The effect of the sanctions: the Russian LNG sector’s problems

The successive moves to tighten the Western sanctions regime targeting the Russian LNG sector have aggravated the problems affecting it as it faces major difficulties which are jeopardising its further development. The technology embargo and other restrictions have resulted in delays in the construction of new liquefaction installations and in the multiplication of challenges regarding logistics and funding. The sanctions are also generating additional costs for the state and reducing its gas revenues.

Russian decision makers view the development of the LNG sector as an opportunity to become independent of the infrastructural and political constraints on the transport of gas via pipelines. As a result of the Kremlin’s decisions, Gazprom has lost a significant portion of the European market, while the prospects for redirecting its gas supplies to Asian markets remain uncertain. In this situation, the need to expand Russia’s LNG export capacity seems to be all the more urgent. Therefore, the problems faced by the LNG sector are negatively affecting the future of Russian gas exports as a whole.

In the context of the ongoing Western debate on moves to further toughen the sanctions against the Russian Federation (RF), the measures which could be taken to slow down the growth of Russian LNG exports are worth considering. Aside from imposing further sanctions on companies involved in these exports, an EU-wide embargo on Russian LNG would be justified. Considering the expected increase in the global LNG supply in the next two or three years, abandoning LNG imports from the Russian Federation is possible. This decision could eliminate Europe’s dependence on the Kremlin in this sphere (Russian LNG accounts for almost 14% of the EU’s total LNG imports), mitigate the threat of the Kremlin using this dependence as an instrument of political pressure, and bring the European Union closer to its declared goal of abandoning Russian supplies as of 2027.

The increase in the importance of Russian LNG

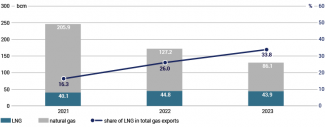

Prior to 2022, the importance of the LNG sector to the Russian state budget was relatively small, despite the Kremlin’s plans to radically increase the volume of LNG exports. This was due to both the tax reliefs offered to companies involved in developing this sector,[1] and the relatively small share of LNG in Russia’s total gas exports. In 2021, the RF exported 40.1 bcm of LNG and more than 200 bcm of pipeline gas. LNG thus accounted for 16% of Moscow’s gas exports.

The last two years have seen a significant increase in the importance of LNG to the Russian economy. In 2023, this type of gas accounted for a third of Russia’s total gas exports. Paradoxically, this was not due to a rise in the volume of exported LNG, but to a radical drop in the sale of pipeline gas. Starting from 2021, the Kremlin unilaterally reduced the volume of gas exported to Europe in order to provoke an energy crisis in the EU. As a consequence, in 2023 Russia exported 116 bcm of gas less than in 2021. This reduction in the volume was only recorded for West-bound gas exports.

Chart 1. Russia’s natural gas and LNG exports in 2021–2023

Source: the author’s own analysis based on data compiled by the Ministry of Energy of the RF.

Moscow’s decision to reduce the volume of gas sent to the West, combined with the EU’s gradual abandonment of Russian supplies, have contributed to a major drop-off in pipeline gas exports. In this situation, as Russia’s prospects for redirecting the ‘lost’ volumes to other markets are still unclear, the Kremlin has been confronted with the need to seek new routes for its gas exports.

At present, no rapid increase in pipeline gas exports to Asia is possible due to the lack of connections between the pipelines which transmit gas from the fields in western and eastern Siberia, and also to the insufficient capacity of the export pipelines leading to China and Central Asia. In this context, an expansion of liquefaction capacity and the related increase in the sale of LNG could offset the fall in pipeline gas exports.

Russian decisionmakers view LNG exports as an opportunity to enter the global market without having to overcome certain infrastructural and political obstacles. The Kremlin is aware of the need to expand this sector, and this has prompted it to launch unprecedented actions to spur this process. For example, it plans to boost the liquefaction of gas drawn from the transmission system, which will undermine Gazprom’s current market position.[2] Since 2023 Russia has increased the tax rates applied to LNG exporters, which is proof of this sector’s increasing importance to the Russian state.[3]

The global LNG market situation is an obstacle for Russia

When exporting LNG via maritime routes using gas carriers (special vessels for transporting LNG), the exporter can choose their client more freely because the flexibility on the global market enables them to redirect the exports to those locations which report demand and accept the origin of this LNG. However, the present situation regarding LNG transport is unfavourable to Russia. While the structural characteristics of the global oil trade (the large supply of oil tankers, the presence of traders operating outside the Western financial system, the operation of the ‘shadow fleet’ which transports oil, for example from Iran and Venezuela) have enabled Russia to mitigate the impact of the sanctions on the volume of its oil exports, similar attempts in the case of LNG, such as hiring companies which are ready to bear the sanction-related risk to transport LNG, will not be as effective. There are several reasons why this is the case.

Firstly, the global number of gas carriers is much smaller than that of oil tankers. In 2023, 668 LNG transporting vessels were active, while almost 9000 vessels transport oil and petroleum products.[4] The relatively small LNG transport fleet reduces the prospects for establishing alternative supply chains which would involve traders and ship owners who are ready to operate in the ‘grey economy’. In addition, the limited number of gas carriers makes it easier to identify those vessels which would violate potential sanctions.

Secondly, the logistical routes on the LNG market are not as flexible as those on the oil market because oil tankers can modify their destination during their voyage or moor offshore for a long time, whereas the vessels transporting LNG do not have such freedom (expanding the transport route using the cargo transported as a fuel to power the ship’s engine is more difficult because the vaporised form of this gas would need to be used).

Moreover, the technical specification of LNG unloading operations makes it more difficult to conceal the cargo’s origin by carrying out secret actions such as ship-to-ship transfer (LNG transshipment in the open sea from one vessel onto another in order to circumvent sanctions). In this context, the geographical location of LNG liquefaction facilities in Russia is of a certain importance because it additionally reduces the flexibility of the supplies. To transport LNG from the installations located beyond the Arctic Circle (Yamal LNG, Arctic LNG 2), vessels capable of operating in freezing waters need to be used, and the number of these is limited.

Thirdly, global LNG supplies mainly rely on long-term contracts, which additionally reduces the potential for the emergence of a ‘grey economy’.

Technological backwardness

The actual expansion of Russia’s liquefaction capacity and the consecutive increase in LNG exports will not be easy to achieve, due to the technological backwardness of Russian systems. The sector’s current dependence on Western know-how is the main problem, as evidenced by the liquefaction facilities currently operating in Russia. All the currently working production lines rely on Western technology, which cannot realistically be replaced with domestic or non-G7-made equipment. The installation which operates at the Yamal LNG facility is an exception: while it does indeed use Russian-made technological solutions, it continues to depend to a great degree on imported components.[5]

In order to increase the sanctions regime’s effectiveness, the Western decision makers have been taking into account Russia’s technological backwardness and the specificity of its market. Cutting Russia off from Western technology has slowed down the pace of work on boosting the capacity of large-scale liquefaction facilities. Contrary to the government’s declarations back in 2021, Russia has not managed to achieve the goals it assumed. These included a plan to reach the production capacity of 46–65 mn tonnes of LNG annually by the end of 2024, while the present actual nominal capacity stands at around 35 mn tonnes annually (including the first line of the Arctic LNG, which since the beginning of this year has been operating at just 50% of its capacity).

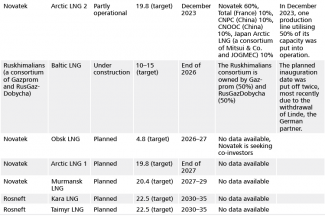

The technological embargo has forced Russian LNG producers to postpone their deadlines for putting the liquefaction facilities into operation. Effectively, this may equate to abandoning the construction of some of them. Gazprom has once again announced its decision to put off the launch of the operation of the first line of the Baltic LNG (which is a joint project between Gazprom and RusGazDobycha) from 2023 until 2026,[6] and even that seems to be an optimistic scenario. This decision was motivated by the withdrawal from the project of the German Linde company, which was acting as both the general contractor and the provider of technology.

In line with the Russian leadership’s assumptions, domestic companies are expected to replace Western contractors in the field of technology. Thus far Novatek, which is Russia’s biggest LNG exporter, has patented two liquefaction technologies, one of which has already been implemented (it is unclear to what degree it relies on Russian-made components). It should be noted in this context that the capacity of the liquefaction line which uses this technology stands at a mere 900,000 tonnes of LNG annually, and no domestic solution has been implemented on a large scale. This raises doubts regarding their commercialisation in the short term. Suffice it to say that the plans for facilities which rely fully on domestic technology are still at the design stage.

Moreover, due to the ban on cooperation with Western companies, Russia faces infrastructural and logistical obstacles which have forced them to modify their concepts for these installations. The Murmansk LNG project is facing the consequences of the technological embargo imposed on Russia, and as such is the best example of this situation. Due to the unavailability of Western-made gas turbines, the facility is to be powered by electrical energy provided directly from a power plant. The assumptions of this project have contributed to the emergence of a conflict between Novatek and Gazprom over various issues, including the decision which company should finance the construction of a pipeline leading to the installation.[7]

Another problem involves the gas carriers which transport the sector’s production. Due to the sanctions, Western shipyards and companies involved in the provision of specific components for these vessels have withdrawn from cooperation with Russia or broken off their contracts.[8] Thus, even if new LNG facilities are put into operation, their production may be deliberately reduced due to the limited possibilities for transporting the LNG liquefied there.

‘Tailor-made’ sanctions

In 2023, selective sanctions introduced by the US further exacerbated the sector’s problems. The US decision to put specific companies involved in Russian LNG exports on the sanctions lists has created numerous problems for Russia; for example, it disrupted the transport logistics for the LNG produced by the Yamal LNG facility. The installation’s geographical location beyond the Arctic Circle has aggravated the problem. In order to reduce the transportation costs, a plan was devised regarding trans-shipping LNG in the open sea from vessels which are capable of operating in these regions (Arc 7 ice-class gas carriers equipped with a reinforced hull to break the ice) onto standard vessels.

For this purpose, floating storage units (FSUs) are used as floating LNG ‘storage facilities’, from which the LNG which was transported from the installation is collected. The US restrictions cover the companies which manage these units; this has disrupted the collection of LNGs, as secondary sanctions may be imposed on the Western ship owners who collect cargo from these FSUs. Selective restrictions have also been imposed on companies involved in work on the Baltic LNGs which were expected to provide technological components for this project.[9]

Moreover, in 2023 the US took an unprecedented step when for the first time it put a specific company which manages a Russian LNG facility, the Arctic LNG 2, on the sanctions list.[10] In light of the relevant legislation, the involvement of any company in any stage of a specific project’s value chain (technological and logistical cooperation, collection of LNG) is viewed as a reason for punishing this company with secondary sanctions. As a result of this restriction, Novatek announced that an instance of force majeure had occurred in this project.[11] The first line, which was put into operation at the end of 2023, is now running at only 50% of its capacity, for reasons including the need to make a technological modification resulting from the unavailability of Western-made turbines[12] and limited access to gas carriers. The dispatch of the first batch of LNG produced at this facility, which was planned for January 2024, has now been postponed, and will most likely happen no sooner than March.[13]

According to media reports, due to the sanctions imposed on the installation, foreign investors have suspended their participation in this project; this will most likely result in it being unable to carry out long-term contracts resulting from its stakeholder structure.[14] As a consequence, the gas produced by Arctic LNG 2 will need to be sold on the spot market, which further reduces the prospects for exporting the planned volumes of the facility’s output (19.8 mn tonnes annually), and casts doubt on the viability of continuing the construction of the other two production lines. The fact that Chinese companies have also invoked force majeure[15] suggests that the Western sanctions are making it increasingly difficult for the Russian LNG sector to obtain foreign capital, because it has become ‘toxic’ to non-Russian contractors.

Further possible sanctions

Considering the declared aim of the sanctions, which is to prevent Moscow from funding the hostilities in Ukraine, the sanctions targeting the Russian LNG sector have proven effective, and they may be especially so in the longer term. The Russians are aware of the political limitations linked with exporting pipeline gas to Europe, and have made attempts to circumvent these obstacles by liquefying gas drawn from the transmission system (this approach has already been launched at the Baltic mid-scale facilities, and similar plans have been made for the Murmansk LNG). The reduced pace of work on developing new liquefaction installations has confronted the Russians with unfavourable prospects for returning to the previous volumes of gas extraction, and thus for ‘regaining’ the lost export revenues from sales of gas (in 2023 these recorded a decrease of almost 50% y/y, that is more than 1.7 tn roubles or around $19 bn).

Thus far, the effectiveness of the sanctions imposed on the Russian LNG sector has resulted from the small degree of independence of LNG exporters in the value chain as a whole. However, Russia will make further attempts to make itself independent of the West in this field, as evidenced by state-funded investments in developing domestic technological components, and by cooperation with Chinese companies (for example, providers of gas turbines).[16] If this happens, the effectiveness of the Western sanctions regime will fall, as it did in the case of the oil and fuel sectors. Thus, it is necessary to step up pressure at this point in order to prevent Russia from becoming increasingly independent in this context.

In addition, some importers pay for Russian LNG using Western currencies; the proceeds of these transactions are an important source of foreign currencies in the context of Russia’s attempts to abandon dollar- and euro-denominated payments for its hydrocarbon exports (for example by forcing the recipients of pipeline gas to make their payments in roubles). Furthermore, the inflow of these funds enriches those companies whose executives are involved in Russia’s war effort and have direct links with the Kremlin. According to reports published by independent Russian media, Novatek’s CEO Leonid Mikhelson sponsors volunteers who join the troops fighting on the Ukrainian front.[17]

Gazprom is another company which exports LNG. Rosneft, another state-controlled giant, has similar plans. Its CEO is Igor Sechin, a close aide to Putin who has previously held several high-ranking posts in the Russian administration. It should also be remembered that the LNG sector’s development is significantly disrupting the Arctic ecosystem and causing irreversible environmental damage.

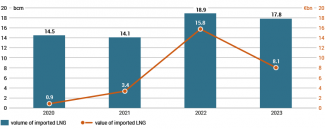

Chart 2. The European Union’s Russian LNG imports in 2020–2023

Source: the author’s own analysis based on data compiled by the Bruegel think tank and Eurostat.

Considering the LNG sector’s importance to the Kremlin, the EU continuing to import LNG from Russia contradicts its declarations of Western support for Ukraine. In 2023, the volume of these imports decreased only slightly compared with 2022, down around 5% to 17.8 bcm (the drop in the value was due to the lower gas prices recorded in 2023). This proves that thus far the EU has neither shown the will to abandon the Russian LNG completely nor significantly reduced the volume of its imports. This is why no embargo on this type of fuel has been introduced.

For some EU member states (Belgium, Spain, France), Russian LNG accounts on average for more than 10% of their total gas imports (a portion of this volume is dispatched to recipients in other states via the onshore transmission system). Thus, opposition to the ban is most often communicated by companies from those states which had signed long-term gas supply contracts prior to 2022 (these include Frances’ TotalEnergies and Spain’s Naturgy)[18], as they fear the possible consequences of breaking off these contracts. Moreover, the LNG terminals located in the EU are used as transshipment hubs.[19] In the first three quarters of 2023 around 20% of the EU’s total Russian LNG imports was received in Belgium and France, and was later re-exported to non-EU markets.

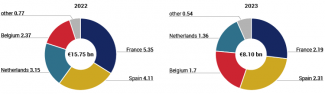

Chart 3. The value of the EU’s Russian LNG imports in 2022 and 2023

Source: Eurostat.

Russia has repeatedly demonstrated that it is ready to sacrifice both the position and the revenues of its domestic export companies in order to put political pressure on other countries, as evidenced by the decision to use the supplies provided by Gazprom to the EU as an instrument of pressure as of 2021. It should therefore not be assumed that the Russian leadership sees LNG supplies any differently than it does pipeline gas supplies. Although Russian LNG has a relatively small share in the EU’s total imports (almost 15% in 2022–3), it is mainly imported by four countries: Spain, France, the Netherlands and Belgium. In this context, it should be remembered that these volumes continue to be ‘at Russia’s mercy’ to some degree. By deciding to reduce Russia’s LNG exports, the Kremlin could most likely provoke a hike in gas prices. This, in turn, combined with the possible low filling level of gas storage facilities during the heating season, could spark problems for EU member states.

Paradoxically, the proposals in favour of the EU maintaining its Russian LNG imports – which are mainly motivated by the fear that gas prices could rise due to Russia’s unilateral decision to reduce the supply – could be used as arguments to advocate the abandonment of these imports. Removing this dependence by imposing an embargo on Russian LNG would cancel this threat and also force Russia to redirect its LNG to Asian markets, reduce its competitive advantage, and decrease its export revenues. According to estimates prepared by the International Working Group on Russian Sanctions at Stanford University, an EU embargo could reduce Russia’s revenues of around $5.6 bn annually.[20]

From the European perspective, imposing an EU-wide ban on Russian LNG imports is possible. This argument is supported by the expected increase in the global LNG supply in 2025–7, which will result from the rise in liquefaction capacity in the US, Qatar and other countries at the end of this year. Assuming that the imports from alternative suppliers are stable, abandoning Russian LNG imports will probably not pose any problems for the EU. At the same time, it is worth noting that the solution of leaving the freedom to implement regulations at member state level – allowing them to arbitrarily block receiving infrastructure for fuel from the Russian Federation – will probably not bring a complete halt to supplies from Russia, due to their attractive price.

In this context, a gradual implementation of restrictions should be considered, starting with the introduction of sanctions against the Baltic mid-scale facilities (Cryogas-Vysotsk and Portovaya LNG, which mainly serve the European market). In addition, a timeline for a complete drop of Russian LNG supplies should be devised, including a transition period and a ban on the re-export of Russian LNG at EU terminals. Another highly important element is the political will in the home countries of the companies involved in the development of the Russian LNG sector. For example, the French TotalEnergies company, which holds a stake in Yamal LNG, is still bound by a Russian LNG supply contract, and that forms an obstacle to banning such imports.

The introduction of an EU-wide embargo would bring the EU closer to its goal of completely abandoning Russian gas imports by 2027. Should a complete ban on Russian LNG imports not prove feasible, due to concerns about potential shortages, a solution enabling gas procurement via a common purchasing platform and at a fixed price threshold would be worth considering. This would further facilitate price reductions while at the same time eliminating the risk of insufficient supply. However, only an effective blockade of the EU market (including the restrictions implemented hitherto) could deal a major blow to the Russian LNG sector.

At present, Europe receives almost half of Russian-made LNG. This means that such sanctions could significantly worsen the situation of Russian producers. If they lose their Western clients and access to Western terminals, this would disrupt their logistical routes, undermine the prospects of Russia maintaining its status as an important LNG market actor, and challenge the profitability of its efforts to further increase its liquefaction capacity.

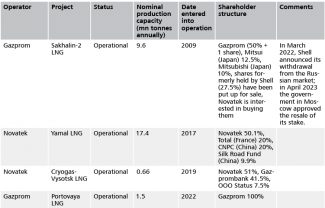

APPENDIX

Table. Current and planned LNG producing facilities in the Russian Federation

[1] In Russia LNG projects are subject to tax reliefs, for example as regards export tariffs and extraction tax. For more see S. Kardaś, ‘Expansion at the state’s expense: Novatek as a driving engine of the Russian LNG sector’, OSW Commentary, no. 275, 27 June 2018, osw.waw.pl.

[2] F. Rudnik, ‘Russia: liberalisation of LNG exports’, OSW, 7 December 2023, osw.waw.pl.

[3] In 2023 the income tax rate paid by LNG exporters was raised from 20% to 34%. Proposals have also been put forward to introduce other tax burdens to gradually reduce the privileged status of the LNG sector.

[4] Data from the IGU World LNG Report 2023 and Lloyd’s Register.

[5] For more see F. Rudnik, ‘Unfulfilled ambitions: Russia’s LNG sector in the grip of sanctions’, OSW Commentary, no. 516, 5 June 2023, osw.waw.pl. No line operating fully on the basis of non-Western components and know-how has been commercialised on the market.

[6] А. Гришков, ‘Запуск завода по сжижению газа в Усть-Луге сдвинули на конец 2026 г.’, Ведомости Северо-Запад, 2 August 2023, spb.vedomosti.ru.

[7] The Murmansk LNG is expected to be the first large-scale facility to which gas intended for liquefaction will be delivered from the transmission system rather than from the gas field. This was the source of a conflict between Gazprom and Novatek regarding who should finance the gas pipeline to transport gas to the facility. For more see ‘Russia: liberalisation of LNG exports’, op. cit.

[8] O. Kobzeva, ‘Lack of Arctic tankers puts Russia’s LNG development dreams on ice’, Reuters, 22 December 2023, reuters.com.

[9] V. Afanasiev, ‘US targets Baltic LNG suppliers with secondary sanctions’, Upstream, 13 December 2023, upstreamonline.com.

[10] F. Rudnik, I. Wiśniewska, ‘The United States steps up its sanctions against Russia’, OSW, 13 November 2023, osw.waw.pl.

[11] C. Aizhu, O. Kobzeva, ‘Russia faces mighty obstacle in western LNG sanctions’, Reuters, 29 December 2023, reuters.com.

[12] M. Humpert, ‘Undeterred by Sanctions Novatek Begins Production at Arctic LNG 2’, High North News, 10 January 2024, highnorthnews.com.

[13] Т. Дятел, ‘А газ и ныне там’, Коммерсантъ, 8 February 2024, kommersant.ru.

[14] Aside from Novatek (60% of the shares), the project’s stakeholders include foreign companies such as the French TotalEnergies company, the Japanese Japan Arctic LNG consortium (Mitsui & Co. and JOGMEC) and the Chinese CNPC and CNOOC companies. These entities hold 10% of the shares each; this is why the investors are entitled to receive the LNG produced at this facility under long-term contracts. See Т. Дятел, ‘«Арктик СПГ-2» теперь сам по себе’, Коммерсантъ, 25 December 2023, kommersant.ru.

[15] A. Hayley, L. Lee, ‘China criticizes U.S. sanctions on Russia’s Arctic LNG-2 project’, Reuters, 26 December 2023, reuters.com.

[16] S. Tani, A. Stognei, ‘Russia foils western sanctions on natural gas project as shipments near’, Financial Times, 21 February 2024, ft.com.

[17] A. Korotkova, M. Zholobova, ‘How the Russian Billionaires Provide Mercenaries to the Russian Army’, Важные Истории, 1 August 2023, istories.media/en.

[18] S. Elliott, ‘EU Council, Parliament agree new gas regulation, Russian import measures’, S&P Global Commodity Insights, 8 December 2023, spglobal.com.

[19] A.M. Jaller-Makarewicz, ‘EU turns a blind eye to 21% of Russian LNG flowing through its terminals’, Institute for Energy Economics and Financial Analysis, 29 November 2023, ieefa.org.

[20] ‘Energy Sanctions: Four Key Steps to Constrain Russia in 2024 and Beyond’ (Working Group Paper #18), The International Working Group on Russian Sanctions, 7 February 2024, fsi.stanford.edu.