Key to the future of the Energiewende: support for building new power plants

It took many weeks of negotiations for the leaders of the SPD-Greens-FDP coalition to reach a compromise on the strategy for building new power plants, which are intended to complement renewable energy sources (RESs) and enable the final phase-out of coal. The first step in this direction is to provide financial support for investments in gas power plants with a total capacity of 10 GW which can be transitioned to hydrogen, followed by the development of a capacity market concept, which is expected to come into effect no later than 2028. The agreement is quite general in nature, but nevertheless it marks a political breakthrough. However, many decisions on the key details will still have to be made in the future, which means that tough negotiations within the coalition must be undertaken, and the entire mechanism will still need to be approved by the European Commission (EC). The scale of support for the construction of new power plants, which is much smaller than originally envisaged, means that Germany can no longer be expected to phase out coal by 2030. Nevertheless, this is a top-priority initiative in Germany’s energy policy in this parliamentary term, and failure to implement it will prevent the process of the Energiewende from continuing.

On 5 February, the Federal Ministry for Economic Affairs and Climate Action (BMWK) announced that Robert Habeck (Greens), who is in charge of this ministry and serves as Vice Chancellor of Germany, Chancellor Olaf Scholz (SPD) and finance minister Christian Lindner (FDP) had reached an agreement on the key elements of the government’s strategy (Kraftwerksstrategie) regarding the construction of the new back-up power plants which are intended to complement renewable energy sources (RESs). It was also announced that special auctions will soon be held allowing operators to apply for subsidies to support investments in new gas-fired units with a total capacity of 10 GW (four auctions of 2.5 GW each). These units will be required to transition from natural gas to hydrogen between 2035 and 2040; the final deadlines for the transition are expected to be determined in 2032.

Additionally, public funds would be used to support the construction of power plants with a total capacity of 500 MW; these would utilise hydrogen from the outset. It was also agreed to adopt regulations to streamline the construction of electrolysers to produce so-called green hydrogen, and to introduce facilitations regarding the use of surplus energy from renewable sources in electrolysers. Procedures for the construction of gas-fired power plants will also be streamlined. Furthermore, the agreement also allows gas-fired generation units to use the carbon capture, utilisation and storage (CCUS) technology.

On top of that, the coalition leaders have agreed that a concept for a capacity market will be developed by this summer. It is intended to be ‘technologically neutral’ (not excluding specific generation technologies) and will be implemented in Germany no later than 2028. Alongside this, an analysis of the reform to the electricity market will be prepared so that it better meets the requirements of a future system based on renewable energy sources. Finally, it was stated that the agreement will first be subject to negotiations with the European Commission (which evaluates the compatibility of subsidy mechanisms with EU public aid rules), and then presented for broader public consultation.

No-one wants to build power plants

The German model of energy transformation aims to increase its reliance on renewable energy sources. According to the statutory goals, RESs are expected to account for 80% of Germany’s electricity consumption by 2030 (in 2023, it was 51%), and ultimately the country’s entire energy mix should be fully based on RESs. However, considering the instability of energy from such sources (primarily wind and solar energy in Germany), back-up power plants will be needed to secure volatile renewable sources. For political and ideological reasons,[1] Germany has decided to decommission the low-emission nuclear power plants which could have largely served this purpose.

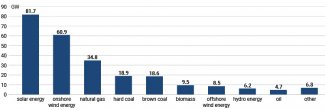

At the same time, Germany has begun phasing out coal as part of its decarbonisation efforts.[2] The legislation currently in force envisages that the last coal-fired power plant must be closed no later than 2038. However, Chancellor Scholz’s government has expressed a willingness to accelerate this process and create conditions to end it ‘ideally’ by 2030 (as per the coalition agreement). Last year, coal-fired power plants in Germany had a combined capacity of 37.5 GW (see Chart). In Germany’s energy transformation model, gas-fired power plants are intended to primarily complement RESs, and eventually (starting from the 2030s) to transition to using low-emission hydrogen. According to estimates by the Federal Ministry for Economic Affairs and Climate Action (BMWK), new back-up power plants (mainly gas-fired) with a total capacity of 17–25 GW, to be commissioned by 2030, will make it possible to step up the phase-out of coal and will guarantee the security of national energy supplies.

Chart. Installed capacity of German power plants in 2023

Source: Federal Network Agency (BNetzA).

However the problem is that, given the current structure of the German energy market, where power plants are only paid for the electricity they generate, it is unprofitable for investors to build the new conventional units intended to operate as balancing capacities. In a system which is increasingly reliant on renewable sources, conventional units will be used less frequently, thus generating lower revenue and returns on investment. As a result, in recent years the German energy sector has implemented hardly any new gas projects, in anticipation of a state-supported financial mechanism. In early 2023, Vice Chancellor Habeck promised that a Kraftwerksstrategie would be developed and would focus primarily on subsidies for investors, covering funding for both the construction of power plants and their subsequent operation based on hydrogen (it has been promised that this will offset the difference in costs between hydrogen and natural gas usage).

Initially, the strategy was planned to be ready by mid-2023 so that work on the construction of the power plants could be finished by the end of the decade (according to the sector’s estimates, the construction process takes five to seven years). However, it was only last August – after lengthy negotiations – that Habeck’s ministry reached a compromise with the EC regarding a general overview of the mechanism. According to the outlines of the draft proposal presented at the time, support would be provided for the construction of the following units: hydrogen power plants with a total capacity of 4.4 GW; hybrid hydrogen units (including renewable energy installations, electrolysers, hydrogen storage and hydrogen turbines), also with a capacity of 4.4 GW; and gas-fired power plants with a total capacity of 15 GW, which would transition to hydrogen by no later than 2035. Investors would compete through special auctions for funds to cover both their construction and subsequent operation based on hydrogen. According to preliminary estimates, it would take up to €60 billion to implement this concept over 15 years.

The immense scale of investments, as well as the very structure of the mechanism (the arbitrary selection of subsidised technologies, and the push for expensive and untested innovative hydrogen solutions), sparked controversy from the outset, and last autumn provoked a dispute inside the coalition. The dispute was further escalated by a ruling from the Federal Constitutional Court regarding the Climate and Transformation Fund, which was supposed to finance the planned subsidies.[3] The prolonged disagreement over this issue, which delayed the adoption and implementation of the planned strategy, led to growing frustration; this was openly articulated in the media, not only by the energy sector but also by the entire German business elite.

Scaled-down, rationalised plans

The arrangements presented on 5 February significantly differ from those Habeck made with the EC last August. Firstly, the plans regarding hydrogen units were greatly reduced (from 4.4 GW to 0.5 GW), and the hybrid solutions were skipped completely. Secondly, the capacity of the planned gas-fired power plants was reduced from 15 GW to 10 GW. These cuts were primarily driven by the need to cut expenses for the entire mechanism, which are currently estimated at €15–20 billion over 20 years (additional expenses linked to the capacity market were not included in this calculation). Ultimately, the expenses will depend mainly on future operating costs based on hydrogen.

At the same time, the reduction in the scale of subsidised investments by 2030 (from 23.8 GW to 10.5 GW) means that it is not just unlikely but in fact illusory that Germany will phase out coal by that time. Meanwhile, an increasingly plausible scenario is emerging in which a large portion of the remaining coal-fired power plants will be placed in reserve at the legislator’s discretion towards the end of the decade (according to regulations currently in force, coal power plants with a total capacity of 17 GW can operate until 2030). In several cases, the Federal Network Agency (BNetzA) has already refused to issue permits for the decommissioning of individual units until at least 2031, because they are essential for the power grid. Germany will only be able to completely phase out coal on condition that additional power plants are built in the following years based on the planned capacity market mechanism.

Major changes have also been made in the parts of the strategy concerning hydrogen. The transition from gas to hydrogen has been postponed to the second half of the next decade, when it will be possible to use gas from various sources (not just electrolysis). This means that the expected costs will be reduced, and that a more cautious and realistic approach has been adopted regarding the assumed high availability of so-called green hydrogen especially. The date of transition from gas to hydrogen has been set for 2032 most likely because the completion of the so-called base hydrogen network is scheduled at that time.[4] The groundbreaking news is both the planned creation of a capacity market (Berlin has been reluctant to adopt this mechanism in recent years) and the permission to use the CCS technology in gas units (until now, the opinion that this technology should be used only in industry had prevailed in the German debate).

The energy sector has mostly reacted positively to the agreement, since most of the changes were introduced in response to the expectations expressed by the CEOs of major companies such as RWE, Uniper, EnBW and LEAG; according to media reports, they were invited to join the final stages of the negotiations to consult the proposed solutions. These companies, as potential investors, are among the most likely beneficiaries from the future subsidies. However, their representatives have also pointed out that the agreement is not very specific, and that it is still unclear what the conditions for investing in new gas capacities will be. According to Holger Lösch, Deputy Director General of the influential industrial lobby BDI, the arrangements represent “just the long-awaited first step towards securing Germany’s future energy supplies”.

Kraftwerksstrategie: to be continued

The consensus between Scholz, Habeck and Lindner does signify a major political breakthrough, but it does not mean that the work on the Kraftwerksstrategie is over – it has just set its general direction. It took the government leaders weeks of negotiations and several meetings with senior officials just to agree on its most urgent and rather general principles. The purportedly finished strategy was not revealed, nor was a press conference convened: only a fairly brief and general communique was issued. An analysis of this communiqué suggests that many key details (regarding the structure of the mechanisms supporting the construction and operation of gas-fired power plants or the capacity market concept) will still need to be developed through further coalition negotiations and talks with the EC. Considering the fundamental differences between the terms agreed upon and earlier arrangements, the negotiations with the European Commission may prove to be tedious and prolonged, especially since the first proposal, as speculated, had been seriously questioned by the Commission; the current form of the mechanism may in fact only raise more doubts.

In political terms, the compromise reached on 5 February should be viewed as a significant success for the FDP and a setback for the Greens. The FDP managed to push through many of their own proposals which are at odds with their coalition partner’s political agenda. These primarily include the emphasis on establishing a capacity market (without favouring selected technologies), opening up the energy sector to the use of the CCS technology, and the use of low-emission hydrogen regardless of how it is produced. Some members of the Green Party (and even more so their political supporters, particularly environmental organisations) have harshly criticised the party leaders’ compromise, and have declared they will make efforts to modify it during the legislative process. Therefore the agreement is not yet final; it needs to include more specific details, and some of its provisions may even change during the negotiations both within the coalition and with the European Commission in the coming weeks.

[1] See M. Kędzierski, ‘It is official: Germany abandons nuclear energy’, OSW, 21 April 2023, osw.waw.pl.

[2] See idem, Germany bids farewell to coal. The next stage of the Energiewende, OSW, Warsaw 2022, osw.waw.pl.

[3] See M. Kędzierski, S. Płóciennik, ‘Germany: the Constitutional Court deprives the government of €60 billion earmarked for transformation’, OSW, 17 November 2023, osw.waw.pl.

[4] See M. Kędzierski, ‘Germany: the next steps in designing the hydrogen network’, OSW, 23 November 2023, osw.waw.pl.