Fear of retaliation: Germany’s concerns about punitive tariffs on electric cars from China

The European Union is nearing a decision on whether to impose restrictions on imports of electric cars from China. The German automotive industry is observing this scenario with apprehension as it expects both retaliation from the government in Beijing and a further erosion of its position on the Chinese market, which is crucial for its turnover and profits. Germany’s federal government has taken due consideration of the need to protect the EU’s competition rules and the development of e-mobility, but it also fears retaliation from China, and in particular, its spillover into other sectors of the economy.

Chinese exports will be the focus of a growing dispute – particularly between France, which has insisted on a tougher course of action, and Germany, which will seek to moderate China’s sanctions and negotiate with it. If punitive tariffs are imposed, the automotive industry may have to change its strategy and adapt to the fragmentation of the global trade space resulting from the use of protectionist tools. This could lead to a further regionalisation of production and its relocation to either China or countries that benefit from easier access to its market.

During the State of the Union address on 14 September 2023, President of the European Commission, Ursula von der Leyen, announced the launch of an investigation into the scale of the Chinese government’s support for domestic manufacturers of electric cars. The Commission believes that the subsidies China provides have violated the competition rules for the EU’s common market, where strict rules concerning state aid apply.

Following the formal launch of this procedure, the Commission has 13 months to decide whether to raise duties or apply other remedies. However, it can impose temporary restrictions ahead of this deadline. Officials are facing a daunting task: within a relatively short period of time they will have to scrutinise a complex supply chain, including the production of batteries and engines, the conditions of access to rare earth metals and steel, the financing of investments, and finally export subsidies. The fact that both central and regional governments in China have provided differentiated support for the industry will not make this process any easier. Moreover, it will apply to Chinese-owned manufacturers as well as those from other foreign countries, such as the US-based Tesla, which is the current leader in sales of electric vehicles to Europe.

It is worth emphasising that the Commission launched this procedure on its own initiative rather than at the request of a member state or an individual company. This is no coincidence: as the EU anticipates a harsh reaction from the government in Beijing, this formula will make it harder for China to exert individual pressure and engage in efforts to divide its European partners. China’s actions towards Lithuania in 2022 in response to the Baltic state’s moves to develop relations with Taiwan provided an important lesson for the Commission.[1] At that time, the Chinese government took a series of harsh steps to bully Lithuania while also trying, with some success, to break European unity in assessing Lithuania’s moves.

The Commission’s motivations

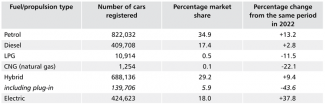

The Commission’s decision comes against the background of the situation on the European automobile market and the challenges facing EU car manufacturers. The most serious of these relate to e-mobility, that is, the gradual displacement of combustion-powered vehicles by electric cars. According to data from the European Automobile Manufacturers’ Association (ACEA), 1.4 million battery-powered cars (excluding plug-in hybrids) were sold in the EU in the first eleven months of 2023, an increase of 48.2% from the same period last year. Their share among newly registered vehicles reached 16.3%, more than that of diesel cars (12.2%). Petrol-powered cars still lead the way (32.7%), but their advantage over second-ranked hybrid cars (27.4%) has been shrinking.

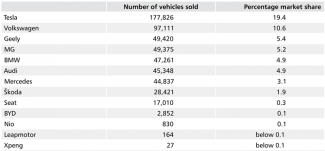

European players face considerable obstacles on this fast-changing market. So far, the technologies that are important for the development of e-mobility have been a weakness for European companies, which have only recently started to make up the ground they had lost over the previous years. Some of them have been relocating production abroad, especially to China, in an effort to cut costs and benefit from access to this enormous market, as well as the country’s mechanisms of support and technologies. This has allowed them to offer cheaper products. There is nothing unusual about this strategy: Tesla, the aforementioned leader in sales of electric cars (see Table 1), owes its success to imports from factories located in China.

For the European Commission, this trend is a cause for concern as it signifies a gradual degradation of the European industry’s potential. In addition, Chinese manufacturers, such as BYD, Nio, MG and Geely, pose an increasingly serious direct threat. Their strengths include attractive prices, which are around a fifth lower than those of their EU competitors, and their growing technological sophistication. In total, their market share may soon approach 15%.

Table 1. Electric cars in Europe in the first half of 2023: the market share of individual manufacturers

The European market is here considered to include the following countries: Germany, France, Spain, Italy, Portugal, the United Kingdom, Ireland, Belgium, the Netherlands, Austria, Switzerland, Luxembourg, Sweden, Norway, Finland, Denmark, Greece, Poland, the Czech Republic, Slovakia, Hungary, Romania, Croatia, Slovenia, Bulgaria and Estonia.

Source: R. Tyborski, ‘Das China-Paradox der deutschen Autohersteller’, Handelsblatt, 24 October 2023, handelsblatt.com.

The expansion of brands from China is not surprising. The country’s manufacturers dominate the global e-mobility sector, accounting for around 60% of the world’s production of electric vehicles. Obviously the scale of the Chinese market plays a key role here, but so do its structural features. In recent years, it has become a real laboratory of innovation and an arena of fierce competition in terms of prices and technological advances. The state has supported its development with generous subsidies: according to the Economist, tax incentives for buyers alone have totalled $30 billion. As a result, in Shanghai, for example, electric cars already account for half of all newly registered vehicles, while other major metropolitan areas are on track to reach this level within 2–3 years. Nationwide, the 10 top-selling car models in the first half of 2023 included only three with traditional internal combustion engines. However, the situation is not easy for manufacturers: overcapacity is running as high as 15 million vehicles per year, which has led to price wars and a drastic reduction in margins.

In this situation, their interest in exports has been growing. However, due to geopolitical tensions, it is difficult for Chinese companies to expand in the US, where tariffs are already as high as 27%: meanwhile the new regulations introduced as part of the IRA have added another barrier. Other potentially large markets such as India and Turkey have also started resorting to protective tools. This makes Europe seem an ideal target, as it has a relatively low duty of 10% and a huge pool of potential customers, but it has been lagging behind in the development of e-mobility. Logistics and transport still present some difficulties, but China has been rapidly expanding its capacity to deliver goods to European ports.

Faced with an impending “flood of Chinese cars”, as President von der Leyen put it, the EU has decided to take countermeasures and narrow the space for unfair competition that involves subsidies. The Commission does not want to repeat its past mistakes, such as when Europe ceded the field to China’s photovoltaic panel industry, which the Chinese government also generously supported. This led to European manufacturers going bankrupt, and the continent’s economy became dangerously dependent on external supplies in an important segment of the energy industry.

German caution

The Commission’s moves have received mixed reactions from the member states. France has endorsed this initiative after its government (according to unofficial reports) worked for a considerable time to devise an anti-subsidy procedure. For France, this is an avenue to protect the interests of its automotive industry, which is particularly vulnerable to pressure from its Chinese rivals. French companies have prioritised the development of cheap mid-range and low-end cars, such as the €25,000 Citroen C3, and they are determined to prevent Asian competition from jeopardising these plans. They are less concerned about a possible response from China as the presence of French brands on that market is fairly limited. The launch of the procedure is also in keeping with President Emmanuel Macron’s statements concerning the need to build up the EU’s ‘strategic autonomy’, which must include a firm defence of its own economic interests and key sectors.

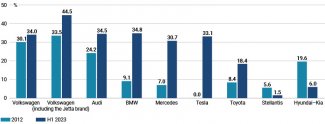

Germany has taken a much more cautious stance. This is primarily due to the different competitive profile of its automotive industry and the nature of the country’s economic ties with China. The German car industry is mainly concerned about the risk of retaliation, which could prove painful in light of its heavy dependence on the Chinese market. In the first half of 2023, China accounted for around one-third of the sales of Germany’s biggest brands (VW 34%, Audi 34.5%, BMW 34.8%, Mercedes – 30.7%; see Chart). Germany’s automotive companies both export to China and also manufacture there. In particular, VW has focused on expanding its production capacity in this country. It has 24 factories in China which operate in partnership with local entities, mainly SAIC, FAW and JAC. It has also recently invested €700 million in its collaboration with the Xpeng start-up to jointly develop a new platform for electric vehicles. In addition, it has been working on new technologies with Horizon Robotics, a supplier of software for cars. Mercedes and BMW have also been expanding their production in the Chinese market, albeit on a slightly smaller scale. They have focused on the premium segment, which is more profitable and allows them to avoid direct competition with Chinese brands, at least for the time being.

Chart. The Chinese market’s share in total sales of automotive companies in 2012 and the first half of 2023

Source: R. Tyborski, ‘Das China-Paradox der deutschen Autohersteller’, Handelsblatt, 24 October 2023, handelsblatt.com.

China could hurt German companies in two ways. Firstly, it could introduce trade barriers such as tariffs, type-approvals and import quotas. These would weaken manufacturers who rely more heavily on imports of vehicles from European factories. However, the Chinese government could go much further and target German investments on its own market, especially those owned by VW. This would involve restrictions on acquiring shares in Chinese entities and additional business regulations, while inspection authorities would harass production plants; however such a scenario is far less likely because China is keen to ensure that inflows of capital and technology continue. Furthermore, the Chinese government could launch media campaigns to discourage consumers from buying ‘foreign’ products in favour of those made by local industry and fed by ‘national’ capital. Nationalist sentiment has been rising in Chinese society, so such steps could prove effective.

German companies see the likelihood of new trade restrictions as quite high, partly because of overcapacity in Chinese companies and their difficult situation: for example, Nio recently had to announce a 10% reduction in its workforce. Their managements will lobby for a tough response to any European restrictions, or for a sharp increase in subsidies for ‘national’ companies. In such a situation the competitive position of German companies, which is already weak, would deteriorate further. They dominate the shrinking sector of combustion-powered cars, but have struggled badly in the electric sector. In the first half of 2023 VW sold only 40,000 units of its ID models in China, a third less than the previous year. New restrictions and greater government interventionism could even push it out of this very lucrative market.

However, the doubts of German automotive companies about the EU’s moves are not only confined to the potential reaction from China. In the context of the current situation in the global economy, another important risk for this industry, which exports two-thirds of its production, lies in the very fact that protectionist measures could be taken. Indeed, such a step could encourage other countries to take similar decisions. This is all the more likely as many governments have their own ambitions in the area of e-mobility. The high saturation of the markets and the weakening demand for cars as a result of inflation and high interest rates also encourage protectionist practices.

Sanctions as an opportunity

For all its wariness towards the Commission’s actions, Germany’s industry also sees the benefits of slowing down the expansion of Chinese manufacturers in Europe. First of all, VW, BMW and Mercedes will get a little more time to catch up with the technological advances of recent years, move beyond the premium niche to prepare a more affordable line-up of electric cars, resolve problems in their supply chains, and carry out the necessary restructuring. For example, VW has just started negotiations with labour unions in a bid to cut personnel costs by 20%. By doing so, it wants to raise its operating margin from 3.4% to 6.5%, and thus gain more room for capital expenditure.

Subcontractors such as Continental have also been preparing for the new market realities and announcing savings. The increasingly visible innovations in the sphere of e-mobility augur well for the industry. At the IAA show in Munich in September 2023, German manufacturers showcased their new platforms for electric vehicles, energy-saving technologies and innovative electric motors, such as those that reduce the demand for rare earth metals.

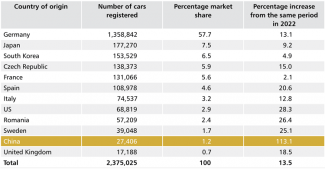

However, there is not much time to implement the new strategies; moreover, conditions have become more difficult since the German government ended generous subsidies for purchases of electric-powered cars earlier than had been expected. Consequently, the promising 37.8% growth in their sales in January-October 2023 (see Table 3) is likely to slow down significantly. Nor are their competitors going to just stand by: Tesla has announced recently that it intends to produce its basic €25,000 model at the Gigafactory in Grünheide near Berlin, which could push the German car industry into a deeply defensive position. In fact, the US company’s decision may have been related to the Commission’s statements: the likely imposition of tariffs could prompt Tesla to reduce its imports from China in favour of production in Europe. Chinese brands have also been preparing to go into attack mode: although their share in the German market stood at just 1.2% in 2023, it soared by more than 113% (see Table 2). Some of them, such as BYD, are even planning to manufacture vehicles in Germany itself.

Table 2. Passenger cars registered in Germany in January-October 2023 by country of manufacture

Source: ‘Neuzulassungsbarometer im Oktober 2023’, Kraftfahrt-Bundesamt, kba.de.

Table 3. Cars registered in Germany in January-October 2023 by fuel or propulsion type

Source: ‘Neuzulassungsbarometer im Oktober 2023’, Kraftfahrt-Bundesamt, kba.de.

The perspective from Berlin

The federal government shares a number of the concerns that German car companies have voiced about the introduction of higher tariffs on Chinese vehicles, although not always for the same reasons. Certainly, one common denominator is the fear of starting a protectionist race that could spill over into more industries and relations with other trading partners, causing harm to Germany’s export-oriented economy. This would be particularly painful now, at a time when the economy is weak and industrial orders have been falling for many months in a row.

Olaf Scholz’s government may also be hesitant to impose restrictions because of the ambitious goals of its e-mobility policy. The coalition agreement includes the target of putting 15 million electric vehicles on German roads by 2030. For now, this goal is slipping away; the industry itself now says that half of this number is a realistic ceiling. Consumers do not want to pay high prices for new cars, and also believe that the 100,000 charging stations set up so far are not enough to ensure the convenient use of electric cars. Another reason is the previously mentioned discontinuation of financial support for buyers, the so-called Umweltbonus. In the background, the conflict between the industry and the government is growing; the latter has accused manufacturers of being reluctant to bring cheaper vehicles to the market. Chinese competition could force them to do so, not to mention the fact that it would accelerate the transformation towards e-mobility as a result of increased supply.

Those in favour of protectionism also have a strong case. From the government’s point of view, what matters is the overall economic importance of this sector: the fact that it employs two million people, and generates 20% of exports, plus a considerable sum of tax revenues. The perspective of the corporations, which are concerned with global market shares, labour costs, profit rates and share prices, plays a secondary role in these calculations. Above all, the government in Berlin wants to protect production in Germany; its worst-case scenario sees Chinese goods flood the market while at the same time German companies flee to China to manufacture more cheaply there. If punitive tariffs targeting China were to prevent this, Scholz’s coalition would certainly look upon them more kindly.

Political issues have been pushing the German government in the same direction. One of the most prominent lessons from the war in Ukraine is that it is necessary to reduce the risks inherent in economic cooperation with autocratic states, particularly China. This is precisely why the federal government has developed a new strategy vis-à-vis China known as ‘de-risking’, one element of which involves defending the EU’s common market and strategic industries from unfair competition and excessive dependence. Therefore, the Commission’s anti-subsidy procedure could be regarded as a way in which Germany could implement one of its most important strategic measures.

Consequences

The final outcome of the Commission’s actions remains to be seen, as do China’s reactions to the EU’s tougher stance on the trade in electric cars. Nevertheless, the German automotive industry must be prepared for a negative scenario in which the introduction of punitive tariffs on imports of Chinese electric cars into the EU triggers a similar, perhaps even harsher, response from the government in Beijing.

This situation will produce a dilemma regarding the chances of surviving on the highly competitive Chinese market. The development of local ‘platforms’ covering the entire production and distribution cycle will probably protect companies from trade restrictions, but not from harassment by the government. It may therefore become necessary to disperse production in the region and build factories in countries such as Vietnam. In particular, the managers of VW will start asking themselves questions about reorganisation, as almost all the vehicles VW sells in China are now manufactured in this country. This effectively shields the Wolfsburg-based company from possible trade wars, but also makes it particularly vulnerable to any attempts to push foreign capital out of China.

The diversification of global sales should be the second component of the German industry’s response to protectionist tendencies in China’s relations with the EU. The focus on China over the last decade was understandable given the growth prospects of this market, but it has led to German industry becoming dangerously exposed. It should respond to this by expanding into other countries, thus counterbalancing the importance of China. This is especially true of its presence in the US, which was somewhat neglected after the scandal involving the falsification of emissions data broke out. In order to succeed, however, it will need the capacity to mass-produce affordable electric cars, which will comprise the fastest-growing segment of the market in the future. The niche of premium cars, where German manufacturers have entrenched themselves, will not be enough.

At this stage of the preparations for the anti-subsidy procedure, the Scholz cabinet has refrained from taking a clear position. Economy minister Robert Habeck has said that in the event of a breach of the common market rules by Chinese car imports there will be “no political option” other than to take appropriate measures, but these remarks can hardly be regarded as an expression of a clear stance. If the Commission does propose the option of imposing punitive tariffs, the German government will likely push for negotiations with China and seek to avoid direct confrontation. This is certain to cause friction with France, which is the main proponent of sanctions, and the administration of President von der Leyen.

Germany can draw at least two conclusions from the current situation. The first relates to the Scholz cabinet’s industrial policy and its relations with the automotive sector. It appears that for too long the government has given in to pressure from the industry’s lobby, which has been pushing the idea of ‘technological openness’; this has essentially meant spending huge sums on keeping combustion engines alive. In the case of electric cars, the government has too easily accepted the retreat of domestic manufacturers into the expensive premium sector while offering them generous subsidies for purchases of these vehicles. As a consequence of this overly soft approach, the industry has found itself in perhaps the most serious crisis it has ever faced, without any guarantee that it will catch up with its competitors.

The second conclusion is more general and relates to the economic model. The looming trade dispute has further highlighted the risks associated with dependence on exports, which stands at 75% for Germany’s automotive sector. For the German economy as a whole, this figure is as high as 45% of the country’s GDP; half of these exports go to non-European markets. Therefore, a considerable part of Germany’s manufacturing capacity is vulnerable to a possible increase in protectionist tendencies around the world. This has been known since at least the mid-2010s and the trade frictions with the US under Donald Trump, but little effort has been made to change this. De-risking, which emerged as a concept following the outbreak of the war in Ukraine, will not make a difference either, as it actually means a reduction in dependence rather than diversification. Europe’s dispute with China over one of its most important industries could produce a breakthrough in this context and force the German government to boost domestic demand (especially investment), which would make the German economy somewhat more resistant to the political risks of protectionism.

[1] See J. Hyndle-Hussein, J. Jakóbowski, ‘A new phase of China’s pressure on Lithuania: weaponisation of European value chains’, OSW, 22 December 2021, osw.waw.pl.