Dynamic imports vs. dwindling exports. Belarus–EU trade in 2023

In 2023, trade between the European Union and Belarus was characterised by a significant surplus of EU exports over imports. Sales to the Belarusian market totalled €8.1 billion, while trade in the opposite direction was almost six times lower at €1.4 billion. Belarusian exports to the EU have been declining for three years as a result of the successive imposition of sanction packages following the rigged presidential elections in 2020.

Meanwhile, as part of its growing imports from the EU, Belarus buys goods that are not subject to restrictions, primarily cars, a significant portion of which likely ends up in Russia through so-called parallel imports. Poland stands out as Belarus’s main trading partner in the EU, both in terms of imports and exports. In 2024, the downward trend in Polish imports from Belarus is likely to continue, as is the negative trend in overall Belarusian sales to the EU.

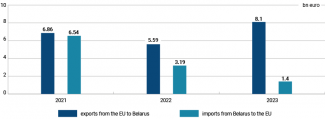

Increasing surplus of EU exports over imports

The results of the EU–Belarus trade reveal a growing gap between imports from Belarus and exports to this country from the EU. While in 2021, the deficit on the Belarusian side was only €320 million, in 2022 it reached €2.4 billion, and in 2023 it was as high as €6.7 billion. This strong downward trend is not so much a result of an increase in the value of sales to the Belarusian market (in 2022, there was even a slight decrease of around €0.3 billion year-on-year) but is rather an effect of a drastic reduction in imports. This reduction has been caused by the implementation of EU trade sanctions introduced in 2021–2 that cover goods which used to generate high revenues, such as petroleum products, salts and potassium fertilisers, wood and wood products, and metal and steel products.

Chart 1. Trade between Belarus and the EU in 2021–2023

Source: Eurostat.

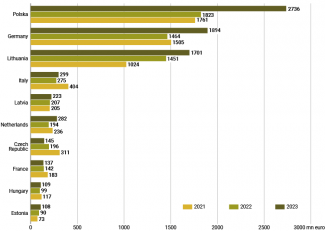

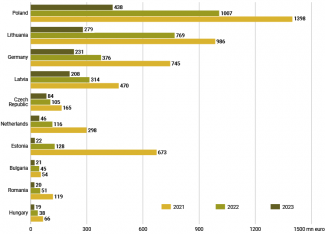

All Belarus’s key EU trading partners increased their sales to the country or at least maintained them at similar levels. At the same time, they cut imports, in some cases even by half compared to 2022.

Chart 2. Top EU exporters to Belarus in 2021–2023

Source: Eurostat.

Chart 3. Top EU importers from Belarus in 2021–2023

Source: Eurostat.

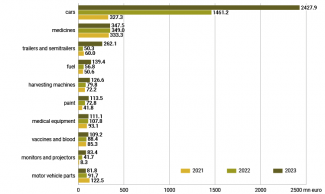

According to preliminary data for 2023, the dominant categories in EU exports to the Belarusian market were: vehicles (excluding trams and railway coaches) and vehicle parts, machines and machine parts, pharmaceutical products and medical equipment. It is especially worth noting the significant increase (by approximately €1 billion) in the export value of cars, which is largely related to the so-called parallel imports to the Russian market. Unlike with Belarus, car imports to Russia are subject to an EU embargo.

Chart 4. Main exports from the EU to Belarus

Source: Eurostat.

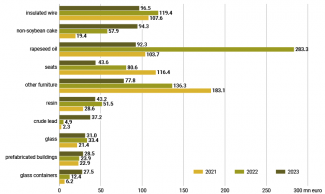

In turn, main imports from Belarus to the EU were primarily: insulated wire, residues and waste from the food industry (mainly non-soybean cake), rapeseed oil, furniture, crude lead, glass and glass containers and glassware.

Chart 5. Main imports to the EU from Belarus

Source: Eurostat.

High exports from Poland

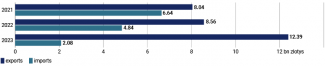

Compared to other EU countries, Poland stands out with the highest trade with Belarus, both in terms of imports and exports. Nevertheless, Polish–Belarusian trade in 2023 saw a downward trend in imports from Belarus (a 58% decrease) and an upward trend in exports to Belarus (a 44% increase).

According to data from Statistics Poland (GUS), last year Poland imported goods from Belarus totalling PLN 2.08 billion (€0.4 billion), while its exports to Belarus stood at PLN 12.39 billion (€2.7 billion). For comparison, in 2022, Belarusian imports were worth PLN 4.84 billion (about €1 billion), while exports were PLN 8.56 billion (about €1.8 billion). Poland is still Belarus’s leading trade partner among EU countries – in 2023, Poland’s share in EU imports from Belarus was around 30%, and in EU exports to this country it stood at 33%.

Chart 6. Dynamics of Polish-Belarusian trade in 2021–2023

Source: Statistics Poland.

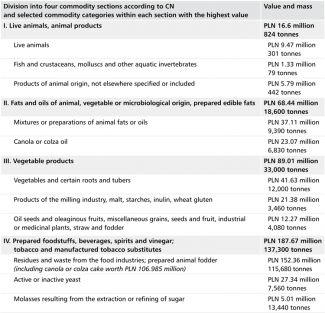

Agri-food imports from Belarus to Poland

Agri-food products account for 18% of the value (PLN 360 million) of Poland’s total imports from Belarus (see table). Imported grain (mainly buckwheat), worth only PLN 921,000, constituted a negligible part of it. Poland mainly imported chemical products (PLN 341 million), including fertilisers (PLN 108 million), furniture (PLN 312 million), stone, gypsum, cement and asbestos products (PLN 272 million), glass and glassware (PLN 237 million) and vehicles, mainly locomotive parts, railway rolling stock and containers (PLN 90 million).

Table. Value of agri-food imports from Belarus to Poland in 2023

Source: Statistics Poland.

Prospects

The involvement of Alyaksandr Lukashenka’s regime in the Russian invasion of Ukraine, as well as Minsk’s ostentatious unwillingness to make concessions, including the release of political prisoners, will make Belarus even more isolated from the West. It cannot be ruled out that the current trade restrictions imposed on Belarus will be expanded to include more sanctions, which will include closing loopholes in the restrictions imposed on Belarus and Russia.

Thus, it is most likely that the already significant disparity between imports and exports in Belarus–EU trade will increase further in 2024. Currently, the EU’s share in Belarus’s foreign trade is only 5%, while Russia (both as a direct importer/exporter and a transit country) accounts for as much as 90% of Belarus’s trade (see ‘Towards a dependence with no alternative: Russia's increased role in the Belarusian economy’).