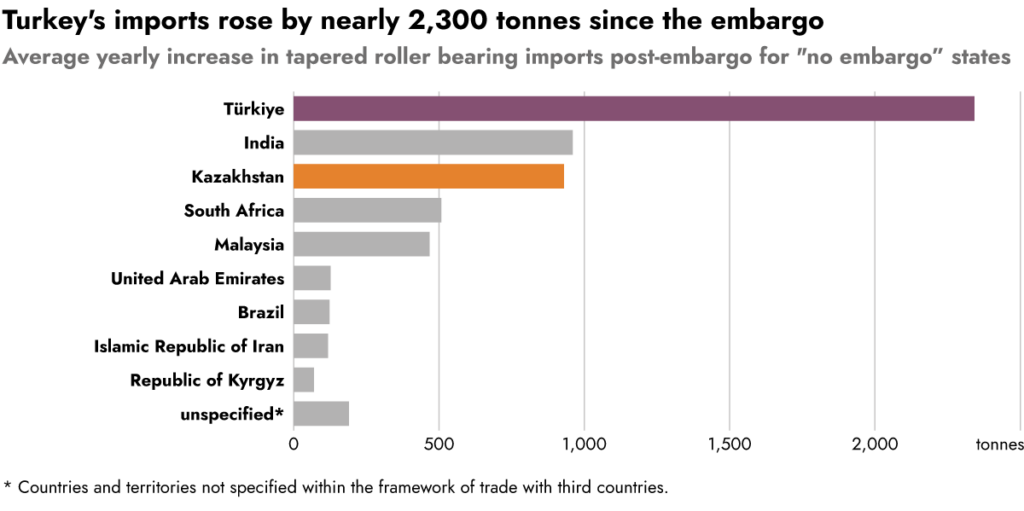

We narrowed down our search to the so-called “no embargo” group, countries that did not join the global sanctions coalition against Russia.

We further refine our analysis by focusing on countries within the “no embargo” group that have shown the most significant increase in trade volume and are geographically close to Russia.

Turkey, as it maintains well-established trade relations with Russia and is a key partner of the EU. Due to the functioning the EU-Turkey Customs Union, Ankara trades fairly easily with EU member states. Its strong logistics infrastructure further supports trade activities. Additionally, due to internal challenges in the year preceding and following Russia’s invasion, Turkey has pursued a pragmatic approach to cooperation with the Russian Federation.

Kazakhstan, as its geographical position holds a strategic trade advantage and is the only Central Asian country sharing a land border with Russia. It is closely tied to Russia through multiple agreements – notably the Eurasian Economic Union with the free movement of goods (with some restrictions) and facilitation of capital movements, which is dominated by Russia. Despite signalling respect for sanctions to the EU and USA, Kazakhstan faces political pressure from Russia.

Finding EU’s lost bearings

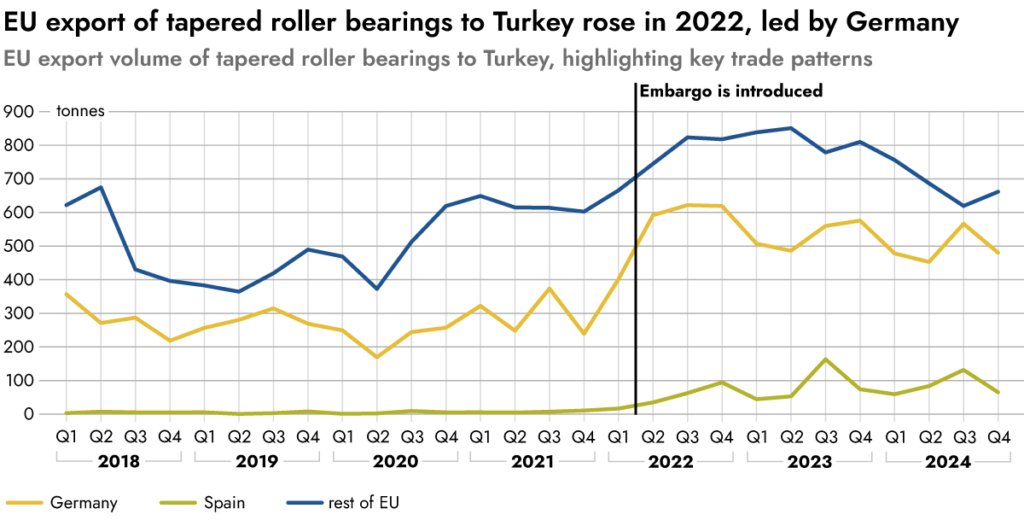

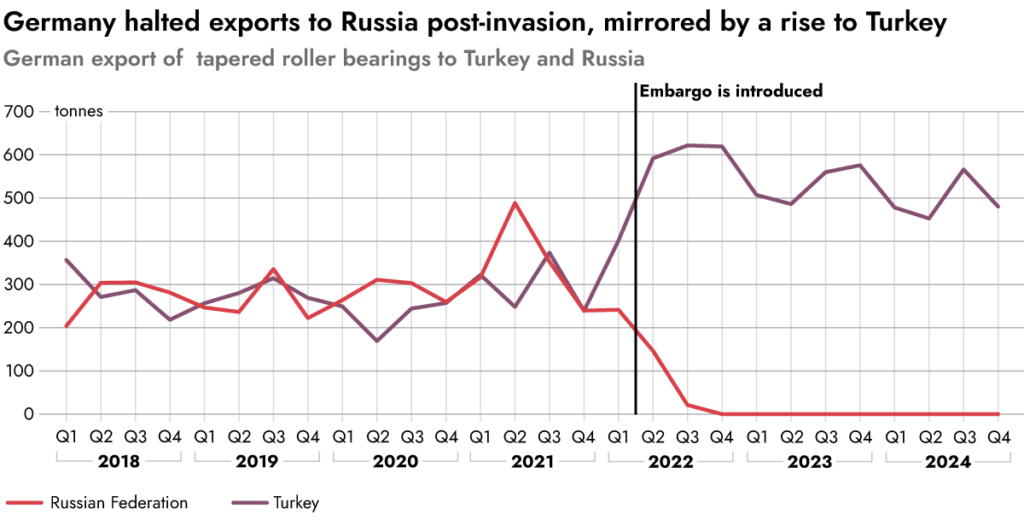

European exports of tapered bearings to Turkey significantly increased in 2022, particularly after sanctions were implemented. In 2024, export volume was 37% higher than in 2021, driven mainly by Germany – the largest exporter, with a 67% increase in 2024 compared to 2021. Other countries, like Spain, also contributed by opening new trade channels.

While Turkey – as an established manufacturing hub – imported bearings before the war, the Russian invasion caused a significant uptick in demand, correlated with EU sanction rounds.

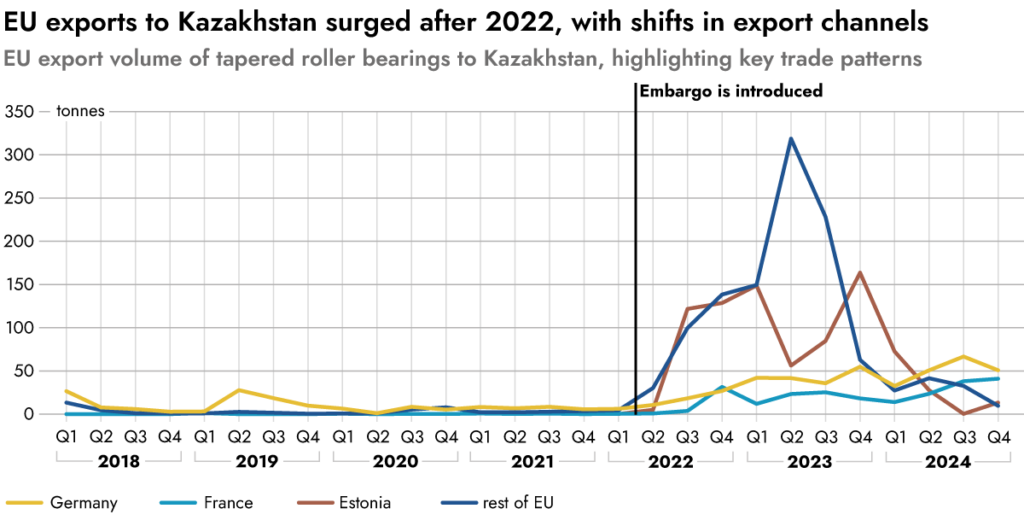

In 2022 Europe has drastically increased its export of tapered bearings to Kazakhstan. This was primarily driven by Estonia and Germany in 2022 and 2023, but after January 2024 Estonia limited its export, whilst France became more prominent. At the end of 2024 Germany and France were the stable exporters.

We can clearly show sanction circumvention channels opening-up and closing after regulatory crackdowns, with some trade patterns here to stay for longer time.

Tracing further export of tapered roller bearings

Given the EU’s increased export of tapered roller bearings to Turkey and Kazakhstan, it is important to examine whether these countries have also increased exports of this item to Russia. This reexport potential can be verified using the United Nations’ Comtrade trade database.

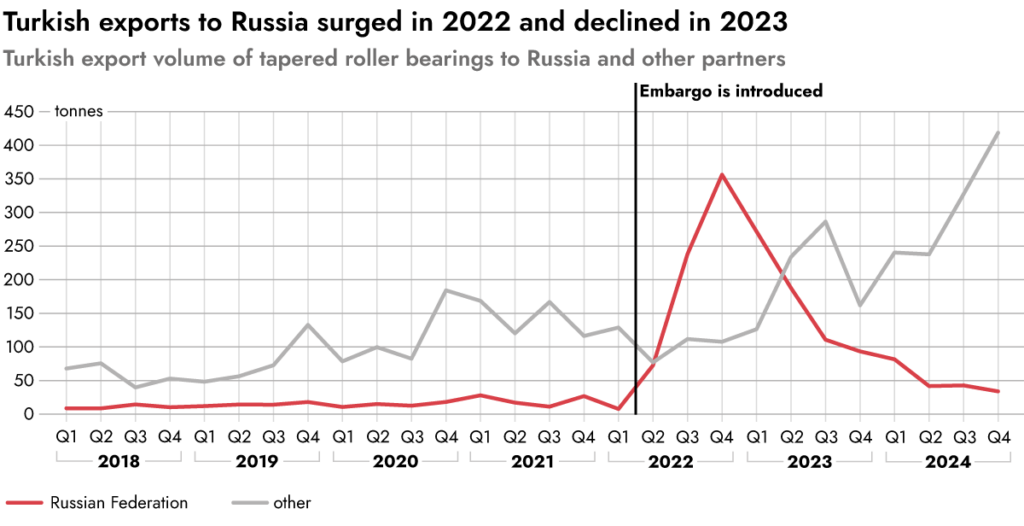

Around the same time the EU increased exports to Turkey, and Turkey significantly boosted its exports to Russia. While these exports remain elevated compared to pre-invasion levels, they have decreased substantially since peaking at the end of 2022. Nevertheless, Turkey’s total export of tapered roller bearings remains 2.2 times higher than pre-invasion levels in 2024. Export to other partners increases at a similar rate to the Russian decrease

Since 2022, Turkey has exported an additional 1.4 kilotons to Russia compared to pre-invasion levels.

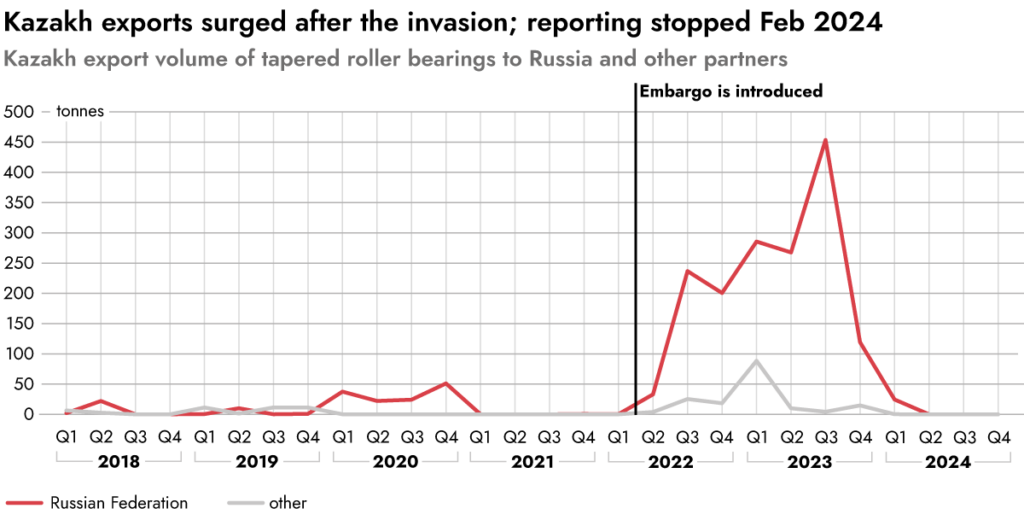

Prior to the Russian invasion, Kazakhstan exported tapered roller bearings only sporadically. However, after the invasion, exports surged – primarily to Russia. In 2023, export levels declined, and by February 2024, Kazakhstan ceased reporting data to Comtrade.

Since 2022, Kazakhstan has exported an additional 1.5 kilotons to Russia, similar in magnitude to Turkey’s additional 1.4 kilotons.

Reaching Russia through proxies

As shown by many real-life investigations, sanction circumvention often takes a form of sophisticated, multi-country logistics chains. Some of the sanctioned goods will not go from EU to Russia via one proxy, but a chain of many proxies.

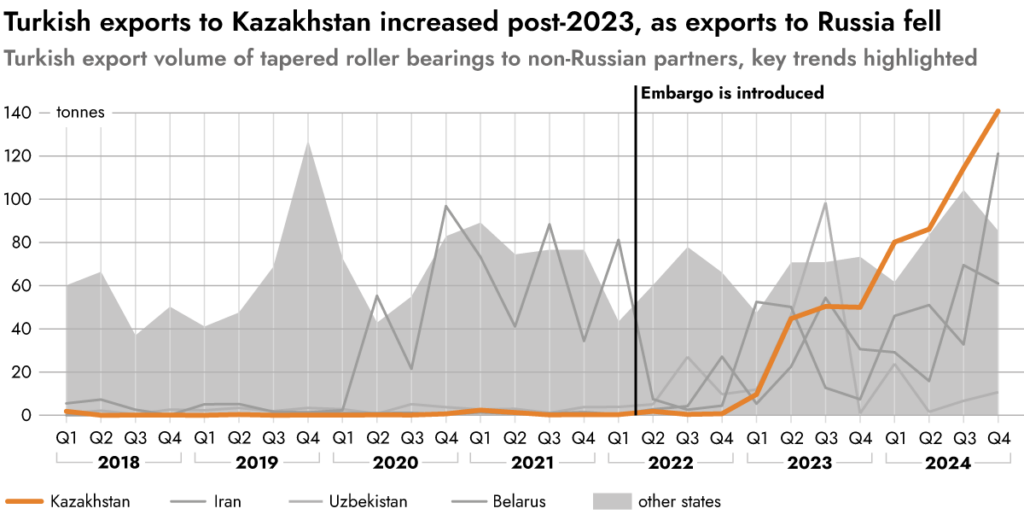

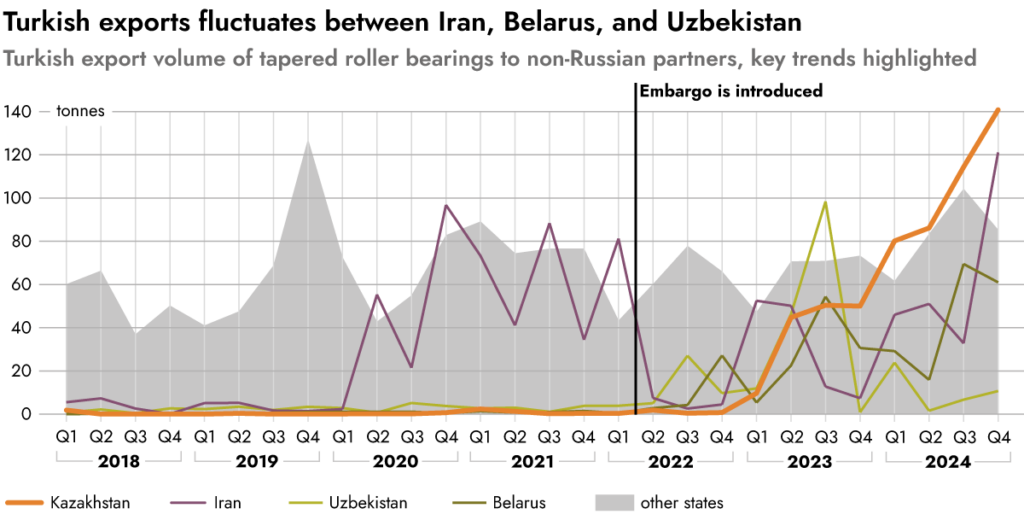

This pattern can also be observed in the Turkish export of tapered roller bearings. While exports to Russia declined, exports to other countries increased at a similar rate, warranting further scrutiny.

We focus on Turkey’s largest trade partners, accounting for 77% of its export volume: Kazakhstan, Iran, Belarus, and Uzbekistan—all of which maintain close ties with Russia. To provide context, exports to other countries are shown as a background comparison.

In the second quarter of 2023, when sanctions took effect, Turkish export of tapered roller bearings to Kazakhstan surged, and still is on an increasing trend. Interestingly, in February 2024 Kazakhstan stopped reporting data, so the item cannot be traced further.

Relatively stable imports by other countries suggest that the selected countries are the primary drivers of increased Turkish exports.

Since 2022, Turkey’s exports to Belarus, Iran and Uzbekistan started to oscillate. As one limits its imports, another increases.

By late 2024, both Belarus and Iran significantly increased their imports. Overall, these countries display an increasing trend.

The bottom line: circumvention hidden in a plain sight

Though Turkey and Kazakhstan differ significantly in market size and structure, both have shown similar patterns: a rise in imports of tapered roller bearings from the EU and a corresponding increase in exports to Russia. Notably, the volume of goods exported to Russia from each country is comparable. Given that Turkey’s market is roughly ten times larger than Kazakhstan’s, it may offer greater capacity to obscure potential sanctions circumvention at scale.

Against this backdrop, it is notable that Germany—Europe’s largest exporter—has sharply increased its exports to Turkey. Following the introduction of sanctions, the monthly average volume of German exports to Turkey rose by an amount equivalent to 94% of Germany’s pre-invasion monthly exports to Russia. This shift underscores the importance of examining export trends from key EU member states—particularly Germany—when assessing Turkey’s growing role in regional trade flows.

Case studies – like exports of tapered roller bearings – can be found using relatively simple statistical and computational methods. While the statistical analysis is never a definitive proof, it can be a guide for more focused regulatory oversight, investigative journalism and public scrutiny.

Find more in a detailed report on sanctions circumvention:

A game of cat and mouse

How Russia is circumventing sanctions

Iwona Wiśniewska

Cooperation: Filip Rudnik