Unplugged. The uncertain future of electromobility in Germany

The German electric car market has seen a rapid growth over the past few years, with the country becoming the undisputed electromobility leader in Europe. This success has largely been possible thanks to generous subsidies for electric vehicle purchases. However, the German government’s sudden decision in December 2023 to end the subsidy programme has cast doubt on the further development of electromobility in this country. Both the industry itself and experts anticipate that this decision will have a negative impact on sales in this market sector for up to two years.

This would mean that the country has given up on its ambitions to reach a target of 15 million electric vehicles on German roads by the end of the decade. From the viewpoint of the automotive companies, the government’s decision not only undermines their interests but also comes at a very inconvenient time. Demand for electric vehicles is still growing more slowly than expected, domestic manufacturers are struggling to compete with rivals from the US and China, and the looming threat of a Sino–EU trade war adds further uncertainty and concern.

A change which was politically forced

At least some members of the German political-business elites recognised the potential of electromobility as early as the late 2000s. In 2009, the federal government developed a strategy that prioritised this direction of development, announcing that there would be a million electric cars on German streets by 2020.[1] However, initially the German automotive industry was not engaged in developing battery technologies, partly due to failed experiments with new technologies and uncertainty about the pace of technological change, as well as global market trends and the reluctance to give up internal combustion engines which a significant section of the industry shared.[2] Similarly, despite the ambitious goals which had been declared, it turned out that the political elites were actually not so interested in incentivising domestic manufacturers to invest more boldly in electromobility.

It was only in the second half of the last decade, when the pace of transformation in foreign competition became increasingly evident, coupled with the backwardness of German manufacturers (exacerbated by the so-called ‘dieselgate’ scandal)[3], that the issue began to gain real significance and rise to the level of a priority on the political agenda. This was linked on the one hand to attempts to support the domestic industry in the global technological race (and, by some political elites, even to stimulate it towards a more ambitious course), and on the other hand to the growing importance of climate policy both in Germany and the EU. The transport sector accounts for just over 20% of Germany’s greenhouse gas emissions, with individual road transport responsible for 60% of these. In this sector, the transition from high-emission internal combustion engine cars to electric vehicles is considered a key instrument for decarbonisation.

As increasingly demanding climate policy targets were set, ambitions regarding electromobility also grew. Angela Merkel’s last cabinet aimed to have 7–10 million electric cars on German roads by 2030.[4] To achieve the emission reduction targets set for the transport sector, the Olaf Scholz administration decided that by the same date there should be as many as 15 million electric vehicles in Germany (it was not specified whether these should include only battery electric vehicles (BEVs) or also plug-in hybrids (PHEVs)), which would correspond to one-third of all passenger vehicles used in Germany.

Meetings at the Chancellery during which the federal government discusses current issues with the automotive industry are inherent in the German political tradition. The fact that the agenda of these meetings has increasingly revolved around the transformation towards electromobility since the middle of the last decade is the best proof of increasing significance of this issue, both for the industry itself and the country as a whole. The meetings, known as Autogipfel, transformed into a platform for coordinating actions not only for the development of the domestic electric vehicle market but also for addressing the numerous challenges associated with the sector’s transformation towards electromobility. The most important decisions are taken during these meetings, such as the establishment (and later the doubling) of subsidies for the purchase of electric cars, preceded by weeks of lobbying from the industry.

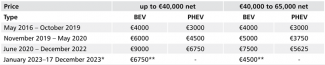

Table. The values of subsidies for the purchase of electric vehicles in Germany

* Subsidies for business customers were withdrawn in September 2023.

** Subsidies at this level were to remain in effect until the end of 2023. Starting from January 2024, they were planned to be reduced to €4500 and maintained at this level until December 2025, and would only cover cars priced at under €45,000. However, it was decided to terminate the programme on 16 December 2023 with immediate effect.

Source: Federal Office for Economic Affairs and Export Control (Bundesamt für Wirtschaft und Ausfuhrkontrolle, BAFA).

All the key political forces in Germany (with the exception of the AfD, which rejects the Energiewende entirely) are generally in favour of state support for the development of electromobility. However, the political parties have been unable to agree on the choice of instruments and the scope of this support for years, because they also disagree as to whether electric cars should be treated by the state as the principal technology, and as such, should be clearly favoured by the state at the expense of others. An alternative approach would involve directing support instruments to other solutions as well (in the automotive industry these could include hydrogen vehicles or internal combustion engines powered by synthetic fuels), and adopting the assumption that the market should decide which low-emission technologies are most suitable. The different perspectives on these issues are part of a wider debate about the government’s role in promoting specific technological solutions in the energy transformation process across various sectors (another controversial example being heat pumps in heating buildings). This dispute boils down to the question as to whether the government should favour specific technologies, or rather maintain ‘technological neutrality’ and only set general requirements (in this case, low emissions). The Greens and the SPD primarily support the former approach, while the CDU and the FDP advocate for the latter.

Double-charged development

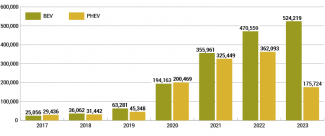

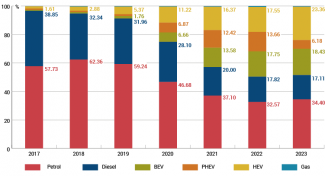

At the end of the last decade, electric cars – both battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) – were niche solutions in the German market. While the sales of these cars were gradually increasing, they were doing so at a very slow pace compared to the scale of the market. The initial subsidies introduced in 2016 had no major impact. Until 2019, the number of BEVs and PHEVs allowed on the roads annually was only in the tens of thousands (see chart 1), accounting for about 1% of the market (see chart 2).

The breakthrough came in 2020, when the range of available electric vehicles expanded significantly. Additionally, and more importantly, subsidies for the purchase of electric passenger vehicles were raised substantially (until the end of 2022) as part of the government’s economic incentive package related to the COVID-19 pandemic. These subsidies reached up to €9000 for BEVs and €6000 for PHEVs (see table). Generous funding was also offered to private buyers of charging stations (wallboxes).[5] During this period, sales of both types of vehicles increased several-fold, and the market gained momentum.

The share of battery electric vehicles among new registered cars rose from just under 2––% in 2019 to almost 18% in 2022, while that of plug-in hybrids went up from slightly over 1% to nearly 14%. In absolute numbers, this represented about an eight-fold increase in sales over three years. It is worth noting that the growing popularity of electric vehicles was accompanied by an equally rapid increase in the sales of conventional hybrid vehicles (those without a plug). Thus, clear trends on the German market could be observed: a decrease in the significance of petrol and diesel engine cars and an increase in those with alternative powertrains. While cars with conventional engines accounted for nearly 97% of the market in 2017, by 2023 their combined share had shrunk to just over 50%.

Chart 1. Registrations of new battery electric vehicles and plug-in hybrid vehicles in Germany in 2017–2023

Source: Federal Motor Transport Authority (Kraftfahrt-Bundesamt).

Chart 2. Registrations of new passenger cars in Germany by type of powertrain in 2017–2023

Source: Federal Motor Transport Authority (Kraftfahrt-Bundesamt).

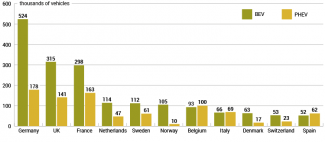

The rapid development of the domestic market in recent years has turned Germany into a real European electromobility powerhouse. According to ACEA data (see chart 3), last year Germany was the largest market for battery-powered electric vehicles on the continent, significantly surpassing the United Kingdom and France in this regard. Of all the electric cars registered in the European Union, every third one hits the roads in Germany (if the United Kingdom and the EFTA countries are taken into account, every fourth one). The share of BEVs on the German market was significantly higher than the EU average (which stood at 14.6%, or 13.2% excluding Germany) or the European average (15.7%, or 15% excluding Germany). Germany also maintained its leading position on the plug-in hybrid market, ahead of France and the United Kingdom. On a global scale, Germany remains the third largest market for electric vehicles behind China (which leads the sales of such cars by a significant margin) and the United States.

Chart 3. Europe’s largest markets in terms of registrations of new electric vehicles in 2023

Source: European Automobile Manufacturers’ Association (ACEA).

The data for 2023 perfectly illustrates the great impact which the high subsidies have had on the development of the German electric vehicle market. While the reduction in bonuses for the purchase of battery electric vehicles (from January 2023) and the withdrawal of subsidies for companies (from September 2023) only slowed down the growth of these vehicles’ sales, the complete abolition of subsidies for plug-in hybrids caused a real slump. Their sales fell by over half year-on-year, and their market share fell from almost 14% to just over 6%.

The Scholz government announced at the beginning of its term that state subsidies for the purchase of battery electric vehicles would be reduced again in 2024 and remain in effect until the end of 2025 (see table 1). However, the government coalition’s plans were thwarted by a ruling from the Federal Constitutional Court regarding the Climate and Transformation Fund (KTF) which financed the subsidies.[6] Since its budget for 2024–7 was cut by €60 billion, the government was forced to urgently find ways to save money, and ultimately, subsidies for electric vehicles were included in the expenses earmarked for cuts. On 16 December 2023, the economy ministry announced the end of the programme, effective the next day.[7] A total of €10 billion was paid in subsidies for the purchase of 2.2 million vehicles (1.4 million BEVs and 800,000 PHEVs) between 2016 and 2023. This means that the purchase of over 90% of all electric vehicles used in Germany (2.4 million BEVs and PHEVs as of the end of 2023) was subsidised.

The expected downturn

Surveys suggest that electric vehicles are no longer a niche product and have become genuinely mass-market products in recent years. However, Germans are still sceptical about this technology due to the numerous problems inherent in electromobility. According to the latest survey by the Deutsche Automobil Treuhand (DAT) research centre, 39% of respondents are considering purchasing an electric vehicle. However, only one in twenty people in this group would be ready to do so within the next year, and nearly half of them would be ready to consider this option only within a five-year period. On the other hand, 34% of respondents completely rule out switching to an electric car at present.[8]

The study commissioned by the automotive club ADAC reveals even more pessimistic prospects regarding the development of the market: 31% of respondents might consider purchasing an electric vehicle, and 59% were of the opposite opinion, with 31% of them completely ruling out this option.[9] Survey results also clearly show that price is the most important purchase criterion for prospective buyers in Germany. 55% of respondents surveyed by DAT said that a high subsidy was a key argument for purchasing an electric car, which was significantly more important to them than environmental issues (38%) or the desire to try out a new technology (35%). Meanwhile, the catalogue of doubts associated with purchasing an electric car has remained almost unchanged for years. For example, in a survey conducted by the Allensbach Institute for the National Academy of Science and Engineering (Acatech), the following ‘cons’ were identified: excessively high prices (71% of respondents), the insufficient number of public charging points (64%), the high charging costs (62%), objections regarding the environmental friendliness of electric vehicles (60%), their limited range (59%) and the lengthy charging times (54%).[10] Given that electric vehicles are still much more expensive (sometimes by tens of percent) than similar models with internal combustion engines, it is therefore clear that price continues to be the most serious obstacle to stepping up the development of private electromobility, especially in the sector of cheaper compact cars. The range of these vehicles is narrowest because manufacturers initially focused on the development of high-margin, larger and more expensive cars.

Representatives of the industry fear that, as the prices of electric vehicle are an important criterion for drivers, the abrupt termination of the subsidy programme in December 2023 will adversely affect their sales on the German market. The original intention was that the subsidies would stimulate sales during the transitional period (according to the plans, until 2025 specifically), thus until a sufficiently wide selection of affordable models for the average driver appeared, and until German manufacturers began to see returns on their investments. Without subsidies for electric cars, the German market will have to face a downturn, at least throughout 2024 and probably also in 2025. Interestingly, the automotive industry’s forecasts are the least pessimistic. The German Association of the Automotive Industry (VDA) expects that in 2024 the number of registrations of new battery electric vehicles will drop by 14% to 451,000, while that of plug-in hybrids may even rise slightly (by 5%) to 185,000.[11] Some esteemed experts in Germany who are often cited, however, are more sceptical: according to Stefan Bratzel from the Centre of Automotive Management, BEV sales may drop by 100,000 vehicles (nearly 20%), and according to Ferdinand Dudenhöffer from the Centre for Automotive Research (who has been dubbed Autopapst – ‘the automotive pope’), in the worst-case scenario it may even plummet by 200,000 vehicles, or almost 40%.[12] A revival in the market is expected only in the second half of the decade, after new models have been introduced, economies of scale achieved and costs reduced. The data for January 2024 proves that these forecasts are correct: battery electric vehicles accounted for only 10.5% and plug-in hybrids for 6.7% of the newly registered passenger cars in that month.

Given the expected two-year downturn at a crucial moment of market growth, achieving the Scholz government’s goal (15 million electric cars in Germany by the end of the decade) now seems not only unlikely but downright illusory. By the end of 2023, there were 1.45 million battery electric vehicles and 950,000 plug-in hybrids on German roads. Even before the subsidies for electric cars were cancelled, the Federal Ministry for the Environment estimated that, without additional market-stimulating instruments, there would be 8.2 million BEVs and 3.7 million PHEVs in Germany by 2030.[13]

The automotive Industry is having a hard time

The sudden and premature cuts of government subsidies will not only slow down the pace of electromobility development in Germany, but will also adversely affect the interests of local automotive manufacturers. The decision was taken at a very difficult moment for these companies. Although electric car sales were increasing both domestically and abroad, the pace of growth was much slower than anticipated. One of the effects this had was reducing the number of orders in factories that had already transitioned to electric vehicle assembly. German manufacturers are particularly struggling with sales in China, which is the largest and most crucial market for them. They are also facing increasingly severe challenges competing with their US and Chinese rivals on the global markets. Furthermore, the threat of EU sanctions on electric cars from China and potential retaliations from Beijing raises additional concerns, as the latter could seriously harm German manufacturers and further erode their position on this market, which is crucial in terms of their sales volume and profits.[14]

Moreover, Berlin’s decision to abolish subsidies for the purchase of electric vehicles has led to a price war in the German market, which is often referred to as a ‘bloodbath’ in debates. Fearing a rapid decline in the sales of their own vehicles, and in order to maintain market share and comply with stringent EU regulations on CO2 emissions, individual manufacturers have embarked upon a price race, offering appealing discounts that are sometimes even higher than the recently cut government subsidies. The substantial discounts please customers, but this ‘price war’ may pose a serious problem for the manufacturers themselves. According to some German experts, domestic brands are currently being forced to sell electric cars even at the expense of significant losses. Dudenhöffer estimates that in the case of Volkswagen, these losses may exceed €3000 per vehicle.[15] Experts are warning that German manufacturers are less prepared for such a race than their American and Chinese competitors, who are able to maintain minimal margins even with high discounts.

Other proposals for stimulating the development of electromobility

At this stage, nothing seems to suggest that the Scholz government’s withdrawal of subsidies for the purchase of electric vehicles marks a change of course or a political retreat from promoting electromobility. The reasons why the German government engaged in stimulating the development of this technology on the domestic market remain unchanged. Despite the various problems facing it, the automotive industry itself is consistently and gradually transitioning to electromobility, as it views this as the main global direction of development and the dominant technology of the future, at least in the passenger car sector. When it comes to climate policy, the transportation sector continues to be the slowest in achieving emissions reduction, so the pressure to take additional action in this area will only increase.

The question regarding the instruments and the scope for further stimulating the development of electromobility in Germany remains open. Berlin is now placing the strongest emphasis on stepping up the creation of a nationwide charging network. As part of the governmental programme, a total of 9000 fast-charging points in 1100 locations scattered throughout the country are set to be put into operation in the coming months, both along national roads and highways.[16] Additionally, the government is finalising work on a law that will impose the obligation to install chargers at petrol stations.[17] Both initiatives are aimed at improving the availability of public charging points in Germany; by the end of 2023 their number exceeded 120,000, meaning that there is one charging point per c. 25 BEVs and PHEVs overall.

Many other ideas for initiatives that would encourage drivers to choose electric vehicles have long been proposed in the German debate on electromobility. Suggestions including making their purchase more appealing by reducing their registration costs, cutting their road tax, lowering electricity prices for vehicle charging (for example, cutting excise duty and/or VAT), or introducing additional financial (mainly tax) incentives for companies opting for electric vehicles. Other ideas aim to discourage the use of vehicles with internal combustion engines; these mainly involve increasing the costs of their use, for example, by adding emission components to road tax or increasing fuel taxation (such as excise duties). However these latter concepts, mainly originating from experts linked to the Green Party, are highly controversial and politically risky, especially given the current low poll ratings of the government coalition and the upcoming federal elections scheduled for autumn 2025. Therefore, their implementation before the end of the present government’s term seems unlikely.

Promoting electric vehicles in the EU

There is also a strong indication that Berlin may intensify its efforts to promote electric vehicles at the EU level in the coming months, both to compensate for the slowdown on the domestic market and to address disparities in the pace of electromobility development across different parts of the continent. The German automotive industry has long been making efforts to make the political elite aware of the significant disparities in this regard, especially with what it perceives as slow progress in Central, Eastern and Southern European countries. One frequently cited problem hindering the development of electromobility in the region is what the industry sees as the slow expansion of charging infrastructure. It is also possible that Germany will seek to harmonise policy instruments for promoting electric cars within the EU, and to encourage the European Commission to take initiatives to this effect.

Months ahead of the European Parliament elections (scheduled for June), it is evident that electromobility could become a major topic during the pre-election campaign. For example, CDU/CSU politicians have announced they will make efforts to reform EU regulations imposing a ban on the sale of new cars with internal combustion engines from 2035 onwards. Similar suggestions have also been heard from their coalition partners from the FDP. Their proposals to either postpone the implementation of this ban (there is talk of moving the deadline to 2040) or open up to alternative solutions – especially the option of using synthetic fuels in new internal combustion engine cars (which is particularly important for the FDP[18] – are in line with appeals from sections of the automotive industry, especially medium-sized and smaller suppliers, who have long called for a more flexible approach to shaping EU regulations and for a broader consideration of the challenges arising from the transformation of the automotive sector.

[1] Nationaler Entwicklungsplan Elektromobilität der Bundesregierung, Federal Ministry of Transport and Digital Infrastructure, August 2009, bmdv.bund.de.

[2] K. Popławski, At a crossroads. Crisis in the German automotive industry, OSW, Warsaw 2020, osw.waw.pl.

[3] Idem, ‘The diesel scandal in the German car industry’, OSW, 9 August 2017, osw.waw.pl.

[4] Förderung der Elektromobilität durch die Bundesregierung, Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection, 29 September 2021, bmuv.de.

[5] The subsidy introduced in autumn 2020 was €900 per charger, covering around 25% of the purchase and installation costs. The subsidy was offered on condition that only renewable energy sources would be used for charging the vehicle.

[6] M. Kędzierski, S. Płóciennik, ‘Germany: the Constitutional Court deprives the government of €60 billion earmarked for transformation’, OSW, 17 November 2023, osw.waw.pl.

[7] ‘Umweltbonus endet mit Ablauf des 17. Dezember 2023’, Federal Ministry for Economic Affairs and Climate Action, 16 December 2023, bmwk.de.

[8] DAT Report 2024 – Betrachtung des Autojahres 2023, Deutsche Automobil Treuhand, 30 January 2024, dat.de.

[9] ‘Umfrage: Jeder dritte Autofahrer will ein E-Auto kaufen’, ADAC, 10 August 2023, adac.de.

[10] ‘Umfrage Mobilitätsmonitor: Die Bevölkerung nimmt Klimaschutz im Verkehr wichtig und möchte Veränderungen’, Deutsche Akademie der Technikwissenschaften, 13 February 2023, acatech.de.

[11] ‘VDA-Präsidentin fordert Paradigmenwechsel: Reformen statt Regulierung und strategische Weitsicht für erfolgreiche Transformation’, Verband der Automobilindustrie, 30 January 2024, vda.de.

[12] D. Zwick, ‘Fünf Probleme blockieren den Durchbruch des Elektroautos’, Die Welt, 12 January 2024, welt.de.

[13] H. Förster, R.O. Harthan (eds.), Projektionsbericht 2023 für Deutschland, Climate Change 39/2023, umweltbundesamt.de.

[14] S. Płóciennik, ‘Fear of retaliation: Germany's concerns about punitive tariffs on electric cars from China’, OSW Commentary, no. 568, 5 February 2024, osw.waw.pl.

[15] L. Meier, ‘Autoexperte Dudenhöffer erwartet Millionenverluste für VW’, Stern, 30 January 2024, stern.de.

[16] ‘Das Deutschlandnetz’, Nationale Leitstelle Ladeinfrastruktur, nationale-leitstelle.de.

[17] A. Wilkens, ‘E-Mobilität: Tankstellen sollen Schnellladepunkte einrichten’, Heise Online, 28 February 2024, heise.de.

[18] M. Kędzierski, ‘Niemcy wobec przyszłości samochodów spalinowych – wewnątrzpolityczny kontekst zmiany’, OSW, 17 March 2023, osw.waw.pl.