Towards a dependence with no alternative: Russia’s increased role in the Belarusian economy

Macroeconomic data for the first six months of 2023 confirm Belarus’s steadily increasing dependence on Russia. In the second year of the war, Minsk is paying a high price for its complicity in Russia’s aggression, the regime’s acts of repression targeting its opponents, and its confrontational policy towards the West. This has involved Belarus losing a major portion of its markets in the EU and Ukraine. As a consequence, Belarus’s trade in commodities with the Russian Federation already accounts for around 70% of its total trade; considering that the transport of Belarusian goods (mainly fuels and potash fertilisers) is dependent on transit through Russian ports and railways, Russia’s share in Belarusian exports now exceeds 90%.

Minsk presents this far-reaching dependence as a success in fighting the pressure of Western sanctions. It also emphasises that over the past six months, which came after many months of recession, Belarus officially recorded an economic growth rate of 2% of GDP. However, it ignores the fact that its imports increased significantly in that period, which generated a trade deficit of more than $1.6 billion. This means that Belarus now faces a situation in which not only the health of its economy but also the survival of the state as a whole depends on its cooperation with Russia and its willingness to continue prioritising Russian exporters.

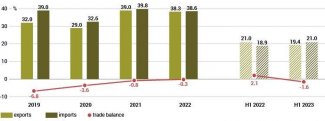

Belarusian foreign trade in H1 2023

According to Belarusian statistics, in the first six months of 2023 the total value of Belarus’s trade in commodities stood at more than $40 billion. This represents an increase of 17% compared with H1 2022, and a stabilisation of the trend compared with H2 2022 ($42 billion). At the same time, between January and June 2023 Belarus’s exports increased by a mere 12% to $19.4 billion, while its imports grew by as much as 22% and its value slightly exceeded $21 billion. This means that Belarus’s foreign trade balance stood at $-1.6 billion, while in the corresponding period in 2022 it was strongly positive, amounting to more than $2 billion.

This serious deficit mainly results from the radical increase in the value of Belarus’s imports from countries located outside the Commonwealth of Independent States,[1] which in that period amounted to almost $9.8 billion (71% of Belarus’s total imports). According to the available figures from Eurostat, between January and May 2023 Belarus imported goods from the EU worth €3.3 billion, which prompts the conclusion that EU-made goods account for no more than half of Belarus’s imports from non-CIS states (the CIS de facto includes most of the post-Soviet area).

On the basis of this (incomplete) data, it can be assumed that one factor affecting the increase in Belarusian imports involves the actions carried out by the Belarusian authorities to make up for the deficit of selected Western-made goods, which are subject to embargoes imposed by the EU and the US prohibiting European and American companies from exporting tobacco products, microelectronic components, many types of machines, devices and their spare parts, as well as other goods to Belarus. In this situation, the Belarusian government has decided to seek new suppliers. At present, these mainly include Asian states such as China, which has now become Minsk’s second biggest trade partner after Russia.

According to Chinese calculations, in the first five months of 2023 the value of bilateral trade stood at $3.7 billion, with Belarusian exports most likely accounting for $1 billion of this sum. This glaring difference between imports and exports has been typical of the trade between Belarus and China from the very beginning of their bilateral trade. At the same time, it should be noted that the increase in the value of imports could have been due to more intensive purchasing activity in markets much more distant than the EU; this would increase the duration and complicate the logistical aspects of the supplies, and in turn boost the final cost of the imported goods.

Another factor affecting the value of Belarusian imports has been the depreciation of the Belarusian rouble, which has been following the same trend recorded for the Russian rouble. It cannot be ruled out (although no precise data is available) that a portion of Belarus’s imports are goods re-exported to Russia, which has been subject to even more restrictive sanctions as a result of its invasion of Ukraine. On the basis of the available information, which nonetheless cannot be confirmed using numerical data, it seems that this is how the Russian market has mainly been receiving passenger cars and the spare parts & components which are important to the Russian industrial sector. It should be noted that an analysis of data for individual months of H1 2023 indicates a growing predominance of imports over exports, which suggests a likely growing foreign trade deficit in the statistics compiled for the entire year.

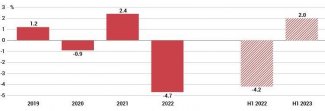

Chart 1. Belarus’s GDP change in 2019–2023

Source: National Statistical Committee of the Republic of Belarus.

The strengthening of Russia’s key role

Due to the EU’s economic sanctions against Belarus, which have been gradually imposed since autumn 2020, the EU’s share in Belarusian exports has now decreased to around 5%, whereas just three years earlier it stood at around 40–50%. As a result of these restrictions and the war-related loss of the Ukrainian market (in 2021 the value of Belarusian exports to Ukraine exceeded $5 billion), Russia has become the natural, and in fact the only destination for Belarusian exports. At present, the Russian market’s share in Belarus’s total trade is almost 70%. In the first five months of 2023, the value of bilateral trade reached $18 billion (no data is available for the full six months), up 20% compared with the corresponding period in 2022.

The available Belarusian statistics for Q1 2023 indicate that Belarusian exports to Russia rose by 56% in that period compared with the first three months of 2022. This shows the magnitude of demand for Belarusian goods in the Russian Federation, likely due to both their low price and the shortage of Western products which cannot enter due to sanctions. Another reason behind these significant hikes in exports is that Belarusian suppliers have privileged access to the Russian market.

The dynamic of trade between the two countries has prompted their governments’ representatives to highlight the resilience of their economies to sanction-related pressure. On 3 June 2023, the Russian ambassador to Belarus Boris Gryzlov stated that the 40% increase in Belarusian exports recorded for the whole of 2022 had enabled Belarus to make up for almost half of the losses resulting from its exclusion from EU markets. The Belarusian ambassador in Moscow Dzmitry Krutoi went a step further in his assessments. During the 10th bilateral Forum of Regions held on 28 June, he expressed his doubts regarding the point in continuing to trade with “problematic” Poland in a situation when the Belarusian state was generating a higher turnover with one region of Russia alone, namely Bryansk oblast. He also stressed that Russia’s decision to grant access to the port of Murmansk to Belarusian exporters of petroleum products was of major importance; in his view, it has enabled Belarus to fully replace its transshipment operations in the Dutch port of Rotterdam, which are currently unavailable to Belarusian exporters.

It should be noted that over the last few months Minsk has repeatedly stated that it has managed to fully make up for the losses it has suffered due to sanctions. Both Belarus and Russia have also emphasised their increased cooperation at the regional level, as well as the stimulating effect of the so-called ‘anti-import programme’ which is a de facto Russian credit line offered to Belarusian companies operating in the machine-building and microelectronics sectors. This programme is being implemented within the framework of the Union State, and at present its total value stands at around $1.7 billion.

The scale of Russia’s growing importance for the Belarusian economy is also evident in figures relating to the transit of goods from Belarus via Russian territory. According to official statistics, 6 million tonnes of these goods were transhipped in Russian ports in H1 2023, compared to just 1.5 million tonnes in H1 2022. Almost all Belarusian cargoes contain petroleum products, chemicals and artificial fertilisers which are all subject to the EU embargo. The transshipment capacity available to Belarusian operators will enable them to transport 12 million tonnes of goods by sea via Russia in 2023. Minsk has expressed interest in raising this volume up to 17.5 million tonnes, including by expanding their portfolio to add more products which have been blocked as a result of another package of EU sanctions introduced last spring (timber, wood, metal and steel products). At present, Belarusian exporters are allowed to use 19 Russian ports located in the Baltic, Caspian and Black Seas, while priority is given to the Baltic Sea ports. They are also using the Russian railway infrastructure; between January and June 2023 they transported 1.5 million cargoes by rail, the majority of which contained potassium fertilisers bound for the Chinese market.

Chart 2. Belarus’s foreign trade in 2019–2023

Source: National Statistical Committee of the Republic of Belarus.

Positive GDP growth despite the sanctions? Belarus’s economic outlook

The lasting increase in the value of Belarusian exports to the Russian Federation and the remarkably dynamic development of the transit of Belarusian goods through Russian ports and railway hubs have enabled Belarus not only to mitigate the impact of Western restrictions, but also to increase its industrial production. According to official statistics, between January and June 2023 almost all manufacturing sectors recorded growth rates of between 4% and 8%. As a consequence, H1 2023 saw an increase in domestic investment and domestic demand, and Belarus’s GDP rose by 2%. The first signs of minor economic growth emerged in May 2023, when an increase in GDP (of 0.9%) was recorded, for the first time since the beginning of 2022; last year the Belarusian economy shrank by 4.7% due to recession.

Although Minsk and Moscow’s official announcements regarding major or even complete successes in making up for the losses they have suffered due to sanctions seem exaggerated, the macroeconomic indicators show the Belarusian economy’s considerable resilience to Western embargoes. This resilience is greater than many observers had expected back in the first months of 2022, following the Russian invasion of Ukraine. At the same time, in the longer term, the dynamic growth in imports will pose a serious challenge to Belarus, as they will put increasing pressure on foreign currency reserves. At present these stand at almost $8 billion, which is a relatively safe level; however, the Belarusian economic system’s near-total dependence on Russia poses the most serious risk to Belarus’s economic stability, as Russia is waging a costly war and is also subject to Western sanction packages. All this equates to Belarus gradually becoming another region of the Russian Federation, at least from the economic perspective.

[1] Belarusian statistics do not provide specific figures for individual states, instead applying a useless division into CIS states and non-CIS states. Their low transparency results from the Belarusian leadership’s intention to conceal the real economic situation, which makes it difficult to verify the credibility of the statistics currently provided.