Germany’s port strategy: a disappointing response to the crisis

Germany’s seaports are facing a crisis. Their freight traffic volumes have been decreasing for years, and last year they dropped to levels not seen in two decades. Due to weakening competitiveness, structural issues, a failure to modernise and expand transport infrastructure (mainly railways), as well as insufficient digitalisation and automation, German ports are losing customers both domestic and foreign to rivals from neighbouring countries, including ports in the North Sea (Rotterdam, Antwerp-Bruges and Amsterdam), the Baltic Sea (Gdańsk, Gdynia and Klaipėda) and even the Adriatic Sea (Trieste and Koper). Furthermore, the Energiewende envisages that ports should be transformed into energy hubs, which poses additional challenges for them.

In response to the crisis, both the port & logistics-transport sectors and the governments of the coastal federal states have long been demanding that Berlin pursue an active port policy, especially as regards financing the necessary investments. High hopes had been pinned on a long-awaited strategy by Olaf Scholz’s government to address all these issues, but it turned out to be a disappointment. The diagnostic and declarative aspects of the document adopted on 20 March met with approval, but it was criticised for missing the most important element: a clearly determined method and scope of investment co-financing on the part of the state. Other barriers include German federalism and disputes within the government coalition.

The ports’ economic significance

Germany has 19 seaports, ranging from major international hubs like Hamburg, Bremerhaven, Wilhelmshaven and Rostock to smaller yet regionally significant ports such as Wismar, Puttgarden, Flensburg and Nordenham (see map). Seaports play a crucial economic role in Germany, as they primarily serve as transshipment points for goods and raw materials. Around 60% of Germany’s trade is handled through these ports. The fact that the German economic model is export-oriented adds to their significance as major logistical hubs.

Importantly, the main ports of Germany are used not only by domestic firms but also handle shipments originating from Central & Eastern Europe as well as Northern Europe, thanks to their strategic geographic locations. They also contribute to government budgets through excise duties, customs, VAT and port fees. The German port industry directly employs around 36,000 people, with an additional 124,000 employed in closely related maritime transportation logistics chains. Indirectly, German ports provide employment for up to 1.35 million people.[1] Furthermore, they generate an annual added value to the German economy of around €25 billion.[2]

Map. German seaports

Source: Federal Ministry for Digital Infrastructure and Transport.

The port crisis

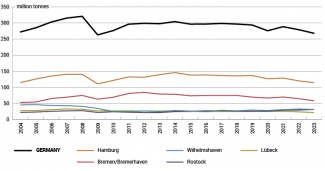

The performance of the German seaports has been worsening over the past few years. In 2023, a total of 267.8 million tonnes of cargo were handled in these ports: this marks their worst result since the crisis year of 2009, and represents a return to levels seen two decades ago (see chart 1). Since 2014, the peak year in the previous decade, there has been a clear downward trend. In 2023, the ports’ total freight traffic volume was 12% lower than in 2014 and nearly 17% lower than in the record year of 2008. The situation for the two largest ports, Hamburg and Bremen-Bremerhaven, is almost identical. They achieved their best results in 2014 and 2012 respectively, and since then they have experienced a regular fall-off in cargo volumes to levels not seen in 20 years.

Chart 1. Freight traffic in key German ports (2004–2023)

Source: author’s own estimates based on data from the Federal Statistical Office and the port operators.

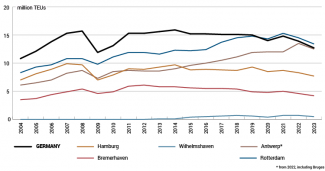

The situation regarding container handling is similar. In the record-breaking year of 2014, German ports handled a total of 15.9 million TEUs.[3] Since then, the number of incoming and outgoing containers has declined steadily, reaching 12.7 million TEUs last year. Such levels were last seen in the mid-2000s, and then temporarily during the crisis year of 2009. In Hamburg, the largest container handling port, the best result was achieved in 2007 (9.9 million TEUs). Subsequently, this level was approached twice (in 2008 and 2014), followed by a drop down to 7.7 million TEUs last year.

In Bremerhaven, the second-largest container handling port, the upward trend ended in 2012 when 6.1 million TEUs were handled. Since then, the freight traffic volume fell to 4.2 million TEUs last year. Wilhelmshaven, the third-largest container port in Germany, presents a different scenario. This, Germany’s only deep-water terminal, was put into operation in 2012 and expected to see further growth in freight traffic. During its peak period, it handled 700,000 TEUs, which means that only around 25% of the terminal’s total capacity (2.7 million TEUs annually) was being utilised. In the case of Hamburg and Bremerhaven, utilisation rate was around 60% last year (with respective maximums of 12.8 million and 7 million TEUs).

Chart 2. Container handling in German ports, Rotterdam and Antwerp-Bruges (2004–2023)

Source: author’s own estimates based on data from the Federal Statistical Office and the port operators.

It is worth noting that the situation in German ports has not matched the global or European trends over the past two decades, or even the economic indicators within Germany itself. For instance, according to World Bank data, global container shipments between 2004 and 2021 (the latest available data) rose by 149%; in the case of Asia-Europe routes they increased by 82%, and container throughput volume in European Union ports went up by 72%. Between 2004 and 2023, Germany’s GDP increased (nominally) by 84%, exports by 117% and imports by 137%. Over the same period, however, container handling in German ports increased by only 18% (from 10.8 to 12.7 million TEUs), and overall cargo handling even dropped by 2% (from 272 to 268 million tonnes).

The declining significance of German ports in the EU

While German ports have remained stagnant for years, their direct competitors have been developing, albeit some more rapidly than others. Between 2008 and 2023, the throughput of the container terminals in Hamburg and Bremerhaven shrank by 21% and 22% respectively. During the same period, the throughput in Rotterdam grew by 24%, and in Antwerp-Bruges (operating as a port complex since 2022) it increased by 44%. It is worth noting that Polish ports saw a 570% increase in container throughput during this period, primarily thanks to the Baltic Hub terminal in Gdańsk.

The competitive ports in neighbouring countries have to some extent been developing at the expense of the German ports, which have become less appealing and lost their former and/or prospective clients to their rivals. This concerns both domestic and foreign clients. As regards domestic clients, this is particularly true of the highly industrialised western and southern regions of Germany which are well-connected to the ports in Rotterdam and Antwerp, as well as those located in the Mediterranean and Adriatic regions.[4] With regard to the foreign clients, these are companies that used ports like Hamburg for transhipping goods that were then transported to Central European countries (including Poland, the Czech Republic, Austria, Slovakia and Hungary). Customers from these countries have opted to use domestic (as in the case of Poland) or nearby infrastructure in other countries. As a result of these shifts, German ports have at least partially lost their significance as transport hubs for Central, Eastern and Northern Europe (the Baltic Sea basin). This is well illustrated, for example, by the declining ship-to-ship transshipment[5] values for the port of Hamburg: in the record year of 2013, transhipment accounted for 42% of the containers handled there (3.9 million TEUs), but last year this share dropped to 34% (2.6 million TEUs).

As a result, German ports are losing their importance in Europe. In 2008, Hamburg was the second-largest container handling port on the continent, with results only slightly lower than Rotterdam’s and significantly higher than Antwerp, which was ranked third (at that point it was still separate from Bruges; see chart 2). Bremerhaven in turn ranked fourth, achieving much higher results than the next port in the ranking, Valencia. Since then their direct rivals have been developing rapidly, while the German ports, as has already been mentioned, have been plunging into stagnation. As a consequence, last year Hamburg ranked third among Europe’s most important ports in terms of container handling, with much lower results than Rotterdam and Antwerp-Bruges. Meanwhile Bremerhaven fell to seventh place behind Valencia, Algeciras and Piraeus. Another important fact is that in 2023 all the German ports together handled fewer containers than Rotterdam alone, and only slightly more than Antwerp-Bruges.

The most important reasons for the declining competitiveness of German ports, according to domestic experts and industry representatives, include:

- the outdated port infrastructure: there have been years of neglect in investing in the modernisation and expansion of quays, piers, storage yards and port basins, as well as in the automation and digitalisation of handling processes;

- the outdated access infrastructure: even though the ports are relatively well connected to the railway, road and inland waterway networks, bottlenecks within the country’s infrastructure (especially in the case of railway transport) pose a problem, due to numerous network failures and ongoing modernisation work, which lead to congestion and resulting delays in transportation;

- red tape, both in terms of settlements between port operators and customers, as well as obtaining bureaucratic permits for various types of investments;

- uncompetitive prices: container handling costs at the port of Hamburg are estimated to be as much as 30% higher than those in Rotterdam;[6]

- the shortage of skilled workers: port operators have highlighted the increasing difficulties in filling vacancies requiring specific qualifications; according to some industry representatives, this is one of the most serious challenges currently, albeit one which is less frequently mentioned in public debate;

- the lack of political will to include international shipping companies and/or operators as shareholders in German ports, which has become common practice in major competitors such as Rotterdam or Antwerp-Bruges:[7] German container terminals are mostly managed by the German companies Eurogate and HHLA.[8] In the latter case, Hamburg’s port authorities changed their policy only in 2023: first, the Chinese COSCO acquired a 24.99% stake in the Tollerort terminal (one of four in Hamburg), and then the Swiss-Italian MSC (currently the world’s largest shipping company) acquired a 49.9% stake in HHLA. Smaller ports, on the other hand, are mostly owned by the federal states or cities, and therefore have limited options to obtain funding for investments on their premises;

- in the case of Hamburg,[9] an additional weakness is the relatively long stretch from the sea to the port through the mouth of the River Elbe, which translates into a limited capacity for the waterway, the need for regular dredging of the river to accommodate larger container ships, and a significant dependence on tidal conditions for port entry and exit. Another issue is the insufficient height of the Köhlbrandbrücke bridge, which restricts entry to the Altenwerder terminal for the largest vessels.

The great significance of ports for the Energiewende

Ports – both those on the littoral and, to a lesser extent, those inland – have long played a significant role in the German energy sector. They are primarily used to import crude oil and refined fuels[10] as well as coal,[11] as well as liquefied natural gas (LNG) since late 2022.[12] As the energy transition progresses, the importance of ports will change. Volumes of crude oil, refined fuels and coal imports will decrease as demand diminishes; these trends have already been observed in recent years. However, they will be entrusted with new tasks of key importance for the Energiewende.

Firstly, they will be used for importing new low-emission energy carriers, primarily hydrogen and its derivatives, such as ammonia, methanol and synthetic fuels. Germany assumes it will be able to meet only about 30% of its demand for hydrogen (and its derivatives) from domestic sources; the rest will need to be imported. While the hydrogen is expected to be transported mainly via pipelines, its derivatives would mostly be imported by sea. Importing (low-emission) ammonia is considered the most promising element in the German debate; it could be used directly, for example, in the chemical industry, or after importation it could converted back into hydrogen and injected into the planned hydrogen network. Such concepts for industrial-scale ammonia imports have been devised, for example, for the planned gas terminals in Stade and Brunsbüttel (both locations are also chemical industry clusters), as well as in Hamburg, Rostock and Wilhelmshaven.

Secondly, ports can also be used in the production of new ‘green’ energy carriers. In this context, the concepts most frequently considered are the construction of electrolyser farms to produce so-called green hydrogen, using energy from offshore wind farms. Such plans have been presented for Wilhelmshaven, Hamburg, Rostock and Lubmin, for example.

Thirdly, ports are expected to play a crucial role in the development of offshore wind energy. Currently, Germany has offshore wind farms with a capacity of 8.5 GW, but according to statutory regulations this capacity must be increased to 30 GW by 2030, and eventually to 70 GW by 2045.[13] In order to achieve such ambitious plans, it will be necessary to build the infrastructure required in both the process of construction and the ongoing maintenance of the farms, especially the installation and maintenance ports. Currently, the port at Cuxhaven plays the most important role in this regard, and significant expansion is planned for it. There are similar plans for the ports in Bremerhaven, Emden, Wismar, Rostock and Mukran.

Fourthly, the ports are also intended to be used for exporting captured industrial carbon dioxide, which would then be stored under the seabed. Currently, CCS (carbon capture and storage) projects are being implemented in Norway, Denmark and the Netherlands; these countries expect German industry to be one of their major customers. Berlin is also considering allowing CO2 storage in the exclusive economic zone in the North Sea, but initially it would be exported to neighbouring countries that already have advanced facilities. This will require the appropriate export infrastructure; concepts for its construction have been presented for the ports in Wilhelmshaven, Brunsbüttel and Rostock.

In all four of these areas, initial projects are already being implemented in the ports in Rotterdam and Antwerp, and they will be the natural competition for similar investments in German ports. This especially (although not exclusively) concerns the industrialised Ruhr region, where companies from various sectors (such as the chemical, cement and metallurgical industries) plan investments in hydrogen and CCUS (carbon capture, use & storage) technologies. Companies from this region may more often opt to use Dutch or Belgian infrastructure (as is now the case, for example, with coal imports).[14]

Waiting for the government to step in

The existing issues, which are becoming increasingly serious, as well as the challenges that German ports need to face have long been subjects of public debate in Germany. Representatives from the industries concerned and the governments of the coastal federal states (Lower Saxony, Bremen, Hamburg, Schleswig-Holstein and Mecklenburg-Vorpommern) have used various forums, such as the Bundesrat, the media, economic conferences, etc. to appeal to the federal government to step in to help them improve the condition of German ports, assist in resolving structural problems and prepare for new challenges. They often criticise the federal government for having neglected the seaports for many years while neighbouring countries (such as the Netherlands, Belgium and Poland) actively pursue port policies. They insist that above all, Berlin should allocate significant funds for development investments.

However, German federalism turns out to be a serious problem when it comes to resolving the funding issues. According to the constitutionally established distribution of competencies between the federation and the federal states, the financial and administrative responsibility for both maritime and inland ports rests with the regional authorities, while the central government is only in charge of access infrastructure of federal importance, such as highways, railways and waterways. The federal states can to some extent pursue their own policies, manage assets and reap benefits, but they also have to meet the expenses of maintaining the infrastructure. According to the German Constitution, the five coastal federal states receive an annual compensation from the federal budget (Hafenlastenausgleich) to cover part of the current port maintenance costs; since 2005 this subsidy has been fixed at €38 million.

The expenses, which have been rising for years (partly due to inflation), are thus borne by the federal states, which have limited financial capacity (due to the so-called debt brake) and are finding it increasingly difficult to allocate the additional funds for necessary investments. According to the port industry, represented by the ZDS association (Zentralverband der deutschen Seehafenbetriebe) and the regional authorities, the federal subsidy would have to be raised more than tenfold, to €400 million annually, and preferably for a period of at least 5 to 10 years, so that they can implement the necessary projects to modernise and expand the ports’ infrastructure.[15] The problem is that, according to legal experts, any increase in this subsidy would be unconstitutional (due to the distribution of competencies) and could be challenged by the Federal Constitutional Court (FCC).[16]

The government’s port strategy

In response to the deteriorating condition of German ports in recent years, the government formed by the SPD, Greens and the FDP announced in the 2021 coalition agreement that it would develop a strategy to address the present needs of these ports and the challenges they were facing. The new cabinet, led by politicians from northern federal states (Chancellor Scholz was once the mayor of Hamburg, and Vice-Chancellor Robert Habeck served as the energy minister in Schleswig-Holstein), declared their commitment to shaping the country’s port policy.

Work on this document, in which representatives of the federal states and the port industry were actively involved, began in 2022 and was initially planned to end in a presentation of the strategy in September 2023 at a conference in Bremen. However it was impossible to reach a compromise within the scheduled timeframe, mainly due to disputes over financial issues between the coalition partners, the FDP, the Greens and the SPD. In November negotiations were further complicated by a ruling from the Federal Constitutional Court (FCC) regarding the climate fund,[17] which had previously been considered as a potential source of funding for port support.

Ultimately, the Scholz government only adopted the National Port Strategy (Nationale Hafenstrategie) on 20 March this year.[18] This document emphasised the crucial importance of ports for Germany in various fields – economic, commercial, logistical, energy, military and tourism – and declared that the successful development of the ports would be a “top priority” for the German government. Furthermore, five areas of action for state institutions were identified, within which strategic goals and implementation instruments were specified.

The first area is improving the competitiveness of German ports. The overriding objectives here are to make the ports more appealing both within Germany and the European Union; to seek synergies between individual ports; to standardise port-related regulations across different federal states; and to enhance cooperation in port policy between the federation and the federal states, as well as among the federal states themselves. Among the instruments agreed, the most important seems to be the establishment of a special team to address port-related issues, comprising representatives from federal and regional authorities. Its primary tasks would include identifying investment needs, agreeing on the financing of selected projects, and coordinating actions between the federation and the federal states in port policy at both the national and EU levels.

At the EU level, Germany intends to advocate for the adoption of a community port strategy, the simplification of state aid rules, and the harmonisation of tax issues. Moreover, the federal and regional authorities intend to jointly develop ways to reduce red tape in investment procedures, and the ports will be granted the legal status of critical infrastructure, which will ensure the government more control over potential ownership changes in this sector.

The second area focuses on transforming ports into energy hubs. The main goals in this field include creating the capability for importing and handling low-emission energy carriers (hydrogen and its derivatives), integrating the ports into the planned German and European CO2 transport infrastructure, enhancing the ports’ role in wind energy development and transport, and supporting emission reductions in maritime shipping. The most important solutions envisaged in the instruments include the following: developing a financing mechanism for expanding port infrastructure in line with the investments linked to the Energiewende; ensuring the availability of land in ports for the future construction of import terminals, storage tanks and electrolysers; and creating a ‘future energy port’ study outlining a vision for development. Germany also aims to take actions towards establishing regulations for the handling of alternative energy carriers (hydrogen, ammonia and methanol) that would apply across the EU.

The third area focuses on the digital transformation of ports. The main goals in this field include supporting the development and implementation of new digitalisation and automation technologies in cargo handling and logistics processes at the ports, as well as enhancing the cybersecurity of port infrastructure. The instruments to this effect include the creation of financial programmes to stimulate research and investments in new digital technologies; intensifying cooperation among industry representatives; streamlining data exchange between them; digitising some bureaucratic procedures, and expanding cooperation between ports on cybersecurity issues.

The fourth area concerns the training and employment of workers in the port industry. The main objectives here are to improve the attractiveness of work and to tailor the processes for training new staff to meet the ports’ needs. The instruments developed in this area are aimed at developing cooperation between universities and ports in creating teaching programmes, organising internships, promotional campaigns and job fairs. Additionally, a separate strategy for acquiring workers qualified for the industry is to be developed.

The fifth and final area focuses on the maintenance, expansion and protection of transport and communication infrastructure. The main objectives in this field include adapting it to new logistical, energy and military needs, as well as ensuring the security of ports and their personnel in scenarios of peace, crisis and war. The instruments developed in this area are focused on the simplification of procedures, ensuring financing (including from the EU, for example, through the Connecting Europe Facility (CEF) Transport or CEF Military Mobility programmes), improving access infrastructure (mainly railway) and revising security procedures.

Disappointment with the strategy: generalities devoid of a solid financial base

The National Port Strategy adopted by the federal government is a collection of diagnoses of current problems and a summary of the state of debate on the condition of German ports. The document identifies key challenges and outlines directions for development and action, but it is notable for being general and declarative in character. Compared to similar documents in areas such as energy, there are relatively few concrete proposals, data, forecasts or – as is usual for German policy – formulations of long-term development goals.

The biggest shortcoming of the strategy, which has been openly criticised by representatives of the industries concerned and the authorities of the coastal federal states, is that it fails to envisage any financial support from the government for investments in the modernisation or expansion of port infrastructure which have been identified as necessary and urgent. The fact that after several months of discussion no compromise has been reached on this matter, something which is fundamental for implementing the strategy, reveals the political impasse in the negotiations, both between the federal government and the federal states, and within the government coalition. Decisions in this regard have been deferred until 2025, when the team named in the document is expected to conclude its work.

According to representatives of Germany’s port industry, the strategy meets their expectations in terms of diagnosis and declarative aspects (after all, they themselves were involved in its formulation). They are particularly pleased with the clear recognition of the strategic role which ports play for Germany and the federal government’s political commitment to take action in port policy. However, according to the ZDS association, the lack of a compromise on financing the strategy makes the entire document disappointing. It fails to address the urgent needs of the industry because, without adequate funds, it will not be possible to achieve the goals formulated.[19] The governments of the five coastal federal states have criticised the federal strategy in a similar vein, and have once again called on the government to significantly increase its participation in the costs of maintaining and developing German ports.[20]

As a result, the government’s strategy does not represent a genuine breakthrough in German port policy. In the coming months, further rounds of negotiations and attempts to reach agreement on the methods and scope of financing port development can be expected, both between the federal government and the federal states, as well as within the government coalition itself. Given the doubts as to whether the possible direct increase in the state’s funding of port maintenance would be constitutional, it seems most likely that subsidies will be focused on specific investment projects that align with those policy areas for which the central government is responsible, or those which can be sufficiently credibly linked to the federal government to ensure that the subsidies cannot be challenged by the Federal Constitutional Court. Investments related to the transformation of ports into ‘green energy hubs’ are certainly among such areas, especially since Habeck, who serves as the deputy chancellor and minister for economy and climate action, has already expressed the political will in this regard. However, according to representatives of the port industry, limiting support only to projects that fit in with the Energiewende will not help make up for the investment backlog, and thus will not improve the competitiveness of Germany’s ports in Europe.

An uncertain future

It is unclear how the situation in German ports will develop in the coming years. Chancellor Scholz’s government plans for the next decade include a comprehensive modernisation of 40 railway corridors (primarily, the most frequently used and long-overloaded routes on the north-south and northwest-southeast lines), most of which are crucial for the ports. Starting this year, successive sections will be completely closed for reconstruction.

However, before the modernisation brings any tangible positive effects, it will cause congestion on the remaining routes and lead to disruptions in both passenger and freight railway traffic. This in turn may lead to congestion at container terminals and result in delays in deliveries of goods to end customers. Furthermore, starting next year fees for using the German railway infrastructure by freight trains will rise significantly (by up to 16%).[21] Since December last year, tolls for trucks have also been drastically increased (by up to 83%).[22] Both increases will adversely affect the attractiveness of freight transport through Germany, and indirectly the competitiveness of its ports.

There is a silver lining for German ports, though – especially given the financial involvement of the foreign shipping companies COSCO and MSC in Hamburg’s container terminals (global carriers generally seek increased utilisation of the ports in which they have stakes), as well as the active involvement of HHLA (including through its subsidiary, Metrans, the largest intermodal operator in Central and Eastern Europe) in expanding the network of connections in the Central and Eastern European region. The establishment from 2025 of the new Gemini Cooperation shipping alliance by Germany’s Hapag-Lloyd and Denmark’s Maersk, which intend to turn Hamburg, Bremerhaven and Wilhelmshaven into their hub ports and use them to provide services to the Northern European and Central & Eastern European markets, may also have a positive effect on the volume of transshipments at German container terminals.

[1] Data from the Federal Ministry for Economic Affairs and Climate Action: ‘See- und Binnenhäfen’, bmwk.de.

[2] Untersuchung der volkswirtschaftlichen Bedeutung der deutschen See- und Binnenhäfen auf Grundlage ihrer Beschäftigungswirkung, Fraunhofer Institute, May 2019, verkehr.fraunhofer.de.

[3] The TEU is a twenty-foot equivalent unit of cargo capacity, usually used for containers.

[4] For more detail, see S. Baniak, K. Popławski, ‘The Adriatic ports: a silent expansion onto the Central European markets’, OSW Commentary, no. 541, 2 October 2023, osw.waw.pl.

[5] Moving cargoes from one ship to another to be transported to the next destinations, usually in other countries.

[6] O. Preuß, ‘Hamburgs Hafen verliert den Anschluss’, Die Welt, 28 March 2024, welt.de.

[7] For example Rotterdam: APMT, Hutchison Port Holding, COSCO, DP World, TiL (MSC) and TL (CMA); Antwerp: PSA. DP World, COSCO, TiL (MSC) and TL (CMA); Valencia: APMT, COSCO and TiL (MSC).

[8] HHLA manages three terminals in Hamburg: Altenwerder, Burchardkai and Tellerort (China’s COSCO is expected to acquire a 24.99% stake in it). In turn, Eurogate manages the CTH terminal in Hamburg and three more in Bremerhaven, owning 100% of the stakes in CTB, 50% in North Sea Terminal BHV (the other 50% is held by APMT) and 50% in MSC Gate (50% is owned by TiL), and 100% in Jade Weser Port Wilhelmshaven.

[9] The reasons for the low competitiveness of the port of Hamburg were outlined in an extensive report by the Hamburg Chamber of Commerce: Wettbewerbsfähigkeit des Hamburger Hafens. Impulse für eine zukunftsgerichtete Hafenpolitik, Handelskammer Hamburg, 15 March 2024, ihk.de.

[10] Germany is able to meet nearly all of its oil demand with imports, as domestic production accounts for only about 2% of consumption. Since pipeline deliveries from Russia were cut, Germany now imports its oil almost exclusively by sea. It utilises its own ports in Wilhelmshaven, Brunsbüttel, Hamburg and Rostock, as well as foreign ports such as Rotterdam, Trieste and Gdańsk. The Polish port of Gdańsk currently plays a crucial role in supplying the refinery in Leuna and is used as an auxiliary port for deliveries to the Schwedt refinery.

[11] Since the closure of the last coal mine in 2018, 100% of Germany’s hard coal demand has also been met through imports, which are almost entirely transported by sea. In this case the main role is played by foreign ports in Antwerp, Rotterdam and Amsterdam, where the coal is transhipped onto barges and transported onwards to Germany. Domestic ports such as Hamburg, Wilhelmshaven, Rostock, Nordenham and Bremen account for about 25% of the imports.

[12] In addition to this, Germany covers 94% of its natural gas demand through imports. Until 2022, LNG (imported via terminals in Rotterdam and Bruges) played a supplementary role in order to direct pipeline supplies from Russia and Norway. It was only after the outbreak of the war in Ukraine that Germany began urgently developing its own LNG import infrastructure. Currently, the country has three operational floating storage and regasification units (FSRUs) in Wilhelmshaven, Brunsbüttel and Lubmin. By mid-2024, three more are expected to start operations: Mukran, Stade and a second unit in Wilhelmshaven. Additionally, there are plans to build three onshore LNG terminals (Stade, Brunsbüttel and Wilhelmshaven), which should replace the existing FSRUs at these locations by 2027. Currently, domestic terminals account for c. 7% of Germany’s gas imports. German importers also bring in LNG on a large scale via Rotterdam and Bruges, with 24% and 18% of imported gas respectively coming from the Netherlands and Belgium, according to BNetzA data. For more detail, see M. Kędzierski, ‘At all costs. Germany shifts to LNG’, OSW Commentary, no. 510, 28 April 2023, osw.waw.pl.

[13] Additionally, neighbouring countries have similar plans in which German ports could participate. For example, in the North Sea alone there are plans to develop offshore wind farms with a total capacity of 120 GW by the end of this decade, and 300 GW by 2050.

[14] O. Preuß, ‘Europas neue Energie-Achse’, Die Welt, 10 April 2024, welt.de.

[15] D. Delhaes, J. Olk, ‘Länder wollen 400 Millionen Euro für Häfen, auch Habecks Umfeld macht Druck’, Handelsblatt, 5 September 2023, handelsblatt.com.

[16] See for example the expert opinion from the Bundestag’s analytical department: Zur Frage der finanzverfassungsrechtlichen Zulässigkeit des Einsatzes von Bundesmitteln zur Ertüchtigung der Hafeninfrastruktur, Bundestag, 21 March 2024, bundestag.de.

[17] M. Kędzierski, S. Płóciennik, ‘Germany: the Constitutional Court deprives the government of €60 billion earmarked for transformation’, OSW, 17 November 2023, osw.waw.pl.

[18] Die Nationale Hafenstrategie für die See- und Binnenhäfen, Federal Ministry for Digital Infrastructure and Transport, 20 March 2024, bmdv.bund.de.

[19] ‘ZDS und BÖB zum Kabinettsbeschluss der Nationalen Hafenstrategie: Viele gute Vorhaben, aber große Enttäuschung der Hafenwirtschaft über fehlende Finanzzusagen’, ZDS, 20 March 2024, zds-seehaefen.de.

[20] See, for example ‘Madsen zur Nationalen Hafenstrategie: "Bedeutung der Seehäfen ist erkannt, aber Küstenländer sehen viele nationale Aufgaben"’, Landesportal Schleswig-Holstein, 20 March 2024, schleswig-holstein.de.

[21] ‘Trassenpreise sollen weiter steigen’, Deutsche Verkehrs-Zeitung, 15 March 2024, dvz.de.

[22] Ch. Schlautmann, ‘Verbrauchern drohen höhere Preise’, Handelsblatt, 15 November 2023, handelsblatt.com.