German exports under pressure: Germany’s trade in 2024

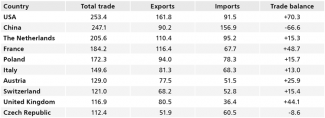

In 2024, the United States was Germany’s most important trading partner, with a trade volume of €253.4 billion and a surplus of €70 billion (see table). The US thus surpassed the previous leader, China (€254.2 billion in trade volume in 2023), which ranked second, experiencing a decline in trade of approximately 2.8%. The main reason for this decline was the growing demand for domestic brands among Chinese consumers, which reduced their interest in German-made goods and, consequently, the value of Germany’s exports to China (by around €7 billion). Poland gained significance, with German exports reaching €94 billion, surpassing sales to China by €3.8 billion. Meanwhile, German imports from Poland amounted to €78.3 billion. China remains Germany’s leading supplier of goods, resulting in a trade deficit of approximately €66.6 billion with the country last year.

The German economy is grappling with long-standing investment and technological backlogs. German companies risk losing not only the Chinese market but also, in the longer term, third markets such as ASEAN and BRICS countries. Furthermore, the tariffs announced by President Donald Trump could significantly disrupt Germany’s international trade relations and diminish the profits of German businesses.

Commentary

- A conflict with the United States over tariffs could significantly weaken the German economy in the coming years. Since 2015, the United States has remained the most important export market for Germany, particularly in the automotive, machine building, and chemical industries. Sales to the US support 1.2 million jobs in Germany, accounting for 10% of all export-related positions. The high trade balance value in 2024 is attributed to the economic boom in the US and Joe Biden’s industrial expansion strategy (see ‘The German dilemma: Berlin’s response to the trade conflict with the USA’). Additionally, economic stagnation in Germany has led to a significant decline in imports of United States goods. The introduction of tariffs on European-made products could put up to 300,000 jobs in Germany at risk, while economic output could decline by 1.5 percentage points by 2027 as a result. Tariffs imposed on Mexico, Canada, and China also affect Germany’s trade relations, as raw materials exported to these countries are processed there and subsequently sold to the US. In 2023, exports to these three nations generated approximately €12.5 billion in total German gross value added.

- The decline in exports to China poses a threat to German industry, particularly the automotive sector. In recent years, Chinese companies have significantly increased the production of goods that were previously imported from Germany. Domestic Chinese electric vehicle brands now compete with German brands in both price and quality, while German vehicles continue to be perceived as premium products. The motor vehicle and automotive parts sector in Germany recorded a 17.9% decline in exports to China (see Chart). Additionally, high energy and labour costs are prompting many major corporations – including BASF, Bosch, VW, and Mercedes-Benz – to relocate production directly to China. In 2022, China was the second-largest destination for German foreign direct investment (after the US), with investments amounting to €122 billion. This trend contradicts the EU’s de-risking strategy, which aims to enhance the bloc’s economic security and reduce dependence on Beijing in this sphere (see ‘Making up for lost time. Germany in the era of the Zeitenwende’). Moreover, a significant portion of the profits generated by German companies in China is reinvested locally rather than repatriated to Germany. Relocating production is rarely feasible for small and medium-sized enterprises, which form the backbone of the German economy. The outlook for 2025 is therefore pessimistic: approximately 80% of exporters anticipate a further decline in sales, which could lead to mass layoffs. In 2024 alone, German automotive suppliers cut 11,000 jobs.

- The decline in Germany’s foreign sales has been partially offset by growing exports to Central and Eastern Europe. Although total German exports fell by 1%, exports to Poland increased by 3.5%, reaching €94 billion. Over the past six years, sales to Poland have grown at an average annual rate of 7.8%. In 2024, for the first time since 2008, Germany sold more goods to Poland than to China. German-made cars were in particularly high demand, driven by the growing popularity of company cars as employee benefits. Among new vehicle registrations, Volkswagen and Mercedes recorded growth of 13% and 35%, respectively. Additionally, some goods imported from Germany to Poland are later re-exported to other countries. In 2024, German value-added accounted for approximately 5% of Poland’s total exports.

Table. Germany’s most important trade partners in 2024 (in billions of euros)

Source: Federal Statistical Office of Germany.

Chart: The value of exports of specific categories of goods to China in 2024 and percentage change compared to 2023

Source: Eurostat.