Partial success: Russia’s oil sector adapts to sanctions

More than six months after the European Union imposed sanctions on Russian exports of oil and petroleum products, Russia’s oil sector has adapted to the new reality. Having found new markets, the industry has managed to cut crude production by only 5% while avoiding a reduction in oil processing. Moreover, sales of oil and petroleum products have increased.

However, the fact that drastic production cuts have been avoided represents only a partial success. Firstly, the current structure of Russian exports of oil and petroleum products is marked by instability and a heavy dependence on sales to two customers, India and China, which account for up to about 80% of Russia’s total sales. Secondly, following the EU and G7 countries’ introduction of a price cap on Russian oil, some exports have been discounted while the transport of crude has generated additional costs as a result of the sanctions. This allows Russia to sell more oil, but it also reduces its budget revenues. Thirdly, the Russian government has pushed through reforms to the taxation of this sector, but these have failed to increase budget revenues, and have also spurred further capital outflows from Russia and weakened incentives to investment.

By choosing not to slash crude production, the government has seemingly given priority to keeping its level stable at the expense of budget revenues. Therefore, the reduction of these revenues shows that the West has achieved the objectives of its sanctions, while also avoiding disruptions to supplies on global oil markets. However this situation may change in the second half of 2023, when an anticipated global oil deficit and a subsequent increase in the price of oil are set to boost Russian revenues from sales of crude and fuels.

The dual purpose of the Western sanctions

Following Russia’s assault on Ukraine in 2022, Western countries decided to introduce unprecedented sanctions against the Russian Federation. The oil and fuel industry was one of the targets. The European Union imposed an embargo on the seaborne imports of Russian oil (from 5 December 2022) and petroleum products (from 5 February 2023). Similar bans are also in place in some non-EU countries, including the US and the UK. The European Union and the US have also banned investments in the Russian energy sector and exports of technology & goods destined for Russian energy operators.

In addition, the EU countries, together with the G7 and Australia, have set a so-called price cap on Russian oil ($60 per barrel) and petroleum products ($100 per barrel for light fractions such as gasoline, and $45 per barrel for heavier fractions such as fuel oil). Under this mechanism, these goods can only be exported to third countries with the use of services provided by Western companies (transport, insurance, technical and financial assistance) if the product is sold at a price lower than or equal to that determined by the price cap. It is worth noting that in the case of oil, this limit exceeds the price of Urals oil per barrel that the Central Bank of Russia has adopted itself ($55 in 2023–2025).

The aim of these restrictions is to limit Russia’s ability to finance its war effort by reducing its revenue from exports of oil and petroleum products. The plan is for this to happen without triggering sanctions-induced surges in the prices of these commodities. Concerns about possible market disruptions stem from Russia’s prominence as a producer and exporter of both oil and fuels. In 2022, the Russian Federation again ranked third in terms of crude oil production, behind only the United States and Saudi Arabia.[1] In the year before its invasion of Ukraine, Russia’s exports of oil and petroleum products accounted for 13% and 11% of the global market respectively.[2] This sector is crucial to the Russian budget: in 2022 alone, the so-called oil and gas receipts accounted for 41.6% of its total revenues (35.8% in 2021), or nearly 11.56 trillion roubles.

Adjusting production in response to the embargo

The Western embargo on Russian fuels and oil forced Russia to adjust its production to the new realities. However, the fall in Russian oil production was not as sharp as international institutions had predicted last year.[3] According to estimates by the International Energy Agency (IEA), oil production in Russia has not faltered (this text uses data provided by the IEA[4]). The deepest cut came in March 2022, with a drop of around 800,000 barrels per day (bbl/d excluding condensate) from a level of 10 million bbl/d. Production started to increase again in the following months. The next serious drop occurred in 2023: production decreased gradually starting from February, eventually falling to 9.45 bbl/d in May and June.

Chart 1. Oil production (excluding condensate) in H1 2021–2023

Source: IEA.

Production of petroleum products (the Russian Statistics Service is still publishing data for these) showed more stable dynamics. According to Rosstat, the refining of the two main categories of fuels (petrol and diesel) was higher in the first half of this year than in the corresponding periods in 2021–22. The production of diesel saw the biggest increase, more than 8% up on last year. One exception was the production of fuel oil, which did increase, but only in comparison to last year’s reduction.

Chart 2. Production of gasoline, diesel and fuel oil in H1 2021–2023

Source: Rosstat.

Deepening dependence on new customers

The relatively small reduction in oil production (by around 5% from the pre-war level) has been achieved thanks to the successful redirection of the volumes that had previously been sold in the EU. The production of fuels (diesel and petrol) has not faltered either, as Russia has managed to find new markets. Moreover, total exports of oil and petroleum products from Russia registered an increase in the first half of this year.

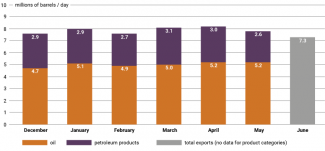

Compared to the first six months of 2021–22, sales of fuels and crude rose to around 7.9 million bbl/d in the corresponding period of 2023, with crude oil accounting for the majority of this. Looking month by month, we can see that these exports have been fluctuating: they reached a record volume of 8.3 million bbl/d in April, but then fell by around 1 million bbl/d to their lowest level since March 2021 in June.

Table 1. Exports of oil and petroleum products (in million bbl/d) from Russia in H1 2021–2023

Source: IEA.

Chart 3. Russian exports of oil and petroleum products in December 2022 – June 2023

Source: IEA.

The EU’s embargo on Russian oil, along with other restrictions, has shut out some 2.5 million bbl/d of the crude that had previously gone to the EU by sea.[5] Other customers, mainly in Asia, have picked up almost all of the oil that Europe no longer purchases. The share of two of these countries, China and India, is particularly notable: their imports from Russia, primarily oil, increased several-fold as early as 2022.

India has increased its imports of Russian crude from modest levels before February 2022 to more than 2 million bbl/d since April this year, while shipments of both oil and petroleum products from the Russian Federation to China have increased by an average of about 500,000 bbl/d per month compared to the levels from a year ago. The dominance of these two customers in the structure of Russian oil sales is considerable: in May this year they accounted for as much as 80% of Russia’s total oil exports, while the rest was redirected to Turkey and other countries.

Chart 4. Total Russian exports of oil and petroleum products by customer in January 2022 – April 2023

Source: IEA.

Unlike crude oil, the new supply structure for petroleum products is much more diversified and volatile. The overall volume of Russia’s foreign sales of fuels in the first half of this year rose slightly, to about 0.3 bbl/d; this is more than last year’s average of 2.6 bbl/d.

However, the redirection of supplies of Russian petroleum products has been more chaotic than in the case of its oil. This is because it is physically more difficult nature to transport this fuel, and also because competition on this market, which includes China, India and Saudi Arabia, is strong. Russia has significantly increased its exports to existing customers (Turkey, Egypt, the UAE), but it has also started sales to completely new customers, including African and South American countries. In some of these, supply levels have been fluctuating from month to month.

Table 2. Exports of gasoline and diesel fuel (in thousands of tonnes) from Russia to selected countries in H1 2022 and 2023

Source: Argus.

Thanks to the new customers for its exports of oil and petroleum products, Russia has avoided having to significantly reduce its extraction and production. However, we should keep in mind that the current situation comes with a number of uncertainties that could affect the stability of exports in the future.

India and China have both exploited Russia’s dependence on the two countries for oil sales to secure discounts or preferential terms of supply. Before 2022, Russia’s crude exports were more diversified: its destinations included European countries, the United States and others. The purchase of more than half of the total Russian crude sales by Chinese and Indian customers now makes a significant part of these exports dependent on the domestic economic situation of just two markets, and also carries risks in the event that either of these countries halts imports. Moreover, due to the discounted price of Urals crude oil, Russian exporters were able to send the commodity in such quantities. As a result of the sanctions, from last December to May this year the difference in prices between the Western Brent brand and Urals oil reached a record high of more than $30 per barrel (see Chart 5). It remains to be seen whether China and India will still be interested in imports from Russia if prices rise as a result of the anticipated shortage of crude on the global market. Both countries can turn to competing suppliers, whose oil is transported over shorter distances and is not subject to sanctions.[6]

The prospects for Russia maintaining the current level or increasing the exports of its petroleum products remain equally unclear. Although the structure of Russian petroleum exports is currently much more diversified than that of oil, its fluctuations reflect a rather situational and unstable sales model. In addition, the markets of African countries are relatively small compared to those in the EU and do not show any significant growth potential, while transport to Latin America is expensive. On the other hand, Russia is having to export its petroleum products to countries with considerable refining capacities, such as the Gulf countries, as a consequence of the EU’s embargo on these products. Saudi Arabia and the United Arab Emirates have been importing cheap fuels from Russia to cover their domestic demand or to re-export them. Meanwhile, they have been selling their own products on EU markets at higher margins. In the long term, as Europe moves away from fossil fuels, petroleum products from the Gulf states will either have to partly return to the domestic markets or compete with Russian production elsewhere.

Methods of circumventing the sanctions

The Western restrictions have also affected the very dynamics of the prices for Russian oil, which was heavily discounted after the embargo came into force and the price cap mechanism was introduced. The low pricing for crude has dented the Russian Federation’s budget revenues, which is why its government has resorted to measures that both violate the Western restrictions and mislead the public.[7]

Chart 5. Average monthly price per barrel of Urals and Brent crude oil in December 2022 – June 2023

Source: the Ministry of Finance of the Russian Federation.

Industry reports have suggested that Russian oil and petroleum products may be deliberately underpriced at ports in Russia’s European part in order to keep them below the Western price cap. This stems from the still important (albeit declining) position of Western capital in the mechanism for exporting raw materials from Russia. While in March 2022 Western entities (from the G7, the EU and Norway) transported or insured more than 80% of Russian exports of fuels and oil, in June this year their share stood at around 55% and 65% for oil and petroleum products respectively.[8] Even though this proportion has fallen significantly, Western companies are still essential to Russian exports; indeed, any shift away from using their services could force the Russian government to reduce these exports and consequently slash production.

For this reason, the current practice is to sell the product in a Russian port at a price that allows the use of Western transport and insurance services. Companies which were established after March 2022 and registered in the United Arab Emirates, Hong Kong, Turkey and other countries are buying these volumes and then reselling them to end users at a higher price.[9] There are many indications that these traders are linked to Russian oil companies, which are thus trying to evade the sanctions and the Russian tax burden. Some of these do not even bother to hide their origin; one such is Litasco, the Swiss subsidiary of Lukoil, which has moved some of its operations from Geneva to the Middle East.[10] The exporters pay tax and duty on the export price, that is, the understated value at the port, while an intermediary company registered outside Russia collects an additional margin on the sale to the actual customer.

The widespread nature of this practice can also be seen in the price structure of crude oil. While the price of crude at Russia’s European ports has remained below the limit of $60 per barrel since last December, it has been hovering above this threshold at the Far Eastern port of Kozmino. This is because the scheme for exports of crude from that port (most of which goes to China from there) did not have to be adjusted to the restrictions, and so it was not necessary to look for new carriers or customers.[11] The situation has been different in Russia’s European ports, where exporters have more frequently been resorting to services provided by Western entities. The embargo has forced them to find new buyers for shipments from those ports, and to use longer transport routes.

Table 3. The average price (in USD) per barrel of Russian oil at the ports of Primorsk, Novorossiysk and Kozmino, as of 28 June.

Source: Argus.

Traders in Russian oil and petroleum products have also resorted to a number of measures designed to enable them to transport crude outside the reach of Western sanctions. One of these is the creation of the so-called ‘shadow fleet’: these are tankers without Western registration and insurance, which operate in a similar fashion to ships that transport oil from Iran or Venezuela. S&P Global estimated the number of such vessels at nearly 450 in March this year[12], and it has likely risen further since then, as suggested by the calculations mentioned above which show a drop in Western ownership of ships that serve Russian exports. Moreover, vessels which are insured by Western institutions but continue to transport products from Russia have been using other methods to evade sanctions, such as turning off their transponders or using them to send false location signals.[13] Russian fuels and crude have also been trans-shipped on the high seas in ship-to-ship operations designed to conceal their origin, for example by mixing oil from Russia with oil from other sources. The European Commission has recognised the use of similar procedures as constituting a breach of the sanctions.[14]

The impact of all these activities is difficult to estimate due to their secretive nature. Nevertheless, it should be noted that the scheme as developed has failed to yield any additional revenue to the Russian budget, while its organisation (especially due to the longer transport routes from Europe to the new customers, the high cost of the illegal procedures and the deliberate reduction of the prices at ports) are actually generating further financial burdens. In this situation, these efforts should be seen as primarily aimed at avoiding a drop in the production of oil and petroleum products. By selling higher volumes, Russia has been trying to offset its losses resulting from the low crude and fuel prices, which have fallen partly because of the Western sanctions. At the same time, the high level of exports puts off the prospect of shutting down oil fields or reducing refinery production; such stoppages generate additional costs. Allowing Russian companies to sell their volumes at a cost to the state budget may also be a means of containing the negative sentiments in the Russian oil and fuel industry.

The budgetary tug-of-war

Despite adopting the priority of keeping exports high, the Russian government has also been trying to adapt systemically to the current conditions by reforming the tax system for the industry. The sanctions, and particularly their effect of driving down the prices of Russian oil, have led to a sharp reduction in revenues of the oil and gas sector. While in the first half of 2022 these accounted for around 45% (6.4 trillion roubles) of the total revenue in the federal budget, this figure had already fallen to some 27.5% (3.2 trillion roubles, a drop of 47% year-on-year) in the same period this year. Since 2006, when revenues from the oil and gas sector were singled out in budget statistics, their average share has fluctuated between 36% and 51% of total annual receipts.

In an attempt to counter this negative dynamic, in April the Russian government introduced a new taxation mechanism for the oil industry. Previously, the reference price of the Urals brand was used as the basis for calculating the tax burden (primarily extraction tax and export duty). However, the Western restrictions have created a significant price difference between Urals and the Western Brent brand, to the disadvantage of the former, which has had a negative impact on budget revenues. Since April, the tax base has been calculated on the basis of the average price of Brent oil, which a government-determined discount reduces if the market price of Urals is lower. In August, the government decided to embed this reform by setting this discount at $20.

Early this year, the government also announced the reform of an equally important fiscal mechanism aimed at maintaining stable fuel prices in Russia, the so-called price-damping mechanism. This involves paying compensation to fuel producers when the export price for these products is significantly higher than the domestic price. In this way, the state encourages fuel operators to sell actively on the Russian market in order to prevent spikes in domestic prices and avoid shortages. Conversely, when prices abroad are low, the companies pay money into the budget.

The Russian government has decided to reduce subsidies for petrol and diesel producers from September this year until the end of 2026.[15] The compensation rate will be less than half what it was before, which the government says will generate greater budgetary savings. After the government announced the amount of this change last April, gasoline prices on the Russian wholesale market entered a long upward trend: they rose from nearly 50,000 roubles per tonne to almost 64,000 roubles in mid-July.[16]

The Kremlin is also not ruling out the possibility of implementing ‘manual’ export controls on petroleum products to protect the domestic market from high prices and avoid shortages. To this end, in May the ministry of energy was expected to issue a ‘recommendation’ to refining entities, instructing them to boost domestic petrol and diesel sales at the expense of exports.[17] The extent of the state’s intervention may go even further: at a government meeting on the situation in the petroleum product market on 31 June, deputy prime minister Aleksandr Novak ordered the development of a preliminary scheme for fuel operators that will introduce export quotas for such products[18]; this scheme may take the form of a list of companies that will be allowed to sell their products abroad.[19]

So far, none of these measures have had the desired effect of boosting budget revenues or preventing the sanctions from having a negative impact. Interestingly, the new formula for taxing the oil sector (Brent price as a benchmark, reduced by a ‘fixed’ discount) has not actually been implemented: since April this year, the global price of Urals has been higher than that suggested by the rate introduced in April. However, the mere announcement that the compensation mechanism for fuel producers would be reformed and that quasi-manual export controls might be introduced has already led to palpable negative consequences. Since April, wholesale petrol prices in Russia have risen by nearly 20% to reach record highs, and the number of illegal petrol stations has increased.[20]

Conclusions: a future test of flexibility

During their first six months in operation, the Western sanctions have proven effective in achieving the stated objectives: reducing Russian budget revenues while avoiding any destabilisation of the market or spikes in the prices of oil and petroleum products. The Western embargo and price cap have effectively driven down the price of Russian oil and generated additional costs for shipments of crude and fuels. This has dented Russia’s budget revenues, in which the proportion of proceeds from taxation of the oil and gas sector has fallen significantly. The steady devaluation of the rouble, which indicates a reduced inflow of foreign currency, also reflects these declines.

The regulations that the government has introduced to increase revenues from the oil and gas sector have so far failed to reverse the downward trend in these receipts. Moreover, the new regulations have exacerbated the negative developments within Russia, such as illegal fuel sales and price increases. They have also removed investment incentives and encouraged capital flight abroad. In the long term, this will have a negative impact on the competitiveness of exporters.

The Russian government has decided to prioritise keeping production stable rather than making major production cuts, which could have pushed up prices and revenues from taxing this sector. The small reduction in oil extraction (by around 5% compared to early 2022) and the increases in average petroleum production and total exports have been achieved primarily by finding new markets and using a number of methods to circumvent the sanctions (as can be seen, for example, in the expansion of the so-called shadow fleet).

However, despite the Kremlin’s threats, Russia’s influence on the global market is rather limited; its most effective tool would be to unilaterally reduce supplies, but so far it has refrained from taking this step. This stems from the fact that a drastic reduction in the production of oil and fuels would mean halting work at some fields and refining facilities; that would generate costs and raise risks associated with resuming production at a later date. Despite the relatively low prices of crude in the first half of this year, the Russian state still earned money on its exports, as the total cost of producing a barrel of crude in the Russian Federation is in the range of $15–45.

Another test of the effectiveness of the Western sanctions, as well as Russia’s adaptation to them, will come with the anticipated long-term crude deficit on the global market, which is likely to keep the average price of Russian oil above the price cap ($60 per barrel). The big unknown is whether Russia will continue to depress the value of its exports due to its dependence on Western insurance companies and shipowners. Paradoxically, an increase in the price of Russian crude will also reduce its competitiveness in relation to other producers, as the attractiveness of the discounts on offer has been the main driver of the surge in exports. A possible drop in sales as a result of greater competition from other exporters may lead to a deeper reduction in domestic production of both oil and fuels.

[1] Data from the International Energy Agency (IEA).

[2] C. Heusaff, L. Guetta-Jeanrenaud, B. McWilliams, G. Zachmann, ’Russian crude oil tracker’, Bruegel, 15 June 2023, bruegel.org.

[3] In March 2022, the IEA predicted that production would fall by up to 3 million barrels per day.

[4] It is currently impossible to determine the actual volume of oil production in the Russian Federation due to the Russian government’s deliberate policy of withholding data related to crude production. The CDU TEK agency, which operates under the energy ministry, stopped the publication of statistics on the volumes of oil production and exports in April 2022, while Rosstat also removed statistics on crude production from its monthly industrial indicators in April this year.

[5] Oil 2023: Analysis and forecast to 2028, International Energy Agency, June 2023, iea.org.

[6] According to Indian estimates from June, Indian refiners had saved more than $7.1 billion by purchasing discounted oil from Russia. See S. Sharma, ‘Discounted Russian crude imports saved Indian refiners $7 billion’, The Indian Express, 5 July 2023, indianexpress.com.

[7] The opacity of data on oil production has triggered a wave of speculation in the media about Russia’s policy inside the OPEC+ cartel. See F. Rudnik, ‘The OPEC+ summit: an increase in Russian oil exports at the expense of other producers’, OSW, 7 June 2023, osw.waw.pl.

[8] ‘June 2023 – Monthly snapshot on Russian fossil fuel exports and sanctions’, Centre for Research on Energy and Clean Air, 12 July 2023, energyandcleanair.org.

[9] A. Nightingale, J. Lee, S. Cho, ‘How an Aging Armada and Mystery Traders Keep Russian Oil Afloat’, Bloomberg, 12 May 2023, bloomberg.com.

[10] T. Wilson, ‘How Dubai became ‘the new Geneva’ for Russian oil trade’, Financial Times, 19 July 2023, ft.com.

[11] B. Hilgenstock et al., Russian Oil Exports Under International Sanctions, KSE Institute, 26 April 2023, kse.ua.

[12] B. McKinney, ‘Russia’s Shadow Fleet – Understanding its Size, Activity and Relationships’, S&P Global, 17 March 2023, spglobal.com.

[13] C. Triebert et al., ‘Fake Signals and American Insurance: How a Dark Fleet Moves Russian Oil’, The New York Times, 30 May 2023, nytimes.com.

[14] For more detail see I. Wiśniewska, ‘Tightening restrictions: the EU’s eleventh package of sanctions against Russia’, OSW, 26 June 2023, osw.waw.pl.

[15] А. Гончаренко, ‘Президент РФ В. Путин подписал пакет налоговых поправок для нефтегазового сектора’, Neftegaz.ru, 31 July 2023, neftegaz.ru.

[16] А. Гончаренко, ‘Цена бензина Аи-92 и Аи-95 на российской бирже продолжает рекордный рост’, Neftegaz.ru, 20 July 2023, neftegaz.ru.

[17] В. Милькин, Д. Савенкова, ‘Оптовые цены на бензин обновили исторический максимум’, Ведомости, 15 June 2023, vedomosti.ru.

[18] ‘Александр Новак провёл совещание по ситуации на рынке нефтепродуктов’, The Government of the Russian Federation, 30 June 2023, government.ru.

[19] ‘Минэнерго рассматривает возможность ограничения числа экспортеров топлива’, TASS, 24 July 2023, tass.ru.

[20] В. Воронов, ‘Выйдет баком: в России активизировались нелегальные заправщики’, Известия, 1 June 2023, iz.ru.