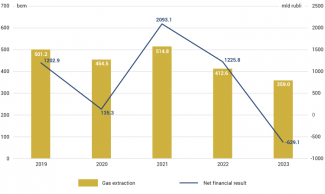

Gazprom in 2023: financial losses hit a record high

In May, Gazprom published its annual financial report for 2023, revealing a loss of 629 billion roubles (around $7 billion at the current exchange rate). This is the first time the company has reported a negative result since 1999. The largest decline was observed in the gas segment, where revenues fell from 7.72 trillion roubles to 4.41 trillion roubles year-on-year (equivalent to a drop from $87 billion to $50 billion). The oil and power segments, however, did see modest increases. The report also noted a drop in foreign sales from 7.3 trillion to 2.9 trillion roubles. In addition to this, Gazprom reported a fall in gas production in 2023 by 13% year-on-year to 359 bcm, which is a historical low.

For all these reasons, the company’s board of directors decided not to pay dividends to investors for 2023. Dividends had been consistently paid out from 1998 through 2022, though it was decided to forego payment for 2021, and in 2023 to limit payments to only the first half of 2022. This move hit Gazprom’s stock price on the Moscow Stock Exchange; the price dropped from 150 roubles per stock at the beginning of May to nearly 115 roubles per stock by 13 June, marking a decrease of almost 25%, and reaching the lowest level since 2017.

Commentary

- Gazprom’s unprecedented financial loss is the result of two major factors: the significant loss of market share in Europe due to politically motivated decisions by Russia to limit gas supplies in that direction (while it was still impossible to redirect them to other markets) and a decline in commodity prices on the global markets after reaching record highs in 2022. In 2023, Russian gas exports to Europe via pipeline stood at just over 26 bcm, compared to nearly 150 bcm in 2021. The most drastic decline was seen in 2022, when gas sales dropped by nearly 90 bcm compared to the previous year, but the negative financial impact of this reduction was mitigated by high hydrocarbon prices (‘Gazprom in 2022: production and exports down, profits up’).

- Gazprom’s financial result in 2024 is set to improve as a result of a resurgence in its international sales. Currently, Russian exports are higher than last year across all routes. In the first quarter of this year, Gazprom exported nearly 7.9 bcm of gas to Europe via Ukraine and the European section of TurkStream, compared to around 5.5 bcm in the same period in 2023. Sales via the Power of Siberia pipeline running to China are also increasing, an expected 8 bcm up on 2023. There are also plans to boost exports to Central Asia. An uptick in sales to Turkey is also possible, since the BlueStream and TurkStream pipelines are only being used to up to two-thirds of their capacity (the latter is designated for domestic consumption), so a capacity of around 10 bcm is still available. Furthermore, Gazprom’s LNG sales, albeit relatively small compared to the pipeline volumes, are set to grow in 2024 following the acquisition of a 27.5% stake in the Sakhalin-2 project from Shell.

- It is uncertain whether Gazprom’s financial situation will continue to improve in 2025, as the company will be unable to rebuild its lost power without strengthening its presence on the lucrative European market. Meanwhile its presence on this market will likely shrink, as the transit agreement between Gazprom and Naftogaz of Ukraine is due to expire this year (Russia currently exports around half of the volume destined for the European market through Ukrainian territory). Unless a solution is developed to extend transit via this route beyond 2025, the only operational route available for gas exports from Russia to the EU will be the Bulgarian section of TurkStream, with an annual capacity of 15.75 bcm. Despite these challenges, according to media reports citing an internal Gazprom document, the company envisions increasing its sales to Europe to 50–75 bcm per year by 2035. This optimistic outlook hinges on expanding current transmission capacities as a result of the reconstruction and/or reactivation of existing pipelines (Nord Stream and Yamal) or the construction of new connections that would make it possible to re-export gas to European customers via Turkey in line with this country’s ambitions to become a gas hub. The internal Gazprom report cited in the media suggests that the company has not given up hopes of remaining a major gas supplier to Europe, while no longer being a key supplier. This attitude, however, contrasts with the EU’s declaration to discontinue purchasing Russian gas by 2027 altogether. Despite the Kremlin’s announcements of ‘turning Eastwards’ (including in the gas sector), the Russian government will most likely make efforts to continue the Russian presence in the European market. Therefore, the EU must demonstrate its determination to effectively eliminate this dependency as planned.

- Increasing Gazprom’s presence on Asian markets will not compensate for the loss of Europe, given the lower profitability of exports in that direction and the greater assertiveness of Asian buyers. It is uncertain whether the Kremlin-promoted Russian-Chinese Power of Siberia-2 pipeline, with a planned annual capacity of 50 bcm, will be built to redirect gas from Western Siberian fields to Asia (so far the output from these fields has been sent to Europe). No official announcements indicative of any progress in talks concerning this project were made during Vladimir Putin’s recent trip to China in May (see Together against the West. Putin in China). According to media reports, the project has not moved forward any further because the parties have been unable to agree on the price and volume of gas transmission. Reportedly, the Chinese side is demanding supplies at a price close to the domestic Russian rate, which would make the entire venture totally unprofitable. Furthermore, Beijing is reportedly not interested in utilising the full capacity of the proposed Russian pipeline. On the other hand, Gazprom recently achieved success by signing contracts with three Central Asian countries, thus gaining more access to markets in Uzbekistan and Kyrgyzstan via Kazakhstan until 2040. Under these contracts, it will be able sell up to a maximum of 12 bcm of gas per year, although this is still a small volume compared to the amounts it had been transporting to Europe before 2022.

- The decline in export revenues is complicating Gazprom’s operations in Russia, specifically its activities involving regional gasification and selling gas to local consumers at low, state-regulated prices. Gazprom could afford to offer preferential prices to domestic consumers because its export sales generated high revenues, facilitating the subsidy of supplies on the Russian market. The reduction in foreign income is forcing Gazprom to seek new sources of financing, including inside Russia – for example, by persistently advocating for the liberalisation of the domestic market so it can sell gas to domestic consumers at market prices. It is worth noting that the government has decided to partially raise tariffs for local consumers (by 11% from July of this year, and another increase is expected in 2025). However, to achieve a level of rates profitable for Gazprom, it would be necessary to sell gas at market prices to both individual and industrial customers. This in turn could trigger inflation and adversely affect the defence industry (which has been given particular priority in wartime conditions) and worsen the public mood. Considering all this, the Kremlin is unlikely to adopt this solution, so Gazprom’s situation will only worsen. In the longer term, Gazprom may turn from a major revenue source for the government into a financial burden. This would raise structural questions about its role in Russian energy policy.

Chart. Gazprom’s annual net financial result compared to levels of gas extraction in 2019–2023

Source: Gazprom.