A key partner. Ukraine–EU trade in 2023

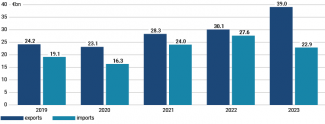

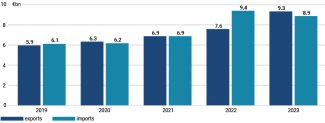

In 2023, EU exports to Ukraine rose significantly, while its imports from this country fell. Sales from member states to Ukraine rose by 29.8% to €39 billion, and imports shrunk by 17.3% to €22.9 billion, mainly due to the low global prices of agricultural and metallurgical products. The share of EU countries in Ukraine’s exports stood at 66%, and in its imports the figure was 53%. Poland was Ukraine’s largest trading partner in this group.

Ukraine’s economic situation is unlikely to improve in 2024, EU exports to the country will most probably remain at last year’s level, and fuel, weapons and vehicles will continue to be the predominant exports. Imports will depend on the functioning of the Black Sea corridor and the global prices of agricultural and metallurgical products.

The EU surplus

The EU primarily sold fuel, vehicles and weapons to Ukraine, with Poland leading in these areas. The imports mainly consisted of agricultural, food and metallurgical products, as well as iron ore. The embargo on grain sales to five Central European countries had no negative impact on total Ukrainian exports, since new destinations in other EU countries were found (primarily Spain).

Chart 1. Value of the EU–Ukraine commodities trade in 2019–2023

Source: Eurostat.

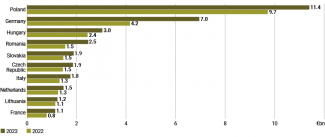

All of Kyiv’s most important EU partners, especially Germany, increased their exports to Ukraine. In the case of Germany, their value rose by 67.3% compared to 2022.

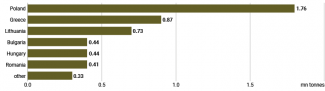

Chart 2. EU’s largest exporters to Ukraine in 2022 and 2023

Source: Eurostat.

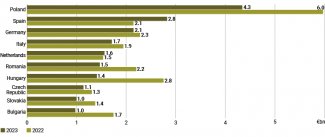

Imports of goods from Ukraine principally fell in the countries which border it, as well as Bulgaria. In April–May 2023, these countries imposed an embargo on some Ukrainian agricultural production. Spain was the only major recipient of Ukrainian goods to have seen a significant increase in imports, mainly due to a 51% rise in the amount of grain imports from Ukraine.

Chart 3. EU’s largest importers of goods from Ukraine in 2022 and 2023

Source: Eurostat.

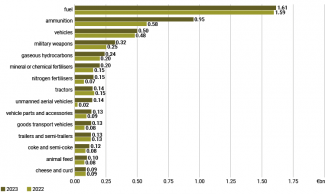

Main exports and imports

The EU’s most important exports to Ukraine were fuel, various types of vehicles and weapons components. Poland played a key role in each of these categories (see below). Other important export categories were products of the machinery and pharmacological industries.

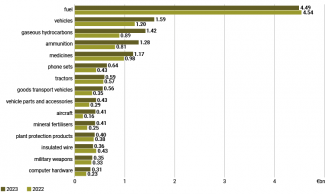

Chart 4. EU’s main exports to Ukraine in 2022 and 2023

Source: Eurostat.

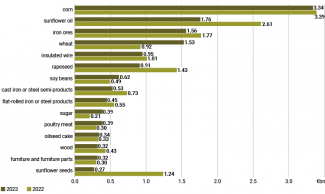

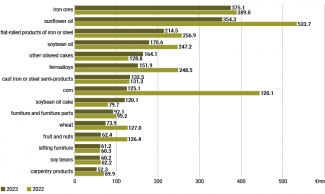

In 2023, EU countries typically imported mainly agri-food products, metallurgical products and iron ore from Ukraine. Sales of Ukrainian grain to the EU rose by 10.3% in terms of value and 23.9% in terms of volume. The 29.6% lower value of exports of vegetable oils (mainly sunflower oil) resulted from a drop in price, as the sales tonnage was 7.4% higher.

Chart 5. EU’s main imports from Ukraine in 2022 and 2023

Source: Eurostat.

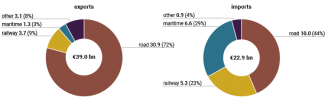

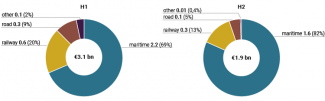

Modes of transport used in trade

Road transport plays the most important role in EU-Ukraine exports and imports of goods. In 2023, it accounted for nearly 80% of sales value. This means that Ukraine’s land border crossings with EU member states are of primary importance for the bilateral flow of goods.

Chart 6. Exports from the EU to Ukraine and imports from Ukraine in 2023 by modes of transport

Source: Eurostat.

It must be emphasised that road transport has substantially gained in importance in trade with Ukraine after Russia launched its full-scale invasion of this country. Between 2021 and 2023, the volumes of shipments rose by 35% in the case of exports from the EU, and by 29% for imports into the EU.

Chart 7. Road transport trade between EU member states and Ukraine in 2019–2023

Source: Eurostat.

At the same time, during 2023 certain goods imported by the EU from Ukraine, especially grain, began to be transported to an increasing extent by sea. This was caused by two factors: the launch of the new Black Sea corridor (see ‘Ukraine: the new Black Sea corridor is a success’) and the blockage of imports of part of Ukraine’s agricultural production by its neighbours (see ‘Reactions to the EU’s lifting of restrictions on grain imports from Ukraine’).

Chart 8. Grain imports from Ukraine to EU member states in 2023 by modes of transport

Source: Eurostat.

Poland’s position amongst the EU27 countries

In 2023, as in the previous year, Poland was Ukraine’s largest EU trade partner, reaching a 25% share in the EU’s total trade with Ukraine. Poland ranked first among the EU27 countries in terms of both its exports to Ukraine (30.6%) and its imports from this country (19%).

At the same time, Ukraine remains an insignificant market for Polish commodities: in 2023, goods imported from Ukraine accounted for just 1.3% of Poland’s total imports. In the case of exports, Ukraine’s share was a little larger, at 3.2%. This means that Ukraine’s significance as Poland’s trading partner is comparable to that of Slovakia, which has less than a sixth the number of inhabitants.

In 2023, Polish sales to Ukraine were worth €11.4 billion (an increase of 17.2% compared to 2022). An analysis of its structure reveals that growth was seen in all main product groups, and was particularly intense in the case of military equipment (including drones).

Chart 9. Poland’s main exports to Ukraine in 2022 and 2023

Source: Eurostat.

The most important commodity Poland sells to Ukraine is fuel. Although in terms of value the increase in exports in 2023 was small (1.1%), it was very significant in terms of volumes. Gasoline and diesel sales spiked from 1.27 to 1.76 million tonnes, or by 38.6%. This means that Poland’s share in EU supplies of fuel to Ukraine exceeds 35%, and when deliveries from the Orlen refinery in Lithuania are taken into account, this share rises to 50%. According to data from the Customs Service of Ukraine, the largest non-EU exporters were India and Turkey, which sold 1.06 million and 640,000 tonnes of gasoline and diesel oil respectively.

Chart 10. The EU’s largest fuel suppliers to Ukraine in 2023

Source: Eurostat.

Unlike exports, imports from Ukraine to Poland in 2023 shrank significantly compared to the previous year – from €6 billion to €4.34 billion, or by 27.3%. In effect, imports of all the most important commodity groups fell, except for oilseed cake and other sunflower seed residues (a significant increase was seen in this category).

Ukrainian imports primarily fell as a result of the ban on importing wheat, corn, rapeseed and sunflower imposed in April 2023; in 2022 these commodities had accounted for a significant share of imports from Ukraine. The second factor was the decline in the prices of agricultural products on global markets, which also affected Ukrainian goods. For example, the value of imported sunflower oil (which is not subject to any restrictions) fell by 33.6% in 2023, but in terms of volume it rose by almost 9%. The same was the case with metallurgical production, such as products made of cast iron, steel or ferroalloys.

Chart 11. Poland’s main imports from Ukraine in 2022 and 2023

Source: Eurostat.

In the case of Poland – as with other Ukraine’s neighbours (except Romania) – land transport, especially road transport, plays the greatest role in trade exchange. Poland is a transit country for the key Western EU economies such as Germany, France and the Netherlands, which means that nearly half of the goods exported from the EU to Ukraine come from Poland or pass through its territory. In the case of imports, this indicator is slightly lower (in 2023 it stood at 42%). These data are proof of the great importance of the Polish-Ukrainian border.

Chart 12. Trade between Poland and Ukraine in 2023 by modes of transport

![]()

Source: Eurostat, database DS-058213.

Prospects

The Russian invasion, along with Brussels’ unilateral lifting of tariffs and quotas on Ukrainian goods in June 2022, has led to a significant change in the geographical structure of Ukraine’s foreign trade. Between 2021 and 2023, the EU’s share in its exports rose from 41% to 66%, and from 42% to 53% in its imports. Apparently, the European Union will be an increasingly important trade partner for Kyiv in the near future.

Since the war is unlikely to end this year, no significant economic growth that could lead to a revival of foreign trade should be expected in Ukraine. In 2024, the EU’s exports of goods to this country are likely to remain at a level similar to last year’s, including in terms of the commodity structure: fuel, weapons and vehicles will still predominate. Imports from Ukraine will depend on the continued functioning of the Black Sea corridor (there are currently no indications that it is under any threat) and the prices of agricultural and metallurgical products on the global markets.