The legacy of Petr Kellner – assets, interests, the significance for Central Europe

On 27 March this year, 56-year-old Petr Kellner, the richest Czech, died in a helicopter crash in Alaska. The value of his fortune, estimated at $17.5 billion, placed him in 110th place on the Forbes global ranking for 2020 (he amassed more than four times as much as the richest Pole, Michał Sołowow, who is in 727th place). In the Czech Republic, Kellner had the position of the most important oligarch, which was due to the extensive scope of his political connections and the activities of his company, PPF, in areas strategic for state interests. Kellner's ability to influence the Czech public debate was significantly increased by the 2020 takeover of the most popular Czech private television station, TV Nova. There have even been claims in the media that decisions concerning Kellner's succession may be more important for the Czech Republic than the outcome of the parliamentary elections scheduled for October. If the scenario of the fourth richest Czech, Daniel Křetínský, taking over the management of Kellner's assets were to come to pass, a player with great business ambitions and assets estimated at almost $22 billion could emerge in Central Europe.

PPF (registered in Amsterdam), a group in which Kellner had nearly 99% of shares, brings together almost 400 companies operating in more than 30 countries, mainly in the areas of finance, telecommunications and the media. It employs more than 15,000 people in the Czech Republic, and has local control over the largest mobile network operator and internet provider (O2), the biggest telecommunications and data network operator (CETIN), the largest private TV station (TV Nova), and is active in finance (two smaller banks and a non-bank consumer finance provider) and e-commerce (a 40% stake in the most popular price comparison site and a major online store). In 2018 PPF acquired one of the most important Czech industrial companies, Škoda Transportation, injecting it with significant funding, increasing production and creating jobs.

Commentary

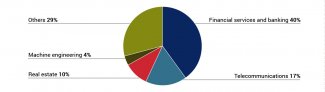

- Kellner's first profits came from the so-called voucher privatisation (kupónová privatizace) and the subsequent restructuring of the country's largest insurance company, Česká pojišťovna (PPF took over control of the management in 1996 and gained a majority stake in 2000). Kellner sold its shares at a profit to the Italian Generali group in three deals between 2007 and 2014 for more than €3.6 billion. He was the richest Czech citizen for about 15 years. In various aspects of conducting business, Kellner was among the pioneers in his country. He was one of the first to register his holding company in the Netherlands, where it still has its formal headquarters today, which brings, for instance, tax advantages. Kellner quickly began to diversify its business globally. In addition to the Czech Republic, the company has a strong presence in the Far East, Russia and the Balkans, with Czech employees accounting for only 5% of the workforce. Although PPF has also expanded into more industries over time to reduce business risk, two areas came to the forefront: finance and telecommunications (see the Chart). Since 2013, it has significantly increased its assets in the Czech Republic, taking control of many significant companies in important industries. In the same year, the world of Czech politics had a newcomer – the country's second richest man Andrej Babiš, whose ANO received the second-highest electoral result and became part of the governing coalition. This was as the term of President Václav Klaus, who was close to Kellner, was coming to an end.

- Kellner did not enter politics directly, like Babiš. He was careful about his privacy, rarely appeared in the media (he gave his last interview in 2012), and made his views known only in the PPF's annual reports (the one from 2019, when he spoke out against the "relativisation of traditional values", gained particular traction). However, his close relationship with those in power brought him specific benefits. In 2018 controversy shrouded his success (through a consortium involving his company CzechToll) in a tender to operate the Czech highway toll system for ten years. A close relationship with president Miloš Zeman was instrumental in this regard. This alliance, symbolised by Zeman's flights in Kellner's private plane, was built by Kellner soon after Zeman took over the presidency. Also of significance was the informal non-aggression pact with Prime Minister Babiš, with whom he essentially did not compete in business. Kellner's TV Nova shows restraint in reviewing the government's failure to deal with the pandemic. In turn, Prime Minister Babiš, despite announcements, has not forced the introduction of a fourth mobile operator on the Czech telecommunications market, thus preserving the existence of an oligopoly. O2 is the main beneficiary of this situation. Mobile internet prices in the Czech Republic are among the highest in the EU: Czechs pay 11 times more for 1 GB of data than Poles, and telecom prices are 20% higher than the EU average, while in Poland they are 50% lower.

- There are many indications that Kellner was one of those who inspired and benefited from the pro-Chinese and pro-Russian course pursued in Czech politics, especially by President Zeman. This is associated with Kellner's extensive activities in the Chinese consumer finance market, which requires close relations with the authorities in Beijing, as well as his business presence in Russia (from mining, through agriculture, to life insurance). In both countries, Zeman has personally supported Kellner's interests, including by putting pressure on the Czech government. The policy of “opening up to China”, pursued in 2010-2017 by successive cabinets of various groupings, was linked to the interests of Kellner, who had been active there since 2007. PPF was also one of the main sponsors (along with VW) of large annual Czech-Chinese business forums, which promoted political and economic cooperation between the two countries. As China's relations with the West deteriorated, this also roused growing controversy in the Czech Republic, e.g. in connection with the disclosure of information by the media about Kellner's financing of operations to improve the image of China in the Czech media.

- Formally, Kellner's main heir will most probably be his wife Renáta Kellnerová, who will take over the mantle of the richest Czech citizen. There are more question marks about who will actually manage the assets. The most frequently mentioned person in this context is the fourth richest Czech, Daniel Křetínský, who for five years has been the life partner of Kellner's daughter (one of four children) and a friend of the family, and who has repeatedly cooperated in business with PPF. For example, they bought coal assets in Germany in 2016 (a 50% stake each) and shared the Mall and Heureka internet projects (both hold a 40% stake in each). Křetínský has even more in common with Kellner: they shared ambitions of operating beyond the Central European region, both demonstrated an out-of-the-box approach, and both conducted activities in a wide range of industries. The succession proceedings will take at least several months and will delay some transactions (e.g. the acquisition of the Czech bank Moneta). Management volatility will also be caused by the transition from the model of a single owner making key decisions to a more complex structure with key managers playing a greater role. Kellner's long-time business partner, Ladislav Bartoníček, has temporarily taken over the management of PPF. He has already announced that, in accordance with the wishes of the family of the deceased, projects that have already been initiated are being continued (e.g. the creation of a large banking group in the Czech Republic), and PPF is considering acquisitions of infrastructure and media companies in Europe.

- Taking into account the realities of business activities in China and Russia, where support was to a large extent possible thanks to Kellner's personal connections, a decision to gradually withdraw from those markets cannot be ruled out, especially in view of the increasingly poor results of his companies operating there. Arguably, this would also dismiss the prospect of another Czech-Chinese political rapprochement. Also, given Křetínský's previous main business directions (energy, logistics, portfolio investments, the media) and his focus on Europe, it may be expected that he will primarily be interested in managing Kellner's European financial and media assets. In recent years, Kellner expanded his operations in the Balkans and Central Europe, acquiring major TV stations in Slovakia, Slovenia, Bulgaria and Romania, a Serbian internet bank and profitable mobile operators (in Hungary, Bulgaria, Serbia and Montenegro), and had also previously been present in the Slovak market for consumer loans and telecommunication services. The Slovak assets in particular will be attractive for Křetínský, who has a key influence on important energy companies there. There are many indications that cooperation between the two businessmen was already in place in Slovenia (Kellner's December 2020 meeting in Ljubljana with Prime Minister Janez Janša was linked to EPH's approval of Křetínský's acquisition of a 49% stake in the state-owned Slovenian rail transport company – for more details, see: Slovenian-Czech alliance in rail freight transport). However, Křetínský is focused on EU operations and it is unclear whether he will be interested in PPF's Balkan assets, especially since PPF's cooperation with governments there has already caused controversy.

- Poland has not been a major area of Kellner's business activity – there are branches of the rolling stock manufacturer Škoda Transportation (last year it won a tender for the delivery of trains for the Warsaw metro) and the online store Mall. The activities of Křetínský, who may take over the management of a significant part of Kellner's empire, are also relatively small-scale (EPH is withdrawing from the coal mine in Czechowice-Dziedzice, but wants to remain on the rail freight market – EP Cargo Poland). Škoda Transportation engages in competition with some Polish companies, such as PESA, Newag or Solaris – although the latter company has also established cooperation with Škoda, which resulted in the production of trolleybuses with Czech engines. In the case of withdrawal from business in Russia and China, it cannot be ruled out that PPF will take a greater involvement in Central Europe. It may be a partner of Polish businesses, but it may also be a competitor. The important question here may be whether Křetínský will be interested in continuing Kellner's intentions regarding a stronger involvement in logistics in Central Europe.

Chart. Share of industries in PPF's equity in 2019.

Source: PPF data (total assets of the company in 2019 amounted to €48.6 billion).