Tough business in tough times: Belarusian exports of potash fertilisers

The extraction of potash salts and their processing into fertilisers have long been hallmarks of Belarusian industrial success. The state-owned company Belaruskali accounted for up to 20% of the global market, relying entirely on domestic raw material deposits. The sale of large quantities of potash fertilisers to major buyers such as China, Brazil, and India (with EU countries considered secondary importers) not only generated significant revenue for the state budget but also enhanced the prestige and prominence of the Republic of Belarus. This sector represented the country’s sole instance of global leadership in the production of a key commodity.

However, the profitability of Belarus’s potash sector has been in jeopardy since 2021, when it became subject to US and EU sanctions. In early 2022, Belaruskali lost access to the Lithuanian port of Klaipėda, which it had used for transhipment. Consequently, it faced the challenge of establishing new – longer and more costly – export routes through Russian ports, with only partial success. Despite these difficulties and the reliance on cooperation with Russia, Belarus managed to maintain, and in 2023 even increase, its sales of potash fertilisers to China. However, sales to other markets, including the EU (where direct exports are subject to an embargo) and India (where exports have almost completely ceased), declined. The temporary expansion in the Chinese market does not, however, ensure a lasting recovery for Belarus’s potash industry. In the near future, as it struggles merely to survive, it is unlikely to recover the losses incurred due to sanctions.

The potash bonanza

The industrial exploitation of Belarusian potash deposits began in the 1950s. At that time, the city of Soligorsk, which now has a population exceeding 100,000, was founded in the eastern part of the Minsk region. This was followed by the construction of the Soligorsk potash complex, which became the main employer in this part of the country. Since Soviet times, potash mining has been managed by the state-owned company Belaruskali, while sales – including those to international markets – have been handled by the Belarusian Potash Company, which holds a monopoly on potash fertiliser trade. According to official data, current reserves allow for continued exploitation for the next 40 years. Additionally, the corporation has the potential to develop new sites, such as the Petrikov deposit in the Gomel region, which has been operational since 2021.

Belarusian potash salt deposits, ranked among the largest in the world and accounting for approximately 20% of global production, have become the cornerstone of the rapid development of the fertiliser production sector. Since the 1990s, this has been one of Belarus’s strategic industries, alongside the petrochemical, machine manufacturing, and metallurgical sectors. Belarus is generally poor in resources; however, in this instance, it has relied on its domestic reserves, significantly reducing the cost of manufacturing the final product and ensuring independence from external suppliers and raw material price fluctuations. These factors have often negatively impacted the profitability of other industries, such as the fuel sector, which heavily relies on imports from Russia.

Over the past decade, the volume of fertiliser exports has fluctuated between 5 and 7 million tonnes annually, with their value ranging from $2 billion to $3 billion, representing up to 9% of Belarus’s total export revenues. Revenue levels have been influenced by trends in the global potash market, prices negotiated in contracts with individual buyers, and annual production volumes. The highest revenues were recorded in 2018 and 2019, amounting to $2.7 billion and $2.8 billion, respectively. By contrast, the downturn during the pandemic in 2020 led to a decline in revenue to $2.4 billion.

China, Brazil, and India have been the primary importers of Belarusian fertilisers, accounting for approximately 50% of Belarus’s total sales in this commodity category. The remaining exports were distributed among a wide range of countries, with Indonesia and selected EU nations, such as Belgium, being the largest buyers. The vast majority of production was shipped to buyers via the Lithuanian port of Klaipėda. In April 2013, Belaruskali acquired a 30% stake in one of the cargo terminals at this port, which was used, among other purposes, for storing potash fertilisers.

The sanctions shock of 2021–2022

Recognising the strategic importance of the potash sector in Belarus’s economy, its role in sustaining the regime’s financial stability, and the repressions of Belaruskali workers who protested en masse against the rigged 2020 elections, the EU and US imposed sanctions on Belarusian potash fertiliser exports in 2021. This was also a response to Minsk’s confrontational actions targeting the West, such as triggering a migration crisis. The US sanctions had a particularly strong impact, prompting Lithuania to terminate, as of February 2022, its agreement to transport Belarusian fertilisers via Lithuanian railways and to handle their transhipment at the port of Klaipėda. From 2009, Klaipėda had effectively been the sole transhipment port for these goods. This forced the Belarusian regime to seek alternative solutions.[1]

Russian ports became the only viable alternative to Klaipėda, and the Belarusian government developed a new logistics network accordingly. Building on Russian-Belarusian bilateral agreements in effect since February 2021, which granted Belarus access to Russian ports for its exports (supplemented by an agreement signed in September 2022), Belaruskali gradually redirected its shipments to terminals in the Leningrad region, including the ports of Ust-Luga and Bronka, as well as to Novorossiysk, Astrakhan, Murmansk, and even Vladivostok. Minsk also announced plans to construct its own transhipment terminal in Bronka, near St Petersburg, although no updates on the commencement of this project have been reported.

Simultaneously, discussions were initiated with Russian Railways and the Chinese government to negotiate terms for fertiliser deliveries to the Chinese market via land transport. However, these alternatives presented significant drawbacks. Distances involved were substantially greater than to Klaipėda, ranging from 400 to several thousand kilometres, depending on the Russian port. Additionally, Belarus faced competition from Russian counterparts, Uralkali and Eurochem, which claimed priority access to Russian railway and port infrastructure. Disputes over terminal and railway access, as well as pricing, further complicated matters. To maintain its market position, the Belarusian manufacturer engaged in aggressive dumping, reportedly offering prices up to 50% below the market value.

These measures proved insufficient to sustain pre-sanction production and export levels. Official government data indicate that Belarus’s share in the global potash market fell from 20% to just 9% in 2022, with even sharper declines in some regional markets. For instance, in Africa (including Zimbabwe, Zambia, and Kenya), Belarus’s share plummeted from 42% to a mere 3%. Market gaps were quickly filled by competitors, including the Canadian potash company Nutrien, which reported a tenfold increase in sales during the first quarter of 2022 alone.

Since May 2021, Minsk has classified statistical data on fertiliser trade, selectively disclosing figures to support its narrative on international platforms such as the UN or BRICS. This narrative criticises the “irresponsible” Western sanctions policy, claiming it restricts access to fertilisers from Russia and Belarus for Global South countries, with Belarusian diplomats blaming the West for rising food prices and undermining global food security. According to American industry experts, potash production in Belarus fell by 60% in 2022, dropping to just 3 million tonnes, highlighting the severity of the challenges faced by Belaruskali.

The Chinese priority

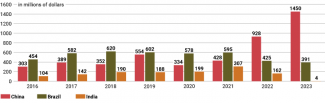

Officially, the Belarusian government assured a swift return to pre-2022 export levels, claiming, for instance, that the 2023 sales target of 8 million tonnes of fertilisers would be met. This would imply surpassing results achieved under much more favourable conditions when full access to Klaipėda was available. However, disclosed data show a significant decline in 2022–2023, with a roughly 50% reduction in deliveries to Brazil and an almost complete collapse of sales to the Indian market. As a result, since 2022, Belaruskali has been unable to meet the overly ambitious targets set by the regime.

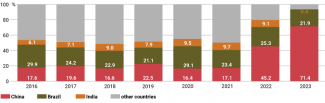

At the same time, there was a dramatic surge in exports to China, which became an absolute priority for Minsk in both volume and financial terms. The scale of this growth is illustrated by an increase in China’s share in Belarus’s potash sales from 17% in 2021 to over 70% in 2023. However, the nature of this ‘success’ reveals certain limitations. A comparison of the quantity and value of potash exports to China in 2022 and 2023 shows a much larger increase in sales volume than in revenues generated. This suggests that Minsk prioritised maximising export volumes at significantly reduced prices.

This strategy has been driven by the ongoing global potash market downturn since 2023 and China’s strong negotiating position, bolstered by several factors: Minsk’s lack of access to alternative markets, large fertiliser stockpiles within China, and intense competition in the sector. Furthermore, growing competition from Russian and Canadian suppliers has increasingly pushed Belaruskali out of the Chinese market since early 2023. This is reflected in a 50% drop in the value of Belarusian sales (to $585 million) during the first eight months of the year, even as competitors reported growth.

This trend persists despite Belarus’s reported increase in fertiliser deliveries to China. According to Belarusian sources (not yet corroborated by Chinese statistics), these shipments reached 1 million tonnes, equivalent to the company’s maximum monthly production capacity. This suggests that Belarus is unlikely to replicate its 2023 performance, when sales to China reached nearly $1.5 billion for the first time.

Other key markets

The two other key importers of Belarusian fertilisers, Brazil and India, have presented significant challenges: issues with intermediaries who previously handled deliveries to these markets and concerns about potential repercussions from secondary US sanctions. Brazil continues to import from Belarus but has significantly reduced its purchases. This reduction has been partially offset by aggressive dumping strategies, with discounts reportedly exceeding 60%, and vigorous lobbying efforts by the Belarusian embassy in Brazil. Numerous meetings with Brazil’s ambassador to Belarus have also occurred, including a meeting with Alyaksandr Lukashenka in August 2023, during which potash fertiliser exports were a key topic of discussion. Minsk’s ultimate goal is to restore previous sales levels, when Belaruskali’s production accounted for 20% of the Brazilian market.

Belarus’s position in India is significantly worse, with sales dropping to nearly zero. The Indian government announced its intention to seek alternative suppliers as early as spring 2022, shortly after the US embargo on Belarusian fertilisers took effect. Factors discouraging India from continuing collaboration with Belaruskali included logistical challenges after the loss of Klaipėda and failed attempts to process payments in the national currencies of both countries, bypassing euros and dollars to circumvent sanctions-related financial restrictions. Despite these setbacks, the Belarusian government has not abandoned this once highly profitable market. In January 2023, Alyaksandr Lukashenka appointed a new ambassador to New Delhi, tasked with revitalising bilateral trade from its “state of decline”.

Western sanctions have also led to a complete cessation of exports to the EU. Consequently, with the exception of the three key markets of China, Brazil, and India, the share of other countries in Belarusian fertiliser imports has drastically diminished (see Chart 3).

Challenges rather than benefits

The Western embargo and more expensive logistical solutions for transporting goods have caused significant shifts in Belarusian potash fertiliser exports, severely restricting access to key markets. Despite Minsk’s propaganda-laden statements, Belarus has been unable to recover the losses caused by Western sanctions, nor has it established a fully stable supply system or secured new markets.

The unprecedented surge in sales to China was achieved at the cost of aggressive dumping, and there is little to suggest that this level of trade can be sustained. The Belarusian potash industry is now effectively dependent on Russian rail transit and port operations, as well as contracts with Chinese buyers. This dependency has significantly undermined the sector’s potential, even though it was one of the most profitable branches of the Belarusian economy just two years ago.

As a result of Western sanctions, the Belarusian potash sector is on the brink of collapse. Without the lifting or at least partial easing of these restrictions, it will be unable to regain the momentum it enjoyed before 2022. Consequently, Belarus is gradually losing its position in the global potash market. What was once a powerful export engine and a source of national pride is increasingly becoming a challenge for the Belarusian economy.

APPENDIX

Chart 1. Exports of potash fertilisers to China, Brazil, and India

Source: Comtrade.

Chart 2. Exports of potash fertilisers to China, Brazil, and India

Source: Comtrade.

Chart 3. The share of China, Brazil, India, and other countries in the export of Belarusian potash fertilisers

Source: Comtrade.

[1] J. Hyndle-Hussein, S. Matuszak, K. Kłysiński, ‘Białoruś: częściowa blokada kolejowego tranzytu towarowego z Litwy’, OSW, 24 February 2022, osw.waw.pl.