Crisis of the Putin economic model in Russia

On 15-16 December there was a crisis on the Russian financial market, during which the rouble lost about a quarter of its value. The Central Bank decided to hike the base rate by 6.5 points, and made a series of interventions on the foreign exchange market. Some banks have stopped providing loans or trading currency. The Kremlin has distanced itself from the situation, and the government and the Central Bank have agreed to recapitalise the banks. The current problems are only one element of the rapidly deteriorating economic situation in Russia. This is being exacerbated in particular by the falling price of oil, which is the main source of Russia's export and budgetary revenue, and to a lesser extent the Western economic sanctions which were introduced in response to Moscow's aggressive foreign policy. The root of Russia's problems, however, is the exhaustion of the raw-materials model of the Russian economy and the growing flaws in an increasingly corrupt and inefficient political and economic system. Russia will not escape economic crisis in 2015. Not even a clear improvement in the economic situation and the lifting of Western sanctions will help it protect itself from long-term stagnation at the very least, unless deep, systemic political and economic reforms are introduced in the country. These, however, are impossible under the rule of Vladimir Putin.

The financial crisis and the government's reaction

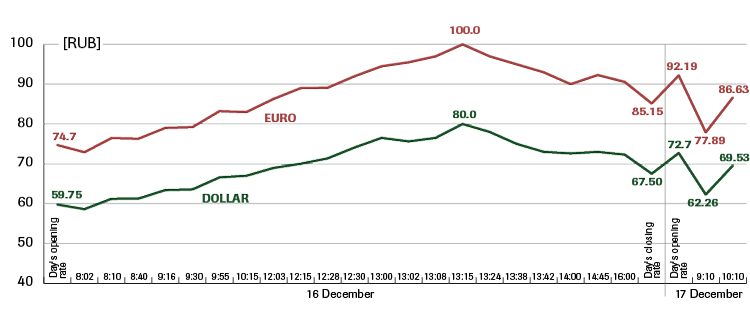

On 15-16 December there was a crisis on the Russian financial market. Initially the rouble lost 38% of its value against the dollar (from 58 to 80 roubles to the dollar). This was accompanied by drops in the stock market indices (by a total of about 23%). Only a series of interventions on the currency market by the Central Bank brought about a temporary stabilisation of the exchange rate at around 70 roubles to the dollar by the morning of 17 December. Some banks have stopped granting loans or trading currency, and there have been reports of people buying up stocks of imported goods.

The immediate cause of the currency market's collapse seems to have been an insufficient supply of dollars resulting from their hoarding or purchasing (for fear of a further decline in the rouble) by Russian banks and exporter companies (allegations of this have been levelled against the state-owned Rosneft, among others), as well as continually falling oil prices, the main source of Russia's export revenue. The problem intensified the panic on the markets which resulted from a lack of confidence from economic entities and the general public in the government and its economic decisions.

In response to the situation, the Central Bank, in agreement with the Kremlin, took a dramatic decision on the evening of 15 December to raise the base rate from 10.5% to 17%. These measures proved to be ineffective, and only the Central Bank's sale of an unspecified sum of currency reserves on 16 and 17 December stabilised the rouble's exchange rate.

The Kremlin has formally distanced itself from the trouble. President Putin has not spoken in public, and has not taken an official stand; and his spokesman Dmitry Peskov has designated the Central Bank and the government as being the responsible institutions in the current situation. Pro-Kremlin commentators have raised the idea that Russia is the victim of a speculative attack organised by the West. A meeting of the government and the Central Bank, which was held under the chairmanship of Prime Minister Medvedev on the afternoon of 16 December, took a series of unspecified decisions to recapitalise the banks and maintain interest rates.

The sources of the Russian economy's problems

The current financial crisis in Russia is only one element of the Russian economy's major problems. These include not only the significant weakening of the Russian currency (the rouble's exchange rate for the US dollar has risen by 110% since the beginning of 2014), but also the rapid outflow of foreign capital (estimated by the Central Bank at US$128 billion by the end of 2014), rising inflation (projected at about 10% by the end of 2014), and declining GDP growth (projected at 0.4-0.7% in 2014).

Three groups of factors have contributed to this situation:

First and foremost, structural problems. We are witnessing the exhaustion of the potential of the development model for the Russian economy based on energy exports (crude oil, petroleum products and natural gas), which has provided about 70% of export earnings, 50% of budget revenues and 20% of Russia's GDP. This was clearly apparent in 2012-2013 when, despite sustained high oil prices on global markets, the Russian economy's growth rate slowed steadily (3.4% GDP growth in 2012; 1.3% in 2013). This slight increase was only maintained thanks to consumer demand stimulated by wage increases, mainly in the public sector. The plans to diversify and modernise the Russian economy as a basis for its further development, which were declared in a number of government programmes, have remained on paper. Such significant investments as were made, including those from foreign countries, were carried out primarily in the energy sector. At the same time, businessmen linked to President Putin were given special privileges. The unfavourable investment climate was worsened by the following factors: vast and growing systemic corruption; the embezzlement of public funds; inefficient management; the state's increased participation in and extent of control over the economy; and especially the increasing feeling of insecurity regarding property. Regarding this last point, the attack by the state on the AFK Sistema company and its chief Vladimir Yevtushenkov was of considerable psychological importance (in the autumn of 2014 Yevtushenkov was deprived of his shares in the oil group Bashneft and put under house arrest).

Secondly, Russia's aggressive foreign policy under the leadership of President Vladimir Putin - the most spectacular manifestation of which has been the occupation and annexation of Crimea, together with the instigation of and support for the armed rebellion in eastern Ukraine in the spring of 2014 - has led to the most serious crisis in Russia's relations with the West since the end of the Cold War. The Western sanctions introduced in March 2014 (especially the economic sanctions at the end of July), have restricted the access of major Russian banks, energy and arms companies to foreign currency loans. And although the Russian Ministry of Finance has estimated direct financial losses due to the sanctions at US$40 billion, they have also been indirectly affected by the deterioration of the investment climate (foreign direct investment in Russia fell by more than half in 2014, to US$21 billion), by the increasing outflow of capital from Russia, and by increasingly limited cooperation between leading Western and Russian companies.

Moreover, President Putin's militant, anti-Western rhetoric has deepened the fears of both Russian and foreign businesses that the situation will deteriorate further. Paradoxically, the effects most noticeable to Russian society have not been the Western sanctions, but rather the counter-sanctions introduced by President Putin in August 2014 (the ban on the import of many food products from Western countries). In view of the significant proportion of selected imported goods in consumption, this move resulted in an increase in food prices, and fuelled the rise of inflation.

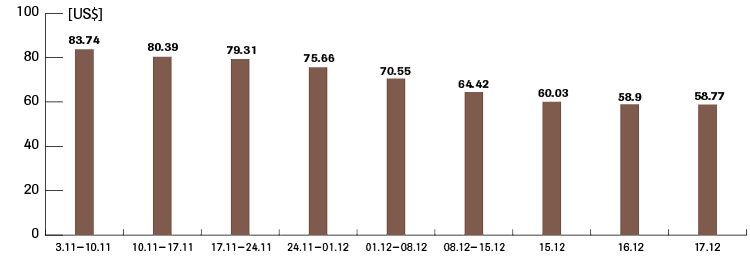

Thirdly, October 2014 saw the start of a steep fall in oil prices on world markets (from US$94.40 per barrel at the beginning of October to US$58 per barrel in mid-December). This accelerated the depreciation of the rouble, contributed to the rise in inflation, and created a major challenge for the Russian budget, which draws half of its revenue from oil and gas exports (to balance the budget in 2015, the price of oil has to stay at around US$100 per barrel, and every dollar of decline in the price of oil represents approximately US$2.5 billion of export revenue loss). On the one hand, the depreciation of the rouble has made imports more expensive (Russian industry is on average 60% dependent on imported foreign, mainly Western, components; in certain positions this figure reaches 90%). On the other, however, it saves the Russian budget from complete collapse; a decrease in the dollar exchange rate of 1 rouble represents a gain of about US$5 billion in revenue for the budget.

What next?

Both the persistent negative factors affecting the Russian economy, as well as the anti-crisis measures taken by the Russian government, will have a serious impact on the deterioration of Russia's economic indicators in 2015. While oil prices remained at around US$60 per barrel, the Central Bank estimated the GDP's contraction at 4.5-4.7%, and the Ministry of Finance foresaw a loss of revenue totalling US$100 billion. It will therefore be necessary to make an amendment to the budget for the years 2015-2017, which is presently based on unrealistic indicators.

Another major problem is the need to repay US$134 billion of the foreign debt of Russian companies (70% of which are state-owned companies) by the end of 2015, although this is likely to be at least partially restructured by the creditors. Instability in the foreign exchange market will engender aversion to the rouble and - at least informally - the dollarisation of the Russian economy (as had already happened in the 1990s). Russia may indeed benefit from its accumulated reserves of foreign currency and ore (which currently amount to about US$400 billion), but only some of these are liquid assets which, in case of the need to make currency interventions to support faltering companies and banks, will rapidly disappear - the more so as a number of large companies (including Rosneft, Gazprom, Novatek, Russian Railways) are already seeking financial support for their planned investments. The decision to raise the base interest rate to 17% will make loans significantly more expensive, which will result in serious financial difficulties for many banks and companies. Nor will Russia be able to replace most of the goods imported from the West, because of the technological backwardness of its own production.

The growing problems of the Russian economy have not so far brought about any change in the government's economic policy, and there is no indication that such a change will take place in the near future. The government's current actions do not appear to be sufficient to avoid a serious economic crisis. In this situation, we cannot rule out the possible introduction of administrative measures to control the currency market and the prices of basic goods, or ultimately a moratorium on the repayment of corporate foreign debt. On the other hand, even if Western sanctions are eliminated and oil prices rise, the Russian economy cannot avoid long-term stagnation at the very least. The victim of this situation will be Russian society, especially the most active and mobile part of it.

The diagnosis of the economic situation presented by President Putin (including his annual report to the Federal Assembly in December) and his proposed actions show that the Kremlin rejects the possibility (even if limited) of reforms to the current political and economic model, which is the real source of Russia's economic problems.

This text was prepared at 12 00pm. 17 December

Appendix

Changes in the price of Brent crude oil (US$ per barrel) in the period from 3 November to 17 December

Changes in the dollar and euro rates to the rouble on 16-17 December