Sanctions on Russia: the Biden administration’s parting blow

The sanctions package adopted on 10 January by the outgoing Biden administration represents the most severe blow to Russia’s oil sector since early 2023. The restrictions targeted a record number of tankers from the ‘shadow fleet’ which transport Russian oil and fuels. Additionally, several Russian energy companies were directly targeted by the sanctions.

The Russian oil sector is likely to face substantial challenges due to the recently imposed measures, as difficulties in exporting its production via maritime routes will be further exacerbated. The threat of secondary sanctions will discourage partners from engaging in oil and fuel trade with Russia, while also preventing some ports and refineries from accepting shipments from the country. This will complicate Russia’s export operations, increasing associated costs and negatively impacting budgetary revenues. The introduction of these sanctions shortly before the change in administration reflects the outgoing team’s intent to intensify pressure on Moscow. This may serve as a bargaining tool for the incoming Trump administration in potential negotiations regarding a ceasefire in Ukraine.

The unprecedented scale of the sanctions package

The new US sanctions impose the most severe restrictions on Russia’s energy sector in two years, following the G7 countries’ introduction of the price cap mechanism on Russian oil. Under the new package, more than 400 individuals and entities from the oil and fuel sector’s entire value chain, as well as from other industries, including gas and coal, were put on the updated US sanctions lists.

The measures also targeted companies that violated previous regulations, such as the operator of a Chinese oil terminal that accepted a shipment from a sanctioned tanker. The sanctions lists were expanded to include several key figures managing Russia’s most important energy corporations. These include Vadim Vorobyov (Lukoil), Alexander Dyukov (Gazprom Neft), Vladimir Bogdanov (Surgutneftegaz), and Alexey Likhachev (Rosatom), along with several senior officials from Russia’s Ministry of Energy.

Tankers under special scrutiny

The United States has sanctioned 183 vessels, 155 of which are tankers involved in exporting Russian crude oil and petroleum products. The remaining vessels include LNG carriers, tugboats, and icebreakers. Previously, as of October 2023, 54 tankers were on the sanctions list. This new package therefore quadruples the number of targeted ships, affecting the servicing of approximately one-third of Russia's maritime oil exports. The sanctions also extend to traders involved in this trade, registered in Hong Kong, the United Arab Emirates, India, and other countries, as well as two major Russian tanker insurance providers: Ingosstrakh Insurance Company and AlfaStrakhovanie Group.

Washington’s decision will significantly hinder Russian oil exports and likely increase costs due to the need to establish new supply chains. The fact that the vast majority of vessels targeted in 2023–2024 have been removed from active service proves that US sanctions on tankers are an effective measure. This is the result of the ‘chilling effect’ of US restrictions, which deter third-country entities from handling cargo from these ships.

A blow to the primary sector

The United States has also imposed sanctions on several companies involved in the extraction of energy resources (coal and oil) and rare metals (such as lithium), as well as entities managing specific projects. These include Vostok Oil and two mid-scale LNG terminals on the Baltic Sea: Cryogas-Vysotsk and Portovaya LNG. The inclusion of two major corporations – Surgutneftegaz and Gazprom Neft (a subsidiary of Gazprom) – in the sanctions list is expected to significantly impact Russian oil exports. Several associated entities were also targeted, including Serbia’s NIS, in which Gazprom Neft holds a 50% stake and Gazprom a 6.15% stake. Surgutneftegaz and Gazprom Neft rank among Russia’s most important oil and fuel producers and exporters, ranking fourth and third in national oil output, respectively. In 2023, their combined production accounted for 23% of Russian crude extraction. According to industry estimates, they were responsible for 30% of Russia’s seaborne oil exports during the first ten months of 2024.

Sanctioning these companies increases the risk of US restrictions being extended to any refinery processing their crude. This is likely to compel both firms to reconfigure their supply chains. They may redirect more production to the domestic market or send shipments to refineries willing to assume the associated risks, such as smaller facilities, including ‘teapot’ refineries in China, that do not participate in global trade. They could also sell crude and fuels to other exporters within Russia. However, given the companies’ market significance, these channels are unlikely to fully absorb their production. Furthermore, such adjustments will inevitably impact the companies’ revenues.

The United States has also banned the provision of services to Russia’s oil and fuel sector, including activities related to exploration, extraction, and refining of crude oil. Exceptions were made for projects under the Caspian Pipeline Consortium, Tengizchevroil, and Sakhalin-2. Simultaneously, several companies operating within Russia were added to the sanctions lists, primarily those that acquired the assets and personnel of Western firms that withdrew from the country in 2022.

These measures, designed to impair Russia’s technological capabilities, will have a moderate impact on the industry. According to estimates by Norway’s Rystad Energy, approximately 15% of Russia’s drilling sector relies on foreign technologies. Nonetheless, Washington’s ban is likely to result in the complete withdrawal of the remaining Western companies still operating in Russia, such as Texas-based SLB.

Russian reactions to the sanctions so far

In response to the US decision, Russia’s Ministry of Foreign Affairs issued a standard statement, asserting that unspecified measures would be taken and claiming that the restrictions imposed so far have been ineffective and destabilising to global markets. The Russian stock market largely disregarded the new restrictions. Initially, the rouble depreciated by approximately 1.5%, and the shares of sanctioned companies fell by up to 2%. However, these losses were swiftly recovered. This suggests confidence in the Russian state’s ability to mitigate the impact of sanctions, as well as the belief that the incoming Trump administration may soon lift them.

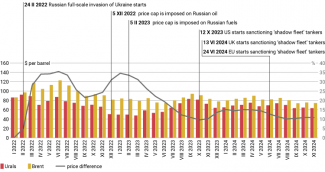

In anticipation of reduced Russian oil supply, the global market reacted with a rise in crude prices. Brent crude increased from $76 per barrel on 9 January to over $80 following the market opening on 13 January, including a rise in the price of Russia’s Urals blend. The broader effects of the US measures will emerge over time, as licences permitting transactions with sanctioned entities remain valid until the end of February.

The impact of the American sanctions on the EU

Some of the announced restrictions indirectly pressure EU states to fully cease importing Russian gas and enhance their oversight of ship traffic in nearby waters. Sanctions targeting two LNG facilities – Cryogas-Vysotsk and Portovaya LNG, with a combined production capacity of approximately 2.1 million tonnes annually – effectively block these volumes from reaching European terminals. This will significantly complicate export logistics by lengthening supply routes and is likely to affect the revenues of the facilities’ owners, Gazprom and Novatek. In doing so, Washington indirectly encourages the EU to reduce its reliance on Russian LNG. In 2024, EU imports of Russian LNG increased to a record 16–17 million tonnes, representing approximately 20% of total LNG imports.

While US sanctions are expected to curtail the operations of designated tankers in the Baltic Sea, the inclusion of two Russian insurers, Ingosstrakh and AlfaStrakhovanie, on the sanctions list further pressures EU countries to strengthen oversight of ‘shadow fleet’ vessels passing through their waters. Media reports suggest that Ingosstrakh policies contain clauses invalidating claims for oil spills if the insured tankers transport crude sold above $60 per barrel, thereby breaching the G7 price cap mechanism. This raises doubts about compensation for environmental damages in the event of actual incidents. The designation of Russian insurers has intensified calls for the EU to put the ‘shadow fleet’ under greater scrutiny, particularly given repeated incidents involving such tankers in regional waters. Enhanced oversight is increasingly critical to address the environmental and security risks posed by these operations.

The uncertain future of the restrictions

The US sanctions policy had previously been constrained by the Biden administration’s concerns about potential increases in oil and fuel prices, which stricter measures on Russia’s oil sector could have triggered. This was considered a political risk in the context of the US presidential elections. However, the removal of this concern, combined with the relatively balanced global oil market, has created conditions for the tightening of restrictions. Reducing the availability of Russian exports on the market may also facilitate the incoming Trump administration’s plans to increase the global market share of US oil and gas producers.

The effectiveness of the sanctions regime partly relies on sustained enforcement against violations, with a particular focus on entities receiving shipments sold in breach of the restrictions. However, the future of sanctions policy remains uncertain due to the impending change in US leadership, as the new administration has signalled an intention to initiate peace negotiations with the Kremlin. If sanctions are relaxed as part of any agreements with Russia – given Moscow’s insistence on sanction relief as a condition for peace in Ukraine – it will cast significant doubt on whether the G7 will maintain the restrictions in the long term.

Chart. Average monthly prices of Russian Urals oil and the Western Brent benchmark from January 2022 to November 2024

Source: the author’s own estimates based on data from the Ministry of Finance of the Russian Federation, the Ministry of Economic Development of the Russian Federation, and the US Energy Information Administration.