Security trumps growth. China’s economy heading into 2024

- China’s ‘economic miracle’, understood as a decades-long period of world-leading GDP growth, has come to an end. The Chinese government’s main priority has shifted from supporting economic activity to strengthening the country’s economic security and preparing for a potential conflict with the US.

- The current problems stem from a cumulation of several factors: the costs of the existing development model, the deteriorating public mood, the deepening crisis in the real estate sector and weakening foreign demand. However, China does not face a crisis typical of market economies, but rather a repeat of the Japanese scenario, namely prolonged stagnation.

- The economic slowdown does not mean that Chinese companies will become less competitive or that China’s political influence on the international stage will wane. The industrial sector, in particular the green energy and automotive sectors, has taken on a central role in the Chinese economy. This has led to further overcapacity, which poses a threat to other economies.

As the current economic model runs out of steam and relations with the US and the European Union become increasingly strained, China’s leader Xi Jinping has redefined the priorities of China’s economic policy. Now, the Chinese government’s main objective is to strengthen the country’s security and reduce its susceptibility to foreign influence. The government’s efforts are no longer focused on stimulating economic activity, but on pursuing self-sufficiency in sensitive areas such as technology, energy and food production. As a result, China’s GDP growth rates have slowed and the era of its ‘economic miracle’ has ended. The Chinese economy’s performance in 2023 has confirmed this, signalling that Xi Jinping’s vision faces both costs and obstacles.

GDP follows the party line

Excluding the period of the COVID-19 pandemic, China’s GDP growth last year was the lowest since 1990. This points to a structural economic slowdown aggravated by the current problems,[1] but it also suggests that the Chinese government has accepted a lower rate of expansion. Indeed, its main priority now is to strengthen the country’s economic security through measures such as promoting domestic industry and exports.

Premier Li Qiang’s announcement in Davos that China’s GDP growth was 5.2% in 2023 has been cast into doubt, although the country’s economic dynamics have actually increased after the government dropped its ‘zero COVID’ strategy in late 2022. According to the bureau of statistics, China’s GDP growth was 3% in 2022. However, the credibility of these calculations is low and the actual rate of growth is unknown. Analysts have offered markedly different assessments. Estimates for China’s GDP growth in 2023 compiled by Bloomberg have ranged from 1.5% to 7.2%.

The fundamental problem in assessing the growth rate for 2023 is the basis for comparison: the results from the pandemic-affected year of 2022. The official statistics for that year were probably inflated given the sharp slowdown in the second and fourth quarters due to successive waves of COVID-19. It is unlikely that China’s GDP grew by 3% in 2022 and 5.2% a year later. At least one of these two figures must be off the mark. Contrary to the official data, economic growth in 2022 most likely hovered around 0% and in 2023 was also lower than before the pandemic, when it was reported to have regularly exceeded 6%.

The GDP indicator has for years been a tool of the Chinese government’s internal and external propaganda. As the primary gauge of economic health, China has used it to demonstrate its successes under the Communist Party’s rule. Economic studies have proven that Chinese statisticians have been manipulating the size of the GDP deflator (a measure of how prices change in the economy) and thus adjusting the nominal value to the desired real value, which is commonly compared internationally.[2] In the past, there have been outright allegations that this indicator was falsified.[3] Moreover, the reported GDP growth is a cause rather than an effect of economic activity as every year the government sets the expected growth rate for the next period. As a result, some of this activity is not driven by economic motivation and is therefore unproductive.

In March, the Chinese government will announce a growth target of around 5% for 2024, similar to the one last year. It will be more difficult to reach this ceiling this year due to the base effect—the benchmark for 2023 was the pandemic-affected year of 2022, when economic activity was subdued. On the other hand, declines in the property sector are likely to be less pronounced in 2024.

In 2023, the United States’ advantage over China in the ranking of the world’s largest economies widened to its highest level since 2008: US GDP was around $9.5 trillion larger than China’s. In nominal terms (calculated in current prices, ignoring the inflation rate), China’s GDP rose by only 4.6%. With the exception of 2020, this was its worst performance since 1976. In dollar terms, it fell for the first time since 1987. This does not mean that Chinese companies will become less competitive or that China’s political influence in the international arena will wane. GDP does not fully reflect a country’s strength or global standing. The wider gap between the US and China primarily stems from a weaker yuan and a rapid expansion of the US economy. However, America’s nominal GDP growth rate is likely to weaken in the coming years while China’s currency is expected to stop depreciating sharply, so the US advantage will not increase any further.

China struggled with deflation last year. While the CPI (which illustrates changes in the prices of consumer goods) rose marginally, the corresponding benchmark for producer prices and the aforementioned GDP deflator were already negative. This situation brings to mind the problems of the Japanese economy, which plunged into stagnation in the 1990s following decades of rapid growth. It has also prompted many economists to call on the Chinese central bank to ease monetary conditions. Falling prices are eroding nominal income and increasing the value of debt in real terms, which further discourages new borrowing and favours spending cuts. This translates into even slower economic growth and puts additional downward pressure on prices, fuelling a vicious circle that is fairly challenging to break.

In the case of China, as previously in Japan, a more expansionary monetary policy would fail to solve the problem and even be counterproductive. The flow of cheaper money would go mainly to companies and raise production capacity more than consumption. The surplus of supply over domestic demand would widen, leading to greater downward pressure on prices. The current monetary conditions are already lax and the main barrier for potential borrowers is not the high cost of money, but their reluctance to incur debt in the face of a worrying economic outlook.

Meanwhile, China’s debt has increased by the greatest margin ever. Aggregate financing to the real economy rose by a record 33.9 trillion yuan last year, or almost 27% of the country’s GDP. According to official data, they reached 299.9% of GDP at the end of 2023. It took 6.7 yuan of new debt to generate one yuan of GDP growth. In the last two decades, only 2020 saw a worse balance reported. In China, where the government has a considerable influence on the volume and direction of lending, a significant increase in debt implies that Beijing has been stimulating the economy.

The high and rapidly growing debt poses a threat to the country’s financial stability and suggests that spending has been economically inefficient. Other benchmarks indicate that China’s liabilities relative to its GDP have doubled over the past 15 years, rising from around 140% to over 300%. This is a very high level of debt for the Chinese economy’s relatively low level of development (see Chart 4). The broad stream of money has been driving investment and powering the country’s GDP. However, this economic model has become increasingly ineffective as it has required more and more money to achieve similar results. History shows that periods of rapid debt accumulation are followed by episodes of correction – either in the form of a crisis, as in the US, or stagnation lasting for several years, as in Japan. However, for Xi Jinping stability is paramount as the foundation of security and resilience to external influences.

A weak labour market and pessimistic consumers

The Chinese government faces a difficult task to improve the public mood, which is currently a major barrier to economic recovery and growth in domestic consumption. The Chinese population remains pessimistic in the face of a relatively low rate of income growth, a challenging labour market and a real estate crisis. Official data shows that last year, for the second year in a row, disposable income for households rose significantly more slowly than before the pandemic. In urban areas it continued to grow more slowly than the country’s GDP. For the first time since at least 2014, the median rose less than the average, meaning that high earners benefited more.

The average unemployment rate reported by the bureau of statistics fell from 5.6% in 2022 to 5.2% in 2023. However, these figures do not include internal migrants who have been forced to return to the countryside, for example due to a lack of jobs, or those who work fewer hours than they would like. China has also resumed the publication of unemployment figures for the 16–24 age group following a hiatus of nearly six months. After revising the calculation method, its statisticians put the youth unemployment rate at 14.9% in December compared to 21.3% in June.[4] Due to the methodological changes, these figures are not directly comparable. Moreover, this phenomenon is strongly seasonal since unemployment rises during the holiday season before falling in subsequent months. As a result, it is difficult to assess whether there has been an improvement in the situation of young people in the labour market.

Data on income and the situation on the labour market is one of the sensitive statistics that the Chinese government publishes. It can also be manipulated since it concerns issues that are fundamental to the population. Consequently, economists have raised doubts about these data, especially as in recent months the state and party organs have been vocal in calling for “strengthening economic propaganda and public opinion guidance”, and “promote a positive narrative about the bright prospects of the Chinese economy”.[5] Therefore, it is worth looking at more niche statistics, including those collected by private entities. These stand in contrast to the official message.

A survey conducted by the central bank found that in the second quarter of 2023, the proportion of households that reported falling income was higher than those who felt that their income had increased. In the following months, reports on this subject were no longer being published. According to data from the Zhaopin recruitment firm, average wages in major cities fell in the second, third and fourth quarters of 2023 compared to 2022; this was the first time since at least 2016 that salaries decreased in three consecutive quarters. Employment sub-indices from PMI surveys conducted by the bureau of statistics have shown that the number of jobs decreased in eleven out of twelve months last year. According to data from Paris-based QuantCube Technology, the number of job offers posted online from July to November was around 40% lower than a year earlier. China Labour Bulletin, a Hong Kong-based NGO that promotes and defends workers’ rights in China, has reported that 2023 saw the highest number of protests in seven years “amid mass layoffs, wage cuts and company closures”.

In 2023, Chinese people continued to accumulate massive savings amid high uncertainty. Households increased their deposits by 16.7 trillion yuan, just over one trillion yuan less than in the record year of 2022. This was due to several factors, including growing concerns about the current health and future of the economy and personal finances, stable prices of consumer goods, and depreciating investment assets such as real estate and stocks.

Consumption increased, but more modestly than expected. Economists had assumed that deposit growth would be considerably slower after the government dropped its ‘zero COVID’ strategy, and that Chinese people would spend the excess funds they had accumulated during the pandemic on consumer goods and services, as was the case in the US and the EU. Instead, retail sales increased by only 7.2% after falling by 0.2% the previous year. This was the slowest growth in the more than 20 years that preceded the outbreak of the pandemic.

Low consumption has been a problem in China for years, reflecting the extreme imbalance of its economy, in which investments play an exceptional role. As a result, Chinese people have enjoyed limited benefits of the country’s GDP growth. Chinese household consumption has remained below 40% of the country’s GDP, while in Germany it is over 50% and in the US it is around 70%. The Chinese government has long pledged to encourage consumption, but its words have not been followed by action.[6] Currently, its main priority is to strengthen the country’s economic security. It has sought to achieve this goal through investment and industrial production. Thus, the government has in fact partly returned to the old economic model, with one difference being that it has greatly increased its spending in the energy sector instead of encouraging investment in real estate. Exports are a side-effect of capacity expansion that enables private companies to make a profit.

A deepening crisis in the real estate market

The real estate crisis deepened last year as prices and sales of homes, capital expenditure and the number of construction projects started all decreased. The government’s efforts failed to stabilise the situation. Country Garden, the former leader on the Chinese market, joined the ranks of developers who defaulted on their obligations. In late January 2024, a Hong Kong court announced the liquidation of Evergrande Group, a company that became the symbol of this crisis. State-owned companies began to play a central role in the market, occupying the top six spots in the ranking of the country’s largest developers in 2023.

The real estate sector has played a key function in the Chinese economy over the years. Together with related industries, it has accounted for around 25% of China’s GDP. Homes form a major part of Chinese people’s assets while the sale of land use rights provides the financial basis for the local authorities’ residual independence from the central government. Real estate, as collateral for creditors in the event of a debtor’s insolvency, is also an important asset for the financial sector. The protracted crisis in the real estate sector has had a negative impact on Chinese people’s financial situation and mood and has also hamstrung the economic rebound after the ‘zero COVID’ strategy was dropped in late 2022.

In 2024, the situation in this sector should slowly stabilise, but its heyday is definitely over. Sales have plunged so low that they are now close to the level of the population’s actual demand for homes as places to live. Local authorities have been working strenuously to stem the crisis, and the government in Beijing has increasingly embraced and supported these efforts. However, this does not mean that it wants to see this sector return to its glory days. Xi Jinping’s main goal is to strengthen the country’s economic security. The excessive growth of the real estate sector and the soaring housing prices pose a threat to this plan as they tie up resources and can potentially destabilise the country both financially and socially. High housing prices are making it difficult to start families, which has translated into a shrinking birth rate and exacerbated China’s demographic crisis.[7]

Trade and exports: the Chinese economy’s new (old) engine

Data on foreign trade, rather than on China’s GDP growth, is crucial from the perspective of other countries, including those in the EU. This is because the external trade balance, rather than GDP dynamics, determines whether an economy supports or hinders global growth. China is not an engine of economic growth, because it maintains a very high trade surplus. It adds to global GDP in the simple arithmetical sense, but not by actually contributing to the economic expansion of other countries. China primarily imports raw materials, but exports processed goods. In 2023, its trade surplus in manufactured goods stood at around 10% of the country’s GDP and 2% of the world’s GDP. This is less than in 2022, but still more than any period before that.

In 2023, China’s trade surplus narrowed slightly to $823 billion from $838 billion the previous year. However, it remained significantly higher than before the outbreak of the pandemic. While its exports and imports fell in dollar terms, this was largely due to the US currency’s appreciation and lower prices of commodities and raw materials after a period of rapid growth.

The yuan’s depreciation last year helped to make Chinese exports more competitive. In early September, the Chinese currency traded at its weakest against the dollar since 2007. This reflected investors’ assessment of the Chinese economy’s health and prospects. In the face of numerous problems, the People’s Bank of China has pursued a cautious, expansionary monetary policy. This set it apart from other central banks last year but it is expected to be the mainstream this year.

The government’s efforts to reduce China’s dependence on foreign countries and deepen their dependence on China have driven it to increase the production capacity and competitiveness of domestic companies while reducing the demand for imported goods. China has been rapidly boosting its spending on the development of selected areas of the economy, including renewable energy and the production of electric cars. In 2023, it increased its investment in the production of electrical machinery and equipment by more than 32%, In the generation and supply of electricity and heat the increase was over 27%, and in the automotive sector it was nearly 20%.

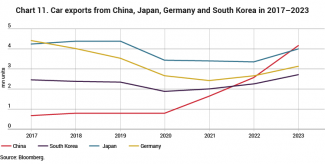

The domestic market has absorbed most of this production, but it is so large and the expansion to foreign markets is so profitable that the pressure to boost exports has been growing. In 2023, China became the world’s largest exporter of cars while the Chinese manufacturer BYD emerged as the global leader in sales of electric cars in the fourth quarter. More photovoltaic panels were installed in China in just one year than the total capacity installed in any other country. Chinese companies already control more than 80% of the global solar panel supply chain and their exports have been growing by the tens of percent a year.

Tensions in China’s relations with other countries resulting from Beijing’s pursuit of its policy priorities will escalate, especially in the context of the US and EU elections in 2024. China has been working to enhance its economic security and stimulate economic activity by investing in the expansion of its production capacity and energy infrastructure. This has inevitably led to the substitution of some imports with domestic production and the export of industrial surpluses abroad. Imports of competitive goods from China make consumers happy, but run the risk of their countries becoming dependent on supplies and of local producers being squeezed out of the market, which results in job losses.

Therefore, the governments of many countries have been stepping up their efforts to restrict the inflow of sensitive goods from China. This is particularly true of sectors that account for a significant share of their economies and which are important for the energy transition and crucial for public security.[8] The electric car industry, which combines all of these aspects, is a prime example here. The US has already imposed high tariffs on imports of cars from China. The EU has launched an anti-subsidy investigation into electric cars from China, which should lead to similar decisions. Both the US and the EU have taken action not only to protect their markets, but also to boost the domestic production of: electric cars and their components; semiconductors; and products for generating energy from renewable sources.

[1] See M. Kalwasiński, ‘Disappointing post-COVID-19 recovery. China on the path of a protracted slowdown’, OSW Commentary, no. 522, 7 July 2023, osw.waw.pl.

[2] E. Kerola, ‘In Search of Fluctuations: Another Look at China’s Incredibly Stable GDP Growth’, BOFIT Discussion Paper No. 23/2018, 27 December 2018, papers.ssrn.com.

[3] S. Rabinovitch, ‘China’s GDP is “man-made”, unreliable: top leader’, Reuters, 6 December 2010, reuters.com.

[4] See M. Kalwasiński, ‘Youth unemployment in China hits record-high levels’, OSW, 3 August 2023, osw.waw.pl.

[5] Statement following a meeting of the Central Economic Work Conference, ‘中央经济工作会议在北京举行 习近平发表重要讲话’, 12 December 2023, gov.cn.

[6] See M. Kalwasiński, ‘Disappointing post-COVID-19 recovery…’, op. cit.

[7] See M. Bogusz, ‘A disaster of their own making. The demographic crisis in China’, OSW Commentary, no. 570, 7 February 2024, osw.waw.pl.

[8] See P. Uznańska, ‘The EU clashes with Beijing: the EU-China summit’, OSW, 13 December 2023, osw.waw.pl.