Turkey: opportunities and challenges on the domestic gas market in 2024

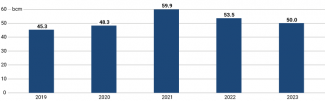

Last year Turkey’s gas imports fell significantly, from 54.7 bcm in 2022 to 47.5 bcm. This mainly stemmed from declining gas consumption in the country (down more than 6% y/y to 50 bcm), partly as a consequence of the financial crisis it is undergoing.

Chart 1. Turkey’s domestic gas consumption in 2019–2023

Source: The Energy Market Regulatory Authority (EPDK), epdk.gov.tr.

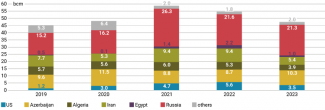

The volume of Turkey’s gas imports from Iran decreased most sharply, plunging by more than 42% to 5.4 bcm. LNG imports were also down in 2023, falling by a third to around 10 bcm. By contrast, gas imports from Russia remained fairly stable at around 21 bcm. Turkey also reported an increase in its gas imports from Azerbaijan to 10.25 bcm. As a result, the share of Russian and Azerbaijani gas in Turkey’s import mix increased in 2023 to around 45% and 21.6% respectively.

Chart 2. Turkey’s gas imports in 2019–2023

Source: The Energy Market Regulatory Authority (EPDK), epdk.gov.tr.

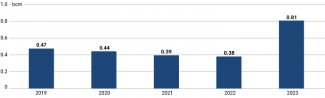

The drop in gas imports to Turkey is also related to the start of gas production in the Turkish part of the Black Sea: this rose from 0.38 bcm in 2022 to 0.8 bcm in 2023. According to the Turkish government, domestic gas currently supplies 1.8 million households. Finally, Turkey made its import and transmission capacity (up to more than 1.5 bcm per year) available to Bulgaria over the past year and started exporting gas to Moldova and Romania last autumn, followed by Hungary in April this year.

Chart 3. Turkey’s gas production in 2019–2023

Source: The Energy Market Regulatory Authority (EPDK), epdk.gov.tr.

This year, Turkey has clearly stepped up its activity in the gas market. On 29 April, its energy minister announced plans to increase the production of gas from the fields at the bottom of the Black Sea; this is expected to rise to about 15 bcm by 2026, and to cover up to 30% of total domestic demand. To meet this challenge Turkey has continued to drill on the Black Sea seabed, the total gas reserves of which have been estimated at 710 bcm. On 2 May, an amendment to Turkey’s mining legislation came into force along with a number of new energy laws that will make it easier for Turkey to export gas to neighbouring countries and onto European markets more broadly.

As part of Turkey’s efforts to diversify its sources of gas supply, on 8 May the Turkish state-owned oil and gas company BOTAŞ signed an agreement on LNG imports and trade with the US energy giant ExxonMobil. According to media reports, this agreement (whose details have not been made public) will operate for 10 years and provide for the supply of up to 2.5 million tonnes of LNG per year (3.5 bcm of gas) to Turkey. Consequently, the share of US gas in the Turkish market will increase under this agreement. Turkey is currently the world’s seventh largest importer of gas from the United States.

In addition, on 14 May Turkey and Azerbaijan signed an agreement on the transport of natural gas from Turkmenistan to Turkey via Azerbaijan and Georgia. This follows up on the Turkish-Turkmen agreements on gas imports from Turkmenistan which was struck in March (for more see ‘The start of a process? Turkey and Turkmenistan are planning gas cooperation‘). The details of the Turkish-Azerbaijani agreement, including gas transmission volumes, have not been made public. During the conference, Turkey’s energy minister said that the agreement with Azerbaijan also includes arrangements to increase the capacity of TANAP and the South Caucasus Pipeline, two gas pipelines that form part of the Southern Gas Corridor. However, no date for the start or completion of the work has been given, which suggests that this is actually a preliminary agreement in the form of a political declaration. Finally, Turkey’s energy minister also announced that a new gas pipeline running from Iğdır to Nakhichevan would open by next winter; it will supply gas from Turkey to the Azerbaijani enclave of Nakhichevan.

Commentary

- Figures from the Turkish gas sector for 2023 showed a drop in domestic consumption that will most likely remain at a similar level this year. However coupled together with growing production and expanded import capacities this trend also increases the potential for gas re-exports by Turkey. Last year, Turkey stepped up its activity in this area, signing agreements for the export of Turkish gas and giving access to its energy infrastructure to Bulgaria, Romania, Moldova and Hungary. Along with this year’s gas commitments and agreements (including the import deals with ExxonMobil, Turkmenistan and the expansion of Turkey’s transmission infrastructure), this demonstrates that Turkey has increased its efforts to establish itself as a gas hub and an important regional energy player connecting Europe with the countries of the Caucasus, Central Asia and the Middle East.

- One of the major domestic challenges for Turkey is its high level of dependence on foreign gas and the associated vulnerability to price fluctuations (particularly with regard to imports on the spot market), which could have a negative impact on the Turkish economy. For this reason, Turkey has been actively reducing the share of gas in its electricity production (which currently stands at more than 21%), and ultimately it wants to increase the share of electricity generated by nuclear power plants (by 2030, this source is expected to meet about 30% of domestic demand). However, even when the Akkuyu plant is completed in 2026, nuclear power will only meet 10% of the national demand for energy. This will keep Turkey highly dependent on imports and also justify its efforts to shape the domestic gas supply mix in the best possible way.

- Turkey will face an additional challenge over the next two years as several of its large import contracts (which cover almost 65% of the country’s current gas consumption) are set to expire, making it necessary to either extend them or replace them with new ones. Three contracts with Gazprom Export (to supply 16 bcm/y via the Blue Stream pipelines and 5.75 bcm/y via TurkStream) expire in late 2025, while the agreement with Iran to supply up to 9.6 bcm/y runs out in mid-2026. This means that the increased imports of gas from Azerbaijan, the deal with ExxonMobil and the plans to obtain gas from Turkmenistan could not only help Turkey diversify its gas supplies in the short term, but also reduce domestic demand for Russian and Iranian gas and broaden Ankara’s negotiating options in talks with Moscow and/or Tehran with regards to new contracts. In addition, the favourable terms of supply and contracting larger than necessary volumes of gas will allow Turkey to continue re-exporting this resource to third countries.

- Russia, the country from which Turkey continues to import the largest volumes of gas, will remain Ankara’s key partner in this field. Turkey is the second largest market for Russian gas after China. In the context of the ongoing war in Ukraine and the sharp drop in exports to Europe, the Turkish government is seeking to put its gas cooperation with Russia on a more favourable footing by either extending the current supply contracts or by signing new ones on satisfactory terms. It also hopes that Russia will remain interested in cooperating on creating a gas hub in Turkey; this would allow Russian gas (as well as some Turkish domestic production and imports from other sources) to be re-exported to third countries (so-called Turkish blend). Currently Ankara does not need to further expand the transmission infrastructure connecting the two countries to potentially import more gas from Russia, as only two-thirds of the capacity of the TurkStream and Blue Stream pipelines is in use; a further 10 bcm of capacity remains available. This does not change the fact that Russia will remain Turkey’s key energy partner over the coming years, which means that we should not expect any radical shifts in Turkey’s policy in this area.

- Cooperation with Azerbaijan is also becoming increasingly important for Turkey. Firstly, the role of Azerbaijani gas and its share in Turkish imports has been growing. In addition, the two countries have been tightening their bilateral transit cooperation. On the one hand, Turkey is becoming increasingly important as a corridor for transporting Azeri gas to Europe; on the other, Azerbaijan has been playing an increasingly prominent role in facilitating the supply of Turkmen gas onto the Turkish market. This also entails Azerbaijani-Turkish cooperation in expanding the existing gas pipeline infrastructure, primarily as part of the Southern Gas Corridor.