The Czech Republic no longer depends on Russian oil

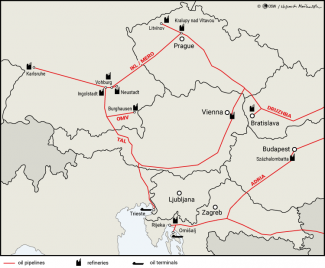

On 17 April, Prime Minister Petr Fiala announced that the Czech Republic had definitively ended its dependence on Russian oil supplies. For the first time in its history, the country was supplied exclusively with crude oil from non-Russian sources, delivered solely via the interconnected TAL pipeline (running from the Italian port of Trieste to southern Germany) and the IKL pipeline (linking Ingolstadt in Bavaria to the Czech Republic). This milestone was achieved through the implementation of the TAL-PLUS project, approved in autumn 2022, which significantly increased the capacity for transporting oil along this route (see ‘The TAL is expanding: the Czech Republic is gaining independence from Russian oil supplies’).

Under the leadership of the centre-right government, the Czech Republic has steadily reduced its energy dependence on Russia and can be now counted among the regional leaders in this respect. Efforts to enhance the security of oil imports have been driven by a reluctance to indirectly support Moscow’s war effort, negative past experiences with supply disruptions from the East, and uncertainty over the reliability of the Druzhba pipeline amid the ongoing Russia-Ukraine war.

Commentary

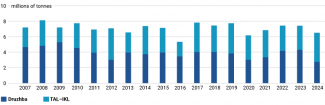

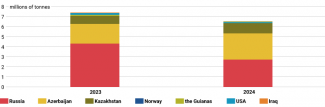

- The completion of the TAL-PLUS project significantly enhances the Czech Republic’s energy security, marking the second major turning point in the country’s oil supply history. The first came with the launch of the IKL pipeline in January 1996. The decision to construct the pipeline had been made two years earlier, prompted by a desire to establish an alternative supply route, frequent delivery disruptions, and the poor technical condition of the Druzhba pipeline. Oil had been supplied to what is now Czech territory via the Druzhba pipeline since the 1960s. Over the past decade, the share of oil volumes delivered via Druzhba and TAL–IKL fluctuated between 40:60 and 60:40 in favour of one route or the other (see Chart 1). Following the modernisation of the TAL pipeline, the volume of crude that can be transported via this route to the Czech Republic will double, reaching 8 million tonnes per year. This will be sufficient to meet the country’s annual demand, which in recent years has ranged from 6 to 7.5 million tonnes (see Charts 1 and 2). Meanwhile, the Orlen Group, which owns both Czech refineries, has successfully adapted the Litvínov refinery – with an annual processing capacity of 5.4 million tonnes – for non-Russian crude. The other refinery, located in Kralupy nad Vltavou (3.3 million t/y), was already processing oil delivered via the TAL and IKL pipelines.

- The expansion of the TAL pipeline's capacity represents a major success for Prime Minister Fiala’s government. It lends credibility to the centre-right’s campaign slogan of “protecting the future” ahead of the autumn elections to the Chamber of Deputies, and aligns with the broader prioritisation of national security. In 2024, after two decades, the Czech Republic met its target of allocating 2% of GDP to defence, a goal the current cabinet previously enshrined in law. Prague also aims to increase this spending to 3% by 2030. The Czech Republic has positioned itself at the forefront of support for Ukraine, coordinating the procurement and delivery of artillery ammunition to Kyiv. Nevertheless, these achievements are unlikely to be sufficient to keep the centre-right in power after this year’s elections, due in part to a decline in living standards experienced by a significant portion of the population during the current term (see ‘Fialia's government halfway through its term: security reinforcement overshadowed by economic problems’).

- The move to eliminate dependence on Russian oil is part of the Czech Republic’s broader and consistent effort to reduce its overall energy reliance on Russia. Since summer 2022, the country has no longer relied on Russian gas supplies under its long-term contract with Gazprom. This shift has been supported by government-initiated actions by the state-controlled energy giant ČEZ (70% state-owned), which secured capacity at the FSRU terminal in Eemshaven, the Netherlands (from 2022 to 2027, covering one-third of national demand), and at the onshore terminal under construction in Stade, near Hamburg (from 2027, for 15 years with an extension option, covering 25% of demand). Although Russian gas began reappearing on the Czech market in greater volumes from autumn 2023 – due to an influx of cheap supplies reaching Slovakia, Hungary, and Austria – it was primarily imported by private trading companies. However, the cessation of transit through Ukraine at the start of this year has once again reduced Czech imports of Russian gas to a marginal level. The Russian company TVEL no longer supplies nuclear fuel to Czech power plants, although existing reserves are expected to last for up to three more years. The first deliveries of nuclear fuel from US-based Westinghouse are expected this year, via its manufacturing facility in Sweden, followed by deliveries from France’s Framatome. It is worth noting that the latter currently produces fuel under a licence from TVEL, with production based in Lingen, Germany, near the Dutch border. However, Framatome is also working in parallel to develop its own proprietary nuclear fuel.

Chart 1. Volume and structure of crude oil supplies to the Czech Republic from 2007 to 2024

Source: Data from the Ministry of Industry and Trade of the Czech Republic.

Chart 2. Structure of supplies by country of origin of crude oil in 2023 and 2024

Source: Data from the Ministry of Industry and Trade of the Czech Republic.

Map. The Czech Republic’s oil supply infrastructure

Source: tal-oil.com.