The shadow of recent glory: the Belarusian IT sector after 2022

The rapid growth of the IT sector in Belarus – an ‘island of modernity’ within an outdated economic model, partly based on Soviet-era management and planning standards – had been a success story for nearly two decades since 2005. This was evident in the sector’s increasingly robust financial performance and the country’s growing appeal for investment. The development of the IT sector accelerated significantly after its operational conditions were liberalised in 2018. Notably, neither the COVID-19 pandemic nor the Western sanctions imposed following the disputed 2020 presidential elections halted this growth.

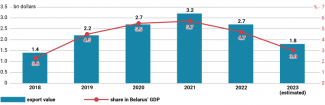

The turning point occurred when Alyaksandr Lukashenka’s regime became involved in Russia’s invasion of Ukraine in February 2022. Belarusian IT companies became increasingly problematic for their Western customers, which accelerated the emigration of specialists and the relocation of companies –trends that had begun earlier. Despite the evident signs of crisis, the IT sector has survived and partially adapted to the new, significantly more challenging conditions. However, its growth has lost its previous momentum, and the sector’s contribution to the overall economy decreased from nearly 6% of GDP in 2021 to approximately 3% in 2023. The value of exported services and products also declined, from $3.2 billion to $1.8 billion.

The regime’s IT experiment

In 2005, Lukashenka signed a decree establishing the High Technology Park (HTP) with the aim of creating and developing IT companies. The project capitalised on the relatively high standard of higher education in science and technology, including computer science, which ensured a steady supply of skilled programmers. Initially, the HTP operated as a cluster focused on developing IT products and delivering IT services to major international corporations.

A new phase commenced with Lukashenka’s December 2017 decree ‘On the Development of the Digital Economy’, which introduced unprecedented incentives for IT companies and specialists registered at the HTP. These included tax breaks or complete exemptions (for instance, from paying VAT), unlimited use of cryptocurrencies (which effectively legalised them), visa-free entry with a 180-day stay period for foreigners employed at the park, and more. Furthermore, HTP residents were afforded considerable freedom in opening foreign currency accounts for transactions with their foreign customers and in circulating commercial and technical documentation.

The new regulations incorporated elements of British law (see ‘Is the crisis over? The economic situation in Belarus after two years of recession‘). Consequently, a special investment zone for IT, founded on liberal principles, emerged within the authoritarian state. The aim of this initiative was to develop an innovative sector that would showcase the modern developmental potential of the Belarusian economy while also enhancing the country’s overall investment appeal.

Rapid growth until 2022

In 2018, the Belarusian IT sector entered a phase of rapid growth, increasing its share of GDP from 3.6% to 5.7% over three years. Concurrently, the industry’s exports, particularly in software, increased to $3.2 billion in 2021 (see Chart), accounting for approximately 30% of the country’s total foreign sales of services. Companies based in Western Europe and the US were the primary purchasers of Belarusian IT products. Consequently, with favourable legal regulations and a pool of skilled specialists, the IT sector quickly became one of the key pillars of the Belarusian economy, rivalling traditional sectors such as agriculture, which accounted for approximately 6–7% of GDP between 2018 and 2020. The number of HTP residents grew rapidly, exceeding 800 registered entities in 2020, with a total of 3,574 IT companies operating nationwide. Simultaneously, employment in the sector rose to over 85,000 in 2019. Belarusian IT products rapidly gained global recognition and acclaim, with notable examples including the video game World of Tanks, the messaging app Viber (developed in collaboration with Russian programmers) and the mobile app MSQRD.

This IT phenomenon also possessed a social dimension, as it fostered a dynamic, development-oriented group of predominantly young and affluent citizens (with programmer salaries consistently ranking among the highest in wage rankings) who were socially active. Many of them participated in the post-election demonstrations in 2020 and supported those who were arrested, prompting the regime to implement repressive measures. This hindered the sector’s growth but did not undermine its prosperity in terms of its contribution to the country’s GDP or the value of its exports. In fact, after 2020, the number of HTP residents surpassed 1,000 registered entities.

These growth trends persisted despite the imposition of additional sanctions on Belarus and the emigration of specialists. According to estimates from the independent industry website, devby.io, approximately 20,000 IT professionals departed Belarus between 2020 and the end of 2021, primarily for Poland and Lithuania. This outflow was balanced by new specialists entering the industry, including individuals who were just beginning their careers. Consequently, employment in the sector remained stable at approximately 100,000 during these two years. Harsher repressive measures also prompted some companies to relocate (including PandaDoc, one of the leading producers of business document management software, which is partly based in Belarus); however, the sector continued to grow. The number of businesses continued to rise; according to official statistics, 179 new companies were established in 2020, followed by a further 101 in 2021.

A crisis, but no collapse

Russia’s full-scale war against Ukraine marked a pivotal turning point for the Belarusian IT sector. The Lukashenka regime’s support for its Russian ally resulted in a significant expansion of Western embargoes on Belarusian exports, rendering cooperation with Belarus toxic, even in sectors that were not directly affected by the sanctions. European and American business partners made any further cooperation with Belarusian IT companies contingent upon their relocation abroad. Consequently, many companies exited the market, laying off some employees while relocating others, primarily to Lithuania and Poland.

Following February 2022, several prominent companies departed Belarus, including Wargaming (a developer of computer games) and more specialised firms such as OneSoil (software for optimising agricultural production) and Wannaby (sales platforms). Other companies, including FLO (women’s health apps) and EPAM – a US-based giant with Belarusian roots regarded as a leader in software engineering in Central Europe – reduced some of their projects and personnel in Belarus. Consequently, 17,000 programmers left the country in 2022, nearly as many as had emigrated in the preceding two years combined. Simultaneously, over 13,000 new employees entered the industry, representing a 40% reduction compared to the number of vacancies created by the emigration of specialists. The IT sector’s share of GDP fell to 4.7%, nearly matching the levels seen in 2019. Furthermore, for the first time since the establishment of the HTP, the value of IT exports decreased, falling to $2.7 billion in 2022. In the following year, the sector’s performance worsened further, with exports plummeting to only $1.8 billion (see Chart).

Following the initial shock and subsequent decline, the situation in the IT sector gradually stabilised in 2023. Fragmentary official data indicates that the outflow of specialists was significantly lower, with approximately 6,000 individuals leaving the country – over 10,000 fewer than the previous year. Currently, the number of employees in this sector is estimated to exceed 60,000. Companies that have opted to remain in Belarus are striving to maintain relatively high salaries; the average programmer salary over the past several months has surpassed $2,200, keeping this profession at the top of the wage rankings in Belarus.

Simultaneously, the Belarusian IT sector has been gradually reorienting itself towards collaborative projects with Russia. This shift is driven not only by the increasingly severe impact of sanctions resulting from Russia’s invasion of Ukraine but also by the necessity to fill gaps in the Russian and Belarusian markets left by the withdrawal of Western companies. The Belarusian government implemented repressive measures against IT professionals following the 2020 protests; however, it has opted not to abolish the privileges established in previous years. Currently, the sector operates under the ‘State Programme for Innovative Development of Belarus for 2021–2025’. In addition to the HTP, there are also so-called ‘technology parks’ primarily aimed at supporting start-ups.

Consequently, while the Belarusian IT sector has adapted to the new conditions, it has diminished significantly in its growth potential. In its diminished state, it no longer acts as a significant, innovative, and growth-oriented component of the national economy. Repressive measures have also significantly curtailed civic engagement among IT professionals. Fearing arrest, they are now hesitant to participate publicly in social initiatives or engage in actions that could elicit a negative response from the government.

Chart. The value of IT exports and the share of the IT sector in Belarus’ GDP (2018–2023)

Sources: The National Statistical Committee, belstat.gov.by; the author’s own estimates (2023).