A dangerous dependence on Russia. Germany and the gas crisis

The German economy is heavily dependent on natural gas, almost all of which it purchases from foreign suppliers. More than half of this is from Russia. For years, Germany underestimated the dangerous degree of its gas dependence on Russia because it was convinced that the two countries had common interests. The absence of the adequate diversification of supply sources has proven to be a mistake in Berlin’s energy policy. Stoked by Moscow, the European gas crisis has affected Germany and other countries. Combined with the threat of renewed Russian aggression against Ukraine, it made Germany increasingly aware of the scale of this dependence. Although the country’s energy cooperation with Russia will not change fundamentally in the short term, it is now more likely that Germany will take real action to reduce its vulnerability to similar crises in the future. Although it is likely to be only a provisional move, Berlin’s decision to freeze the certification process of Nord Stream 2 (NS2) indicates that its perception of Russia as a partner in energy cooperation is also changing.

Germany is Europe’s largest and the world’s eighth largest consumer of natural gas. It makes up 23% of the EU’s gas consumption. Gas plays a key role in the German economy – in Germany’s energy mix it is the second most important fuel (after oil) (see Chart 1 in the Appendix). It is the primary fuel in the industrial sector and in households. It is also the most important heating fuel (both in district heating networks and in individual installations). According to statistics, every second German home uses natural gas for heating. Finally, gas plays an increasingly important role in the electricity generation sector, which reflects the ongoing energy sector transformation.

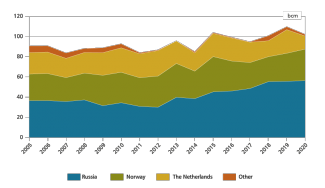

At present, only around 5% of Germany’s annual natural gas demand is provided by domestic production and it needs to import the remaining volume. Until a few years ago, Germany imported its gas from Russia, Norway and the Netherlands in almost equal proportions (Germany has gas pipeline connections with these countries). Over the last decade, the proportions began to gradually shift in Russia’s favour, mainly due to declining gas imports from the Netherlands and to the launch of the Nord Stream 1 gas pipeline in 2011. In 2020, Russian gas already accounted for 55% of Germany’s gas imports (see Chart 3 in the Appendix).[1]

With political backing from Berlin, cooperation between German and Russian companies in the energy sector, including the gas sector, continued to thrive. The industrial sector was particularly lured by the promise of gaining access to Russian gas fields and by the prospect of importing gas at an attractive price. Numerous branches of the German industrial sector viewed cheap gas as a prerequisite for them to have a competitive advantage on the global markets. Two agreements signed in 2015 are symbols of this cooperation and of its painful consequences that are evident today: the first one is the agreement for the construction of the Nord Stream 2 gas pipeline, the other is the agreement for an asset swap between Wintershall (controlled by the chemical giant BASF) and Gazprom. As part of this latter agreement, Wintershall received a stake in the Urengoy gas field in Western Siberia, while Gazprom gained control of two German gas storage facilities (Rehden – one of the EU’s biggest facilities of this type – and Jemgum).[2] At present, Gazprom partly or fully controls almost a quarter of the capacity of facilities of this type located in Germany,[3] and – via another company, WIGA – co-owns the operators of key sections of the gas transmission infrastructure.[4]

Gas-related myths

For years, the problem of Russia’s influence on the German gas sector was played down in Germany until it reached dangerous proportions. There were two prevailing myths in the views held by Germany’s political and business circles, in particular by representatives of big industry who were interested in carrying out various projects in Russia. The first myth involved the conviction that there was a mutual dependence resulting from complementary interests: on the one hand, Germany needed Russian gas and, on the other, Russia was interested in gas export revenues and Germany was its biggest European customer. From Berlin’s perspective, this interdependence was expected to ensure that Moscow never used gas exports as a tool to exert political pressure, otherwise it would risk losing lucrative trade contacts with an important business partner. The second myth is about the image of Russia as a reliable and credible supplier of fuels. It is rooted in the successful energy cooperation between the two countries which dates back to the 1970s and was continued without significant disruptions even during the most turbulent political periods. One recurrent argument in the German debate emphasises the fact that Moscow did not cut the supplies “even during the Cold War”. Until recently, the history of this cooperation was sufficient to corroborate these two myths.

The conviction that the two countries had convergent interests in the energy sector was so strong that successive projects which actually increased Germany’s dependence on Russian gas (Nord Stream 1 and 2) were launched with political support, and the need to diversify gas supply sources was completely disregarded. Despite the fact that initiatives to build an LNG terminal in Germany, to serve as a viable alternative to Russian supplies, emerged as early as 2005, Berlin failed to create an appropriate regulatory environment and to earmark funds for the implementation of these plans. This discouraged successive commercial investors and resulted in the investment failing (the fragmentation of the German gas sector is a unique feature – it is made up of a large number of 100% privately-owned entities, which reduces the state’s ability to impact on how these companies function and practically limits its actions to introducing legislative regulations, offering financial support and similar measures). Although LNG terminals were built in neighbouring countries (Poland, the Netherlands, Belgium, France), Germany – Europe’s biggest gas consumer – has failed to build similar facilities.

Finally, in retrospect it seems that another mistake of Germany’s energy policy and, more broadly, foreign policy was its decision to embark on the Nord Stream 2 project, i.e. to double the capacity of the Baltic Sea gas pipeline by adding another two lines to it. Although on the German side the investment was in fact initiated by privately-owned energy companies (BASF/Wintershall and E.on/now Uniper, and the French company Engie, the Austrian company OMV and the Dutch company Shell), from the very beginning it was being implemented with full political support from the German federal government. It should be noted that the recurrent argument in public debate suggesting that this pipeline is “indispensable” for covering the rising demand for gas resulting from the ongoing energy transition in Germany and in Europe as a whole, is untrue. In fact, the existing gas transmission infrastructure (via Ukraine, Belarus and Poland, and via the Nord Stream 1 and the TurkStream pipelines) has sufficient capacity to handle the expected increase in the import of Russian gas. In fact, from the beginning it was clear that from Russia’s perspective the main goal of the implementation of NS2 was to bypass Ukraine. Berlin, for its part, had the following goals: to switch to a direct and shorter route for Russian gas supplies to Germany and to increase its role as Europe’s central gas hub. From Germany’s perspective, achieving both of these goals was expected to reduce its gas import costs and to increase the security of supplies in the event of political crises in Eastern Europe.

The intention to extend gas cooperation with Russia was advocated most strongly by German business (in particular its most influential companies such as BASF, E.on/Uniper and RWE) due to the fact that this cooperation brought tangible profits. These companies are known to have a major impact on the German government’s decision-making processes. It is normal in Germany that, whenever foreign or security policy interests and economic policy interests diverge significantly, the latter frequently prevail. When it comes to support for NS2, Berlin put its own economic interests first and ignored the positions of Central and Eastern European countries such as Poland, Ukraine and the Baltic states, as well as the views of the European Parliament, the European Commission and the US. The German government fully disregarded the economic and the political risks posed by increasing dependence on Russian gas, as well as regional security issues and EU energy policy goals.

The brutal awakening

Recent months have seen a gradual shift in the German elite’s perception of Russia as a partner in fuel trade. Since summer 2021, due to growing concern, efforts have been underway to monitor Gazprom’s activities in the European gas market. Germany was among the countries affected by these activities despite the strong bilateral ties between Germany and Russia. Despite major demand, attractive prices and an increase in its gas production, the Kremlin-controlled company has for months been limiting its operations to fulfilling long-term contracts and has largely abandoned selling its gas on spot markets. As a consequence, there was a decrease in the volume of gas transmitted to Europe, in particular via Ukraine, Belarus and Poland (since mid-December 2021 no gas has been transmitted via this route to Germany). At the same time, the Gazprom-controlled gas storage facilities in Germany were insufficiently filled before the start of the heating season. Last summer, Gazprom fulfilled a portion of its contractual obligations using stored gas, in spite of the usual practice of filling up gas storage facilities in summer rather than emptying them. As a consequence, although at the beginning of the current heating season the average filling rate of German storage facilities was 68% (i.e. exceptionally low), the filling rate recorded for the Russian-controlled Rehden storage facility, the largest such facility in Germany, was a mere 8%.

Alongside this, for months the Russian side has been hinting at the prospect of an immediate increase in gas shipments to Europe once Nord Stream 2 is launched. Even in Germany these messages leave no doubt that Russia may be deliberately choosing not to increase supplies, using this as a bargaining chip to achieve its specific political goals.

In the second half of 2021, these actions, which Germany also interpreted as an attempt to exert pressure aimed at accelerating the launch of NS2, resulted in an unprecedented increase in the price of gas and of electricity generated in gas-fired power plants. This, in turn, translated into major price hikes affecting households and industrial recipients across Europe, and stoked inflation. Negative consequences of this crisis have affected Germany as well, resulting in the insolvency of several electricity providers and in production activities in industrial plants being suspended or limited. As a consequence, the government was forced to launch protective measures.[5]

In addition, this winter Germany was genuinely at risk of not being able to cover all of its economy’s demand for gas, in particular should the weather in the coming weeks worsen and persisting low temperatures result in increased gas consumption for heating purposes (in mid-February the filling rate of German storage facilities was at its lowest compared with the corresponding period in previous years – 33%, and the filling rate at the Rehden storage facility was 4%). Although in its official statements the Ministry for Economic Affairs has provided assurances that there is no threat to the security of supplies, efforts have been stepped up to prepare for worst-case scenarios involving the need to reduce supplies to selected customer groups.[6] At the end of 2021, RWE, Germany’s largest electricity producer, warned its trading partners about possible interruptions in gas supplies to power stations due to the exceptionally low level of gas reserves in storage facilities.[7]

The already difficult situation on the gas market is accompanied by an escalation in Russia’s aggressive actions against Ukraine, which makes it necessary for European countries, including Germany, to adopt a political stance on this issue. The risk of an armed conflict, in response to which the West would decide to impose severe sanctions on Moscow, could provoke retaliation from Russia, e.g. the interruption of gas supplies to Europe. Although Berlin considers this scenario unlikely, the present circumstances (especially the insufficient supplies) have convinced the German government of the need to seek emergency solutions, such as LNG supplies, in close cooperation with the US and the EU.[8] According to unofficial information, since the beginning of 2022 Chancellor Olaf Scholz and Minister for Economic Affairs Robert Habeck have been directly involved in seeking these solutions (emergency supplies of liquefied gas mainly from the US and Qatar). According to federal government representatives, Germany’s supplies will be secured throughout this winter, including in the event of shipments from the East being stopped.[9]

In recent weeks, the ‘turning off the tap’ scenario and the question of the degree of Germany’s dependence on gas imports from Russia have been among the most important topics in public debate. They were discussed in articles on the front pages of the most influential newspapers, in leading opinion programmes and in televised debates attended by politicians. The mainstream audience has become aware that, as a result of Berlin’s misguided and short-sighted energy policy pursued in recent years, Germany is now dangerously dependent on imports from a supplier that is capable of using its position against Berlin, and it is thus exposed to potential energy blackmail motivated by Moscow’s political interests. This, in turn, is one of the main reasons why in recent weeks, in debates among NATO allies on a possible response to Russia’s aggressive policy against Ukraine, Berlin’s stance was so ambiguous.[10]

Lessons to be learnt

Germany’s increasing awareness of its dangerous dependence on Russia is accompanied by proposed solutions to prevent similar crises in the future. Robert Habeck, Germany’s Vice-Chancellor and Minister for Economic Affairs and Climate Action, has been tasked with dealing with this issue. In his speech in the Bundestag on 26 January, Habeck, who until recently was co-leader of the Greens, announced measures to reduce the German gas sector’s vulnerability to political turmoil. He said that it would be “reckless” if Germany failed to learn a lesson from the current situation. The plan to reduce Germany’s gas dependence on Russia has become one of his main political messages.

Habeck’s ministry is preparing a legislation package to increase the scope of regulations regarding gas storage. Thus far, storage facility operators have enjoyed a high degree of freedom in how they run their businesses. This was due to Germany’s widespread conviction that, in order to guarantee the proper functioning of this system, it is best to apply free market rules. For years, the energy sector has been opposed to the plan to introduce additional requirements to ensure the security of the gas supply and considered it as an unnecessary move that would increase the cost of the system’s operation. As a consequence, Germany’s gas market model is highly liberalised. This means that, in extreme situations, the market participants are allowed to have empty storage facilities at the start of the heating season, which is what Gazprom has done. At present, the ministry is considering two possible system interventions. The first involves creating a strategic gas reserve modelled on the existing oil reserve mechanism which provides Germany with around a three-month oil reserve in the event of a supply cut. The second model, which is preferred by market participants, envisages the introduction of a requirement for gas storage facilities to be filled up to a certain level before the start of the heating season. In the future, this regulation would make it impossible for companies to choose not to fill their storage facilities in summer, for example due to high prices on gas hubs. Unlike during similar discussions held in previous years, in the present crisis the decision to increase the scope of regulations regarding gas reserves has not sparked controversy. Proposals for specific amendments will likely be announced in spring and implemented by summer to give operators time to meet the new requirements before 1 October 2022.

In addition, measures to diversify import sources are also planned. The present crisis has boosted political support in Germany for the construction of an LNG terminal to enable gas imports from other locations. Two investments are being considered (in Brunsbüttel and Stade)[11], although due to various problems (related to the need to obtain the necessary permissions, the unfavourable regulatory environment, market volatility and, finally, to protests organised by environmental activists) their implementation has not been continued.[12] Vice-Chancellor Habeck has openly pledged support for these projects (both regulatory and financial support), which is all the more meaningful since his party, alongside environmental activists, has for years opposed the construction of LNG terminals, viewing them as additional pieces of infrastructure to handle the import of fossil fuels (just like Nord Stream 2). Moreover, the planned construction of LNG terminals enjoys political support from the CDU/CSU, the SPD (including Chancellor Scholz) and the governments of Lower Saxony and Schleswig-Holstein, i.e. those federal states in which these terminals would be built. When designing the new infrastructure, the plan to enable the transmission of hydrogen or other decarbonised energy carriers through it in the future may be one important argument to help various actors, especially the Greens, to save face.[13]

However, the political support from all German parties for the construction of LNG terminals is no guarantee that these will be completed. The facilities in Brunsbüttel and Stade are being built by consortia made up of private companies which are mainly guided by profits. Gas sector representatives are voicing doubts over the level of the market’s readiness to use these terminals and regarding their expected operational time-frame. The new terminal could be launched in 2025 or 2026 at the earliest, and models of future gas demand indicate that Germany’s gas consumption is expected to remain at its present high level or to increase slightly until around 2030 and to decline in later years (see Chart 4 in the Appendix). This would boost market competition and undermine the profitability of the terminals’ operation. In addition, the investment’s implementation may be hindered by environmental organisations that continue to be opposed to this type of project and have both the experience and resources to disrupt them (e.g. by organising protests attended by the local population, commissioning and publishing expert opinions, taking legal action or getting involved in permit issuance procedures).

Finally, various actors – the Greens in particular – will likely cite the weakness of the German economy resulting from its reliance on gas, most of which needs to be imported from an unpredictable partner, as another argument in favour of accelerating the energy transition. Proponents of this Energiewende argue that the sooner Germany switches to RES (and other renewable energy carriers such as hydrogen), the faster it will reduce its dependence on the import of fossil fuels, including natural gas. It is expected that the share of gas in the transformation model adopted by Germany’s electricity generation sector will, in coming years, increase due to the decommissioning of nuclear power plants and the gradual coal phase-out (according to most models it will increase from the present 15% to 20–25% at the beginning of the 2030s); this is not making the task any easier.[14] However, this sector accounts for a mere 13% of Germany’s gas consumption, while the industrial sector and households account for two thirds of this consumption (see Chart 2 in the Appendix). In these sectors, the launch of the process of phasing out gas in favour of other low-emission solutions is expected to accelerate in the second half of the 2020s.

What is the future of Nord Stream 2 and Germany’s gas cooperation with Russia?

One of the key questions in the debate on Germany’s dangerous dependence on Russian gas supplies is about the future of the controversial Nord Stream 2 project. The pipeline is now complete, has received official technical certification and is ready to commence its operation. However, for gas transmission to begin, the adoption of a legal framework for its operation is needed, including the certification of its operator. The German Federal Network Agency is responsible for issuing this certification and the European Commission is required to release an opinion on the compatibility of the agency’s decision with EU law. This procedure was suspended in November 2021 due to formal reasons.[15]

In response to Moscow recognising the independence of two separatist para-states established in 2014 in the Russian-occupied part of Ukraine’s Donbas region, on 22 February 2022 the German government withdrew its positive assessment of the impact of NS2’s launch on the security of gas supplies to Germany and the EU. This decision equates to the certification process being frozen due to the fact that the German Federal Network Agency granting the operator status and, as a consequence, launching the pipeline is conditional on the applicant submitting a positive recommendation issued by the government. However, Berlin’s decision is provisional and should not be understood as the death knell of the NS2 project. The assessment of the impact of the new pipeline’s launch is to be carried out once again, taking account of the new circumstances. Chancellor Scholz suggested that this process may be very long-lasting. Ultimately, the date of resuming the procedure will depend on the development of the situation in Eastern Europe and the possible normalisation of EU–Russia relations.

However, if Berlin resumes the certification process, there will still be fundamental doubts regarding the possible granting of independent operator status to the applicant in the form it has requested.[16] On the other hand, in line with the informal compromise within Germany’s new ruling coalition the new pipeline will only be launched if it is compliant with German and EU law. Should the German Federal Network Agency refuse to certify the pipeline’s operator, Gazprom would need to either take the necessary steps to adjust its operational model to the legal requirements (e.g. to indicate another business entity as the pipeline’s operator) or to attempt to challenge the regulator’s decision in the German courts, to challenge the entire EU Gas Directive in the European Court of Justice, or to use both options concurrently. Ultimately, sooner or later, once the legal issues are clarified, the pipeline will most likely be launched. Otherwise, Germany would be exposed to multi-billion dollar compensation claims from Gazprom and a mounting political dispute with Moscow. Moreover, the plan to launch the pipeline enjoys stable support from German business and – at least according to opinion polls conducted so far – from around three fifths of German society. Ultimately, the question is not if but when, and under what conditions, Nord Stream 2 will become operational.

The recent gas crisis will not trigger a fundamental change in Germany's energy cooperation with Russia in the short term, unless an escalation in the situation in Eastern Europe results in a disruption in gas supplies to Europe, since this would be viewed as the activation of the ‘nuclear option’ and could lead to a profound change in Berlin’s attitude. Firstly, this cooperation is beneficial for Germany, and its continuation is mainly advocated by influential business groups. Secondly, in the coming years, Germany will continue to rely on Russian gas imports, as it is incapable of quickly pivoting and finding alternative suppliers to meet its large demand. However, the experience of the past few months – in particular the ongoing major shift in the perception of Moscow as a partner – is creating an opportunity for Germany to start viewing its long-term cooperation with Russia in a more realistic manner (regarding both traditional and new energy carriers such as hydrogen) and to take genuine steps to reduce its vulnerability to similar crises in the future. Such steps include the already planned increase in the scope of gas storage regulations, which it is hoped will bolster the resilience of the German (and also the European) gas supply system, as well as the government’s announced measures to diversify sources of supply, e.g. by supporting the plan to build an LNG terminal in Germany.

Reducing Germany’s gas dependence on Russia would not only boost Berlin’s energy security, but also increase its prospects for a more assertive policy towards Moscow. The present crisis over Ukraine has clearly demonstrated that the energy dependence (in particular gas dependence) affecting Germany (a key political actor both in the EU and in NATO) is limiting Berlin’s room for manoeuvre and restricting its freedom to pursue its foreign policy. This in turn may have a negative impact on the consistency of the West’s actions.

Please note that this text was prepared before the Russian invasion of Ukraine.

APPENDIX

Chart 1. The structure of Germany’s primary energy consumption in 2021

Source: AG Energiebilanzen e.V.

Chart 2. Germany’s natural gas consumption according to sectors

Source: Federal German Association of Energy and Water Management (BDEW).

Chart 3. Natural gas supplies to Germany in 2005–2020 according to countries of origin

Source: BP Statistical Review of World Energy.

Chart 4. Germany’s natural gas consumption in 2000–2021

Source: Federal German Association of Energy and Water Management (BDEW).

[1] In 2020, Russia was also Germany’s biggest supplier of oil and hard coal. Its share in Germany’s imports of these commodities was 34% and 49% respectively. Due to the different characteristics of these commodities’ global trading markets and because there are better opportunities to obtain them from other sources by sea, Russia’s impact on Germany in this case is much smaller than with natural gas.

[2] S. Kardaś, A. Łoskot-Strachota, K. Popławski, ‘Gas business as usual? The new agreements between Gazprom and EU energy companies’, OSW, 9 September 2015, osw.waw.pl.

[3] At present, via the companies Astora, Gazprom Germania and Wingas, Gazprom controls gas storage facilities such as Rehden (capacity: 4 bcm), Jemgum (1 bcm), Etzel (1 bcm) and Katharina (0.2 bcm). It also co-owns the facility in Haidach (1.2 bcm) in Austria, which is interconnected with the German system and plays an important role in supplying gas to southern Germany.

[4] WIGA Transport Beteiligungs-GmbH & Co. is controlled by Wintershall Dea (50.02%) and Gazprom Germania (49.98%) and is the sole stakeholder in transmission system operators such as Gascade Gastransport GmbH, NEL Gastransport GmbH and OPAL Gastransport GmbH. In Germany, they control a total of almost 4,000 kilometres of pipelines.

[5] M. Kędzierski, ‘Energy prices surge in Germany’, OSW, 13 January 2022, osw.waw.pl.

[6] Initially, this would be carried out on a voluntary basis and compensation payments calculated according to free market rules would be paid out to the affected entities. Should this instrument be exhausted, in emergency situations supplies would be stopped to specific groups of customers according to a list compiled by the government in cooperation with the German Federal Network Agency and the THE nationwide trading hub. For example, power plants and industrial facilities would be at the top of this list and households and hospitals would be at the bottom. Work on devising this system has been carried out on the basis of the EU regulation safeguarding the security of natural gas supplies adopted in 2017.

[7] ‘Gasmangel: RWE warnt vor möglichen Kraftwerksausfällen’, Handelsblatt, 18 December 2021, handelsblatt.com.

[8] For more see A. Łoskot-Strachota, ‘Preparing for a crisis on the European gas market’, OSW, 31 January 2022, osw.waw.pl.

[9] S. Schultz, ‘Deutschland käme wohl ohne russisches Gas über den Winter’, Spiegel Online, 21 February 2022, spiegel.de.

[10] A. Kwiatkowska, ‘More continuity than change. Germany’s response to Russian demands and the future of NS2’, OSW, 17 January 2022, osw.waw.pl.

[11] The LNG terminal in Brunsbüttel (Schleswig-Holstein) is being built by the German LNG Terminal GmbH company established by Gasunie LNG Holding, Vopak LNG Holding (incorporated in the Netherlands) and Oiltanking GmbH (incorporated in Germany). The facility’s planned regasification capacity is 8 bcm annually, with the RWE company expected to book 5 bcm. The construction of the terminal in Stade (Lower Saxony) is invested in by the Hanseatic Energy Hub GmbH, which is controlled by the Fluxys gas transmission system operator (Belgium), the Partners Group investment fund (Switzerland) and the Buss Group shipping company based in Hamburg. This facility’s planned regasification capacity is 12 bcm annually.

[12] M. Kędzierski, ‘Niemieckie terminale LNG – stan i perspektywy’, Komentarze OSW, no. 362, 10 November 2020, osw.waw.pl.

[13] Germany will be unable to cover its future demand for hydrogen and renewable energy carriers from its own sources. A portion of its imports – in particular synthetic products manufactured on the basis of hydrogen – is to be carried out by sea. For more see M. Kędzierski, ‘The H2Global Foundation – an instrument of Germany’s external hydrogen policy’, OSW, 26 January 2022, osw.waw.pl.

[14] M. Kędzierski, Niemieckie pożegnanie z węglem. Kolejny etap Energiewende, OSW, Warszawa 2022, osw.waw.pl.

[15] S. Kardaś, M. Kędzierski, ‘The Federal Network Agency suspends the process of certifying Nord Stream 2’, OSW, 18 November 2021, osw.waw.pl.

[16] For more see S. Kardaś, M. Kędzierski, A. Łoskot-Strachota, ‘Spółka córka Nord Stream 2 – krok w stronę wznowienia certyfikacji’, OSW, 1 February 2022, osw.waw.pl.