The Adriatic ports: a silent expansion onto the Central European markets

For many years, it seemed that the Adriatic ports would not offer any significant competition to those in the North and the Baltic Seas in their rivalry for Central European markets. However, in recent times investments in port and access infrastructure (including rail), combined with an influx of foreign operators, have significantly accelerated their development, in particular of the Slovenian port of Koper, the Italian port of Trieste and the Croatian port of Rijeka. All three of these ports are gradually bridging the gaps in their infrastructure development. In the longer term this will further boost their potential for expansion onto the Czech, Slovak and Hungarian markets, as well as those of Austria and Germany.

The Adriatic ports have even greater ambitions, as they are preparing for the reconstruction of Ukraine, and expect that this will enable them to make their eastbound transport routes more efficient. Moreover, they intend to increase their cooperation with the Polish market; this will pose serious challenges for Poland’s sea ports, while at the same time creating certain opportunities for them. On the one hand, competition for the Central European markets will intensify. On the other, however, there are realistic prospects that the north-south routes will become more efficient, which in turn will threaten the position of the North Sea ports in this region.

Ports are crucial to each nation’s economy because they ensure supplies of goods and raw materials, and excise duties, tariffs, VAT and port fees are sources of revenue for the state budget. Nearly 90% of the global trade volume is still transported by sea, as this continues to be the cheapest (albeit frequently the slowest) method for transporting goods. The huge role of ports as essential important logistical hubs which guarantee the stability of supply chains was confirmed during the COVID-19 pandemic. The Russian invasion of Ukraine has demonstrated that this critical infrastructure is indispensable for maintaining the security of supplies of both military equipment and armaments, as well as of energy carriers.

The Adriatic ports are expanding

The Adriatic ports are expanding increasingly boldly onto Central European markets, and are beginning to offer serious competition to the ports located on the North Sea shores, such as Rotterdam, Antwerp–Bruges and Hamburg, as well as to the Baltic Sea ports. Containers,[1] which are the most popular method for transporting cargo and the one that generates the biggest profits, are playing an important part in the development plans for the ports of Koper, Rijeka and Trieste. In 2022, a total of more than 2.4 mn TEU[2] (TEU is a measure of volume corresponding to the capacity of one twenty-foot long container) were transshipped there, accounting for almost 80% of the volume of cargo transshipped at all Polish sea ports (around 3.1 mn TEU).[3] Over the last decade, the ports of Koper, Rijeka and Trieste have more than doubled the volume of their transshipment operations (in 2012 they transhipped 1.15 mn TEU), and compared with the pre-pandemic period the volume increased by 20% (2 mn TEU in 2019).

Some of these successes resulted from the ports’ ability to attract the cargo flows bound for German, Belgian and Dutch ports which were affected by congestion (the overcrowding of transhipment terminals) caused by various factors including the COVID-19 pandemic and the ongoing trade union strikes (especially in Hamburg and Bremerhaven), the modernisation of railway infrastructure (in particular in Germany) and the blocking of their capacity due to a sudden increase in imports of coal triggered by Russia’s invasion of Ukraine. The logistical sector relies on tested solutions, which suggests that even when the situation in the northern ports improves, the sector will likely increase the volume of cargo flows transported via the Adriatic ports.

However, the ambitions of Koper, Rijeka and Trieste are much greater. The ports are investing extensively in port and access infrastructure to increase their transhipment capacity to at least a total of 4 mn TEUs by 2025. These projects enjoy the support of those specific governments which are hoping for economic benefits and a significant increase in their tax revenues. The port authorities have already started work on dredging the waterways and widening the quays, building new storage sites and purchasing modern transshipment equipment (such as automatic cranes) to handle larger vessels. In addition, they have begun to expand their access infrastructure (rail and road), and are developing cargo rail connections to foreign markets. Alongside this, at the rear of the ports (in close proximity to them), transhipment terminals (so-called dry ports) are being built to enable faster loading and unloading of cargo.

Individual ports’ areas of specialisation

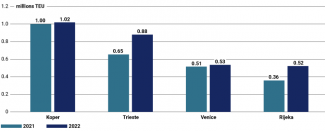

Although the dynamically developing ports of Koper, Trieste and Rijeka have different specialisations and market bases, all three are focused on increasing their container transshipment operations. At present, the port of Koper is the Adriatic Sea region’s leader in this respect: in 2022 it transshipped a record-high volume of more than 1 mn TEU. The port of Trieste, which is located just 20 km from Koper, is the second biggest transshipment facility (878,000 TEU), Venice is the third (534,000 TEU),[4] although it mainly serves the domestic market, and Rijeka is fourth (521,000 TEU).

Chart. Container transshipment operations carried out by the largest Adriatic Sea ports

Source: official statistics (Luka Koper, Autorità di Sistema Portuale del Mare Adriatico Settentrionale, Autorità di Sistema Portuale del Mare Adriatico Orientale, Lučka uprava Rijeka).

The Slovenian port also dominates the Mediterranean Sea basin as regards transshipment of cars. In 2022, it transshipped a record volume of this type of cargo, over 800,000 cars (up 22% y/y). The trend is stable: in Q1 2023 the port transshipped almost 233,000 cars, which is 32% more than in the first three months of 2022. At present, Koper cooperates with the manufacturers of 40 car makes. The contract with the Mercedes-Benz Group AG regarding the export of cars (mainly to China and Singapore) was of key importance for the port. It was signed in 2015 and was renewed twice: in 2017 and in 2019. It enabled the port to become one of the four European harbours (alongside the German ports of Bremerhaven and Hamburg and the Belgian port of Zeebrugge) providing transshipment services to the company’s manufacturing plants located in Europe: it has taken over a portion of the cargo volumes which were previously dispatched via the North Sea ports. In 2021, the contract also enabled it to launch cooperation with Tesla in importing cars produced at the manufacturing facility in Shanghai and exporting the Tesla Model Y cars produced in Berlin.[5]

Trieste specialises in oil transshipment, and has become the leader in this commodity category in the Mediterranean Sea basin as a whole. Although oil accounts for the biggest cargo group transshipped in this port (around 70% of bulk transshipment operations), in 2019–22 its volume fell by almost 12%, from 42 mn tonnes to around 37 mn tonnes. This was due to the global slump in demand for oil caused by the COVID-19 pandemic, and in 2022 also due to EU sanctions imposed on Russian oil supplied by sea. Despite this, the port is an increasingly significant actor in the oil supply chain.[6] One of Europe’s most important oil pipelines, TAL (the Transalpine Pipeline), starts in Trieste. It accounts for 90% of oil supplies to Austria, 50% to the Czech Republic and 100% to southern Germany. At present, the Czech government is modernising this supply route to increase its capacity by another 4 mn tonnes annually. When this modernisation project is completed, the Czech Republic will receive 7–8 mn tonnes of oil via this pipeline annually, which will enable the Czech refineries to meet the country’s entire demand for oil and to become independent of Russian oil imports transported via the southern section of the Druzhba pipeline.

Trieste has consistently attempted to compete with Koper for car transshipment operations. In 2019, it took over a smaller port with a ro-ro terminal (which transships wheeled cargo and vehicles) located in the town of Monfalcone, around 20 km from Trieste.[7] In 2022, Trieste transshipped 337,000 cars, less than half the figure for its Slovenian rival. It had an exclusive cooperation contract with Italian car manufacturers such as Fiat and Alfa Romeo. It also serves as the main port for cars transported from manufacturing plants located in Turkey.

So far, Rijeka has focused on the transshipment of bulk cargoes, mainly coal, grain and iron ores. In 2022, it transshipped a record high volume of cargo (0.5 mn TEU, up 46% compared with 2021). This year, it may likely outpace Venice and become the third biggest port in the Adriatic Sea. These results are mainly due to increased demand on the part of Hungary, the higher volume of trade recorded in Serbia and Bosnia and Herzegovina, as well as the increased capacity of the Adriatic Gate Container Terminal (AGCT) and expanded access to railways.

The Adriatic ports’ growing Central European ambitions

Due to its location and rail and road infrastructure, Central Europe is the natural area of expansion for the Adriatic ports. In particular this involves Austria, the Czech Republic, Slovakia, Hungary, as well as southern Germany and Poland. The limited domestic demand in Slovenia and Croatia is forcing Koper and Rijeka to expand into foreign markets. Trieste, for its part, is not focusing on Italy alone because it uses an old railway connection (dating back to Habsburg times) between the port’s railway system and the railway network in Germany and Austria.

Adriatic ports have an advantage over those in northern Europe, including the Baltics, because they are located at a shorter distance from Asian and African markets, which also translates into shorter (by up to seven days) delivery times. This in turn offers cheaper freight to and from Central Europe, especially for capital-intensive medium- and high-value goods. For example, handling the delivery of cars to be distributed in Poland is important for Koper. Faster transfer of goods via Adriatic ports is particularly beneficial for the transport of foodstuffs between Central Europe and African & Middle Eastern countries. It is easier to guarantee that these products remain fresh and maintain their high quality (for example, this involves the export of Polish apples and the import of Egyptian grapes), especially as Egyptian and Saudi ports have been undergoing a dynamic modernisation.

In 2021, the port of Koper’s main markets were Austria (38% of all transshipment operations), Slovenia (24%), Hungary (12%) and Slovakia (9%); its smaller markets included the Czech Republic (4%), Germany (4%), Italy (2%) and Poland (2%),[8] which are also the target expansion areas for Polish ports. Due to an extensive network of railway connections leading to Central Europe and several transshipment terminals, located mainly in the Czech Republic, Slovakia and Hungary, goods transhipped in Koper reach Poland within just a few days, which makes transit via this route economically favourable.

The port of Trieste mainly cooperates with southern Germany, Austria, Hungary and the Czech Republic. Only around 10% of its cargo is bound for the Italian market. Due to congestion in northern European ports during the COVID-19 pandemic, the Benelux states also became more significant markets for this port. Trieste’s important competitive advantage is its network of regular rail connections, which run in more than 10 directions (including to Germany, Austria and Hungary). The port authorities are increasingly interested in expanding into the Central European markets including the Czech Republic, Hungary, Slovakia and Poland, and also Ukraine in the future. If the Baltic-Adriatic corridor expands to include Ukraine, as is envisaged in the ongoing revision of the TEN-T network,[9] this will enable the Italian ports to increase the efficiency of their eastbound connections, and they will then be able to service a portion of the Ukrainian market. Italy’s minister of economic development Adolfo Urso has openly declared that Trieste and Venice could become “Ukrainian ports”.[10] Containers with Ukrainian-grown rapeseed are already reaching the former port, via routes including Slovakia.

Although Serbia, Bosnia and Herzegovina, Austria, Hungary and Croatia continue to be Rijeka’s key markets, the port is interested in increasing its transshipment operations of goods bound for Central Europe. For this reason it would like to become an element of the Baltic-Adriatic corridor, which already includes the ports of Koper and Trieste, as this could enable it to obtain greater funds for the expansion of its road and rail infrastructure and to improve its connectivity with the centre of the continent. It has launched talks with Brussels with the aim of achieving this goal. So far, Rijeka has only been included in the Mediterranean corridor, which meets the Baltic-Adriatic route in Ljubljana.

A game of interests around the ports

The world’s biggest shipowners and operators have already noticed the growing potential of the Adriatic ports, as have Hungary and the Czech Republic, two landlocked states which view guaranteed access to seaports as a sine qua non of their economic stability.

Shipowners present in Trieste include the global leader, the Swiss-Italian Mediterranean Shipping Company (MSC), and the German Hamburger Hafen und Logistik AG (HHLA) company. The MSC manages the port’s main container terminal, the Trieste Marine Terminal (TMT), and holds an 80% stake in it (the remaining 20% is owned by the Italian T.O. Delta company). It ensures that the port has a favourable network of short-distance connections in the Mediterranean Sea basin, in particular to Turkey, Greece, Israel and Egypt. At present, the terminal’s maximum capacity is 900,000 TEU annually, although in the coming years it is expected to increase up to 1.2 mn TEU, which will enable the port to handle the biggest container ships with capacities of up to 24,000 TEU.

Since 2021, the HHLA has also owned a terminal at the port of Trieste, when it took over a majority stake (50.01%) in the Piattaforma Logistica di Trieste (PLT) multipurpose terminal.[11] Although until recently the two operators were competitors at Trieste, the situation will probably change once the MSC takes over a 49.9% stake in HHLA, which was announced on 13 September. This will also further strengthen the MSC’s position on the European logistical market. The HHLA operates three terminals at the port of Hamburg, as well as terminals in Tallinn and Odesa. It also owns the Czech Metrans company, one of the region’s biggest intermodal carriers. It continues to develop the connections between the PLT and the terminals in Dunajská Streda (Slovakia) and Ostrava (Czech Republic), and from there to other destinations including Budapest and the terminal in Zalaegerszeg, which will be inaugurated in 2024. This will surely trigger an increase in the volume of transhipment operations carried out at Trieste bound for the Czech, Slovak and Hungarian markets. In June 2022, on commission from the French CMA CGM shipowner, Metrans opened a new intermodal connection between Trieste and Slovakia,[12] and since November 2022 the LTG Cargo carrier owned by Lithuanian Railways (LTG) has transported semi-trailers from Kaunas via Poland to Germany, and from there to Italian ports.[13] Since 2021, Poland’s PKP Cargo has also operated a connection from the port of Trieste to the terminal in Gliwice.

As regards Rijeka, the Danish Maersk company has noticed its potential. Through its APM Terminals subsidiary company, the world’s second biggest shipowner has invested in the construction of the Rijeka Gateway container terminal. It has been conceived as the most technologically advanced facility of this type in the northern Adriatic Sea, with a capacity of 1 mn TEU annually.[14] In 2021, Maersk received a licence to operate it for 50 years. The project will be carried out in cooperation with the Croatian Enna Logic company, which was a key goal for the government in Zagreb. The Danish company intends to increase the volume of its transshipment operations in Rijeka bound for Central European markets (mainly the Czech Republic, Slovakia, Austria, Germany and Hungary) as well as the neighbouring states such as Bosnia and Herzegovina and Serbia. The first stage of construction work is expected to end in 2025. The total cost of the investment is estimated at €480 mn by 2026 and Croatia’s state budget revenue from tariffs are expected to amount to at least €180 mn in 2026 alone.

At present, most transshipment operations at the port of Rijeka are carried out at the AGCT terminal, which since 2011 has been 51% owned by the Filipino ICTSI company, the world’s biggest port operator.[15] The terminal can handle up to 600,000 TEU annually. The AGCT has regular train connections on more than 10 routes, to Austria, Bosnia and Herzegovina, the Czech Republic, Serbia and Hungary. The Croatian government has long planned to build another container terminal on the nearby island of Krk, which also hosts an LNG terminal. This move could also significantly boost the port’s competitive position versus Koper and Trieste. However, at present the chances of this investment being implemented in the foreseeable future should be viewed as unlikely, due to the lack of funds to finance it.

Companies from other states in the region are also frequent investors in the Adriatic ports. Czech investors have been present in Rijeka for several months. In March 2023, they purchased a stake in the company which manages the port from the Polish OT Logistics.[16] The new investor is the Port Acquisitions (PA) company, which was established for this purpose shortly after the Polish company announced its intention to sell its stake. It belongs to the Czech CE Industries holding, owned by the well-known businessman Jaroslav Strnad, who has been long active in the armaments industry and has recently expanded into the railway business. The PA intended to purchase the Luka Rijeka company, but has failed to win support for this plan among the company’s Croatian stakeholders; these include the state budget, which holds more than 25% of the shares, and private pension funds, such as Allianz ZB and Erste, which own more than 30% of the shares. They prefer to retain their influence in this strategic state company and the country’s biggest seaport.[17]

The change of key investor will boost Rijeka’s position on the Czech market at the expense of Hamburg, Rotterdam and Koper, which until recently were Prague’s most important partners for cooperation. The decision to carry out this investment was linked to the Czech Republic’s mounting problems with access to Western European ports, in particular those in Germany. These are affected by the insufficient capacity of the rail infrastructure resulting from modernisation work which has been planned to take several years. In August 2022, the Czech Republic’s increasing interest in the port of Rijeka resulted in the launch of the first direct cargo rail connections from the AGCT to the transhipment terminal in Paskov near Ostrava, which is located close to the Polish and Slovakian borders.[18] These connections are operated by ČD Cargo Adria, a subsidiary company of the Czech cargo carrier ČD Cargo, on commission from Maersk. In March 2023, Metrans took over a 51% stake in the Croatian Adria Rail company, including a container terminal in the town of Inđija in Serbia.[19]

The port of Trieste, for its part, has managed to outdistance Koper, and may become the key sea port for Hungary. In 2019, the government in Budapest leased a 32-hectare site at this port for 60 years at a cost of €45 mn.[20] Plans have been made to build a multimodal Adria Gate terminal there by 2026, alongside a distribution warehouse and a railway terminal. Previously, Hungary announced its intention to sign an agreement with Slovenia to build a terminal in the Slovenian port, and to co-fund the construction of another railway line starting at Koper. However, ultimately the Hungarian government decided to invest in Trieste. The construction of the Adria Gate will cost €200 mn, a portion of which (around €45 mn) will come from Italy’s national recovery plan.[21] The new terminal will operate as a free port (in this formula the import and export of goods are subject to less strict regulatory control), which will enable it to collect smaller fees; the importers procuring their goods from non-EU countries will be entitled to an 180-day delay in paying their due tariffs and taxes.

At present, only the Slovenians have failed to express any interest in foreign investors leasing their port’s terminals. The authorities of the port of Koper intend to retain full control of its development, and have greater flexibility in managing the terminals and the warehousing sites. This model is unique: in other Adriatic ports (as in Polish ports) management structures have been formed which supervises the port infrastructure alone and does not interfere in business decisions. However, taking into account the rivalry between the world’s leading shipowners and port operators for influence in the Adriatic Sea basin, it cannot be ruled out that in the longer term the French CMA CGM company, which is the third biggest shipowner globally, will become Koper’s main cooperation partner.

Development still faces obstacles

One weakness of these three ports involves them being unable to handle the biggest container ships, those with capacities of up to 24,000 TEU. At present, they are able to receive vessels with capacities of up to 16,000 TEU, due to the limited depth of their access routes. This is expected to change over the next five years as a result of the implementation of the planned investments, including the Rijeka Gateway project and the expansion of quays and the dredging of waterways at the TMT and PLT terminals and in Koper. However the ports are facing certain limitations, because in order to build the new quays they need to expand into the sea or obtain new pieces of land (as in the case of the Bakar terminals near Rijeka and Trieste taking over the port of Monfalcone).

The port of Koper’s main bottleneck is the railway line to Divača: at present it consists of just one track, with the construction of another track underway (including the cutting of eight tunnels). Once it is completed in 2026, the maximum capacity of this route is expected to increase from around 90 to 200 trains daily[22] and from 14 mn to 37 mn tonnes of cargo annually. The project’s total value is €1.2 bn, of which €153 mn comes from EU funds allocated under the CEF facility, and another €250 mn from the European Investment Bank.

Both road and rail infrastructure continue to pose a problem to Rijeka. Although a motorway runs from the port to the border with Slovenia, on the Slovenian side it changes into a single carriageway national road, which Ljubljana is not interested in expanding. Similarly, the main railway line leading to Zagreb, which was built in 1873, has not been adjusted to the port’s needs. At present, around 25–30% of cargo transshipped at the port is transported by rail; this proportion is among the EU’s lowest. Koper handles 47% of containers in this manner, compared to 51% for Trieste. For many years the government has planned to build a so-called lowland railway line from Rijeka via Zagreb to Botovo near the Hungarian border; it is scheduled for completion by 2035. Chinese investors had previously expressed an interest in this project. However, the European Commission emphasised the risk that it would fail to turn a profit, and in 2015 a €241 mn subsidy was allocated just for the construction of another track and the modernisation of a 42-km long section of the existing track (Križevci–Koprivnica–Botovo), which accounts for around 15% of the ultimate planned length of this railway line. This initiative is expected to be finished in April 2024, although it is almost certain that the Croatian government will not manage to utilise any EU funds for this purpose.[23] It will need to spend another around €40 mn to complete the project.

Outlook

The Adriatic ports are increasingly competing with the Polish ones, and are dynamically investing in new quays and terminals as well as in access infrastructure. Due to the modernisation of the railway lines running via Slovenia, which is expected to be completed by 2026, the options for cargo transport from Koper, and also from Trieste, to the Czech Republic, Hungary, Slovakia and even to Poland, will improve significantly. In addition, due to hydrogeological conditions, none of the Adriatic ports is capable of handling the biggest container ships, unlike the ports on the Baltic. However, this too is expected to change. Koper, Rijeka and Trieste’s main advantage over the Polish and North Sea ports involves an around seven- to eight-day shorter duration of cargo transport between Europe and Asia, and their tendency to increase the number of so-called short-sea (short distance) connections in the Mediterranean Sea basin.

Russia’s invasion of Ukraine has also had an indirect effect on the development of the Adriatic ports. Until recently, they did not generate major profits from the transport of Ukrainian-grown grain because the transshipment of coal brough them much higher revenues. Moreover, some shipowners diverted a portion of their cargo from the Romanian port of Constanța to the Adriatic ports, fearing problems with transporting cargo across the Black Sea, which was an additional source of revenue for Koper, Rijeka and Trieste. However, they generated the biggest revenue due to the congestion in northern European ports. In the context of the investments planned by the biggest market players such as the MSC and Maersk, this will only toughen the competition for the Central European market.

New opportunities for co-operation between the Baltic and the Adriatic ports may emerge if both sides seek to improve the north-south connections. This in turn could enable faster cargo freight, which could open up an alternative to the Atlantic and North Sea routes; the port authorities of Szczecin-Świnoujście and Venice have recently signed an agreement to this effect. This move may also open up new possibilities for transporting cargo (especially foodstuffs) from Adriatic ports by rail to Polish ports and then on to Scandinavia. The establishment of permanent rail connections and the construction of efficient logistical chains could also increase the attractiveness of the Baltic and the Adriatic ports at the expense of those located on the North Sea shores. As an element of cooperation within the Three Seas Initiative, this strategy could boost the position of the Baltic and the Adriatic ports on the Central European markets, which to a great degree are still served by German, Belgian and Dutch ports.

Map. Main transport routes connecting the ports of Koper, Rijeka and Trieste with the Central European states

Source: the author’s own analysis, based on the maps of the TEN-T core network corridors (transport.ec.europa.eu), Rail Net Europe (rne.eu) and Interreg Central Europe (interreg-central.eu).

[1] This is a relatively new cargo freight method. Container freight dates back to the 1950s. Although initially containers were only used in sea freight, over time they began to be used in rail, road, and most recently inland navigation. At present, around 90% of packaged goods (single cargoes, usually of a relatively small size and weight, which are transported in packages or in bulk) are transported in containers. This method of freight is used for transporting foodstuffs, grain, furniture, household appliances, electronic devices, medicines, textiles and even cars (albeit less frequently).

[2] Figures regarding the ports of Koper, Rijeka and Trieste quoted from the following websites: luka-kp.si, portauthority.hr, porto.trieste.it.

[3] As a result of the Baltic Hub investment, in 2022 the port of Gdansk alone handled 2.1 mn TEU, the port of Gdynia 914,000 TEU, and the Szczecin and Świnoujście port complex 75,000 TEU.

[4] Figures published by the port of Venice, port.venice.it.

[5] ‘Tesla exports first cars from Shanghai since reopening plant – media’, Reuters, 11 May 2022, reuters.com.

[6] See K. Dębiec, ‘The TAL is expanding: the Czech Republic is gaining independence from Russian oil supplies’, OSW, 7 December 2022, osw.waw.pl.

[7] ‘Trieste, the Authority acquires the Special Agency for the Port of Monfalcone’, Compagnia Portuale S.r.l., 15 July 2019, c-p-m.it.

[8] ‘Luka Koper – Port of Koper’, Wirtschaftskammer Österreich, 2022, wko.at.

[9] ‘Commission amends TEN-T proposal to reflect impacts on infrastructure of Russia’s war of aggression against Ukraine’, Directorate-General for Mobility and Transport, 27 July 2022, transport.ec.europa.eu.

[10] ‘Urso, per l'export dell'Ucraina i porti di Trieste e Venezia’, ANSA, 26 April 2023, ansa.it.

[11] ‘HHLA completes Trieste’s terminal majority share acquisition’, Container News, 8 January 2021, container-news.com.

[12] ‘New weekly connection between terminal in Trieste and Central and Eastern Europe’, Metrans, 22 June 2022, metrans.eu.

[13] M. Raimondi, ‘LTG Cargo starts tests for Kaunas-Duisburg-Trieste service’, RailFreight.com, 9 November 2022.

[14] M. Glavan, ‘Rijeka Gateway bit će prvi kontejnerski terminal na Jadranu s daljinski upravljanim dizalicama’, Novi list, 30 March 2023, novilist.hr.

[15] ‘ICTSI wins Rijeka port in Croatia’, International Container Terminal Services, Inc., 2 March 2011, ictsi.com.

[16] ‘Kraj dileme: Riječku luku preuzimaju Češi’, Morski.hr, 30 March 2023.

[17] M. Glavan, ‘Država Česima neće prodati svojih 25 posto dionica Luke Rijeka. Što sada?’, Novi list, 25 May 2023, novilist.hr.

[18] Ch. Perlegka, ‘Maersk launches first Rijeka-Czech Republic direct cargo rail service’, Container News, 11 August 2022, container-news.com.

[19] I. Kontos, ‘Metrans acquires 51% stake in Croatian Adria Rail’, Container News, 3 April 2023, container-news.com.

[20] ‘Hungary to establish maritime port in Trieste’, Ministry of Foreign Affairs and Trade of Hungary, 5 July 2019, kormany.hu.

[21] M. Raimondi, ‘Budapest has a new gateway service to the Adriatic seaports’, RailFreight.com, 14 April 2023.

[22] N. Papatolios, ‘Koper-Divača rail line financing takes final and cheaper than expected form’, RailFreight.com, 31 May 2023.

[23] ‘Propast će 40 milijuna eura iż EU fondova za prugu Dugo Selo-Križevci’, Bloomberg Adria, 18 June 2023, hr.bloombergadria.com.