Strength in LNG? The gas market in Turkey

On 2 September, Turkish state-owned energy company BOTAŞ signed a 10-year contract with the British oil giant Shell for the annual supply of four billion cubic metres of gas to Turkey starting in January 2027. The contract also allows for the re-export of LNG from Turkey to other European countries, depending on domestic market demand. On 18 September, BOTAŞ signed a similar 10-year agreement with the French company TotalEnergies to import approximately 1.6 bcm of liquefied gas annually, starting in 2027.

The agreements with Shell and TotalEnergies align with the government’s efforts to diversify Turkey’s LNG suppliers, including this year’s contract with ExxonMobil for 3.5 bcm per year (with no specified date for the commencement of deliveries; see ‘Turkey: opportunities and challenges on the domestic gas market in 2024‘) and an agreement with Oman for 1.4 bcm per year, with deliveries set to begin in 2025. These moves are also linked to Turkey’s efforts to develop a new import portfolio as its major import contracts with Russia and Iran are set to expire.

During a press conference on 18 September, Energy Minister Alparslan Bayraktar announced that the years-long expansion of Turkey’s transmission system, import pipelines, and five LNG terminals has increased the country’s gas import capacity to around 75–80 bcm per year. As a result, this capacity now exceeds what Turkey requires to meet its domestic demand for gas, which totals around 50 bcm per year. Bayraktar added that the resulting surplus of approximately 25–30 bcm per year presents an opportunity for Turkey to act as an energy hub. He also stated that Turkey is ready to use this surplus to (re)export additional gas volumes to Europe via the Trans-Balkan pipeline.

Commentary

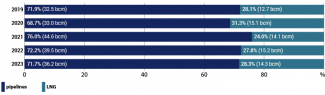

- The new agreements for LNG supplies, along with previously signed contracts, indicate that the share of LNG in Turkey’s total imports and domestic market is likely to increase from 2027 onwards. Currently, Turkey imports an average of 13–15 bcm of LNG per year (see Chart). Under the new agreements, this volume is likely to gradually increase by around 10 bcm. Consequently, from 2027 Turkey could meet up to half of its annual gas demand solely with liquefied gas. Furthermore, unlike the current situation, most of these LNG supplies are expected to be delivered in a more predictable manner, based on medium- and long-term contracts (at present, Turkey purchases most of its LNG through the spot market). Moreover, if Turkey continues to maintain its high levels of purchases through the spot market, the share of LNG in its import portfolio will increase further.

- The recent contracts have bolstered Turkey’s negotiating position concerning the expiring agreements with Iran and Russia, as well as the government’s efforts to extend them. The key contracts that Turkey aims to renew under more favourable terms include the Turkey-Russia agreement for 16 bcm of gas per year supplied through the Blue Stream pipeline (expiring at the end of 2025), the contract for 5.75 bcm per year supplied via TurkStream (also expiring in 2025) and the agreement with Iran for 9.6 bcm per year (ending in July 2026). When negotiations over these agreements commence, Turkey will not yet have received the contracted LNG supplies from Shell and TotalEnergies. However, the increasing gas production from the Black Sea (see below) should provide Turkey with enough confidence to demand better prices and more flexible conditions for imports and (re)exports.

- Despite efforts to diversify its import portfolio, Turkey is unlikely to advocate for a reduction in the volumes of gas it imports from Russia and Iran. This course of action would reduce the potential gas surpluses that the country needs to act as a re-export hub. Meanwhile, Russia and Iran could exploit Turkey’s ambitions to become a major regional energy player by informally selling their gas to the European market as a so-called ‘Turkish blend’, which is likely to raise controversy in the European energy market.

- Turkey will continue its efforts to boost domestic gas production with the aim of enhancing the country’s energy independence and advancing its plan to become a gas hub. In addition to diversifying imports, increasing gas extraction from the Black Sea deposits will be a crucial factor in broadening Turkey's gas portfolio. In 2023, Turkey commenced gas production from these fields, extracting 0.4 bcm in the first year. According to official statements, production in this area is expected to reach 15 bcm by 2026, potentially covering up to 30% of the country’s domestic demand. Achieving this target would significantly reduce Turkey's reliance on gas imports, which currently cover about 98% of domestic demand, and bring down domestic gas and energy prices. Furthermore, such a development could create an opportunity for Turkey to blend its surplus gas from the Black Sea with gas from other sources and sell it to Europe, thereby generating additional revenue for the state budget.

Chart. The composition of gas imports in Turkey

Source: The Energy Market Regulatory Authority (EPDK), epdk.gov.tr.