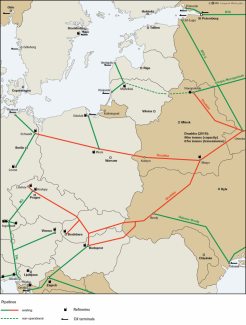

Dirty oil: the greatest crisis in the history of the Druzhba pipeline

On 19 April, the Belarusian oil company Belneftekhim reported a significant deterioration in the quality of Russian oil transmitted to Belarus via the Druzhba pipeline. The level of organochlorine compounds was dozens of times over the acceptable limit, and serious damage was caused to the installation at the Mozyr refinery. On 24 April the Polish oil logistics company PERN stopped receiving supplies from the Belarusian transmission system due to the heavy contamination, and a day later a similar decision was taken by the Ukrainian company Ukrtransnafta, which operates the Ukrainian part of Druzhba’s southern branch. This resulted in supplies being cut off to refineries in Germany, Slovakia, the Czech Republic and Hungary. Transneft, the owner of the Russian oil pipelines, confirmed on 19 April that the supply had been polluted. A total of up to 5 million tonnes of crude oil, worth up to US$2.6 billion, has been contaminated. On 26 April, Russian Prime Minister Dmitri Medvedev said the cause would soon be established, and on 30 April President Vladimir Putin suggested during a meeting with the president of Transneft that the system of supervision for transmitting oil must be changed. There are no reports of the contaminated oil reaching any refineries in Russia.

The complete cessation of oil transmission via Druzhba, which has now lasted over two weeks, is the most serious crisis in the 50-year history of this vital pipeline system, which connects Russia to Belarus and Ukraine, and onwards to Central Europe. This route, which has a technical capacity of about 80 million tonnes of oil, transmitted 67 million tonnes in 2018 (25% of all Russian oil exports). It is still unclear how such a large amount of pollution got into Druzhba. The serious damage this is causing Russia as an oil exporter, in both economic and image terms, may indicate that the crisis is the result of machinations by some of the smaller Russian private oil companies. On the other hand, rising tensions between Russia and Belarus, and the Kremlin’s use of energy to implement its foreign policy goals, means we cannot completely rule out the possibility that this is a politically motivated action undertaken by Moscow.

The process of cleaning the pipeline may take several months, which means it could only operate partially in the meantime (Poland, the Czech Republic and Hungary have already started to draw on their strategic reserves). This crisis could be an opportunity to introduce deeper changes in the Russian oil sector, particularly regarding ownership. It may also motivate the central European customers to make new investments, in order to expand the range of alternative oil transport routes to Druzhba.

What happened?

According to data from Transneft, the contamination occurred at the Lopatino metering unit near Samara. Reports from the Belarusian company Gomeltransneft- Druzhba suggest that the contamination affected 5 million tonnes of oil, of which 1.8 million tonnes is now on the territory of Russia, 1.7 million in Belarus, 1 million in Poland and 500,000 in Ukraine. The scale of the contamination means we can rule out a purely technical cause; contaminating around 5 million tonnes of oil requires conscious actions (or omissions) by the producers or entities responsible for overseeing the operation of the transmission infrastructure.

This crisis is generating serious losses in terms of both economy and image for both the Russian state and the Russian oil companies, so it is likely that the problem is the result of machinations by smaller Russian oil companies. Formal responsibility for the quality of the oil transmitted via the pipeline system is borne by Transneft, which in turn blamed the dirty oil’s entry into the pipeline system on the Samaratransneft-Terminal company. The latter was responsible for the quality control of the oil supplied to the pipeline by smaller producers (including the Volga-Oil company). These small private oil companies extract oil from seriously depleted fields, and they use additional substances (magnesium, salt, hydrofluoric acid, acetic acid, and chloride as a solvent) to increase oil production. They were encouraged to use such methods when in May 2012 the Russian Energy Ministry lifted its ban on the use of organochlorine compounds to maximise oil production. In the case of this incident, it is possible that the companies supplying the oil did not clean their product, in order to minimise their costs.

The contaminated oil problem has arisen at a time of rising tension between Russia and Belarus, which means that the possibility that this was a deliberate action by Moscow cannot be ruled out. The dirty oil was detected in Belarusian refineries shortly after Minsk made public threats (including in a statement by President Alyaksandr Lukashenka on 11 April) that it could temporarily halt transit via Druzhba, in response to Russia’s food sanctions and Moscow's opposition to Belarusian demands for compensation for the introduction of the so-called tax manoeuvre in Russia (reducing export duties and increasing the mineral extraction tax, which would raise the price of oil supplies to Belarus). This also occurred after Belarus notified Russia’s Transneft of its intention to raise its transit tariffs for the transmission of oil via Druzhba to its European customers by 23.1% (Transneft reported this on 5 April, while at the same time rejecting the Belarusian demands).

The crisis also fits into the context of Russia’s political and economic pressure on Ukraine. On 18 April, Prime Minister Medvedev announced that as of 1 June the export of oil and oil products to Ukraine would be embargoed (Russian diesel and LPG account for around 43% and 29% respectively of the Ukrainian market). Deliveries will only be possible after the Russian producers obtain special licenses. Limiting the Belarusian refineries’ production, together with the drop in supplies of Russian oil via Druzhba to the central European countries, will significantly reduce Kyiv’s options for substituting its imports of petroleum products, and that would increase the risk of a fuel crisis in Ukraine.

Another reason for considering political motives is that Russia has used energy issues to achieve its foreign-policy goals numerous times in the past. In January 2006, Russia suspended oil transit along the Druzhba pipeline via Belarus for three days in connection with its energy disputes with Belarus. In the same year, under the pretext of an alleged technical failure, Moscow suspended deliveries of oil to the Mažeikiai refinery, in response to its purchase by PKN Orlen. In the period September 2014–March 2015, Gazprom transmitted amounts of gas to selected customers in Central Europe which were below the nominations from importers; the companies in those countries were thus limited in their ability to send reverse supplies to Ukraine. In June 2017, Russian gas transmitted to Poland via the Yamal transit gas pipeline was found to contain water, which as a rule should not have happened.

Doubts as to the purely technical nature of the current crisis are also strengthened when one takes a closer look at the potentially guilty parties. The Samaratransneft-Terminal company, which has been blamed for the pollution, argues that it sold its terminal in December 2017 to the OOO-Nefteperevalka company; this company, which has a share capital of 10,000 roubles (around US$150) is 100% owned by one Svetlana Balaban, whose professional experience is related to the veterinary industry. In turn, the Volga-Oil company does not appear in the statistics of small private oil producers in Russia; its share capital also amounts to a mere 10,000 roubles. In addition, according to the industry ratings, these small oil producers would not, given the scale of their production, be able to contaminate up to 5 million tonnes of oil.

Consequences for oil customers

The pollution in Druzhba will have far-reaching consequences for all the countries receiving gas from the pipeline, although the scale of the negative consequences is different in each case.

The two refineries in Belarus which are entirely dependent on imports of Russian oil via Druzhba have been forced to cut production by more than half, which has resulted in the need to reduce their exports of oil products. The most difficult situation is at the Mozyr plant, where the contaminated oil caused part of the plant to cease operation. Belarus initially estimated the losses at US$100 million. The refinery in Novopolotsk began to receive good-quality oil on 24 April via the Surgut-Polotsk oil pipeline (although in smaller quantities). The good-quality oil eventually reached Mozyr on 4 May, but throughput will only be possible after the plant has been cleaned. The Belneftekhim company has developed a way of pumping the dirty oil from the Belarusian section of Druzhba by reverse-transporting it to Unecha in Russia, and from there to Ust-Luga, to clean the key oil pipeline, as well as by pumping the oil into the oil storage tanks. The aim is to restore the efficiency of one of Druzhba’s two branches as quickly as possible, while the second will serve as a temporary reservoir for the contaminated oil. Meanwhile Belarus has reported that restoring the entire system of Druzhba’s Belarusian section to full functionality will take up to six months.

The crisis associated with the supplies of dirty Russian oil is another instalment in the long-running energy dispute between Russia and Belarus on prices and conditions for supplying oil and gas. The so-called tax manoeuvre which is currently being introduced in the Russian oil sector will mean a significant rise in oil prices for Belarus (a total of US$11-12bn over the next five years, i.e. around 4% of annual GDP). Moscow is aware of Belarus’s dependence on Russian raw materials and the lack of any viable alternatives to them, so it uses this issue both to exert political pressure (including forcing Minsk to undertake further integration within the Union State), and to take control over the two Belarusian refineries. The current issue of the contaminated oil significantly undermines the financial position of the Belarusian refining industry, which is one of the biggest contributors to the state budget (10% of all taxes) and one of the biggest exporters (around 20% of receipts).

Ukraine does not import Russian crude oil, but the state company Ukrtransnafta guarantees its transit via Druzhba to Slovakia, the Czech Republic and Hungary. On 25 April the company stopped transmission due to the fact that the Slovak and Hungarian operators refused to receive the oil because of its poor quality. Ukrtransnafta intends to clean the dirty oil pipeline by pumping oil into reservoirs, and by stopping its use of the Odessa-Brody pipeline, which is connected to Druzhba. The problem will be easier to resolve because the southern part of the Druzhba pipeline consists of three parallel branches. On 6 May good-quality oil began to flow from the Mozyr transmission station towards the Ukrainian border; this oil will reach Slovakia and Hungary by 18 May, but it will represent only a partial restoration of the supply.

However, the current crisis carries a significant risk for Ukraine, which due to the collapse of its own refining industry is 90% dependent on imported fuels. In particular, the Mozyr refinery is an important supplier to the Ukrainian market (it has a one-third share of sales there). If Belarus cannot rapidly resume production of the necessary amounts, and the Kremlin introduces the embargo which it threatened, it will lead to a very serious shortage of fuel in Ukraine, which at the same time will be unable to find alternative suppliers quickly.

The MOL refinery company at Százhalombatta in Hungary receives half of its processed crude oil (around 4 million of a total of 8.1 million tonnes) via Druzhba. However, the Adria pipeline (with a capacity in Hungary of 10 million tonnes) allows for alternative supplies. In view of the cutoff of supplies, on 30 April the government issued a decision to send MOL 400,000 tonnes from the strategic reserves, and actions were taken to ensure that supplies to Adria were continued.

Slovnaft’s only refinery in Slovakia (owned by the Hungarian company MOL, and processes 6.1 million tonnes per year) is located in Bratislava, and it has access to oil from the terminal at Omišalj in Croatia thanks to its connection to the Hungarian-Croatian pipeline Adria. However, Adria’s capacity in its Hungarian section means that MOL’s refineries in Bratislava and Budapest cannot have their full demands met at the same time. On 27 April Slovnaft began a planned system review which resulted in a significant reduction of production (the downtime will last until the second half of June), and so there was no need to release the strategic oil reserves. The interruption of supplies via Druzhba caused the Czech government to release 100,000 tonnes of oil from the emergency reserves on 29 April due to the threat of a deficit of oil at the refinery in Litvínov (deliveries began on 1 May). This plant (owned by PKN Orlen via the Unipetrol company), which processes 5.4 million tonnes per annum, is supplied almost exclusively by Druzhba. Small amounts of oil also come from the port of Trieste via the TAL and IKL pipelines. Because TAL is at full capacity right now, there may be a significant increase in deliveries to the refinery in Litvínov if Druzhba is shut down completely. The second Czech refinery in Kralupy (3.3 million tonnes, also controlled by PKN Orlen) does not handle Russian oil, and mainly receives supplies from Trieste via the TAL and IKL pipelines. Unipetrol has signed a cooperation agreement with Croatia regarding the use of the Adria pipeline, but so far it has not signed any transit agreements with Hungary and Slovakia, and so it cannot yet use that supply route. The Czech state reserves will guarantee supplies for 84 days.

The contaminated oil has not reached Germany, which is at the end of the Druzhba pipeline. Two East German refineries, at Leuna (owned by Total) and Schwedt (controlled by Rosneft and Shell), which in total process c. 24 million tonnes of oil per annum (representing a third of German refinery production) receive almost all of their oil via Druzhba. In connection with the shutdown of transmission, the Leuna refinery has reduced production by 30%, while Schwedt is currently running at one-third capacity due to scheduled repairs, and their reserves are enough to last until mid-May. Both refineries are connected by pipelines to the terminal in Rostock (owned by the plant in Schwedt), although its capacity (9 million tonnes) is insufficient to meet their needs. There is also an option of delivery via Naftoport, and then via Druzhba.

Conclusions

The specific way the Russian state operates, and the very poor transparency of the energy sector (as well as its frequent use for political purposes), means that an unambiguous assessment of the current crisis cannot be made. It is possible that the oil contamination was caused by the machinations of small oil producers in Russia, although political motivation cannot be excluded, especially when taking the political tensions between Russia, Belarus and Ukraine into account.

The oil crisis could offer an opportunity for deeper changes in the Russian oil sector, including with regard to the issue of ownership of the Russian transmission network. Currently, Transneft owns and operates nearly all the oil pipelines; in recent years there have been reports that Rosneft is interested in acquiring shares in Transneft, which would give it control over the Russian part of the transmission infrastructure.

It is not clear how long it will take to clean at least one of Druzhba’s two branches. It is expected that oil may reach consumers in smaller amounts for several months yet, which may require production to be reduced at some refineries. In particular, this applies to those establishments that have limited access to alternative supplies in the necessary quantities (Litvínov, Bratislava and Leuna). According to a more optimistic scenario, it may still be possible to resume transmission at around 65% of the pipeline’s capacity. The crisis associated with the shutdown of Druzhba exposes all the oil security vulnerabilities of the countries that receive Russian oil from the pipeline, and so this incident can be treated as another ‘stress test’.

Despite several meetings between the operators of the Belarusian, Ukrainian and Polish sections of Druzhba and Russia’s Transneft, there has so far been no mention of financial compensation. For the Russian side, limiting oil supplies to Central European consumers will involve losses, both financially (which can only be estimated after better data is obtained on how much supplies to individual customers have been affected) and in image terms, which will result in some countries intensifying their efforts to diversify their supplies (including Poland).

Map. The Druzhba pipeline