Lignite in the Czech Republic and Germany: controversies and prospects

Lignite still plays an important role in the Czech and German power industries, remaining one of their key sources of electricity. These countries, together with Poland, are the largest producers and consumers of this fuel in the EU. The share of lignite in both countries’ energy mix is trending downward under the influence of the EU’s climate policy ambitions, particularly the rising costs of CO2 emission allowances. The lignite industry in the Czech Republic and Germany is also linked to capital, with some mines in eastern Germany being owned by Czech corporations. The activity of lignite-fired mines, power plants and heating plants in both countries has caused a number of controversies, including environmental ones. Local communities affected by the negative impact of the mines’ operation have engaged in protests, and the significance of environmental issues in national politics is also rising. Both Berlin and Prague are planning to stop mining and burning lignite. Germany has already set a coal exit date of 2038, and the debate in the Czech Republic is approaching a conclusion of setting the same date, or even five years earlier. The decision to give up using this fuel is posing socio-economic challenges for the coal regions, which face numerous structural problems.

The role of lignite in the Czech Republic and Germany

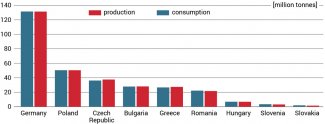

Despite a gradual decline in output, lignite remains one of the two main raw materials used to generate electricity in both countries, and in the Czech Republic it is also the primary source of heat. At the same time, Germany and the Czech Republic (together with Poland) are among the countries with the highest level of lignite extraction, not only in the EU (cf. Chart 1), but also worldwide (in 2018 Germany ranked first and the Czech Republic tenth; Poland was sixth).[1] In both countries, the lignite is extracted by the open pit method (in Germany, as in Poland, 100%; in the Czech Republic more than 99%). Germany and the Czech Republic together account for 55% of the EU’s lignite consumption (43% and 12% respectively), ranking first and third in the EU (Poland comes second with 16%). Burning it produces about 15% more CO2/kWh than hard coal and nearly half as much as natural gas, which translates into high carbon emission from electricity production. According to data from the European Environment Agency, in 2019 the Czech Republic ranked fifth in this respect, Germany eighth and Poland second in the EU. The German companies RWE and Uniper, with the Czech EPH and ČEZ, are also among the five EU power plant operators which produce the most carbon dioxide, jointly accounting for around 36% of total emissions.[2]

Chart 1. Lignite production and consumption in EU countries (2019)

Trace consumption (with no production) is also recorded by Spain, Austria, France, Croatia, the Netherlands, Italy and Lithuania.

Source: Eurostat.

The significant drop in extraction after 1989 was associated with the systemic transformation and depletion of the best deposits. In the Czech Republic, it was cut by more than half during this period (from 90 million tonnes in 1990 to 37.5 in 2019), and a similar situation occurred in the eastern federal states of Germany. One of the key factors accelerating the definitive shift away from lignite is the multiple rises of EU emission allowance prices, from €3 in 2013 and €10 in 2018, all the way up to €42 in March this year. This is part of the EU’s policy of transitioning to low-emission fuels, which includes increasingly ambitious reduction targets and setting a minimum share of RES in the energy mix.[3] Other important factors include the relatively low natural gas prices in recent years, the declining operational life of old coal-fired power plants, and increasing ecological awareness, which has translated into political elites increasingly incorporating environmental demands (including at the EU level). The rise of this awareness was also significantly influenced by the unprecedented drought in the Czech Republic (2014–2020)[4] related to climate change.

Chart 2. Structure of electricity production in the Czech Republic and Germany (2019)

Source: Energy Regulatory Office of the Czech Republic (ERÚ) and AG Energiebilanzen e.V.

The role of lignite in the Czech Republic

Lignite accounted for between 25% (primary energy consumption) and 40% (share in electricity production) of the Czech energy mix in 2019 (cf. Chart 2). After deducting small exports (imports are trace), about 85% of the remaining domestic production is used for electricity and heat generation. In both cases, the share of lignite has declined over the last decade, by 7 p.p. up to 40%, and by 5 p.p. up to 42% respectively (cf. Chart 3).

Chart 3. Share of lignite in electricity generation in the Czech Republic and Germany in 2010–2019

Source: Energy Regulatory Office of the Czech Republic (ERÚ), Ministry of Industry and Trade of the Czech Republic (MPO) and AG Energiebilanzen e.V.

Lignite mines and the power and heating plants powered by them are particularly important for the economies of the coal regions (see the Map), but even there their importance has been decreasing over time. The companies operating in these areas use the typical model of simultaneously managing the mines and the power generation plants adjacent to them, which significantly reduces the costs of transporting raw materials. The private Czech Sokolovská uhelná group is the largest employer in the Karlovy Vary region, where it operates a mine and a nearby combined heat and power (CHP) plant. The ČEZ and Sev.en Energy corporations play a similarly large role in the neighbouring Ústí nad Labem region. The former, which is 70% state-owned, controls more than half of Czech lignite production and four CHP plants located near the two mines (plus more in other parts of the country) through its Severočeské doly company. In turn, the private Czech group Sev.en Energy operates two mines in the Ústí nad Labem region, which together account for 30% of the country’s extraction of this raw material, and supplies its own large power plant from one of them. The number of workers in the mining industry (including in the hard coal-related Moravian-Silesian region) has fallen sharply since the beginning of the transition, from 106,000 in 1990 to 40,000 10 years later, and to 14,000 in 2018.

The role of lignite in Germany

Lignite still plays a very important role in Germany’s electrical power engineering sector. In 2019, it accounted for 18.6% of electricity generation, and constituted the largest source of electricity – ahead of onshore wind (16.5%), but in terms of totals still behind RES, which generated 40.1% of the country’s electricity (cf. Chart 2).[5] In 2018, ten mines in the three German brown coal fields (Lusatian, Central Germany and Rhineland: see Map) extracted a total of 166.3 million tonnes of this resource, equalling 16.3% of global extraction.[6] The companies owned by Czech capital, LEAG and MIBRAG, account for approximately half of domestic lignite production (due to acquisitions in 2009–16). Domestic coal is almost entirely allocated for domestic needs, and is used in 90% of power plants and CHPPs. At the end of 2020, the installed capacity of power plants burning this fuel was 20.86 GW, with units at a total capacity of 2.7 GW remaining in reserve.

From 2018 onwards, the share of lignite in the German energy mix gradually began to decline (see Chart 3). According to preliminary data, whereas in 2010 it was still 23.3% (and even rose to 25.8% in 2012), it fell to 16.2% for 2020, although this was also due to the pandemic crisis. However, lignite still plays a key role in ensuring power security, especially in winter. In contrast, the significance of this fuel in district heating is low: in 2019 it accounted for only 5.6% of district heating production (compared to 43.9% for natural gas, 17.5% for hard coal, and 16.6% for RES).[7]

The lignite industry remains a crucial economic factor in the mining regions. Around 20,000 people work in mines and power plants within the industry, and indirectly it provides employment for an estimated 70,000 people nationwide. Particularly in the eastern Bundesländer, which are facing structural problems such as the exodus of industrial capital, an ageing population and general depopulation, the coal industry has for years been one of the largest and most attractive employers, as well as an important tax contributor to local government budgets.

Map. Lignite mines in the Czech Republic and Germany

|

|

Source: Authors’ own research.

Chief controversies

Both in the Czech Republic and Germany, the activity of lignite mines and nearby lignite burning plants has been the subject of numerous controversies. The far-reaching interference of these activities with the natural environment is arousing increasing opposition from local communities, who have highlighted such issues as dust, noise, and the level and quality of groundwater. This encourages the work of environmental activists, who additionally draw attention to the impact of coal mining on climate change. Environmental issues related to coal are thus increasingly frequent topics of political debate.

Controversies in the Czech Republic

The controversies over the extraction and burning of lignite in the Czech Republic were among the important components of the ecological trend in the opposition to the Communist system. A parliamentary report from 1990 spoke of the destruction of as much as 53% of the forest lichens in the Ore Mountains (Erzgebirge/Krušné hory) due to toxic emissions; the exploitation of the highly sulphurous raw material was also one of the causes of the ecological disaster in the Jizera Mountains (Jizerské hory/Góry Izerskie/Isergebirge) and the Giant Mountains (Krkonoše/Karkonosze/Riesengebirge). Nowadays, it is the public debate on setting a date for ending coal mining and burning that carries a huge emotional load. While hard coal will probably cease to be mined at the end of 2022, and the CHP plants which burn it have already been reduced to a peripheral role (with the exception of the Dětmarovice power plant near the Polish border), the situation with lignite is more complex. It is of greater importance for energy security, and it is the crux of the Czech debate on the exit from coal.

At the end of 2020 a government advisory committee proposed by a large majority of votes (15 out of 19) that the extraction and combustion of lignite be terminated in 2038 – a date chosen by Germany, and a time when, according to estimates, the developable reserves will already be almost exhausted. However, the proposal to move this step up to 2033, which environmentalists have been pushing for, is getting traction in the government. It has been taken up by the ruling coalition’s Czech Social Democratic Party (ČSSD), which is cooperating with the Green Party in the election campaign, and some ministers from the ANO group of Prime Minister Andrej Babiš are also in favour of an earlier date. Since no agreement has been reached, the cabinet’s decision has been postponed. Environmental issues are becoming very prominent in the campaign, the more so because the Czech Pirate Party has highlighted them as one of the pillars of its manifesto, and as one of the main opposition forces, is actively promoting its own pro-environmental demands.

Louder voices objecting to the use of coal stem not only from the environmental problems, but also the declining profitability of the entire industry. The conflict of interests related to the continuation of mining has become the subject of top-level political play on several occasions, as exemplified by the debate over the Bílina plant, the second largest lignite mine in the Czech Republic, operated by ČEZ. The limits of extraction in the North Bohemian Basin were set back in 1991, with the primary aim of protecting the already heavily damaged natural environment in the region. After several years of pressure from the coal lobby, in 2015 the government of Bohuslav Sobotka (ČSSD), supported by President Miloš Zeman, decided to expand them, justifying the decision by the need to provide fuel for local heating plants and preserve jobs. The decision was presented as a compromise since, against the demands of the coal industry, the limits on extraction at the nearby ČSA mine, whose expansion would have necessitated the demolition of 170 residential houses, were retained. As a result of this decision, the process of obtaining further permits to extend mining at Bílina until 2035 has begun. In turn, the ČSA mine will probably be closed as early as 2024 (a 670-hectare water reservoir is to be built there).

However, the expansion of the Bílina plant will exacerbate the problems of the local residents, and also generate additional costs. The area around the facility is already heavily polluted, and the noise exceeds the established standards. The expansion of the mining area will bring it around 500 m closer to the buildings, and the road will have to be demolished. The process of resettling animals to protect the ecosystems has already begun. Archaeologists have stepped up their work, as an 11th-century burial ground will disappear as a result of the increased mining. Some of these issues were taken into account by the Ministry of Environment when it put forth a positive environmental impact assessment (EIA) for the project in 2019, which was crucial for the decision the regional mining authority is expected to take. Although the ministry made the approval dependent on dust reduction (by 9 tonnes over 3 years), the construction of embankments and the planting of a green belt, it was heavily criticised, with the Czech branch of Greenpeace calling it the ministry’s “biggest mistake in its tenure”, and deeming it contrary to the country’s obligations under the Paris Agreement.

The actions of the government and the state-controlled ČEZ company in relation to the coal industry have raised numerous doubts about the sincerity of their declared pro-environmental intentions. This was the case with the decision to sell the Počerady power plant (1000 MW) to the private group Sev.en Energy, which has supplied brown coal to the plant and took over the facility itself at the beginning of 2021. As the country’s biggest emitter of CO2, the plant, located about 20 km from the German border, is in the environmentalists’ crosshairs. According to the opponents of the decision, it is an example of hypocrisy on the part of both the government (which could have blocked it) and the company which, instead of bearing the cost of closing the plant, preferred to cash in on the deal and get rid of the problem. ČEZ acted similarly in previous years, selling old lignite power plants with huge emissions – Chvaletice near Pardubice (2013) and Tisová near Sokolov (2016) – to the Czech coal barons’ companies, and suggesting that the decrease in emissions generated by the company was mainly the result of efforts to make its operations greener.[8]

Controversies in Germany

In Germany too, lignite mining has been the subject of criticism from environmental organisations for years. One of the accusations thrown around is the negative impact which open pit mining has on the hydrology of the region. In Lusatia, where four large facilities of this type are still operating near the Polish border, residents have been complaining for years about falling groundwater levels, the drying up of nearby lakes and the pollution of local rivers with sulphates, among other things. Unlike the mine operator LEAG, which disputes the connection between mining and changes in the hydrological situation, both the Brandenburg government and the local higher administrative court have acknowledged the connection, but justify the continued extraction in terms of overriding public interest.[9] In addition, problems with water resources have been escalated by the increasingly frequent droughts in the region, which reinforces the local residents’ negative attitude towards the facility. They also complain about subsidence and the resulting construction damage, air pollution with dust, and noise from the machinery.

Another frequently raised issue in the public debate is the resulting absorption of further residential or natural areas due to mine expansion. In Lusatia alone, since the end of World War II around 130 villages have been wiped out for this purpose and 30,000 inhabitants have been resettled (lignite was the GDR’s key energy resource).[10] In turn, the protests by environmentalists in the Hambach forest in North Rhine-Westphalia, who opposed the continued felling of trees to expand the boundaries of the mine there, were a major topic in the leading German media for several months of 2018. The public resistance was so strong that eventually the facility’s operator RWE agreed to leave the forest as part of a compromise reached in January 2019 with the coal commission.[11] However in return – in order to meet the needs of its power plants – the company will be able to expand the site of another mine in the Rhineland (Garzweiler) at the expense of five surrounding villages, which will be demolished.

In recent years, coal-based power generation has also increasingly come under a barrage of criticism due to its high carbon intensity, which contributes to accelerated global warming. In the energy sector, which generates 35% of emission in Germany, the largest source is lignite-fired power plants, which account for about half of all emissions. With growing environmental awareness and national public interest in climate change issues, as well as Germany’s failure to meet its climate policy objectives, stepping away from coal has become an increasingly urgent topic.[12] In Germany halting the generation of electricity with this fuel is considered to be the fastest and cheapest way to meet national and EU emission reduction commitments.

Perspectives

In Germany, the coal exit date has been set for 2038, and the debate in the Czech Republic, where both 2033 and 2038 are being considered, is nearing a conclusion. This begs some questions about what will substitute for the lignite, with RES and (temporarily) natural gas coming to the fore. As an ultimate goal, new technologies (e.g. hydrogen) are also being considered, as well as (in the Czech Republic) the construction of further nuclear units; the last reactors in Germany will be shut down at the end of 2022, which will temporarily lead to the more frequent use of coal-powered units. At the same time, the transition away from coal poses a huge challenge for the coal regions, whose transformation – due to the social structure and many years of neglect – is not destined to succeed by any means.

Phasing out the coal industry in the Czech Republic

The most likely date for the end of decarbonisation in the Czech Republic is 2038, but this may change after the autumn elections if a new and probably more pro-environmental political voice comes to power. In addition to the German example, delays in the process of developing nuclear power and uncertainty as to the direction of EU policy on (increasingly marginalised) gas serve as arguments in favour of the later date. To a large extent, the government has relied on gas as a substitute for coal and as a necessary base for the development of RES. This has led to continued support for the construction of the Nord Stream 2 gas pipeline and for the infrastructure related to it being built in the Czech Republic. Moreover, a coal exit as early as in 2033 would, according to the scenario given by the transmission system operator ČEPS, entail significantly higher investment expenditure and end-user power prices than in the 2038 variant. These fears have been bolstered by the coal industry: for example, Sev.en Energy ran a media campaign "Fortunately, we have coal", trying to convince the public that in the Czech context RES would not be a viable alternative to this raw material. On the other hand, most of the country’s coal-fired power and heating plants are approaching the end of their life cycle, which affects their emission levels, and newer units are few and far between. The profitability of plants, especially the less efficient ones, has been reduced by the rising price of emission permits. In addition, the increase in the funds allocated by the EU to the energy transition as a result of the pandemic speaks in favour of sooner decarbonisation.

The increasingly imminent prospect of an exit from coal is influencing the strategy of companies in this sector, which are building alternative fields of expertise. The ČEZ Group is pursuing a policy of gradually disposing of its coal assets, which includes the aforementioned transaction regarding the Počerady power plant, as well as the ongoing talks on the sale of CHP plants in Chorzów and Skawina (near Cracow). Meanwhile, the state-controlled behemoth is developing its activities in the area of energy services (ESCO) and RES. The Czech coal groups from the private sector are in turn expanding their portfolio to include RES (EPH), innovations in energy storage and hydrogen technologies (Sev.en Energy), or industrial and residential properties (Sokolovská uhelná). In some cases, CHP plants are gradually being converted to run on other fuels. Nevertheless, in the case of private companies, not only is it difficult to discern any will to dispose of coal assets swiftly, but an expansion (EPH, Sev.en Energy) taking advantage of their falling value can even be seen. These companies are probably hoping that objective difficulties will delay the decarbonisation process, while at the same time expecting state subsidies for the closure of old power plants or the reclamation of post-mining areas (for example Sev.en Energy has already established a specialised company, Rekultivace, for this purpose).

The perspective of energy transformation presents a challenge, but also an opportunity for the current coal regions. Although they benefit economically from the presence of numerous mines, and power and heating plants, in many areas they are among the worst in the country. For instance, the percentage of the population subject to debt enforcement procedures is the highest there: whereas in the Czech Republic as a whole it was 8.6%, in the Ústí nad Labem and Karlovy Vary regions it reached 16.8 and 16.5% respectively. Both areas also have the lowest percentage of people with a higher educational background (15% each, compared to 45% in Prague). These indicators illustrate the scale of the challenge for the knowledge-based industries which could replace coal-based industries, especially given the low domestic mobility of the population. This is confirmed by the experience of the Czech coal regions, which have had the highest unemployment rate in the country since the beginning of the systemic transformation.

Phasing out the coal industry in Germany

The topic of the coal exit permanently entered the German public debate at the end of 2015, alongside the negotiation of the international climate agreement at the COP21 conference in Paris. The issue of doing away with coal power concerned many social groups and their frequently opposing interests, and became very politically inconvenient for those in power. The German authorities decided to set up a commission which, with the participation of the stakeholders, came up with a set of compromise solutions in January 2019. Its recommendations formed the basis of the law adopted in July 2020, on which basis the last coal-fired power plants are to be phased out at the latest by the end of 2038 (with the option to accelerate the shutdown by three years). The federal government, together with the regional authorities, negotiated an agreement with the operators of the mines and power plants, including a timetable for phasing out the plants and the issue of financial compensation. For the units owned by RWE and LEAG to be phased out until 2029, the companies will receive a total of €4.35 billion. Operators of plants that are shut down after this date may not hope for compensation. The negotiated schedule assumes that lignite-fired power plants with a total capacity of 6 GW (a third of the total) can remain in operation until the end of 2038. The contents of the agreement (late expiry dates and the amount of compensation) have sparked great controversy: the latter issue has raised doubts in the European Commission, and is currently being examined for compliance with EU law on public aid. However, the European Council’s decision to raise the 2030 emissions reduction target from 40% to 55% (compared to 1990) adopted by the has already triggered a debate in Germany on the need to exit coal even earlier than 2035.

Setting 2038 as the date for the closure of the last power plants, and scheduling the start of the process in the eastern Bundesländer for only the second half of the 2030s, was largely a result of the pressure exerted by the governments of the federal states where the lignite mines are located. The prime ministers of Saxony, Brandenburg and Saxony-Anhalt insisted that the funding agreed with the government from the federal budget (€40 billion until 2038) to restructure the coal regions be used to start the planned investments well before the mines and power plants are actually shut down. The regional authorities hope that the development of transport infrastructure and the opening of branches of universities, research centres and federal administration offices will provide new prospects for local residents and bring in new, attractive jobs, thus resulting in greater social acceptance for the coal exit.

|

APPENDIX Cross-border problems of the Turów mine The issue of the cross-border impact of the open-pit Turów lignite mine (Bogatynia municipality) on the Czech Republic and, to a lesser extent, Germany has been the subject of growing controversy in recent years. Problems with access to and contamination of drinking water, dust, noise and subsidence are among the most crucial issues that the residents of these areas associate with mining. In the Czech Republic, these matters receive regular coverage in the national media, are discussed by leading politicians, and have been raised by successive prime ministers at bilateral meetings with their Polish counterparts. In Germany, in turn, the Turów issue is mainly a topic of interest for local media and politicians in Zittau and Saxony, where it is raised especially by the Greens. The dispute over the mine intensified when, in March 2020, the PGE company obtained an extension of their concession for lignite extraction in Turów until 2026, while signalling that the validity period would have to be extended all the way through 2044. Objections to how the consultations were conducted in this case resulted in a complaint from the Czech Republic to the EC, which partially agreed with them in the so-called reasoned opinion issued in December 2020. The government in Prague then filed a complaint with the Court of Justice of the EU on 26 February 2021 also requesting a preventive cessation of mining. For both countries, the trial will be unprecedented, and unique in the history of the European Community and the European Union (there have only been six such judgements issued since 1979, and two cases have been withdrawn). The Czech stance on the issue has also been made more urgent by the parliamentary elections scheduled for October. The Turów dispute reflects typical discrepancies and controversies related to lignite mining in cross-border conditions. The Polish side argues for energy security: without the mine, it would not be possible to operate the nearby power plant, which meets approximately 5% of Poland’s electricity needs (this share will increase after the new power unit is launched in spring 2021) and which receives more than 90% of its coal from the Turów coal mine. The arguments of the Czechs and, to a lesser extent, the Germans echo the voices of environmentalists, as well as those inhabitants of mining regions who, while suffering the negative effects of mining, do not benefit from the activities conducted by the mines and nearby power plants. Many environmental issues remain controversial at the expert level as well. One of these concerns the impact of the Turów mine on water losses on the Czech side. The Czech Geological Survey (ČGS), which has been studying water level changes in the vicinity of the mine in recent years, admitted at the beginning of 2021 that while in deeper aquifers water loss is solely due to the operations conducted by the facility, in the higher layers (from which Hrádek and Nisou, among others, draws its water) it is a combination of the impact of mining, the on-site water intake and the drought of 2015–19. The consequence of the latter on water loss in the region was also emphasised by an analysis from the Polish Institute of Meteorology and Water Management in 2020. According to ČGS, it is also impossible to determine the specific cause of the subsidence. On the other hand, the phenomena of falling groundwater levels or subsidence observed on the German side (in Zittau) are not only the result of Turów’s activities: they can also be partly attributed to the Olbersdorf open-pit mine which operated on its outskirts until 1991. Most Czech experts are sceptical about the effectiveness of PGE’s underground screen project (aimed at protecting a Czech water intake), which is scheduled to be ready in autumn 2021. PGE, in turn, has demonstrated the effectiveness of a similar solution in a mine on the German border side. One of the objections has already been verified by ČSG: since the water flows from the Czech Republic to Poland, it has basically been ruled out that the mine is contaminating its deposits on the Czech side. |

[1] Global mining data according to the Federal Institute for Geosciences and Natural Resources (BGR). BGR Energiestudie 2019 – Daten und Entwicklungen der deutschen und globalen Energieversorgung, BGR, 24 April 2020, www.bgr.bund.de.

[2] PGE ranks second in this classification (following RWE), accounting for 11.2% of EU and UK emissions. Europe Beyond Coal data for 2019.

[3] In recent years, the rising prices of emission allowances has also been influenced by the behaviour of market players, who buy them in the expectation of more increases to come.

[4] In a spring 2020 survey by the Median agency, drought and other symptoms of climate change were cited as the biggest source of concern by 85% of Czech respondents. According to another survey (CVVM agency) from mid-2020, 89% of citizens are convinced that human activity is contributing to these changes.

[5] Stromerzeugung nach Energieträgern 1990 – 2020, AG Energiebilanzen e.V, www.ag-energiebilanzen.de.

[6] BGR Energiestudie 2019…, op. cit.

[7] Energiemarkt Deutschland 2020, Bundesverband der Energie- und Wasserwirtschaft e.V., May 2020, www.bdew.de.

[8] In addition, ČEZ closed older units at two lignite-burning power plants in 2019–20, since the prospect of retrofitting them turned out to be unprofitable.

[9] ‘Wasserrechtliche Erlaubnis für Tagebau Welzow-Süd bestätigt’, Niederlausitz Aktuell, 23 December 2018, www.niederlausitz-aktuell.de.

[10] V. Budde, ‘Letzte Bastion der Braunkohle’, Deutschlandfunk Kultur, 17 July 2017, www.deutschlandfunkkultur.de.

[11] R. Bajczuk, ‘Germany: compromise on the departure from coal’, OSW, 30 January 2019, www.osw.waw.pl.

[12] See R. Bajczuk, M. Kędzierski, The leader is gasping for breath. Germany’s climate policy, OSW, Warsaw 2020, www.osw.waw.pl.