Can the global battle for electromobility pose a threat to Central Europe?

The Inflation Reduction Act (IRA) adopted in 2022 marks a profound change in the US’s approach to its economic competition with China. This will have global consequences, and will also come to affect Central Europe. Since this document was adopted, Washington has used subsidies to restrict access to the American market as a fully-fledged tool of its industrial policy. This is aimed at blocking the expansion of the Chinese automotive industry in the US and pushing it out of Western companies’ supply chains. As a result, Beijing will most likely utilise its resources to dominate the European market, capitalising on the advantages it already has. The discussion about the European response to the IRA, as well as the growing dependence of German companies on Chinese technologies in the field of electric vehicle production, suggest that Germany and Central Europe are drifting apart as regards the automotive industry, even though they used to have similar interests in this area. German vehicle manufacturers are opposed to imposing restrictions on vehicles made in China on the European market, as they fear retaliation and losing competitiveness. From the Central European perspective, the increasing presence of Chinese electric vehicles (manufactured by both European and Chinese companies) in the EU poses a threat to a key pillar of economic growth. The region has experienced unfair competition from Beijing for years, but it has managed to gain a foothold as a car production hub; its position may be undermined as a result of China’s expansion in the field of electromobility.

The EU has been a powerhouse of combustion car manufacturing for several decades. This industry, thanks to the strength of German, French and Italian manufacturers and their suppliers, generates the second largest share of the EU’s trade surplus and creates huge demand for products from other sectors.

Chart 1. EU trade balance by product categories

Source: author’s own calculations based on Eurostat data, epp.eurostat.ec.europa.eu.

In 2021, the automotive industry generated a positive trade balance of €112.2 billion; only the chemical industry generated a larger one (€185.8 billion). The machine-building industry (€51.9 billion) was third, and food production fourth (€21.8 billion). Other categories of goods – mineral fuels, other raw materials and other processed products – generated trade deficits (€286.2 billion, €29.5 billion and €28.8 billion respectively). The sales of goods such as chemical products and machinery were strongly linked to the investments made by automobile manufacturers, which impose very high standards on their suppliers. They must meet the challenges of just-in-time production, which must be synchronised so that as little inventory as possible is needed. Hence, European factories located outside the EU often arrange for plants of their trusted suppliers from within the EU to be built next to them.

Chart 2. The balance of trade in automotive products of individual countries with the EU and the rest of the world

Source: author’s own calculations based on Eurostat data, epp.eurostat.ec.europa.eu.

For years, German automobile manufacturers have unquestionably dominated the trade in goods in the EU’s automotive industry. In 2021, they generated a vast share of the trade surplus (€90.6 billion, or 80.7% of the surplus generated by the sector in the EU as a whole). Other countries with long vehicle manufacturing traditions and their own brands have been left far behind: France generated a deficit of €1 billion in trade with non-EU countries, and Italy had a surplus of only €5.4 billion. Interestingly, the automotive industries of the V4 countries generated a positive balance in trade with both the EU member states and the rest of the world. This sector has therefore become an important driver of the economic development. Over the past three decades, automobile manufacturers have made numerous investments in Central Europe, and many Central European companies have become specialised suppliers, in particular for German brands. This has been facilitated by lower wages than Western Europe, as well as strong industrial traditions and highly qualified staff. The expansion of German automotive companies in the region was one of the reasons for the extremely rapid development of trade between Germany and countries such as the Czech Republic, Poland, Slovakia, Romania and Hungary.

Beijing’s first halting steps in the automotive industry

Since China joined the World Trade Organisation in 2001, the West and China have been building ever stronger economic bonds. However, this has led to the emergence of an asymmetric model of relations. Although the EU has significantly eased trade restrictions and lowered tariffs, Beijing has not removed many of its informal barriers or elements of its policies of protectionism and state intervention against Western companies. This is perfectly illustrated by the situation in the automotive industry. Foreign car manufacturers could only locate factories in China if they established joint ventures with local partners, who had to hold a 51% stake in the enterprise. Beijing hoped that domestic manufacturers would acquire know-how concerning technology and production organisation in this way. The West tolerated this form of economic relationship because it did not consider it a threat to the technological and capital dominance of its own companies. German automotive companies benefited most of all from the opening-up of the Chinese market; by 2021, they had a 26% share in the market,[1] while at the same time holding a 42% share in the whole investment flow from the EU to China.[2] The Chinese began to realise that joint ventures alone would not bring them success. Although these joint ventures had helped local companies master the basic competences in the field of car manufacture and contributed to expanding the Chinese supplier networks, they did not guarantee sufficient technical progress to provide Chinese brands with export opportunities.

At that stage, the development of the automotive industry in China did not pose a threat to Central Europe, as the labour was divided relatively evenly: the Chinese focused on providing the cheapest components for vehicles on the global scale, and on manufacturing cars for the domestic market in cooperation with Western companies. In turn, the Central European region became a hub for the production of cars sold in the EU. Some components originating from China were also supplied to factories in Central Europe, contributing to the region’s trade deficit with Beijing. Nevertheless, individual countries generated a significant part of the added value, even from assembling Chinese-made parts.

Redefining industrial policy as the key to China’s expansion in the field of electromobility

For many years, Beijing was unable to make progress in the automotive industry comparable to its achievements in other areas. Typically, Chinese entrepreneurs, who enjoyed a huge cost advantage, initially focused on producing simpler goods. Over time, entire industry hubs developed in some regions, and became able to successfully compete with Western entities in the areas which require less complex innovations, such as electronics or photovoltaic cells. But the lack of success in the automotive sector prompted Beijing to reverse its priorities. China curbed its ambitions in the field of combustion car manufacturing, and focused on vying for hegemony in the fledgling segment of electric vehicles, as was openly declared in the ‘Made in China 2025’ industrial strategy developed in 2015.[3]

Government subsidies, together with an industrial policy focused on using the scale of the local market to master the entire value chain of electric cars, contributed to the expansion in electromobility. Beijing realised that if it could beat Western manufacturers in this aspect, it would gain a better starting position to dominate the entire industry. A large part of the funds for research and development (to which 2.44% of GDP was allocated) went to the electric vehicle sector in 2021, and this amount is expected to increase significantly in the coming years. For example, when Chinese manufacturers began to gain competence in the production of lithium-ion batteries for cars, between 2016 and 2018 Beijing temporarily limited access to subsidies for their Korean competitors and marginalised their position on the local market.[4]

These moves proved very effective: Chinese manufacturers have taken over a significant part of the electric car supply chain in less than a decade. At present, they have a 40–90% share in the processing of the resources necessary to produce lithium-ion batteries, a 62–90% share in the production of basic components for them, and a 78–90% share in more complex systems.[5] Currently, China’s CATL is a global leader; it has a share of 32.6% in the production of lithium-ion batteries (and the cells alone account for 35–50% of an electric vehicle’s value)[6]. In 2022, Chinese manufacturers controlled 80% of the domestic market for electric vehicles, while Tesla owned only 15% of it. The situation is different in China’s combustion car segment, where Chinese brands only have a 44% share. Furthermore, the huge market is contributing to the rapid acquisition of knowledge and experience. Already seven out of ten electric cars worldwide are sold in China, generating huge economies of scale.

Global automobile manufacturers are beginning to realise that the electromobility supply chain in China is so extensive that the country is becoming an electric vehicle production hub, not only for domestic demand but also globally. As much as 40% of the vehicles China exported in 2021 went to the European market, which not only offers relatively low trade barriers, but also has a well-developed charging infrastructure. Also, individual European countries grant subsidies for the purchase of electric cars, including exported ones. Beijing has adopted a completely opposite tactic, as it only offers subsidies for vehicles made in China on condition that the technology is transferred to Chinese entities. Automotive companies operating in China, both local and foreign, can also count on additional assistance from regional governments (such as covering energy costs) and favourable conditions for financing investments.[7]

Chinese companies expanding at Central Europe’s expense?

The European automotive giants, having become complacent with their strong position, disregarded the technological and social trends that have been boosting the expansion of electromobility. Some of them, instead of intensively working on the development of electric cars, only feigned action in this direction, while at the same time falsifying their products’ diesel emission measurements to prove they were lowering their environmental impact.[8] Meanwhile, their competitors from the US and China were meticulously developing their products. It will be difficult to make up for lost time, especially since it still cannot be ruled out that the sale of combustion vehicles will be banned in the EU as of 2035, and sales of electric vehicles will likely generate much lower profit margins for European manufacturers.

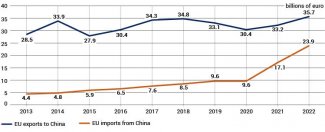

Chart 3. EU-China vehicle trade

Source: author’s own calculations based on Eurostat data, epp.eurostat.ec.europa.eu.

In 2022, China’s exports of electric vehicles rose by 89% to exceed one million units, which is about a third of the country’s total vehicle exports. However its greatest share is still generated by the sales of vehicles of foreign brands: in 2021, local entities (including Volvo) accounted for 37% of exports of such vehicles from China, the American brand Tesla accounted for 49%, and other European manufacturers 14%.[9] The large economies of scale and the increasing technological competence in the field of electromobility have helped Chinese companies to become strong competitors to Western manufacturers in third countries. However, they also have ambitions to rapidly expand their distribution channels and boost their position on the still very competitive European market, on which at present their share is just 5.8%.[10]

The sale of vehicles made in China on the EU market is likely to reach 15% by 2025. According to forecasts by PwC, China will by then be exporting 800,000 (mainly electric) vehicles to the EU. Most likely, only 41% of those vehicles will be Western brands.[11] If these estimates come true, this will mark the first time when China becomes a net exporter of vehicles onto the European market. Over the past two years, the EU’s trade surplus with Beijing has fallen by 43% to €11.7 billion, mainly due to a sharp increase in imports of Chinese vehicles.

China’s easing of the requirement to create joint ventures in the sector which manufactures vehicles for business (in 2020) and private (in 2022) purposes could be a sign of a new self-confidence. The situation has been turned round to such a degree that Western companies have now begun to seek the registration of joint ventures with Chinese enterprises in order to acquire know-how concerning their innovations. Since 2017, German automotive companies have announced plans for 17 investments in electromobility in China, and have established 30 R&D partnerships with Chinese entities.[12]

These tendencies are creating a dangerous situation for the Central European manufacturers. First of all, they are not benefitting from the European companies’ investments in China, where the electromobility chain remains in the hands of local manufacturers. Secondly, the expansion of Chinese vehicles into Europe poses another threat: as the production of combustion cars (in which suppliers from the region have a strong position) winds down, the EU market will come to be dominated by the Chinese, who mainly use components produced in China itself. Although the German brands will probably continue to offer appealing automobiles, especially in the premium segment, a large part of the components installed in them may come from China, which will affect the Central European automotive industry suppliers among others.

The assertive Americans…

Washington is well aware of the effectiveness of Beijing's strategy. At least since the Trump presidency it has adopted a very decisive policy to limit the role of American capital and technology in strengthening China’s technological potential. The Biden administration is largely continuing the tactics of its predecessors, although it has changed the tools slightly: instead of making rather ineffective attempts to block all trade, it has decided to drastically cut off China’s access to American technologies. It has also introduced extensive aid programmes for the American economy: in 2021, a plan was adopted to allocate $1.2 trillion on subsidising the modernisation of infrastructure over 10 years, and an act under which semiconductor manufacturers would be supported with a total sum of $280 billion for 10 years was passed in October 2022. This includes subsidies for building chip factories in the US, as well as expenditures on R&D and on training new staff.

Along with adopting the IRA, the US has decided to engage in the competition for the electric vehicle component market as part of its rivalry with China. Contrary to the name, the largest part of the funds from this programme ($369 billion out of $500 billion) will be allocated to subsidising the production of clean technologies in the United States[13] by offering tax breaks for investments in domestic production. The priority is to help change the supply chains of critical resources and components from the US’s trade partners, and to increase spending and commercialise the R&D process. The key instrument to support electromobility will be the subsidy of purchases of electric vehicles (up to $3750 per vehicle) in which at least 50% of the components have been manufactured or assembled in North America.[14] The second part of the subsidy (also $3750) will be available to buyers of vehicles in which critical raw materials such as lithium, cobalt and nickel are sourced from the US or its trading partners[15] (the share of these parts will be 40% in 2024, and will gradually rise to 100% in 2029).[16] In addition, starting from 2024, vehicles imported from countries branded as ‘foreign entities of concern’ (including China and Russia) will not be covered by subsidies at all. In this way, the Americans intend to limit funding not only for Chinese brands, but also for vehicles imported from China-based plants owned by Western companies.

The IRA also envisages significant tax deductions for manufacturing battery components and processing critical resources (as much as $2700–$3600 per battery)[17]. In many cases, companies will be able to receive support even if it exceeds the amount of tax liabilities, and thus it will take the form of a direct subsidy. This means that the IRA represents the first attempt of this magnitude to both block the expansion of electric vehicle manufacturers based in China on the US market and to push Chinese companies out of the supply chains of corporations active in the US. To a large extent, it is an imitation of the solutions that Beijing itself has been using for a long time with regard to foreign companies.

…and the divided Europeans

The EU has been gradually tightening its policy towards China in recent years; for example, it has introduced a mechanism for checking Chinese investments in terms of security, and reformed the anti-subsidy duties. However, it has not shown any desire to discriminate against them in its industrial policy regarding electromobility. To this day, cars exported by China to the US are subject to a 27.5% duty rate, while in the case of vehicles exported from China to the EU the figure is only 10% (even though vehicles exported from the EU to China are subject to a duty rate of 15–25%)[18]. In general, individual member states have subsidised the purchase of new vehicles, including those imported from China. On the one hand, this was a result of the lucrative interests of German companies on the Chinese market, and their unwillingness to strain relations between the EU and China. On the other hand, though, Brussels has positioned itself as a defender of the open model of globalisation.

When Washington adopted the IRA, this provoked a heated debate within the European Union. Many member states expressed concerns that the US subsidies could not only pose a challenge to the Chinese electromobility industry, but they could also drain new investments out of the EU’s green technology sector.[19] Since the very beginning, Germany and France have been actively involved in negotiations with the US, demanding that those effects of the act that are discriminatory for the EU be limited. Media reports suggest that the United States will only agree to minor concessions, such as subsidies for vehicles imported from the EU and used commercially under leasing. At the same time, Berlin and Paris are using the IRA to push through the relaxation of state aid rules within the EU. Over the past few years, during the pandemic and the Russian invasion of Ukraine, the European Commission has allowed an increase in the scope of EU subsidies, which mainly benefited German and French companies. According to EC data for 2022, 77% of the public financial support for companies (temporarily approved by the EC in connection with the Russian aggression against Ukraine) was allocated to Germany and France (53% and 24% respectively),[20] despite the fact that their share in the EU’s GDP is below half (only 41%); Italy took third place (7%). The data concerning the pandemic period are very similar: in the first half of 2020, Germany received 52% of the aid granted by the Commission.[21] It is not surprising, therefore, that almost all the rest of the EU opposes any further relaxation of the rules for public support, as this is beginning to undermine the cohesion of the single market. The EC has also proposed creating a new programme to support investments in green technologies (modelled on the reconstruction fund). Seven countries (the Czech Republic, Slovakia, Denmark, Finland, Austria, Estonia and Ireland) are opposed to this solution.; they argue that only a quarter of the recovery fund has been spent so far.[22] Germany and the Benelux countries have taken a similar stance.

What is the position of Central Europe?

Since the automotive industry is of enormous importance to the Central European economies, the region cannot remain passive in the discussion on the issues raised. Its consolidated voice could have a significant influence on the direction of the discussion. The IRA’s most dangerous effect is not discrimination against European manufacturers; many of them have assembly plants in North America and will retain access to at least some of the subsidies. A much bigger problem is that the expansion of Chinese electric vehicle manufacturers into the EU could even intensify as a result of the IRA; that will threaten the competitiveness of European brands, and especially their suppliers. It is unlikely that their position in Chinese value chains will be as strong as it is at present, given the fact that China has expanded the entire cluster of domestic suppliers of electromobility solutions. Central Europe and China are competitors in vying for the production of components and vehicles for the demands of the EU market.

Some of the workplaces lost could be compensated by an influx of Chinese investments. For example, from 2025 Hungary will become an important place for the production of CATL batteries. However, projects like this are unlikely to reach a very large scale in the rest of the region. This is for two reasons. Firstly, the Chinese central and local authorities will strive to concentrate high added-value production at home as much as possible, and then to export it to Europe in the form of components or finished products; subsidies for manufacturers or transport (for example by rail) may serve this purpose. Secondly, direct foreign investments from China in the region are increasingly politically motivated; they are used for rewarding loyal partners; one example of this may be the CATL project in Hungary.

The discussion around the IRA shows more and more clearly that the interests of Germany and Central Europe regarding the automotive industry are gradually drifting apart. For years they cooperated in an almost total symbiosis, as Central European plants were part of the German companies’ supply chains. However, the growing problem is that German automobile manufacturers, which are not keeping up with the trends in electromobility, are increasingly linking their fate with China. In the future, their vehicles may come to rely on Chinese components and technologies even more than before – at the expense of their Central European and German suppliers. It is also possible that they will choose to locate their production targeted at the European market in China much more often than they are doing so at present.

So, if the EU does not respond to the IRA, it is likely that Paris and Berlin will eventually push through a relaxation of state aid rules, from which Central Europe will probably lose out. This will mean that the unwritten rule that German and French companies receive the greatest part of EU support that has applied for years still stands. Therefore, it is important to develop an agenda for the region not only in response to the IRA, but also to create mechanisms ensuring a level playing field with China. The proposal to simplify and cut red tape in the EU funds in order to open them up more to the SME sector may be particularly attractive for Central Europe. It might be helpful to establish a programme similar to ‘Buy American’, which is being discussed in the EU. In practice, it would make European public procurement less accessible to enterprises from countries which do not offer a comparable degree of openness. From the region’s perspective, such a solution could actually support the concepts of backshoring and nearshoring, i.e. the return of investments to the EU, which was widely discussed during the pandemic.[23] Although intensive work is underway on tightening climate policy in the EU, which may translate into laying the foundations for an industrial strategy, the current regulations lack any pro-investment instruments comparable to the IRA.

[1] ‘Deutsche Autobauer verlieren in China Marktanteile’, Handelsblatt, 22 December 2022, handelsblatt.com.

[2] G. Sebastian, The bumpy road ahead in China for Germany's carmakers, Merics, 27 October 2022, merics.org/en.

[3] J. McBride, A. Chatzky, ‘Is ‘Made in China 2025’ a Threat to Global Trade?’, Council on Foreign Relations, 13 May 2019, cfr.org.

[4] B. Byung-yeul, ‘China’s extension of EV subsidies to impact LG Chem, Samsung SDI, SK Innovation’, The Korea Times, 8 April 2020, koreatimes.co.kr.

[5] G. Sebastian, The bumpy road…, op. cit.

[6] Ibidem.

[7] G. Sebastian, F. Chimits, ‘“Made in China” electric vehicles could turn Sino-EU trade on its head’, Merics, 30 May 2022, merics.org/en.

[8] K. Popławski, At a crossroads. Crisis in the German automotive industry, OSW, Warsaw 2020, osw.waw.pl.

[9] G. Sebastian, F. Chimits, ‘“Made in China”…’, op. cit.

[10] S. Cheng, ‘Tesla Rival BYD Leads Push to Sell Chinese EV Brands Around the World’, The Wall Street Journal, 3 March 2023, wsj.com.

[11] Electric Vehicle Sales Review Q3-2022, PwC, 2022, strategyand.pwc.com.

[12] G. Sebastian, The bumpy road…, op. cit.

[13] ‘The Inflation Reduction Act: Here’s what’s in it’, McKinsey & Company, 24 October 2022, mckinsey.com.

[14] C.P. Bown, K. Dziczek, ‘Why US allies are upset over electric vehicle subsidies in the Inflation Reduction Act’, Peterson Institute for International Economics, 2 December 2022, piie.com.

[15] This will include Canada, Mexico, South Korea, Australia and Chile among other countries. However the EU, the UK and Japan do not have such agreements with the US. Much depends on the final shape of the regulations developed on the basis of the IRA. During a meeting with Emmanuel Macron, President Biden suggested that the provision should generally include allies of the United States.

[16] A European Response to US IRA, Transport & Environment, January 2023, p. 24, transportenvironment.org.

[17] Ibidem, p. 25.

[18] N. Gibbs, ‘EU should impose higher tariffs on Chinese automakers, Carlos Tavares says’, Automotive News Europe, 19 October 2022, europe.autonews.com.

[19] ‘‘We like the IRA’: European firms lured by simplicity of US green subsidies’, Euractiv, 9 March 2023, euractiv.com.

[20] J. Allenbach-Ammann, ‘EU Commission’s Vestager proposes change to state aid rules’, Euractiv, 13 January 2023, euractiv.com.

[21] K. Popławski, ‘Gospodarka Niemiec – pandemiczne uderzenie i jego konsekwencje’, OSW Commentary, no. 335, 27 May 2020, osw.waw.pl.

[22] J. Strupczewski, ‘Seven EU countries oppose new EU funding as response to U.S. subsidy plan – letter’, Reuters, 27 January 2023, reuters.com.

[23] ‘Post Covid-19 value chains: options for reshoring production back to Europe in a globalised economy’, Policy Department for External Relations, European Parliament, March 2021, europarl.europa.eu.