Climate ambivalence: Russia’s climate change policy

Although the importance of global climate challenges is systematically growing, the actions which the Russian authorities have undertaken in this area to date have been very limited. Moscow has not evaded international cooperation to combat climate change, but at the same time it has not undertaken any very ambitious commitments in this regard. The benchmark for the reduction of greenhouse gas emissions that Russia has agreed to is exceptionally favourable to it. Thus, the reduction goals which the Kremlin has announced do not require the authorities to make radical changes to the Russian economy. Individual Russian companies are showing greater interest in the climate agenda, but it is difficult to consider the results of their activities as significant, especially compared to the experience of international companies. The measures undertaken to change the Russian energy mix are also poor: renewable energy sources only account for a marginal share in electricity production in Russia (in total, about 0.4%). It is true that the Russian authorities have begun to notice the importance of climate challenges; this has been confirmed, among other things, by the latest editions of the strategic documents regarding the development of the state. However, these documents do not offer any ambitious climate policy measures. The authorities’ lack of determination and the interests of lobbying groups from the oil and gas sector may prove to be the most serious barrier to changes in this area in the coming years.

Climate challenges in Russia

Russia is responsible for 4.7% of global greenhouse gas (GHG) emissions, behind China (27.5%), the United States (14.7%) and India (7.3%). According to data from 2018, the total amount of emissions reached 1.63 billion tonnes of CO2: this figure was obtained after deducting the pollutants absorbed by forests and land (c. 590.6 million tonnes in 2018). The main share in environmental pollution belongs to the energy sector, with around 79%. The share of other areas of the economy in greenhouse gas emissions is significantly less: industry (10.9%), agriculture (5.7%), waste management (4.4%).[1] Although the level of GHG emissions in Russia is much lower than it was in the last years of the USSR’s existence (about 3.1 billion tons of CO2 emissions in 1990), over the last decade a slight but consistent increase has been observed. In addition, emissions of methane in Russia are systematically increasing, which among all greenhouse gases has a particularly negative impact on climate change. In 2018, its emissions exceeded the 1990 level by 6%.[2] According to data from the International Energy Agency, the Russian oil and gas sector is responsible for 15.2% of the world’s methane emissions, which are attributable to companies operating in the oil and gas market. Almost 60% of them result from deliberate actions taken by the companies, and are a consequence of the methods used in Russia to extract energy resources from onshore deposits, including the combustion of gas accompanying oil extraction.[3]

Global climate change is taking place at a faster pace in Russia than the world average. For example, the average rise in global temperature over the past 10 years has been 0.18°C. In the case of Russia, it has reached the level of 0.47°C, and in the Russian part of the Arctic it is as high as 0.8°C. Some forecasts indicate that by the middle of the 21st century, the average summer air temperature in Russia may rise by 2–3 or even 3–4°C.[4]

The consequences of climate change for the Russian economy

Although climate change does create some opportunities for the development of certain sectors of the Russian economy, it is unlikely that these can compensate for the serious losses reported by both experts and some government officials.

A temperature rise would increase the accessibility of the Northern Sea Route, which Russia sees as a promising transport route. Back in the 1990s, the period of free navigation along this route was about two months, but now navigation is possible for up to four months a year. This translates into a real increase in the amount of transported goods, the volume of which rose from 6.5 million tons in the 1980s to 20.1 million tons in 2018 and 31.5 million tons in 2019. According to the assumptions of the latest Strategy for the Development of the Russian Arctic Zone and Provision of National Security Through 2035, transport volume could rise to 130 million tons during this time. Global warming may also facilitate the implementation of new extraction projects in the oil and gas sector, especially for deposits located in the Arctic shelf.

At the same time, the scale of the real and potential economic losses associated with climate change outweigh the possible benefits. According to economists’ estimates, the Russian Federation may currently lose about 30–60 billion roubles a year (US$390–780 million) to climate change. In 2019, Aleksandr Krutikov, deputy minister for the development of the Far East and the Arctic, estimated during an interview with Bloomberg that the current losses of the Russian economy due to global warming amount to between 50 and 150 billion roubles annually (from US$650 million to about 2 billion). In November 2020, in his speech to the Federation Council’s Arctic and Antarctic Council, he noted that by 2050 Russia’s total economic losses in the Arctic region could amount to between 2 and 9 trillion roubles (from US$27 to 121 billion dollars).[5] In turn, the then Minister of Natural Resources of Russia, Sergei Donskoy, estimated in June 2015 that by 2030 Russia could lose as much as 1–2% of GDP annually as a result of climate change.[6]

A warming climate threatens infrastructure sustainability, among other things. According to estimates presented by the Bloomberg agency, the current trend of temperature rise may lead to the destruction or damage of c. 20% of the infrastructure facilities located in permafrost areas (including residential buildings, pipelines and other critical energy infrastructure) worth c. US$84 billion. This is a serious challenge to the operation of many companies in industry and the mining sector; about 15% of oil and 80% of gas in Russia are currently extracted in permafrost areas. Temperature warming leading to rises in the levels of rivers and groundwater may, in turn, pose a threat to pipeline networks: around 50,000 km of oil pipelines and around 150,000 km of gas pipelines cross by rivers and other watercourses. The agricultural sector may also be hit by substantial losses as a result of climate change. Successive droughts may lead to soil desertification and a reduction in grain production, which will adversely affect Russia’s food security and the prospects for Russian exports in this area. In addition, regular rises in temperatures may systematically increase the risk of forest fires, which already pose a serious challenge to the Russian authorities.

Russia and its international climate obligations

Although Russia participates in international cooperation mechanisms on climate issues, it has not undertaken any very ambitious commitments in this regard. The Russian Federation is a party to the Framework Convention for the Protection of Climate Change adopted in June 1992. It also acceded to the 1997 Kyoto Protocol, under which the signatory states made binding commitments to reduce greenhouse gas emissions for the first time. Moscow also regularly participates in all the negotiation rounds of the Conference of the Parties to the 1992 Convention. In September 2019, Russia ratified the so-called Paris Agreement adopted at the UN Climate Change Conference in December 2015.

At the same time, however, the scale of Russia’s commitments to reduce greenhouse gas emissions is not very ambitious, and has not required the state to take any significant measures in the most emissive areas of the economy. The main reason for this is the low benchmark for Russian reduction commitments. The volume of greenhouse gas emissions in 1990 reached a record level in the history of the USSR and Russia, of 3.1 billion tons of CO2. Both in the 1990s and in the 21st century, peak emissions slightly exceeded 1.6 billion tonnes of CO2 (values obtained after deducting GHG uptake by forests and land). Therefore, the commitment in the Kyoto Protocol to maintain emissions in the years 2008–2012 at a level not exceeding the values from 1990 posed no challenge to the state’s policy. The contribution (voluntary, legally non-binding obligation) declared by Russia under the so-called of the Paris Agreement of 2015 is also not very ambitious: Russia declared its intention to maintain greenhouse gas emissions at a level below 70–75% of the 1990 ceiling in the period from 1 January 2020 to 31 December 2030.[7] Another inexpensive declaration is the target which Vladimir Putin announced in November 2020 to reduce CO2 emissions to 70% of 1990 emissions by 2030. According to data for 2018, the emission level amounted to less than 1.63 billion tonnes, which is around 52.4% of 1990 emissions (see Chart 1 in the Appendix). Russia’s withdrawal from making any binding commitments was a further illustration of its protective attitude towards the Kyoto Protocol’s prescriptions. The unambitious reduction targets effectively open the way to increasing the level of greenhouse gas emissions in Russia over the coming decades.

Climate issues a low priority in domestic politics

Climate issues have not yet been treated in Russia as a strategic area of the state’s internal policy. This is mainly due to the focus on improving general economic indicators, enabling the increase of profits by the political and business elites which control strategic sectors of the economy, and enabling the fulfilment of social obligations towards society. At the same time, pressure from the oil and gas lobby and the reluctance to introduce costly systemic changes are pushing the resolution of climate problems into the background.[8]

The strategic documents adopted so far and the statements made by senior government representatives indicate that Moscow does not intend to join the group of countries which treat climate issues as a priority in the coming years and have declared their intention to achieve climate neutrality in the next few decades.[9] In the latest draft of the Long-term Development Strategy with Low Greenhouse Gas Emissions to 2050, Russia plans to reduce CO2 emissions to 67% of 1990 values by 2030, and to 64% by 2050. Although the document assumes as many as four different scenarios for achieving this, depending on the level of state involvement in the implementation of climate policy goals, even in its most optimistic variant Russia could not achieve climate neutrality any earlier than the end of this century. Also, the decree which Putin signed on 4 November 2020 to reduce greenhouse gas emissions assumes that Russia will reduce pollution levels by 30% by 2030 compared to 1990.[10] The plan for the first stage of measures to adapt the economy and population to climate change is also very general in nature. Nor is there much evidence that the provisions of the law on the state regulation of greenhouse gas emissions, which have been in the pipeline for many months, are more ambitious.

Moscow is trying to use some of its objective geographic advantages as excuses for unambitious measures to decarbonise the economy. One example is the argument that Russia’s large forest resources have a positive impact on mitigating the effects of climate change. Government officials have repeatedly pointed out that Russia accounts for 70% of the world’s boreal forests and 25% of the world’s total forests. As a result, Russia is reducing its annual net greenhouse gas emissions by around 27%.

Russian companies’ ‘climate awakening’

The rising importance of climate challenges is beginning to attract the attention and interest of Russian companies. On one hand this is being reflected in changing business strategies, although on the other, the current balance of the activities Russian energy companies are undertaking in the field of climate challenges is not very impressive, especially when compared to the activity of large international energy companies.[11]

Tatneft is so far the only Russian energy company that has unequivocally declared an intention to achieve climate neutrality by 2050.[12] LUKoil, Russia’s largest private oil producer, is also planning to adopt a strategy aimed at achieving this goal by 2050.[13] Several other companies are also adopting strategies to reduce greenhouse gas emissions, but they are much less ambitious. RUSAL, Russia’s largest aluminium producer, plans to reduce greenhouse gas emissions by 15% in its aluminium plants and 10% in its alumina production facilities by 2025. In 2018 the Arkhangelsky CBK company adopted a low-emission development strategy to 2030, in which it undertook to reduce greenhouse gas emissions by 55% compared to the 1990 level, i.e. to around 1.4 million tonnes of CO2 annually.[14] SIBUR is one of the few Russian companies to have declared an interest in implementing a sustainable development strategy; it is taking steps to reduce CO2 emissions, modernise its chemical processing plants with a view to taking ecological requirements into account, and to reprocess plastics.

It is hard to accurately assess the activity of the largest Russian state-controlled energy companies. Both Rosneft and Gazprom have noted improvements in greenhouse gas emission levels in their official announcements, but this has not yet translated into comprehensive changes in these companies’ operating strategies. On one hand Rosneft, the largest producer and exporter of Russian oil, has taken a number of measures to reduce greenhouse gas emissions in recent years. In 2019, the company reduced methane emissions from its mining projects by as much as 73% year on year. In the period 2014–2019, Rosneft increased the level of utilisation of so-called associated gas[15] to 93.8%, which significantly reduced the amount of raw material burned in oil extraction. GHG emissions in the processing sector also fell (by 11% year on year in 2018). On the other hand, however, Rosneft perceives investments in renewable energy sources negatively, and its long-term development strategy is based on the assumption that the share of oil in the global energy mix will continue to rise. It assumes that by 2040 global demand for crude oil will increase to 106 million barrels per day. In addition, the scale of Rosneft’s so-called green investment is much lower than that of large international energy companies. Rosneft plans to allocate around US$4 billion by 2025 for this purpose; in comparison, Shell and Total have been investing around US$1.5–2 billion annually in so-called green projects.

The fledgling RES sector

The Russian government has not so far been treating the development of renewable energy sources as a priority,[16] which has translated into a low share for them in Russia’s energy mix (0.15%).[17] Admittedly, it has adopted a support program for renewable energy in 2013;[18] however, its effects have fallen below the expected results. Thus, the government has planned to increase the share of renewable energy sources in the national energy mix to 4.5% in 2024[19] – nevertheless, this goal is completely unrealistic. This is confirmed by the new Russian Federation Energy Strategy to 2035, which shows that the share of renewable energy sources in Russian electricity production will not exceed 1% in the next decade.

While many international oil companies are intensively involved in developing renewable energy projects, most large Russian energy companies treat this sector as a marginal field of activity, and some are openly opposed to making investments in this area. LUKoil is the most involved in developing renewable energy projects in Russia: the company has so far launched one solar power plant to power its Volgograd refinery, and LUKoil also runs three solar power plants in Romania and Bulgaria (with a total capacity of 10 MW) and one wind farm in Romania (84 MW). In October 2020, the company started the construction of two solar power plants in Volgograd (20 MW) and Krasnodar (2.5 MW). GazpromNeft, a company controlled by Gazprom, has one solar power plant with a small generation capacity (1 MW), which produces electricity for the needs of its own refinery in Omsk. Zarubezhneft has also declared a preliminary interest in renewable energy projects, but the company has so far limited itself to analysing the profitability of implementing such plans.[20]

Forecast

Although the Russian government has started to show greater interest in climate issues, we should not expect any revolutionary changes in terms of real actions over the next few years. First, the planned regulatory solutions do not provide for strict measures to reduce greenhouse gas emissions. The bills prepared which concern pollution reduction assume the voluntary participation of companies in implementing climate projects. The state is to monitor the implementation of projects aimed at reducing emissions, but there are no plans to introduce more stringent instruments, such as the so-called carbon tax. Secondly, the Russian government has a different hierarchy of priorities, which is a significant barrier. For those in charge, it is of key importance to ensure financial stability, which is the main challenge in the context of volatile energy commodity markets. Third, resistance from influential representatives of the political and business elite, who are primarily interested in maximising their profits from the current model of the Russian economy, may also prove to be a significant barrier.

There is no certainty that Russia will manage to significantly increase its renewable energy potential in the medium and long term. In 2020, the Russian government decided to extend the programme of financial support for the expansion of generation capacity based on renewable energy sources until 2035, but it remains an open question as to how much money will ultimately be allocated to develop this sector in Russia. The government plan provides for a total financial outlay of 400 billion roubles, of which 231.25 billion roubles is for wind farms, 138.75 billion roubles for solar power plants and 30 billion roubles for small hydroelectric plants; estimates are that these measures will raise generation capacity based on RES by 7–9 GW until 2035. However, in autumn 2020 the Russian media began to report that the programme to finance RES projects may eventually be reduced by 50%, and amount to just 200 billion roubles.

One factor that may motivate Russia to introduce certain changes is the actions taken by states or international organisations which affect export markets which are strategic for Russia, in particular the European Union. The EU’s gradual implementation of the European Green Deal concept – based on the consistent pursuit of climate neutrality in 2050, and including instruments such as increasing the share of renewable energy sources in the energy mix, the development of hydrogen energy, or the use of fiscal instruments (the so-called carbon tax) – may force Russian to make certain adjustments to its actions. Representatives of the Russian government and energy companies are discussing this issue with Western European partners. According to some estimates, the introduction of anti-emission fiscal solutions could lose Russian exporters between US$14 and 30 billion a year. However, minimising this risk would require decisive, systemic action by the Russian authorities, which so far have not been planned. It is also unclear whether the threat of losing markets is enough to force the key Russian energy companies to make radical changes to their own development strategies, which are still based on conservative forecasts of growth in fossil fuel demand.

APPENDIX

Chart 1. Greenhouse gas emissions in the USSR and Russia in 1985–2019

Source: Carbon dioxide emissions volume in Russia from 1985 to 2019, Statista, 10 November 2020, www.statista.com.

Chart 2. Greenhouse gas emissions in Russia by sectors in 2018

Source: Greenhouse gas emissions in Russia in 2018, Statista, 7 December 2020, www.statista.com.

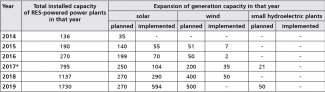

Table. Development of RES generation capacity in Russia in 2014–2019 (in MW)

* From 2017, the total installed capacity of RES-powered power plants includes solar and wind farms in Russia-occupied Crimea.

Source: Рынок возобновляемой энергетики России: текущий статус и перспективы развития, АРВЭ, May 2020, www.rreda.ru.

[1] Greenhouse gas emissions in Russia in 2018, by source, Statista, www.statista.com.

[2] The energy sector, in particular companies operating in the oil and gas market (40%), is the most responsible for methane emissions. Of this, the main sources of environmental pollution are activities in the sectors of transport and storage (61%); extraction accounts for 17%.

[3] А. Лопатников, ‘Нулевой углеродный след: риски и возможности для нефтегазовой отрасли’, Нефтегазой вертикаль, no. 19, 2020, pp. 69–80.

[4] T. Митрова, A. Хохлов, Ю. Мельников, A. Пердеро, M. Мельникова, E. Залюбовский,Глобальная климатическая угроза и экономика России: в поисках особого пути, Сколково, May 2020, energy.skolkovo.ru.

[5] ‘В Минвостокразвия оценили прямой ущерб от глобального потепления в Арктике’, ТАСС, 24 November 2020, www.tass.ru.

[6] ‘Донской: РФ может терять до 2% ВВП ежегодно из-за изменения климата’, РИА Новости, 19 June 2015, www.ria.ru.

[7] INDCs as communicated by Parties, INDC, www.unfccc.int.

[8] This has been confirmed inter alia by an interview with Ruslan Edelgeriyev, Vladimir Putin’s main climate policy adviser. He suggested that some Russian companies prefer individual, short-term interests over the long-term goal of a low-carbon economy in Russia. See ‘Russia Sets Ambitious Targets for Low-Carbon Future’, Energy Intelligence, 20 August 2020, www.energyintel.com.

[9] Apart from the European Union, several other countries plan to achieve climate neutrality by 2050. Among the most significant are Japan and South Korea. For its part, China has declared its intention to achieve this target by 2060.

[10] Указ Президента Российской Федерации от 04/11/2020 г. № 666 О сокращении выбросов парниковых gasoline, Президент России, 4 November 2020, www.kremlin.ru.

[11] One example illustrating the much greater involvement of international energy companies in the implementation of the climate agenda is the Oil and Gas Climate Initiative, established in 2014, which groups 12 major global energy companies: BP, Chevron, CNPC, Eni, Equinor, ExxonMobil, Occidental, Petrobras, Repsol, Saudi Aramco, Shell and Total. The companies linked in this group have brought about a cumulative reduction of methane emissions by 9%, and by 2025 they plan to reduce that figure by 20%.

[12] The reduction is to take place gradually: by 10% by 2025, and by 25% by 2030. In 2019, Tatneft’s greenhouse gas emissions amounted to 120.5 million tonnes.

[13] В. Sidorovich, ‘ЛУКОЙЛ хочет стать углеродно-нейтральным к 2050 году, «как и вся Европа»’, RenEn, 9 March 2020, www.renen.ru.

[14] T. Митрова, A. Хохлов, Ю. Мельников, A. Пердеро, M. Мельникова, E. Залюбовский, Глобальная климатическая угроза…, op. cit.

[15] Gas extracted during oil production.

[16] Russia only joined the International Agency for Renewable Energy Sources in autumn 2014.

[17] The RES sector includes solar and wind power plants, low-power hydroelectric plants (up to 25 MW) and biomass power plants.

[18] Many major international energy companies are involved in projects related to the use of renewable energy sources: these include Total, BP, Equinor, Repsol, Shell, Eni and Chevron.

[19] Распоряжение Правительства РФ от 08.01.2009 N 1 р "Об основных направлениях государственной политики в сфере повышения энергетической эффективности электроэнергетики на основе использования возобновляемых источников энергии", КОДИФИКАЦИЯ РФ, www.rulaws.ru.

[20] Д. Мельник, ‘ВИЭ наступают. Крупнейшие компании в эпоху енергетического перехода’, Нефтегазовая вертикаль, no. 20, 2020, pp. 34–43.