Germany: another extension of state control over Rosneft’s assets

On 6 March, the Federal Ministry for Economic Affairs and Climate Action (BMWK) announced a fifth extension of the trusteeship over Rosneft Deutschland and RN Refining & Marketing, this time until 10 September. Berlin assumed control of the Russian company Rosneft’s assets in Germany in September 2022 (see ‘Germany: the state takes control of Rosneft's assets’). Under German law, a trusteeship can initially be imposed for six months and subsequently extended for equal periods multiple times, if deemed necessary for the country’s energy security. During this period, the formal owner loses management rights over the assets, which are transferred to a government-appointed body – in this case, the Federal Network Agency.

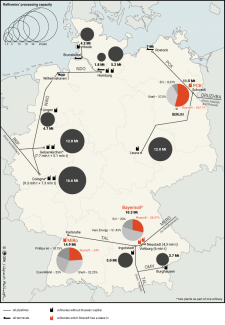

The decision stated that extending state control over Rosneft’s assets is necessary to ensure the uninterrupted operation of three refineries in which the Russian company holds shares (see map). It was noted that business partners, financial institutions, and insurers refuse to cooperate with facilities managed by Russian entities. Many contracts include clauses permitting partners to unilaterally terminate agreements should Rosneft regain control of the companies. Such a scenario – particularly in relation to oil supply contracts – could paralyse refinery operations, posing a serious risk to the country’s fuel security.

The document also referenced an agreement between the German government and Rosneft, under which the company committed to divesting its German assets. Under the latest arrangements, it is required to do so by 28 August. The BMWK statement indicated that the authorities expect a ‘swift’ conclusion of negotiations, with Rosneft having ‘credibly demonstrated that the sale process is actively underway’.

Commentary

- The latest extension of the state trusteeship stems from Berlin’s reluctance to expropriate Rosneft and, most likely, from Russia’s deliberate stalling tactics aimed at delaying the sale of its assets. This effectively maintains the status quo. From Germany’s perspective, a voluntary divestment by Rosneft remains the most convenient solution, given that returning control of the assets is inconceivable in the near future and there is no political will to expropriate them – despite this being a clear option under German law. However, there have been no signs of progress in negotiations over the sale for several months. In August last year, reports emerged of talks between Rosneft and Qatar’s sovereign wealth fund, the Qatar Investment Authority, in which the German government was allegedly involved; however, these discussions quickly faded from public view. In November, the sale of Rosneft’s German assets was reportedly discussed by the leaders of Russia and Kazakhstan, amid speculation – dating back to 2022 – that Kazakhstan’s state-owned KazMunayGas might acquire a stake in the Schwedt refinery. Given the passage of time and the lack of concrete developments, it cannot be ruled out that Russia is merely playing for time, awaiting a shift in the political landscape, and has no genuine intention of selling its stake. At this stage, it also remains unclear what approach Germany’s next government will adopt regarding Russian assets in the country.

- The absence of a lasting solution regarding the ownership of disputed assets is generating increasing tensions, particularly around the PCK Schwedt refinery, while calls to resume Russian oil imports are gaining momentum in Brandenburg. The refinery is currently operating at 70–80% capacity due to limited supply options following Germany’s decision to cease sourcing oil from Russia in January 2023. As a result, it appears to be operating at a loss. Berlin has allocated €400 million to fully finance the modernisation of the pipeline from the Rostock terminal, which would increase its capacity from 7 to 9 million tonnes per year. However, the European Commission has blocked the project for the past 18 months. Reportedly, it opposes state aid for companies owned by Russian entities and insists that shareholders contribute to the investment costs. The unresolved ownership issue – exacerbated by Shell’s ongoing search for a buyer for its stake – has also stalled investment in the refinery. More than two years of uncertainty over the future of this key facility in eastern Brandenburg is fuelling frustration and deepening concerns within the local community. In recent weeks, calls to resume Russian oil imports have intensified, with local officials – including politicians from the CDU and SPD – joining these demands. A movement called Save PCK has also emerged, aiming to pressure both the state and federal governments through various means.

Map. Oil transport infrastructure and refineries in Germany

Source: Association of the German Petroleum Industry (MWV, renamed En2X since 2021).