Ukraine’s trade in 2024: restoration of logistical routes

Despite persistently weak price trends for Ukraine’s key export commodities, in 2024 its exports increased by 15% in terms of value and over 30% in terms of volume. This marks a significant improvement compared to 2023, when foreign sales dropped by nearly 20% (see ‘Falling exports: Ukraine’s foreign trade in the second year of war’). The opening of the new Black Sea corridor in September 2023 contributed to these improved results (see ‘Ukraine: the new Black Sea corridor is a success’), making it possible to return to transporting all commodities, rather than just agricultural produce, via the ports in Odesa, Chernomorsk, and Pivdenne. This resulted, for instance, in a nearly twofold increase in iron ore exports and the identification of alternative markets within the EU for Ukrainian grain, which had flooded neighbouring EU states following the outbreak of the full-scale war in Ukraine. This situation prompted these countries to impose restrictions on certain Ukrainian agri-food exports (see ‘Neighbourly feuds. The problem with Ukrainian grain on the Central European markets’). Consequently, due to increased sales to countries such as Spain, Italy, and the Netherlands, Ukraine’s wheat and corn exports to the EU in 2024 remained at levels similar to those recorded in 2023.

An increase in exports

In 2024, the value of Ukraine’s commodity exports reached $41.7 billion (up $5.5 billion compared to 2023), while its export volumes increased by 30.9 million tonnes to 131.2 million tonnes. Despite this significant growth, Ukraine remains far from pre-war levels, which in 2021 was $68.1 billion and 162 million tonnes.

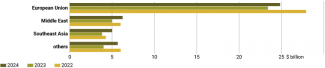

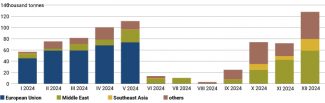

The EU has continued to be Ukraine’s primary export market, accounting for $24.8 billion, which is nearly 60% of total exports. While exports to the EU grew by 6% year-on-year in 2024, significantly higher growth rates were recorded for other regions: the Middle East (up 25% y/y), Southeast Asia (up 31% y/y) and other states (up 42% y/y).

Chart 1. Exports of goods by region

Source: State Customs Service of Ukraine.

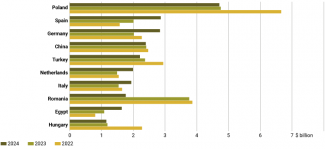

Poland has continued to be the largest importer of Ukrainian goods. In 2024, the value of Ukrainian exports to the Polish market reached $4.8 billion, a decrease of 1% y/y. Among Ukraine’s major trade partners, Romania significantly reduced its imports (by more than 50% y/y) due to restrictions on grain and oilseed imports introduced in 2023. In contrast, exports to the following countries increased significantly: Spain (up 43% y/y), Germany (up 41% y/y), the Netherlands (up 34% y/y) and Italy (up 26%). This growth was primarily driven by higher sales of wheat, corn, and rapeseed to these countries.

Chart 2. Main recipients of Ukrainian goods

Source: State Customs Service of Ukraine.

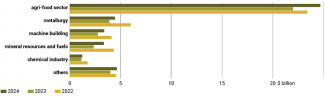

Ukraine’s exports are dominated by agri-food products which in 2024 accounted for nearly 60% of total foreign goods sales, valued at $24.7 billion (up 12% y/y). The primary exports included sunflower oil ($5.1 billion), corn ($5.1 billion), wheat ($3.7 billion), rapeseed ($1.8 billion), and soybeans ($1.3 billion).

Chart 3. The value of Ukraine’s exports by sector

Source: State Customs Service of Ukraine.

The opening of the Black Sea corridor enabled over 95% of Ukraine’s wheat and corn exports, as well as nearly 90% of its rapeseed exports, to be handled through ports in the final months of 2024, reflecting pre-war practices. Before the war, Ukraine’s neighbouring EU states imported minimal quantities of grain and oilseeds from the country. However, Russia’s aggression triggered a sharp rise in such imports, prompting Poland, Hungary, and Slovakia to impose embargoes on certain Ukrainian agri-food products (mainly corn, wheat, and rapeseed) in 2023. Meanwhile, Romania and Bulgaria introduced licensing systems that effectively blocked imports from Ukraine. However, the stable maritime route has enabled Kyiv to redirect its grain exports to other EU countries. Corn and wheat were shipped to Spain, Italy, and the Netherlands, while rapeseed was shipped to Germany, Belgium, and the Netherlands.

Chart 4. Recipients of rapeseed and selected types of grain from 2021–2024

Source: State Customs Service of Ukraine.

In 2024, Ukraine recorded its highest volume of sugar exports in 27 years, reaching 750,000 tonnes, a 45% increase y/y. In June, due to the growing influx of Ukrainian sugar, the European Commission decided to reintroduce quotas, including for sugar. Due to the stable operation of the sea corridor, Kyiv swiftly secured new export markets, primarily in Turkey, Libya, Jordan, and Cameroon.

Chart 5. Monthly volumes of sugar exports by region

Source: State Customs Service of Ukraine.

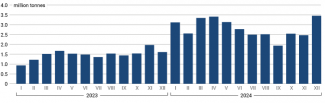

The opening of the sea corridor was even more critical for the export of iron ore and, to a lesser extent, metallurgical products, which were among Ukraine’s key exports before the full-scale war. In 2024, iron ore exports nearly doubled compared to 2023, rising from 21.7 million tonnes to 40.4 million tonnes, driven primarily by demand from the Chinese market.

Chart 6. Monthly volumes of iron ore exports from 2023–2024

Source: State Customs Service of Ukraine.

Imports have also increased

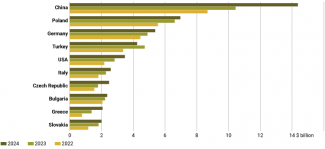

In 2024, the value of Ukraine’s imports was $70.7 billion, an increase of 11% compared to 2023. The EU was Ukraine’s largest supplier, accounting for 50.4% of its imports ($35.7 billion). Ukraine’s main trade partners included China (20% of imports), Poland (9.9%), and Germany (7.6%).

Chart 7. Ukraine’s biggest import partners

Source: State Customs Service of Ukraine.

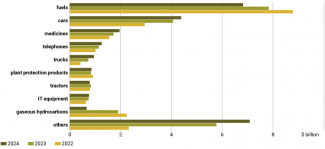

As in previous years, fuels and cars remained the most significant imports. Notably, a substantial value of imports was attributed to unspecified items classified as “others”, totalling $7.1 billion, or 10% of total imports. These are most likely related to defence.

Chart 8. Ukraine’s 10 biggest imports from 2022 to 2024

Source: State Customs Service of Ukraine.

Outlook

Maintaining the operational capacity of Black Sea ports will be crucial for Ukraine’s exports. Despite Ukraine’s gradually deteriorating military situation on the front line, it seems unlikely that Russia will be able to block maritime transport in 2025. Missile and drone strikes on port infrastructure have so far not caused enough damage to significantly disrupt trade, and it is doubtful that this will change in the coming months.

Regarding metallurgical products, a significant challenge for Ukraine will be the loss of the coking coal mine near Pokrovsk, which ceased operations in January and is likely to be seized by Russian forces in the coming months. According to industry estimates, this could reduce Ukrainian production by up to half, with a substantial negative impact on the export of metallurgical products (see ‘The prospect of losing Pokrovsk – a blow to Ukraine’s metallurgical sector’).

Challenges to Ukraine’s agri-food exports will include lower harvest of grains and oilseeds in 2024, primarily due to unfavourable weather conditions. This is particularly evident for corn, with preliminary estimates indicating a harvest 7 million tonnes smaller than in 2023. To a lesser extent, reduced production volumes were also recorded for sunflower and rapeseed crops. If global food prices remain unchanged, these weak harvests could significantly impact Ukraine’s exports.

It remains unclear whether the ban on exporting certain types of grains and oilseeds to Ukraine’s neighbouring EU member states will be lifted. However, even if this were to occur, it is unlikely that the situation observed in 2022 and early 2023–when Black Sea ports were blocked or faced operational challenges due to the mass influx of Ukrainian products into these countries–will reoccur. Nevertheless, a complete lifting of the embargo could create challenges in regions bordering Ukraine, as exporting to these areas may prove more cost-effective than incurring the expenses of transporting goods to Black Sea ports.