The calm before the storm: the state and prospects of Russia’s oil sector

Russia’s invasion of Ukraine will have serious consequences for the health of the Russian oil sector, which is one of the most important branches of the country’s economy. Although its production and export performance, and consequently its budget revenues, remained high in 2022, the situation began to worsen in December, and the negative trend is likely to continue in the coming months. The main reason for this state of affairs is the sanctions introduced by Western countries, in particular the European Union’s embargo on imports of Russian oil and petroleum products.

Russia’s government and companies have taken adaptive measures, such as reconfiguring the directions of oil exports; however, economic, infrastructural and political constraints may make it much more difficult to follow through with the plan for sustainable market diversification. Thus, the EU embargo may lead to a significant reduction in oil production in Russia over the coming years, which will worsen the country’s financial and economic health. The ultimate effect of the restrictions will depend on the determination of Western countries and the pace at which they implement sanctions, as well as the attitudes of Moscow’s other trading partners.

The Russian oil sector under sanctions

Russia’s attack on Ukraine led to the decision to enact unprecedented sanctions targeting Russia’s political & business elites and its economy, including the energy sector. Those imposed by the European Union on its oil industry are the most extensive and severe. The restrictions under the nine sanctions packages adopted so far include bans on investment in the Russian energy sector and on exporting goods and technology for its refining industry. Potentially the most serious impact could come from the embargo on seaborne imports of crude oil from Russia (which came into force on 5 December 2022) and petroleum products (which will come into force on 5 February 2023) introduced as part of the sixth package of restrictions.[1] In addition, the provision of maritime transport services, technical support, brokering services, and financing or financial assistance related to the maritime transport of Russian oil & petroleum products to third countries was prohibited. Apart from the European Union, an embargo on the imports of energy resources from Russia has been imposed by the United States, while the United Kingdom has also banned the imports of oil and petroleum products.

Another restriction put in place by Western countries is the price cap. On 2 December, the EU, together with the G7 countries and Australia, decided that exporters will be permitted to use the services of Western companies for maritime transport, technical support, brokering services, or financing or financial assistance related to the supply of crude to third countries only when oil from Russia is sold at $60 per barrel (or less).[2]

There are many indications that the restrictions imposed and the escalation of the crisis in relations with the West caused by the invasion of Ukraine have not yet had a negative impact on crude oil and gas condensate production figures in Russia.[3] According to data published by Rosstat (the state statistics office), higher production levels than in the corresponding periods of 2021 were recorded in almost all months of the year, apart from April, May and November. In the first eleven months of 2022, oil and gas condensate production rose to almost 488 million tonnes, compared to around 476 million tonnes in the same period of the previous year. At the same time, forecasts produced by the Russian government indicate that oil production in all of 2022 could reach 530 million tonnes (10.6 million barrels per day), an increase of 1.1 percent year-on-year. Detailed data by month is shown in Chart 1.

Chart 1. Oil and gas condensate production in the January-November period in 2021 and 2022

Source: author’s own compilation based on information published by Rosstat and CDU TEK (data for January and February 2022).

Ten months into the war, the oil sector retains its key importance as a source of revenue for the budget, although a month-on-month decline could be seen in the last quarter of 2022. In the period from January to November 2022, oil production tax revenues amounted to nearly 7.9 trillion roubles, an increase of around 41% y/y. At the same time, the share of the oil sector in oil & gas budget revenues fell from 80% in 2021 to 72.4%. This consists of state revenues from the crude oil and gas condensate production tax, as well as export duties on oil and petroleum products. As a result of the decline in trade in non-energy areas of the economy, the share of the oil & gas sector in total budget receipts in the period from January to November 2022 stood at 43.3% (compared to around 36% in the corresponding period of 2021). At the same time, budget revenue from the oil sector was seen to fall in the final months of 2022. As recently as in August, state revenues from the oil production tax stood at 681.3 billion roubles, but dropped to 599.2 billion roubles in September, 508.4 billion roubles in October and 527.8 billion roubles in November.

Reconfiguring export destinations for oil and petroleum products...

Neither the imposition of the embargo on the imports of Russian oil & petroleum products nor the individual decisions by Western governments or energy companies to stop purchasing crude from Russia succeeded in reducing their export levels during the first nine months of the war. According to data published by Argus, sales of Russian oil shipped through the Transneft system (see Appendix 1) between January and November 2022 rose to 192.3 million tonnes, an increase of around 21.4% year-on-year.

However, the decisions by individual countries and companies have had a noticeable effect on redirection of Russian exports, in particular a decline in sales to the European Union and an increase in shipments to non-EU countries. Before the invasion of Ukraine, the EU was Russia’s key market for crude oil. According to 2021 data, crude sales to the bloc’s countries totalled 105 million tonnes, accounting for almost 50% of Russia’s total oil exports. But many Western countries stopped purchasing this crude after the outbreak of war. Lithuania did so in April 2022, followed by the UK in May, Finland in August and France in September. Decisions to opt out of imports were also taken by several Asian countries: Thailand and Australia in April 2022, Japan in May,[4] and Malaysia & Singapore in July.

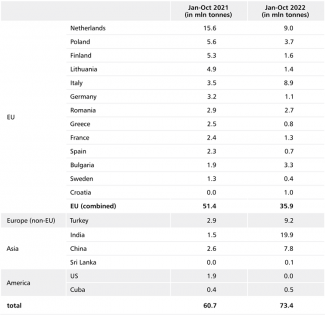

Moscow has offset the decline in exports to Western markets by increasing supplies to those countries that have not joined the sanctions. This is illustrated by rising sales of Russian Urals oil to India, China and Turkey. Among non-European countries, India has recorded the largest increase in crude imports from Russia. As recently as 2021, Indian companies were buying around 50,000 barrels per day; at their peak in 2022 (the first ten days of July), meanwhile, daily supplies reached 1.46 million barrels. In June and July, the share of Russian oil in India’s oil imports soared to 22.3% (compared to under 2% in 2021). According to data from Argus, India purchased nearly 20 million tonnes of Urals oil between January and October 2022 (compared to 1.5 million tonnes in the corresponding period of 2021).

Russia has also increased its exports of Urals oil to the PRC. In the first ten months of 2021, Chinese companies imported around 2.6 million tonnes, but in the same period of 2022 the figure was already 7.8 million tonnes. Turkey also increased its crude purchases, from 2.9 million tonnes in January-October 2021 to 9.2 million tonnes in the same period of 2022.

Chart 2. Russian oil exports to Turkey, India and China in the January-October periods in 2021 and 2022.

Source: Argus Eurasia Energy.

Price discounts were one of the factors that encouraged non-European customers to buy Russian crude. From late March to mid-August 2022, discounts on Urals crude delivered to foreign customers ranged between $30 and $40 per barrel. From mid-August to mid-December, the difference between the average price of Urals and Brent barrels was between $20 and $30. Meanwhile, Reuters reported that in December Russian oil was again being sold to some countries (including India) at a discount exceeding $30 per barrel.

In contrast, there has been little change in the export destinations for Russian petroleum products so far, because of the later date of the EU embargo’s entry into force (5 February 2023). EU countries are still a key market for this group of commodities (primarily diesel), and some even increased their imports year-on-year in the period from January to November 2022. Countries whose purchases rose include Belgium, Greece, the Netherlands, Germany, Italy, Slovenia and Bulgaria. In contrast, France, Poland, Spain, Croatia, Lithuania and Estonia reduced their imports of petroleum products from Russia (particularly diesel) in that period.

...and prospects for further market diversification

More serious consequences for Moscow will come when the oil embargo adopted by the European Union is fully implemented. Preliminary statistics published for December 2022 show that Russia’s seaborne crude oil export fell by about 22% compared to November. In addition, Germany’s halt to oil purchases from Russia at the end of 2022, and the implementation of a similar announcement by Poland before the end of 2023 or at the beginning of 2024, could see Russian exports to the EU market decrease by around 95 million tonnes per year. From the point of view of Russian exporters, the potentially most important markets where oil sales can be redirected include Asian countries, in particular India and China. However, they are unlikely to become an alternative to Europe in the coming years. Indeed, the possibilities of permanently redirecting significant quantities of the oil previously supplied to the EU market appear to be limited, as a result of political, economic and technical determinants.

Although Western countries are introducing further restrictions on the Russian oil trade, it cannot be ruled out that countries such as the PRC and India will also take them into account. Chinese companies reduced their purchase orders for Russian crude back in December 2022, fearing the impact of the price cap. India, on the other hand, has not formally taken a clear position on the cap, but statements from its officials indicate that Indian companies do not intend to give up importing Russian oil, with the proviso that they will monitor developments on the oil markets. On the other hand, some Asian countries (such as Sri Lanka) which have imported single consignments of crude in recent months will not make any further purchases of it.

It may also be problematic for Russia to completely redirect the resources it had hitherto sold to the EU for economic (demand) reasons, as the possible new markets are unlikely to be capable of absorbing such large volumes of crude as those covered by the EU embargo. Back in 2021, China ranked first among the countries importing Russian oil (c. 80 million tonnes), which calls into question Beijing’s ability to continue increasing purchases in any significant way. It is also unclear whether, despite persistently high prices, oil exports from Baltic and Black Sea ports to Asia will be profitable from the Russian point of view in the long term. Oil redirected to these markets (such as India) arrives via various routes, both via the Suez Canal and along the southern coast of Africa. Freight costs depend on whether the crude departs from Russian ports on the Baltic Sea (Primorsk, Ust-Luga) or on the Black Sea (Novorossiysk). Another significant complication, besides the uncertainty over crude prices, is the issue of obtaining insurance for tankers transporting crude, which affects freight charges. Indeed, the sixth package of EU sanctions also includes restrictions on entities transporting Russian oil and insuring its shipments; and while the restrictions do not apply to those transactions where the price cap on Russian crude set by Western countries is respected, they remain in place in case third-country importers still want to buy it at prices higher than $60 per barrel. Although Moscow has already started expanding its so-called shadow fleet (also called the ‘grey’ or ‘black’ fleet by some sources), which is made up of vessels previously used to transport sanctioned Iranian or Venezuelan oil, industry reports suggest that the scale of its needs exceeds supply in this regard. Citing data from the Rystad agency, the Financial Times has reported that Russia acquired 103 tankers in 2022. Thus, if the remainder of the fleet at Moscow’s disposal is taken into account, Russian exporters will need an additional 60 to 70 tankers in order to maintain exports near current levels.[5] Furthermore, it is unclear whether importers who do not join the price cap mechanism will be prepared to import oil which is supplied using vessels of the so-called shadow fleet.

Russia’s options for diversification are also limited to some extent by infrastructural issues. On the one hand, Russia has spare handling capacity in the Baltic and Black Sea ports which would allow it to redirect exports heading to European customers by sea and via the Druzhba oil pipeline. As part of the diversion of oil supplies to Asian markets, crude was transported by rail to the Russian port of Kozmino on 25 September 2022 (for the first time since March 2016). The Argus agency estimates the potential volume of rail transport to this port at 7 million tonnes per year. Thus, if we add the maximum spare capacity of the ESPO oil pipeline (just under 5 million tonnes),[6] the total oil shipments through Kozmino could reach 47 million tonnes. But Argus also points out that maximum use of the rail route is unlikely due to high costs, and that neither Transneft nor Russian Railways (RZD) have so far offered any discounts for transporting crude via these routes. In addition, a lack of tank wagons is another barrier to using the railways.

Laying new or expanding existing oil pipelines in Russia’s Far East will be extremely difficult in the years to come. Although Moscow has already stepped up its efforts to diversify the directions of oil and gas exports,[7] their potential (limited) effects may only be visible after several years, as the construction of new pipeline infrastructure is a time-consuming process.[8] Moreover, the cost of implementing such projects runs into tens of billions of dollars, and setting aside funding for this purpose will be problematic in a deteriorating economic situation. While deputy prime minister Aleksandr Novak suggested in October 2022 that the handling capacity of oil terminals could be increased by up to 40 million tonnes in the coming years, he did not provide any specifics on how this would be paid for. At the same time, industry media have begun to signal that the costs of expansion could be covered by Russian energy companies in exchange for the appropriate tax breaks. Novak further stated that work had already started on the construction of an oil terminal as part of the Vostok Oil project, which is also expected to add to Russia’s export capacity. However, it remains to be seen whether this project can be completed on time and in its entirety, amid sanctions and the withdrawal of foreign partners.[9]

The problem of diversifying markets also concerns petroleum products. While the above-mentioned shadow fleet can be used to transport oil or high-sulphur petroleum products (heavy fuels), it will be difficult to use it to export the so-called pure refinery products, a large part of which are currently destined for the EU market.

The impact of the war on Russia’s refining assets in Europe

The invasion of Ukraine will also have serious implications for the future of Russia’s refining assets located in European countries. This primarily concerns Rosneft’s assets in Germany. On 16 September, the German government announced that Rosneft Deutschland (RND) and RN Refining & Marketing (RNRM), companies owned by the Rosneft group, would be placed under the trusteeship of the Federal Network Agency (BNetzA) by 15 March 2023. RND and RNRM are engaged in the import, refining and sale of oil & petroleum products in Germany. Through these companies, Rosneft co-manages three refineries there, holding a 54.17% stake in PCK in Schwedt, 24% in MiRo in Karlsruhe and 28.57% in Bayernoil in Vohburg/Neustadt.[10] There are many indications that Rosneft’s assets could be nationalised and the seized shares sold off to German or foreign investors (Poland’s PKN Orlen is among those who have declared an interest in purchasing them).

As a result of the EU embargo, LUKoil will find it difficult to supply Italy’s largest refinery ISAB. The Russian company controls this enterprise, which is responsible for supplying oil products to around 20% of the Italian market. According to data from early November 2022, the plant is basically entirely dependent on supplies of oil (Urals) from Russia. Should the plan to obtain crude from alternative sources fail, it cannot be ruled out that LUKoil will decide to sell it, despite the Italian government’s stated desire to provide guarantees to any entities willing to extend credit to make purchases for the refinery. After all, ISAB has been making losses since 2013 and the Russian company took initial steps towards divesting a controlling stake as early as 2017. Another option under consideration is for the Italian authorities to temporarily take control of this refinery (for example through Eni, a company in which the government holds a 30% stake).

Serbia’s Pančevo refinery may also face operational problems. Although Russian oil accounts for less than 40 percent of the plant’s supplies and the company’s management has declared its readiness to stop purchases of this crude from December 2022, it is unclear whether it will be able to keep operating without Russian oil in the long run, as the EU embargo also means that importing oil to Pančevo using the existing route (through the Croatian port of Omišalj and then via the Adria pipeline) will be prohibited.

A pessimistic outlook

If the EU embargo on imports of Russian oil and petroleum products is implemented consistently, it could lead to a noticeable drop in exports, and consequently, in production in Russia. As recently as autumn 2021, Russia’s Ministry of Economic Development (MoED) was making optimistic forecasts for oil exports in 2024. Both the so-called baseline and conservative scenarios (see table below) envisaged an increase in supplies to external markets to levels in excess of 270 million tonnes per year. While the Ministry of Finance is still following the optimistic variant of oil production and export growth, the MoED has already made a radical revision of its assumptions. According to the MoED’s forecast adopted back in May 2022, oil exports will not exceed 230 million tonnes per year in the coming years (baseline scenario). In the conservative variant, meanwhile, export volumes could even fall below 200 million tonnes per year between 2023 and 2025.

Table 1. Projected oil exports from Russia in 2022–2025 (in million tonnes)

Source: author’s own compilation based on data from the Ministry of Economic Development of the Russian Federation.

Chart 3. Russia’s oil production and exports according to the budget assumptions for 2023–2025

Source: author’s own compilation based on a September 2022 release from the Ministry of Finance of the Russian Federation.

Negative forecasts were also made in the World Energy Outlook report published by the International Energy Agency (IEA) on 27 October 2022. It projects that Russian oil exports will fall steadily from 2023 onwards. By 2030, they are expected to fall by 25 percent relative to figures from before the invasion of Ukraine. At the same time, the IEA predicts that the volume of Russian oil exports will not return to those levels even after 2030. According to the IEA’s assessments, Russia’s oil production may drop by 1.4 million barrels per day in 2023 (the IEA’s daily production forecast for 2022 is 10.6 million barrels) as a consequence of the EU oil embargo. The Russian government’s actions may also contribute to lower production rates in the oil sector. On 27 December 2022 Moscow banned the supply of oil and petroleum products to countries that impose price restrictions on these commodities.[11]

How severe the adopted restrictions will prove to be for the Russian economy and its oil sector will depend on the extent of their implementation by Western countries, and also on how many non-G7 countries choose to join the price cap on Russian oil and petroleum products. Also important will be global demand and supply factors, such as the level of demand for crude in important markets (like China and, India), information on oil stocks in the US, and the capacity of oil-rich countries (such as the Middle Eastern countries and Venezuela) to increase oil production.

APPENDICES

Appendix 1

Transmission infrastructure used to export oil from Russian territory

Russian oil is exported by sea and by pipeline. Most of the infrastructure used for this purpose is owned and operated by the state-owned Transneft company. It handles crude shipments through large-scale oil ports and two oil pipelines, Druzhba and ESPO. The part of the exported crude that passes through small-scale oil ports and pipelines other than those mentioned above is handled directly by Russian companies that sell crude, or by their subsidiaries.

- Ports

Russian energy companies export oil through both large-scale oil terminals and small ports located along the country’s coastline. The large-scale oil ports are:

- Primorsk, a Baltic port located in the Leningrad region (handling capacity: 60 million tonnes of oil per year),

- Ust-Luga, a Baltic port located in the Leningrad region (handling capacity: 74 million tonnes of oil per year),

- Novorossiysk, a Black Sea port (handling capacity: 48 million tonnes of oil per year), and

- Kozmino, a Far Eastern port located in the Primorsky Krai (handling capacity: 55 million tonnes of oil per year).

In addition to this infrastructure, small-scale ports are also used for oil exports, which include:

- the ports of De-Kastri and Prigorodnoye, located in the Russian Far East, and

- the ports of Kaliningrad, Murmansk, Arkhangelsk and Varandey located in the European part of Russia.

- Oil pipelines

Russia primarily uses two pipelines to export its oil: the Druzhba (Friendship) and the ESPO (Eastern Siberia-Pacific Ocean) pipelines.

Druzhba, with a total capacity of 66.5 million tonnes per year, allows crude to be transported to Poland and Germany (via the northern line) as well as Slovakia, Hungary and the Czech Republic (via the southern line).

The ESPO oil pipeline is located in the Asian part of Russia and consists of two sections. The first, running between Taishet and Skovorodino, has a capacity of 80 million tonnes per year. A branch connecting the Russian part of the infrastructure to the Chinese town of Mohe runs from Skovorodino, and currently allows for 30 million tonnes of oil to be exported directly to the PRC. The second section of the oil pipeline, connecting Skovorodino to the Russian port of Kozmino, has a capacity of 50 million tonnes per year (20% of which is used to supply oil to Russian refineries in Khabarovsk and Komsomolsk).

In addition, some oil companies (Rosneft and LUKoil) use the KTK pipeline (with a capacity of 67 million tonnes per year) for oil exports. It connects Kazakh territory with the Russian port of Novorossiysk, and is primarily used to transport Kazakh crude. Although the oil pipeline largely runs through Russia, an international consortium formally owns and operates this infrastructure.

Map. Transmission infrastructure used for oil exports from Russia

Source: data from Transneft, transneft.ru.

Appendix 2

Oil exports from Russia in 2011–2021

Although Russia’s crude oil exports are more diversified in terms of sales destinations than gas exports, the European market still plays the main role in this area. According to data from the Russian Ministry of Energy for 2020, total crude oil exports reached 232.5 million tonnes, with the Western direction (European customers are crucial) accounts for around 61% overall: 27.3% was shipped through ports and 25.3% via the Druzhba oil pipeline.

Western markets, especially the EU, are also the most important export destination for Russian oil products. Data from the Russian Ministry of Energy for 2020 shows that Western countries together accounted for 89.5% of the total sales of these products.

According to the methodology used by the Federal Customs Service of the Russian Federation, oil exports from Russia include both domestic crude as well as crude extracted in third countries and transiting through its territory. While it is possible to separate Russian crude from transit volumes for the purposes of statistical analysis with regard to sales data over recent years (the authorities have regularly published data on transit volumes), such a distinction cannot be made for estimates for 2025-5. This is because the forecasts from the Russian Ministry of Economic Development regarding oil export volumes from Russia do not distinguish between domestic and transit crude.

Oil exports from Russia have followed fluctuating trends over the past decade. Between 2011 and 2014, the volumes of crude shipped to third countries declined steadily, from 244.5 million tonnes in 2011 to 223.5 million tonnes in 2014. In the next few years (with the exception of 2017), exports increased, reaching 269 million tonnes in 2019. However, a noticeable reduction in supplies to external markets was seen after the outbreak of the COVID-19 pandemic, resulting in a contraction to 239.2 million tonnes in 2020 and 231 million tonnes in 2021.

Chart. Oil exports from Russia in 2011–2021

Source: author’s own compilation based on data published by CDU TEK and the Argus agency.

Appendix 3

Table. Russian oil exports through transmission routes controlled by Transneft

Source: author’s own compilation based on data published by Argus and Interfax Energy agencies.

Appendix 4

Oil exports from Russia in 2021 and 2022: selected detailed statistics

Table 1. Urals oil exports through ports on the Baltic Sea and Black Sea

Source: Argus Eurasia Energy.

Table 2. Exports of Urals oil via the Druzhba oil pipeline

Source: Argus Eurasia Energy.

Appendix 5

Chart. Russian diesel exports to third countries in the January-October periods in 2021 and 2022

Source: Argus Eurasia Energy.

[1] A list of sanctions implemented by the EU against Russia can be found on the official websites of EU institutions, including the European Council and the Council of the European Union – see ‘EU sanctions on Russia over Ukraine (since 2014)’, consilium.europa.eu.

[2] For more detail, see S. Kardaś, ‘Price cap on Russian oil: EU eases sanctions on Russia’, OSW, 5 December 2022, osw.waw.pl.

[3] The difficulty in clearly assessing the situation in the production sector is related to limited access to statistical data from Russian industry. In April 2022, the CDU TEK agency (a unit within the Russian Ministry of Energy that collects comprehensive data on the Russian energy sector) stopped issuing statements on Russian oil production and exports. Meanwhile, in May 2022 Transneft stopped publishing monthly oil loading schedules, and since then has been informing exporters of these dates individually.

[4] According to industry media reports, Japan resumed purchases of Russian oil in December 2022.

[5] D. Sheppard, C. Cook, P. Ivanova, ‘Russia assembles ‘shadow fleet’ of tankers to help blunt oil sanctions’, Financial Times, 2 December 2022, ft.com.

[6] The ESPO oil pipeline’s capacity is 80 million tonnes per annum, of which around 30 million are used for direct supplies to China, and around 10 million for shipments to Russian refineries in Khabarovsk and Komsomolsk. This leaves some 40 million tonnes of capacity for supplies to the port of Kozmino (35.1 million tonnes were used in 2021), whose current handling capacity is estimated by some sources at 55 million tonnes.

[7] For more detail, see S. Kardaś, ‘Rosja: zapowiedź dywersyfikacji szlaków eksportu surowców energetycznych’, OSW, 21 April 2022, osw.waw.pl.

[8] The construction of the first line of the ESPO oil pipeline, allowing Russian oil to be exported to the PRC, took about three years. In turn, its extension and capacity expansion (from an initial 30 million to 58 million and eventually to 80 million tonnes) took nearly 10 years.

[9] The aim of the project is to create a large energy cluster in the eastern part of the Russian Arctic zone, which would include the production and export of oil (with a target of 100–115 million tonnes), coal (with a target of up to 50 million tonnes) and liquefied natural gas (with a target of 35–50 million tonnes). For more on this, see S. Kardaś, ‘Sny o potędze. Arktyka w polityce energetycznej Federacji Rosyjskiej’, Komentarze OSW, no. 399, 29 June 2021, osw.waw.pl. Trafigura (which held a 10% stake) withdrew from the project in July 2022. The other foreign partner, a consortium comprising Vitol and Mercantile & Maritime Energy, also divested its stake (5%) in the Vostok Oil project in late December 2022.

[10] For more detail, see M. Kędzierski, ‘Germany: the state takes control of Rosneft’s assets’, OSW, 20 September 2022, osw.waw.pl.

[11] For more detail, see S. Kardaś, ‘Russia’s response to Western oil sanctions’, OSW, 28 December 2022, osw.waw.pl.