Digitisation in Romania accelerates during the pandemic

Romania stands out as having one of the EU’s least developed systems of online public services, which contrasts with its extensive telecommunications infrastructure offering very fast and cheap access to the network. This is due both to the policy of the governments, which until 2019 did not show much interest in the digitisation process of the country or failed to propose a comprehensive programme for its implementation, and to the resistance of the public, who were distrustful of the e-government solutions offered. However, the outbreak of the COVID-19 pandemic led to a breakthrough: on one hand, it spurred the authorities to introduce legal changes and deploy new technological solutions that had hitherto been postponed, and on the other, it forced Romanian society to use public digital services.

Developed network infrastructure...

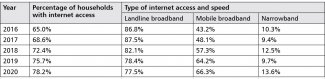

According to the Romanian National Institute of Statistics (NIS), in 2019 (before the pandemic) nearly 76% of all households had access to the internet, which was 11 p.p. better than in 2016 (see Table 1 in the Appendix). Although broadband internet access (i.e., no slower than 30 Mbps) has been available since 2017 (according to the Digital Economy and Society Index [DESI] conducted for the European Commission) to no more than around two-thirds of households (well below the EU average of 78% in 2019),[1] the capacity of the existing networks has been steadily increasing. Even before the outbreak of the pandemic, up to 49% of all households were already using a broadband connection with the so-called ultrafast bandwidth (of at least 100 Mbps).[2] This result is almost twice the EU average of 26%. Romania is also leading in the development of infrastructure for terrestrial very high-capacity network (fixed VHCN – minimum 1000 Mbps). It covers 68% of all households in the country (44% in the EU as a whole), mainly in urban centres. The figure for rural areas is significantly lower (less than 40% of households can be currently connected), but this is still above the EU average of 20%. However, the 4G coverage rate (85%) is below the average EU level (96%).

Romanian telecom companies provide very favourable internet access services compared to other countries. According to Speedtest.net (which monitors network speeds), the average fixed broadband internet speed in Romania in July 2021 was 215.3 Mbps, placing the country fifth in the world. At the same time, according to a study by Picodi analysts published in December 2019, the average monthly price of broadband connection internet access with a bandwidth up to 150 Mbps was just €8 there (i.e. €0.05 per Mbps). By comparison, in Hungary, Poland, the Czech Republic and Germany, access to networks with bandwidths of up to 100 Mbps costs €9.34 (€0.09 per Mbps), €10.63 (€0.07 per Mbps), €21.34 (€0.21 per Mbps) and €42.44 (€0.42 per Mbps) respectively.[3] Both the low prices and the high bandwidth of the internet access offered result from the fact that the market for such services was unregulated for many years, and is highly competitive due to the large number of small local companies operating on it. Currently (as of 2020), it is gradually consolidating around the three largest operators, but smaller entities still have relevant shares of the market (10% for broadband connection internet providers and 15% for mobile services).[4]

The COVID-19 pandemic has led to a surge in demand for internet connectivity and prompted government institutions to launch long-awaited digitisation solutions. The number of new connections reached about 400,000 in 2020, a growth rate that was twice as fast as the year before. As many as three-quarters of these connections were in rural areas (only 100,000 in cities). As a result, the number of the so-called white spots, i.e. localities without access to the internet, fell by up to 40% (from 2700 in 2019 to 1600 in 2020). At the same time, the number of connections has risen by 3% (i.e. by about 500,000, to 20.4 million). Network traffic intensity also surged by as much as 50% in Romania (by comparison, the increase between 2018 and 2019 was only 13%). 90% of data is transmitted via broadband connections.[5]

...and the public’s limited digital competences

The digital competences of Romania’s citizens and their interest in using online services look much less favourable. According to the DESI index, in 2019 only a third of Romanians declared that they had at least the basic skills to navigate the worldwide web (the EU average is almost twice as high).

In 2019, only 11% of Romanian internet users used online banking (the EU average is 66%, in Poland 59%), and 29% of representatives of this group made purchases online (71% EU-wide, in Poland 66%).[6] Only slightly more than half of internet users also obtained information from online websites. The only services which Romanians use more often than the average EU citizen are social media (82%; EU 65%, Poland 66%) and video calls (67%; EU and Poland 60%).[7] In both cases, this is largely related to the very high level of economic migration,[8] as these services allow people to maintain contact with family members and friends who have left the country.

Although the sciences are becoming more popular in Romania every year (according to a ranking based on the DESI index in 2019. 5.6% of all graduates had completed ICT-related education, ranking 5th in the EU), the country still has a serious problem with access to educated personnel. Whereas IT professionals make up an average of 3.9% of the workforce in the EU, in Romania this number is only 2.2% (2018 data according to DESI). Meanwhile, the demand for highly skilled ICT sector workers is huge in Romania due to its rapid development. Between 2007 and 2017, the number of companies operating in the sector rose from less than 10,000 to almost 17,500, while their turnover increased by 150%, from about €2 billion to almost €5 billion. According to KeysFin analysts, of over 106,000 of all ICT industry employees, as many as 39% were employed by small businesses in 2017, while corporations accounted for less than 20%.[9]

The e-government sector before the pandemic: slow progress

Until the outbreak of the COVID-19 pandemic, digitisation of public services had been progressing only slowly. The electronic mailbox, i.e. the system enabling the payment of financial obligations to public institutions, either had limited efficiency and reach, or did not appeal to a significant part of the population for other reasons. The exception was the health service, where some solutions were introduced quickly and efficiently (such as e-prescriptions).

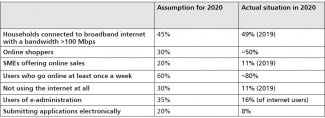

The key document concerning the digitisation of the country is the National Strategy on Digital Agenda for Romania for 2020, which the government of the time adopted in April 2014 (see Table 2 in the Appendix). Although the key objectives set forth in the document were actually fully achieved, this success resulted not from effective state action, but mainly from its modest assumptions, and the fact that the authors of the document probably did not foresee such a rapid development of the internet in society and business, to which the pandemic also contributed.

In 2011 the Ministry of Communications and Information Society launched the National Electronic Payment System (SNEP, Ghiseul.ro), which has been crucial from the perspective of e-government functioning; this enabled individuals to pay their obligations to the state treasury and public administration entities (at the local and central level) using payment cards. It was created thanks to the cooperation between the public and private sectors: although it is currently managed and operated by the Authority for the Digitalization of Romania, the technology necessary for its launch (i.e. the online payment platform) was provided free of charge by the Association of Electronic Payments in Romania, which aims to represent the interests of the industry in its relations with the authorities in Bucharest, among others. Although the number of active users of the Ghiseul.ro platform gradually increased, it had only reached about 470,000 by the end of 2019. The spread of the system was hampered both by the general distrust of the public towards electronic payments and the lack of motivation on the part of some public institutions (local governments included). Although the implementation of SNEP is formally obligatory, failure to comply with this obligation does not entail any clearly-defined consequences (including financial ones). Meanwhile, in smaller municipalities, the local administration has often been reluctant to bear the costs of connecting and maintaining the system (around €1000–5000 per institution) or the commission fees (around 1%) charged by the bank handling the payments.[10] As a result, by the end of 2019, only 384 public institutions at local and central levels were connected to the electronic payment system, while Romania has more than 300 cities and almost 2900 municipalities.[11]

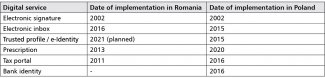

Earlier, in 2007, the Public Procurement Electronic System (SEAP) was launched; this functions as an auction platform where businesses can participate in public tenders. Since 2010, meanwhile, the Single Electronic Point of Contact (PCUe) has been developed, which is a specific equivalent of the Polish ePUAP system. At the beginning, this service primarily allowed the downloading of ready-made application templates and forms for contacting the public administration, but over time (after 2016) it took a more extensive form, allowing the submission of documents to some institutions. Currently, with the help of PCUe it is possible to carry out almost 5000 different administrative procedures, including the registration of companies. The possibility of buying online vignettes, which allow cars registered outside the country to travel on Romanian roads, was introduced very early in 2010. In the same year, electronic toll control was launched (using an automated camera system), which made it possible to do away with the previously obligatory vignette stickers.

The digitisation of the Romanian healthcare sector has been a major success. The e-prescription system was implemented in Romania in a pilot form as early as 1 July 2012. The project proved successful: during the first six months as many as 87% of doctors issued such documents, and 90% of pharmacies sold medicines based on them. On 1 January 2013, e-prescriptions became a mandatory standard across the country. 2015 also saw the introduction of the electronic National Health Insurance Card, which – in addition to basic information about the holder’s identity (including his social security number) – can also contain their medical data in its memory, including treatment history (with the insured’s consent). At the same time, information about the patient’s course of treatment is collected on the server in the so-called Electronic Health Record (DES).

New impulse to digitisation

Past experience raised concerns about how effectively the Romanian administration would manage to function during the COVID-19 pandemic, especially during lockdowns. A happy coincidence for the country was the creation in February 2020 (on the eve of the detection of the first cases of coronavirus) of the Authority for the Digitalization of Romania (ADR). The statutory objectives of the newly established institution included both supporting and coordinating the digital transformation of the economy and society, and implementing the electronic management of public administration.

The pandemic provided an opportunity to accelerate the ADR’s plans. Back in April, the government passed an emergency decree requiring public institutions to issue and accept digitally signed documents and to recognise those signed with a qualified electronic signature as equal to those signed off by hand. In the same month, after only two weeks of preparatory work, ADR launched the aici.gov.ro platform. This website was created to make it easier for citizens and businesses to access government support programmes for individuals and businesses affected by the pandemic.[12] The first functionality it offered was to apply for so-called ‘technical unemployment’ (allowing the state budget to cover a portion of the furlough wages for employees whose establishments had been forced to introduce work restrictions as a result of the pandemic). In the following months, the platform was enriched with more services, and by the end of 2020, according to ADR, it already offered the possibility to handle 16 different assistance programmes aimed at different professional groups. By May 2021, 1,151,000 applications had been submitted through it.

The functionality of pre-existing systems was also expanded. In April 2020, the government passed a regulation allowing businesses to pay their tax obligations (as well as penalties, customs duties, etc.) through the aforementioned SNEP platform. This decision and the general increase in interest in electronic payments caused by the pandemic have led to a dramatic surge in its popularity. While about 470,000 people had been using it before the pandemic, by mid-May 2021 this number had doubled and exceeded one million. The number of payments using the platform also surged by 110% compared to 2019 (more than a million were made last year), and the total amount transferred to the treasury via it in 2020 was 484 million lei (an increase of 180% on annual basis). Another system that clearly increased its popularity during the pandemic for similar reasons (namely reducing contact with officials and decreasing queues), is PCUe. The number of this platform’s users reached 52,500 in May 2021, more than tripling the number from 2019.

The pandemic also forced tender procedures to become more flexible, resulting in the launch of the so-called Dynamic Purchasing System (SAD) in March 2021 (as part of the SEAP system); this allows the buying party to enter into cooperation with service providers at any time without having to wait for the expiration of the framework agreement previously concluded (under another tender).[13]

At the beginning of January 2021, the Romanian government also launched a special platform vaccinare-covid.gov.ro: it allows people to register for COVID-19 vaccination, as well as to check the occupancy rate in particular vaccination points (determining the waiting time), the availability of a particular preparation, etc. After temporary problems related to high interest and overloaded servers, the system now works smoothly and is generally perceived positively.

Surging interest in e-commerce

The pandemic and the associated movement and retail restrictions have also led to a leap in the prominence of the e-commerce industry. Many chains have been forced to launch online sales, a decision previously hindered by the reluctance and distrust of Romanian society. According to NIS, in 2020 as many as 58% of Romanian internet users aged 16 to 74 purchased a product or service online. As a result, the value of the e-commerce sector last year was estimated at €5.6 billion,[14] which was 30% higher than in 2019. The increase in the popularity of e-commerce is also directly related to the increased interest of Romanians in electronic payments. According to the PayU service (one of the world’s largest e-payment operators), the share of electronic transactions in the total number of payments has risen by half in 2020, to 36%.

Cybersecurity as the foundation of digitisation

The progressive digitisation of the administration and the economy has forced the Romanian government to pay significant attention to the issue of cybersecurity. In 2011, the Romanian National Computer Security Incident Response Team (CERT-RO) was established to respond to threats in cyberspace. In 2013 the National Cybersecurity System (SNSC), composed of representatives of public institutions involved in cybersecurity, was established as part of the National Cybersecurity Strategy. The SNSC is supervised by the Supreme Council of National Defence (which includes the president, prime minister, the heads of the intelligence services, several ministries and a representative of the army). The security of the government’s IT network and the data stored on its servers has been entrusted to the SRI (i.e. the Internal Intelligence Service). In 2020 the National Cybersecurity Strategy was developed and supplemented with the National Defence Strategy for 2020–2024. Moreover, in December 2020 Bucharest was chosen to host the European Cybersecurity Competence Centre, which is tasked with managing funds for this purpose from EU research budgets, including around €2 billion from the Digital Europe programme. As of 2 May 2019, Romania has a 24/7 toll-free number (1911) to report cybersecurity breaches. So far, however, the country has not experienced any major attacks targeting its strategic infrastructure.

In addition to the public sector, private companies dedicated to ICT security are also very active in Romania. The flagship company in this area is Bitdefender, founded in 2001, whose products are used by over half a billion people worldwide. This company often cooperates with public institutions and international organisations. In 2018, in cooperation with Europol, Interpol, the FBI and police from several EU countries, it participated in the fight against a hacker group, believed to have originated in Russia, which used the GandCrab virus to extort hundreds of millions of dollars from owners of infected computers.

Conclusions and prospects

Despite the observed acceleration due to the pandemic, the process of digitising public services in Romania is still relatively slow, and does not correspond to the rapid growth of the population’s interest in online services. The country’s network infrastructure is developing rapidly, and the public is becoming more and more comfortable with new technologies, as evidenced by the rapidly growing number of people who use the internet regularly, do their shopping online or make electronic payments. Despite the growing prevalence of digital services, however, the group of e-government platform users remains relatively small (see charts in the Appendix). Increasing their share to 35% of the total population is one of the two main goals (besides the increase in the number of citizens submitting applications and forms via the internet) of the National Strategy on Digital Agenda for Romania for 2020, which not only has not been achieved, but it has not even been half-completed (see Table 2 in the Appendix). Examples include the previously discussed Ghiseul.ro e-payment platform, which, although considered the most popular and efficient component of the country’s e-government system, is only used by a little over a million people, or about 5% of Romania’s population.

The reasons for the relatively slow development of digital public services have remained the same for years. First of all, these include deficiencies in the IT infrastructure used by administrative entities, personnel problems (i.e. the lack of an adequate number of qualified IT specialists), and the absence of a unified and effective legal and procedural framework to develop online public services. The government’s passivity has long been one of the key inhibitors in this process. The importance of political motivation for progress in digitisation was proved by the outbreak of the COVID-19 pandemic, which compelled the authorities to rapidly push forward the previously postponed regulations in this area. However – despite initial difficulties – the implementation of e-government systems turned out to be a success.

There is no doubt that the digitisation of Romanian public services will continue to accelerate. One factor contributing to the development of this sector may be the funds Romania has obtained under the EU National Reconstruction Plan, from which Bucharest intends to allocate a total of €1.9 billion for this purpose.

APPENDIX

Table 1. Household internet access in Romania between 2016 and 2020 (by type of connection and bandwidth)

Source: National Statistical Institute.

Table 2. Selected assumptions and actual status of implementation of the objectives of the National Strategy on Digital Agenda for Romania for 2020

Source: National Strategy on Digital Agenda for Romania for 2020.

Table 3. Examples of digital public administration services implementation in Romania and Poland

Chart 1. Internet usage by individuals* for contacts with public administration in Romania, the Czech Republic and Poland 2015–2020

* (at least once in the last 12 months)

Source: ‘E-government activities of individuals via websites’, Eurostat, ec.europa.eu.

Chart 2. Getting information from public administration websites* in Romania, the Czech Republic and Poland 2015–2020

* (at least once in the last 12 months)

Source: ‘E-government activities of individuals via websites’, Eurostat, ec.europa.eu.

Chart 3. Downloading applications and forms from public administration websites* in Romania, the Czech Republic and Poland 2015–2020

* (at least once in the last 12 months)

Source: ‘E-government activities of individuals via websites’, Eurostat, ec.europa.eu.

Chart 4. Electronic submission of applications and forms* in Romania, the Czech Republic and Poland 2015–2020

* (at least once in the last 12 months)

Source: ‘E-government activities of individuals via websites’, Eurostat, ec.europa.eu.

[1] Digital Economy and Society Index 2020, European Commission, ec.europa.eu.

[2] All bandwidth figures refer to transfer speed to the device (download).

[3] ‘Zestawienie cen internetu na świecie’ [‘Global comparison of internet prices’], Picody.com, 9 December 2019, picodi.com.

[4] ‘Market shares of the main mobile service providers in Romania from 2017 to 2020’, Statista, June 2021, statista.com.

[5] A. Vasilache, ‘Noi date despre utilizarea internetului în România’, HotNews.ro, 15 April 2021, hotnews.ro.

[6] It is worth noting here that the Romanian National Institute of Statistics claims that 42.4% of Romanian internet users aged between 16 and 74 used online shopping in 2019. See Accesul populaţiei la tehnologia informaţiilor şi comunicaţiilor, în anul 2019, Institutul Național de Statistică – România, insse.ro.

[7] The data refers to people who declare themselves as online users.

[8] Between 2000 and 2018, Romania’s population fell from 22.4 million to 19.5 million, a drop of nearly 3 million. Labour migration is estimated to account for three-quarters of this decline. For more information see Talent Abroad: A Review of Romanian Emigrants, OECD Publishing, July 2019, oecd-ilibrary.org.

[9] A. Negrescu, ‘Romania, Europe’s Silicon Valley’, KeysFin, 28.11.2018, keysfin.com.

[10] A. Vasilache, ‘De ce nu poți să-ți plătești online taxele și impozitele la toate primăriile?’, HotNews.ro, 21 April 2021, hotnews.ro.

[11] O. Bărbulescu, ‘Ghiseul.ro va putea fi folosit și de firme și PFA. Vor putea fi plătite de la taxe și impozite până la amenzi’, Profit.ro, 9 April 2020, profit.ro.

[12] ‘2020 este anul în care statul a început să transforme cozile la ghişee în clickuri’, Mediafax.ro, 31 December 2020, mediafax.ro.

[13] ‘Noi funcționalități în SEAP pentru Sistemul Dinamic de Achiziții’, Agenția Națională pentru Achiziții Publice, 2 February 2021, anap.gov.ro.

[14] A. Radu, Raport GPeC E-Commerce România 2020, GpeC Blog, 23 February 2021, gpec.ro/blog.