Fanning the flames: crisis on the Russian fuel market

The increase in fuel prices in Russia seen since the beginning of the year and fuel shortages at individual gas stations forced an unprecedented response from the government: a ban on the export of diesel oil and gasoline. According to decision-makers, the problem with the availability of fuel resulted from the industry’s deliberate move aimed at taking advantage of attractive export prices. However, the real causes lie in structural factors, such as Russian legal regulations and market characteristics. Western sanctions imposed on Russia further disrupted the sector’s operation.

Although the domestic shortage was alleviated and prices fell as a result of the ban on fuel exports, it was impossible to sustain it over an extended period due to the resulting budget losses and the inability to store what is produced. In order to resolve the structural problem with the unprofitability of selling petroleum products on the domestic market, the prices would have to be liberalised to a great extent, and higher subsidies would have to be provided to the industry. Each of these solutions is costly for decision-makers since the liberalisation of retail prices could provoke further public unrest, and subsidising producers would make it difficult to balance the budget. At this stage, the government has opted for hybrid solutions, forcing producers to ramp up domestic supplies while increasing subsidies.

The crisis on the fuel market also has political implications. The availability of petroleum products is a sensitive topic because the Kremlin sees price rises as a potential source of social tension. Therefore, the failure to address this issue for half a year suggests that the government’s decision-making process has lost effectiveness, as it has been unable to force the fuel sector cooperate with it for a long time. The suspension of foreign sales can in itself be interpreted as an attempt to achieve this cooperation by force. The escalation of the conflict and the ostentatious moves from both sides (refineries cutting production contrary to the government’s appeal, and the decision-makers’ imposition of the export ban) are proof of discord within the elite. The reintroduction of subsidies is a partial success for the industry, although this does not solve the structural weakness of the entire market. If another external shock comes, the confrontation is likely to flare up again.

Symptoms of crisis

The current crisis on the Russian fuel market is characterised by a gradual increase in the prices of gasoline and diesel oil. The wholesale prices began to go up when the EU introduced the embargo on Russian petroleum products in February, which further led to an increase in retail prices. Exchange indexes reached record highs as they more than doubled by mid-September. In turn, between January and September, the retail prices of gasoline and diesel oil increased by ‘only’ around 9% and 10%, respectively, and stood at 55.92 roubles and 64.99 roubles per litre on 25 September. The price rises were above the level of inflation which was 5.8% y/y at the end of September. As a result, gas stations had problems with supplies in summer, and some of them ran out of fuel. This happened because selling fuel was no longer profitable for independent gas stations which had to buy increasingly expensive fuel from wholesalers at a high exchange prices.

The upward trend in fuel prices slowed down only on 21 September, when the Russian Prime Minister Mikhail Mishustin signed a regulation suspending the export of gasoline and diesel oil (with several derogations concerning, for example, exports to the countries of the Eurasian Economic Community) until further notice. This decision resulted in a sharp drop in the exchange prices of diesel and gasoline by approximately 20%, which led to a slight drop in retail prices. However, the decline on the exchange was short-lived, and in the end the prices rebounded to the high levels seen at the beginning of summer.

Chart 1. Retail prices of gasoline and diesel oil between 5 February and 2 October 2023

Source: Rosstat.

Chart 2. Exchange (SPIMEX) prices of selected fuels between 23 January and 26 September 2023

Source: SPIMEX.

The ‘impression’ of a shortage

Rising fuel prices quickly became a political topic as this is a sensitive issue for the Russian public, especially given the fact that their country has a thriving refining industry and rich oil deposits. According to the government, the increase in fuel prices is a threat because the public mood may worsen as a result of inflationary pressure and the adverse impact on specific population groups (including farmers). This issue is also important in the face of the presidential elections scheduled for March 2024.

Government representatives consistently emphasised that the problems related to fuel prices and availability only made the “impression of a shortage”, while the market was in fact adequately supplied.[1] However, President Vladimir Putin admitted during the Eastern Economic Forum on 12 September that the government had not responded to price changes promptly enough.[2] Finally, after the export ban was introduced, the President of the Russian Federation and members of the government had an emergency meeting during which Deputy Prime Minister Alexander Novak outlined specific steps to restore balance on the domestic market. In response to his proposal, Putin called on decision-makers and the industry to improve cooperation.

On 6 October, the previously announced solutions were implemented: the higher rate of the so-called ‘price-damping mechanism’ was reintroduced (these are subsidies for the industry encouraging the sale of fuel on the domestic market), the customs duty was increased and the requirement for producers to sell fuels on the national exchange was reinstated (from 9.5% to 12% of the total volume of diesel oil produced and from 13% to 15% in the case of some types of gasoline). At the same time, the ban on diesel exports was lifted and a new restriction was introduced: only those producers who supply 50% of their output to the domestic market can export their products.

A show of strength on both sides

Until the export ban was established, government and industry representatives blamed each other for the deepening crisis but failed to present any concrete solutions to counteract it, even though they did have ready-to-use instruments, which was discussed in the media.[3] Policymakers resorted to verbal appeals, demanding that the sector increase domestic supplies at the expense of exports[4] and threatening to introduce export quotas, among other measures.

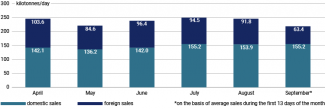

Interestingly, Russian fuel exports fell significantly this summer. In August, the level of foreign sales was the lowest since September 2022. This was partly due to the reduction of gasoline and diesel exports which at that time reached a total level of 1.04 million barrels per day, almost 6% less than in July this year.[5] The negative trend intensified in September, especially in the case of diesel oil. In the first half of the month (before the export ban was introduced), the volume of diesel exported abroad was over 30% lower than in the first two weeks of August.[6] The final volume of fuel exported in September will be even smaller due to the legislation to suspend foreign sales on 21 September. Since Russia lost the EU market due to the embargo, the largest volumes of its fuel exports has been sent to Turkey, the Persian Gulf countries, Brazil and some North African countries.

Chart 3. Domestic and foreign sales of Russian diesel oil in April–September 2023

Source: Bloomberg.

Exports were cut due to the reduction in the output of Russian refineries, allegedly because of the need to do maintenance work (see Chart 4). The fact that maintenance work started at so many plants at the end of August, meaning at the time when the local fuel shortages were the worst, suggests that the industry had reduced production on purpose. In doing so it demonstrated its opposition to the government’s policy and underlined its own influence on the situation in the country. One way to interpret this is that it was industry’s response to the government’s appeals regarding the need to limit exports. In turn, the government’s decision to ban foreign sales came as proof of its attempt to force the sector to cooperate.

Chart 4. Weekly production of gasoline and diesel oil between 6 February and 1 October 2023

Source: Rosstat.

The structural weaknesses

Fuel crises on the Russian market are primarily of a structural nature. They tend to occur cyclically, usually as a reaction to a rapid increase in oil prices on the global market, as in 2018. This is due to the way the oil and fuel sector functions in Russia, as it is particularly susceptible to external shocks.

Firstly, the market is strictly regulated. The retail price of fuel in Russia is regulated by the state and cannot rise faster than inflation. Moreover, increasing fiscal burdens limit retailers’ profits: at present, around 85% of the retail fuel price is taxes. Due to this, retail distribution is particularly unprofitable. This particularly affects smaller entities, such as independent gas stations which cannot produce their own products. Moreover, the degree of fiscal burden on the entire sector makes it difficult for companies to invest in both extraction and refining. According to data from the Russian Academy of Sciences, the revenues of oil and fuel companies are subject to the highest taxes of all industries. In 2020, the share of taxes in this sector’s financial results was on average 87%, while in the gas sector it was approximately 66%.[7]

Secondly, domestic demand is satisfied mainly thanks to governmental instruments affecting the industry. Producers are legally obliged to resell part of their production on the domestic exchange. Moreover, a compensation, so-called ‘price-damping mechanism’, has been in place since in 2019. This involves subsidies paid to companies operating in the fuel sector in situations where the export price of fuel is higher than the domestic price. In this way, the state encourages the industry to actively sell their production in Russia, contributing to reducing wholesale prices and preventing deficits. At the same time, government subsidies compensate the sector for part of the losses resulting from selling its production on the domestic market at lower prices.

Thirdly, the sector has an oligopolistic structure, dominated by a few state-owned or state-affiliated entities. These are ‘vertically integrated’ corporations that have the entire value chain at their disposal – from oil extraction, through its processing and logistics, to domestic distribution and export. These entities account for approximately 75% of total fuel sales on the retail market,[8] and access to their own product allows them to compete more aggressively on prices. Additionally, the ability to export both crude oil and fuels is a valuable source of income for them and compensates for the low margin in domestic trade.

The external shock

The existing regulatory environment is causing a permanent conflict between the government and the industry due to a conflict of interests. The government consistently increases the burden, especially a fiscal burden, on the oil sector, and the sector demands taxes be cut and domestic prices liberalised. The shock of war and sanctions[9] has shattered the fragile consensus between the sector and policymakers. This forced the government to take measures affecting the fuel companies. This has led to a further decline in the profitability of domestic sales, affecting the supply of fuels on the domestic market.

Growing budget expenses combined with low revenues forced the government to look for additional sources of financing and savings. As a result, the fiscal burden on the sector was increased and the so-called ‘damper’ rate for September was reduced (in January-September this year, 1.13 trillion roubles was paid to this effect or 38% less y/y). In August, the government decided to reduce the subsidy, cutting the rate by 50%. Interestingly, there is a chance that the September subsidies will not be paid at all.[10] When the subsidies for the industry were reduced, the refining and sale of fuels on the domestic market became highly unprofitable compared to their export; the difference reaching around 50,000 roubles or 600 dollars per tonne)[11]. Refineries, wanting to make money on their own production, preferred to export it abroad and cut their supplies to the domestic market.

The subsidies were cut because the government had to implement an austerity policy due to reduced export revenues as a result of Western sanctions. The decline in revenues led not only to the reduction of the so-called ‘damper payments’, but also to the imposition of a yet heavier fiscal burden on the industry, namely an increase in the tax rate for oil extraction in 2023–2025. Currently, the idea of imposing an excess-profits tax on the sector is also being discussed.

Another external factor is the gradual devaluation of the rouble, as its exchange rate dropped from around 70 roubles to one dollar at the beginning of February to nearly 97 roubles in October. Growing imports (payments are usually made in Western currencies) coupled with poor export results (largely paid in yuan, dirhams or rupees) led to a shortage of convertible currency in the country. This contributed to a weaker correlation between global oil prices and the exchange rate of the Russian currency, as demonstrated by the further weakening of the rouble despite rising crude oil prices. Therefore, given the cheap money, exports cleared in foreign currencies have become more attractive because exporters also benefit from high prices of oil and fuels on the global market. On the other hand, the ongoing devaluation of the Russian currency contributes to an increase in fiscal burdens because the taxes the industry has to pay are calculated on the basis of the average export price of oil and are paid in roubles. This increases nominal budget revenues and adversely affects the financial results of oil and fuel exporters.

Conclusions: the government has reached a dead end

The ban on exports of diesel and gasoline was a temporary solution. It was unsustainable in the medium term due to budget losses resulting from the suspension of foreign sales. Moreover, if refineries were unable to export their production, they would be forced to suspend operation, which would generate additional costs, not only financial but also infrastructural. Nevertheless, the suspension of exports did work as expected, leading to a significant reduction in the exchange prices of diesel and gasoline on the domestic market and ended the local shortages of fuel.

The sanctions have changed the way the Russian market operates, so the Russian government needs to adjust its policy towards the oil sector and develop a new compromise. A hybrid solution has been chosen: increasing subsidies while strengthening market regulations. The return to the original rate of the so-called ‘price-damping mechanism’ is a success for the industry as it will increase the profitability of domestic sales while shielding consumers from higher costs that may be a source of public unrest. However, the payment of subsidies at the appropriate level will generate large costs for the budget, especially given the devaluation of the rouble and global price rises, which creates a price gap between exports and domestic sales.

All this, coupled with intensifying market regulation (increasing sales quotas on the exchange, enabling export for producers and at the same time imposing on them the requirement to leave 50% of their diesel production at home) proves that the government is determined to tighten its control over the sector. A further tightening of ‘manual’ control will adversely affect the competitiveness of the market, causing the disappearance of smaller entities and weakening the investment incentives. It remains unknown how the government will enforce the obligation to keep half of diesel production on the domestic market. The introduction of this restriction suggests that decision-makers can make arbitrary decisions regarding which refinery will be able to export its production.

The way the discussion on solving the fuel crisis has been developing so far suggests that the government, which also controls the oil and fuel sector, has lost some of its effectiveness. The industry itself, given the personal connections and the degree of government control,[12] is an inherent part of the contemporary Russian political elite. Therefore, one would expect to see coordinated efforts to prevent a crisis. The escalation of the conflict and the ostentatious moves from both sides, such as the refineries cutting production contrary to the government’s appeal and the decision-makers imposing the export ban, suggest that there is discord within the elite, and that it is especially visible in the present conditions.

On the one hand, it is in the interest of the government to maintain a stable level of supplies on the unprofitable domestic market for fear of price increases that could affect the public mood. On the other hand, the industry’s profits, especially from exports, are a source of private income for representatives of the elite, as well as revenues for the budget. Achieving both of these goals at the same time is difficult, given the sanctions, growing war expenses and the resulting sacrifices due to the difficult budget situation. The oil sector’s confrontational response was an attempt to regain control over its profits. So far this has been successful as illustrated by the reinstatement of subsidies at the previous level. However, the market’s structural susceptibility to external shocks shows that the balance may be upset again when another shock comes, such as another decline in budget revenues due to a drop in prices on the global market.

[1] С. Тихонов, С. Задера, ‘Павел Сорокин: Сейчас обсуждаются способы того, как пресечь "серый" экспорт бензина’, Российская газета, 14 September 2023, rg.ru.

[2] А. Горошилова, ‘Путин: правительство договорилось с производителями о ценах на топливо’, Коммерсантъ, 12 September 2023, kommersant.ru.

[3] Д. Козлов, ‘Экспорт — заводам’, Коммерсантъ, 6 September 2023, kommersant.ru.

[4] В. Милькин, Д. Савенкова, ‘Оптовые цены на бензин обновили исторический максимум’, Ведомости, 15 June 2023, vedomosti.ru.

[5] P. Prem, ‘Russia’s Fuel Exports Hit 11-Month Low Amid Refining Slowdown’, Bloomberg, 6 September 2023, bloomberg.com.

[6] ‘Russian Diesel Exports Dip Nearly a Third So Far This Month’, Bloomberg, 18 September 2023, bloomberg.com.

[7] Е. Бурлакова et al, ‘Правительство обсуждает повышение налогов на 400 млрд’, Ведомости, 5 July 2021, vedomosti.ru.

[8] ‘Частные АЗС - бизнес на грани банкротств? Обзор’, Интерфакс, 22 July 2021, interfax.ru.

[9] F. Rudnik, ‘Partial success: Russian oil sector adapts to sanctions’, OSW Commentary, no. 528, 9 August 2023, osw.waw.pl.

[10] The mechanism only works when the exchange prices of gasoline and diesel do not exceed the index prices by 10% and 15% respectively (these prices are 56,900 roubles and 53,850 roubles per tonne). The prices of petrol and diesel in September were on average over 20% and 35% higher, respectively.

[11] О. Мордюшенко, ‘Топливо пугают пошлиной’, Коммерсантъ, 18 September 2023, kommersant.ru.

[12] Control over the oil and fuel sector was one of the priorities during the early stage of Putin’s rule. One of the means to this end was using his aides in the process of taking control of companies (Sibneft was purchased by Roman Abramovich and incorporated into Gazprom’s structures as a subsidiary named Gazprom Neft) or placing them in the companies’ governing bodies (Igor Sechin, who has been working closely with Putin since the 1990s, became the CEO of Rosneft).