Germany and the crisis of globalisation: adjustment strategies

Germany is among the biggest beneficiaries of the global economic system based on free trade and on cross-border organisation of production. However, the functioning of this system has been recently disrupted by the COVID-19 pandemic, which has highlighted the vulnerability of excessively stretched supply chains. It has also been hit hard by Russia’s attack on Ukraine and by the resulting sanctions, which are aggravating supply-related problems and stoking political divisions between the major powers. All of these forces may lead to the global economy splitting into competing platforms, and to the logic of cost optimisation being abandoned in favour of risk mitigation. If this happens, Germany would face a difficult strategic dilemma and embark on one of the following three options. The first option would involve defending the increasingly unstable status quo and the benefits of exchange patterns associated with it. In the second option, Berlin could favour a political and military consolidation of the West, and at the same time let businesses operate freely and move between the competing platforms. The third option involves taking part in the creation of an alliance of democratic states, accompanied by partial de-globalisation and an overhaul of the present economic model. While this is the most radical scenario, in the context of the continuously expanding sanction regime targeting Moscow and the mounting chaos in global supply networks (caused by China’s pandemic restrictions), its likelihood is increasing.

In his speech delivered on 27 February 2022, Chancellor Olaf Scholz referred to Russia’s invasion of Ukraine as “Zeitenwende” – a turning point. In this way he kindled high expectations regarding Germany’s new political course. Two months later, disappointment has prevailed: Germany can hardly be considered as one of the leaders of a decisive response to aggression. Berlin has been reluctant to decide to increase its arms supplies to Ukraine and remains rather cautious when it comes to decisively toughening the restrictions targeting Putin’s regime. Aside from the fear that the war may escalate, the reasons behind this cautious approach include concerns about the state of the economy. However, these relate not only to the widely discussed stability of energy supplies, but also to a much broader issue, i.e. the future of the international economic system.

Globalisation and the German model

In recent decades, the development of the global economy has relied on the expansion of the exchange of goods and services, the rise in direct investments, and the cross-border organisation of production. These were facilitated by increasing liberalisation of trade barriers, harmonisation of regulations and management methods, technological progress, and by the evident decoupling of economic cooperation from political relations. Business has learned to skilfully navigate between disputes and conflicting interests pursued by governments of specific countries.

The logic of this system was focused on increasing the scale and reducing the costs of business activity. Outsourcing and offshoring, i.e. relocating parts of the production process to cheaper sites abroad, became the buzzwords of that era. This is how companies that had thus far operated in their country of origin created complex networks integrating dozens of foreign suppliers. Many of them operated according to the just-in-time principle, which involved synchronising the deliveries so as to avoid having to maintain large costly warehouses.

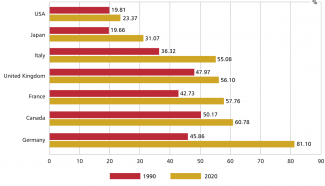

Germany was among those states that benefited most from this global “optimisation” practice – but it was also well prepared for that. It relied on its experience gained in the Cold War era, when it was selling its industrial goods to Western clients and to those located behind the Iron Curtain alike, and even to the so-called Third World countries. In the 1990’s, when the process of lifting the barriers in the movement of goods and capital accelerated, Germany’s knowledge of markets, its network of contacts and the industrial sector’s consistent orientation towards exports, backed by the government, proved valuable. At that time, there was no point in analysing the condition of the German economy separately from globalisation anymore. Between 1990 and 2020, its foreign trade turnover increased from 45.9% to 81.1% of GDP, which was the highest proportion among the G7 countries (see Chart), and at the end of 2021 the NIIP indicator – the net international investment position showing the difference between a country’s foreign assets and liabilities – was +68.1% of GDP, or almost 2.5 billion euros.

Although Germany’s global orientation was beneficial, it came at a price. The economy became less resilient to economic fluctuations and crises happening on other continents – which the pandemic has demonstrated in a particularly evident way. In addition, economic cooperation with certain countries began to trigger dangerous dependences.

This was the case with Russia. Russian fossil fuels covered 55% of Germany’s demand for natural gas, 50% for coal and 35% for oil. In addition, Germany allowed Russia to control important elements of its energy infrastructure – e.g. its oil refinery in Schwedt and its biggest gas storage facility in Rehden. Germany has become dependent on China as well. In 2021, Germany’s trade exchange with China was worth 245.4 billion euros – making Beijing Berlin’s biggest economic partner – and the value of direct investments stood at 90 billion euros (data as of 2019). In the case of certain companies, in particular those operating in the automotive sector, China’s share in their total turnover exceeded 30% (see Table).

This level of economic ties translated into political dependencies. Berlin was increasingly reluctant to criticise these countries for violating human rights, drifting towards dictatorship or operating an aggressive foreign policy. Hopes pinned on the idea of “change through trade”, according to which economic cooperation was expected to result in the spread of democracy and the ‘export’ of liberal values, proved futile. As a matter of fact, this idea has strengthened the authoritarian regimes economically, provided them with additional legitimacy in the eyes of their own citizens and even encouraged them to pursue a confrontational international policy. If one were to name a country whose political system has changed, it would in fact be Germany which, by opening up to Russian capital, has ‘imported’ the networks of the Putin regime and its political lobbying.

Chart. Dependence on foreign trade – trade turnover relative to GDP in the G7 states in 1990 and 2020

Source: The World Bank.

Towards diversification

Since at least as far back as the previous financial crisis (2007-2008), increasingly deep fissures have begun to appear in the model of globalisation based on exchange expansion and cost optimisation. Mounting public opposition to trade liberalisation and relocation of production to other countries has resulted in politicians reluctant to open borders coming to power (e.g. Donald Trump) and the ideas of economic protectionism returning to the political mainstream.

However, it was the COVID-19 pandemic that delivered a more serious blow to global economic cooperation. Overnight, international supply networks began to experience increasing organisational problems, and many industries even faced interruptions to their production activity. Once the initial shock subsided, company executives began to seek solutions to minimise the risk associated with depleting stocks, the absence of alternative supply sources and excessively stretched supply routes. Another wave of the COVID-19 pandemic in China in recent months and the uncompromising stance adopted by the Chinese leadership, resulting in “traffic jams” at the country’s harbours, have additionally corroborated the arguments calling for an overhaul of the current cooperation models.

February 2022 saw another threat to the present globalisation formula materialise. Russia’s invasion of Ukraine has turned the confrontation between democracies and autocracies into a fundamental factor determining the shape of international relations. It cannot be ruled out that the dynamics of the imposed sanctions, counter-sanctions and indirect sanctions will result in the world becoming divided into camps, with and emerging alliance centred around China and Russia emerging as a counterpoint to the West. Their partners may include Pakistan, Iran, the Middle Eastern despotic regimes, as well as some African states – in particular those in which China has invested its capital, and even India and Brazil. The purpose of such a coalition would be to create the largest possible ‘platform’ with its own separate raw materials, energy and technology systems, and to dissociate itself – through the use of digital currencies, a separate payment system and exchange rate coordination – from a financial system dominated by the dollar and the euro.

Therefore, from the West’s point of view, the primacy of optimisation is no longer the main factor in shaping the global economic space. The COVID-19 pandemic, the war and the sanctions are all boosting the importance of the problem posed by risk. Efforts to mitigate risk will translate into supply chains becoming increasingly shorter and production activities being organised closer to end markets. Companies will also seek to diversify their suppliers and to build emergency stockpiles. Alongside this, the importance of politics will increase: the issue of who is involved in trade, with what partners, and what goods are being exchanged may ultimately depend on security assessments and the preferences of national governments, rather than on a calculation of immediate business-related costs. Janet Yellen, the US treasury secretary, only recently referred to this as “friend-shoring”.

Table. The share of the Chinese market in the turnover of German companies included in the German stock index DAX in 2021

Source: U. Sommer, ‘Das große China-Risiko – Einige Dax-Konzerne könnten Konflikte wie mit Russland kaum verkraften’, Handelsblatt, 21 March 2022, handelsblatt.com.

Germany’s choices

Any possible change in the globalisation model will result in Germany finding itself at a systemic crossroads. On the one hand, what is at stake are huge profits from the present model, which is based on exports and the creation of cross-border value chains. On the other hand, an opportunity has emerged to reduce dubious dependencies, to base international relations on respect for human rights and democratic principles to a greater extent than hitherto, and to carry out economic reforms which have so far been curbed by the political system’s inertia and by the influence of various lobbying groups.

These issues are increasingly leaving their mark on Germany’s internal public debate. Proponents of a radical turn are easiest to find among the Greens, who are calling for a hard-line stance towards authoritarian states and for modifications of the economic model, involving a rapid shift to renewables in particular and a review of trade dependencies. Although the FDP and the Christian Democratic opposition (CDU/CSU) have similar views on the political matter, these parties are more cautious when it comes to the international competitiveness of German companies. In the mainstream, the most conservative stance has been adopted by the SPD, which fears an increasing destabilisation of the international order and rising economic costs. In expressing these concerns, the Social Democrats have found a common language with executives of large companies and with trade unions. However, it should be noted that the SPD’s position has been evolving, especially since the uncovering of Russian crimes committed in Bucha.

With this set of views, Germany is joining the ongoing global search for a new balance between the political realm and the economic realm. This process involves a rivalry between those trends entailing an open global system and those trends entailing partial de-globalisation and fragmentation into more coherent ‘platforms’. Ultimately, this rivalry will not necessarily result in a simple situation where one of these two forces emerges triumphant – hybrid solutions may emerge, in which politics and the economy will shape their participation in globalisation differently.

The decision as to which set of trends will ultimately prevail in Germany’s thinking will have a similar qualitative importance to the decision regarding Westbindung (the link to the West) and the development of a social market economy after the Second World War. In fact, this decision boils down to choosing one of the following three directions.

The first direction involves the intention to “defend the status quo”, which equates to maintaining the present global structures of political and economic cooperation and the benefits they offer. Germany will seek to blur the lines of division between the competing powers by calling for a “détente” and a containment of “the new Cold War”, and for joint efforts, e.g. regarding climate protection. Continued cooperation with China (especially in the field of technology) and the intention to rebuild economic relations with Russia once the war with Ukraine ends would be key elements of this logic. It would also be important for business to maintain extensive chains of cooperation, regardless of increased risk and costs. In this way, Germany would continue its “change through trade” approach and at the same time would play the part of an increasingly important intermediary and mediator in international relations. The desire to implement this scenario will increase as more problems will arise in European integration, e.g. a eurozone crisis, and in trans-Atlantic cooperation, such as due to a possible deterioration in Germany’s relations with the US following the next presidential election.

The second direction may be referred to as “an economy between platforms”. Against the backdrop of mounting global tensions and the repercussions of the pandemic crisis, foreign and economic policy priorities will diverge. For example, in the field of security Germany will become involved in boosting the West’s cohesion and defence capabilities and in supporting the development of its political institutions. In the shadow of these activities, German companies will rearrange their supply chains and create ‘closed’ circuits within the competing platforms. This involves not only relocating some of their investments to EU countries or to the EU’s immediate neighbourhood, but also expanding their operations into the “Chinese-Russian platform”, with the federal government’s tacit approval. However, German companies’ involvement in this platform’s economy will equate to them consenting to its rules, e.g. the obligation to reinvest profits, share technologies, use the yuan in financial settlements, and to strict political control and the appointment of ‘local’ managers as CEOs.

The third direction is the “democracy platform”. It will result in curbing the relations with authoritarian regimes to the necessary minimum and in integration of the political and economic activities of democratic states. In practice, this may equate, for example, to a return to plans involving the establishment of a trans-Atlantic free trade area, as well as NATO and EU enlargement. This would also include boosting cooperation with more distant partners, such as the Asia-Pacific region countries that share common values. The aim will be to transform the community of democratic states, which is loosely structured and coordinated in an ad hoc manner, into an institutional platform with a specific strategy and decision-making bodies. Reforms of the economic model to adapt it to the ongoing global fragmentation will be an important part of this scenario. There will be an acceleration of the energy transition and the construction of a closed loop (circular) economy with elements of local autarchy. Investment in the production of public goods and the role of the state will increase, and measures will be taken to reduce the long-standing – and politically risky – wealth disparities. Change will also manifest itself at the macro level: dependence on foreign trade will decrease due to limited access to markets outside the “platform” and to growing domestic demand. One manifestation of the new approach may be a shift from traditional measures of development, such as GDP, to indicators measuring the quality of life and long-term stability and resilience of the economic system. In January 2022, Robert Habeck, Germany’s Federal Minister for Economic Affairs, announced his intention to implement such modifications.

Which scenario will prevail?

The options presented above do not include the most optimistic one, i.e. “democratic globalisation”. This scenario would entail a collapse, or a major weakening, of the authoritarian alternative offered by China and Russia. In the short term, this is difficult to imagine: China is too strong, anti-democratic resentment across the world is too powerful, while the West, riddled with internal problems posed by demography, social stratification and economic tensions, is too weak. However, the situation in the West is not sufficiently problematic to make another extreme option likely, i.e. expansion and global prevalence of authoritarian systems.

The brutalisation of the war in Ukraine and the mobilisation of NATO and the EU in the face of Russian aggression reduce Germany’s ability to choose the “status quo” option and to seek to play the role of an intermediary promoting a “return to dialogue”. Despite a certain sentiment within the German elite, pressure from the allies, in particular the US, is forcing Germany to explicitly support the consolidation of the West. This situation is currently pushing Germany towards the “economy between platforms” scenario which dispels the dilemmas regarding security policy and business competitiveness, at least temporarily. In line with this scenario, Germany has begun to gradually (though still too slowly for many) increase its military support for Ukraine and to implement a strategic energy decoupling from Russia (Berlin is planning to phase out gas by 2024). Moreover, statements offered by Chancellor Scholz during his recent visit to Japan are indicative of an intention to reduce Germany’s dependence on China as well. The key question is how business will behave in this situation. There are many indications that, in the short term, it will seek to maintain its position and to protect the supply chains it has created and the profits associated with them. Should global political rivalry intensify (this should be viewed as the baseline scenario), it would be difficult to imagine that the economic sphere and government strategy could be separated. Companies will start reducing their dependence on the markets of those countries which are in conflict with the West, and will seek a new formula for their operations. The triggered dynamics will favour Germany’s involvement in the construction of a “democracy platform” and the West’s consolidation, which will go hand in hand with an overhaul of the economic model. Today, the likelihood that this scenario, which at first glance seems bold and progressive, will materialise is much greater than it was before Russia’s invasion of Ukraine.

Germany’s decisions regarding the nature of its involvement in globalisation will be of fundamental importance to the situation of Poland and other Central European states – in part due to the magnitude of economic ties and to Germany’s role in the region. From their perspective, Berlin abandoning the “status quo” option and adopting a firm commitment to strengthen the Western institutions would be crucial. This would particularly help to increase the level of security on NATO’s eastern flank. In addition, Central Europe could benefit from moderate de-globalisation and rearrangement of supply chains, due to the fact that it would absorb some of the investments relocated from Asia to the EU. If a more thorough transformation towards a “democracy platform” is launched, the states of the region will face an immense opportunity to transform their economic models, even if it entails certain challenges and risks. In particular, this involves moving away from a low-cost competitiveness model, which at present is accompanied by dependence on fossil fuels, a relatively low level of innovation and a relatively poor quality of public goods. This shift will require a huge financial and organisational effort, comparable to the one that was made in connection with the systemic transformation back in the 1990s.