China on the road to ‘green’ energy security

China aspires to be the leader of the global energy transformation. Unlike the European Union and others, it hasfocused on its main priorities: enhancing national security and turning its green industry into a driving force for its economy. Reducing pollutant emissions is further down the list of its objectives. For this reason, China has been the world’s biggest investor in renewable energy sources, but it has also spent heavily on coal and nuclear power. Any reductions in greenhouse gas emissions are merely a by-product of these processes; in fact, China has been party to global climate agreements mainly for reasons of prestige.

The West’s response to Russia’s full-scale invasion of Ukraine has reinforced the Chinese ruling elite’s conviction that it needs to fast-track the process of reducing China’s dependence on foreign countries in sensitive areas. The Chinese leadership has also become firmly convinced that it is necessary to find new drivers of economic development as the current model, underpinned by investments in transport infrastructure and real estate, runs out of steam. Indeed, the idea to expand the country’s self-sufficiency, modernise its economy by relying on green industry and domestic technology, and boost economic activity are all linked to energy transition. China’s rapid progress and competitive advantages in strategic sectors have raised fears in other countries that they could become dependent on supplies from China.

Coal as the cornerstone of China’s energy security

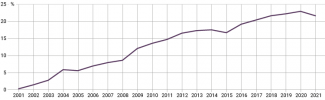

After experiencing rapid economic growth over the past two decades, China has tripled its primary energy consumption and become the world’s largest consumer of energy. In 2022, it accounted for around 26% of global demand, while its GDP and population were each estimated at less than 18% of the world’s totals.[1] Its energy sector’s soaring demand was mainly met by coal mined at home, but its dependence on foreign supplies of raw materials had been growing markedly. Between 2001 and 2023, its oil imports surged more than nine-fold from 1.2 million bbl/d to 11.3 million bbl/d, while its natural gas imports rose from zero to more than 165 bcm per year.[2] Over this period, the share of net energy imports in its total consumption soared from just above 0% to more than 20%; regarding gross volumes, this share surged from less than 8% to around 25%. Currently, supplies from abroad meet about 75% of China’s oil demand and over 40% of its gas demand.

Chart 1. The share of net energy imports in China’s total energy consumption from 2001–21

Source: author’s own compilation based on data from the International Energy Agency (IEA).

Coal, the cornerstone of China’s energy security, has been the main counterweight to the country’s growing dependence on foreign supplies of raw materials. Despite years of efforts to diversify domestic sources of energy production,[3] coal still accounts for around 60% of China’s primary energy consumption.[4] Unlike oil and gas, domestic production meets the majority (more than 90%) of the country’s demand for coal.

Therefore, China’s dependence on this fuel is not a security challenge, but rather one that adds to environmental degradation and makes China the world’s largest carbon emitter responsible for about a third of global emissions, a position which is detrimental to its image. China has pledged to decarbonise, seeing it as an opportunity to support bolster the development of its domestic industry and modernise its economy while also demonstrating its concern for the wellbeing of humanity. The Chinese government has set 2030 as its target to reduce carbon intensity per unit of GDP by 65% from 2005 levels. However, it intends to reach peak emissions even before that date and achieve carbon neutrality by 2060.[5]

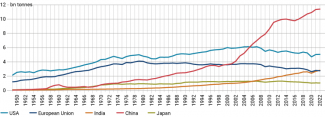

Chart 2. Annual carbon dioxide emissions between 1950 and 2022

Source: Our World in Data based on the Global Carbon Budget.

In recent years, the pursuit of these long-term goals has given way to short-term priorities as climate policy has been subordinated to industrial policy. The Chinese government has emphasised that the green transition will continue, but not at the expense of the security of energy supply.[6] For years, the state has struggled with periodic regional power shortages, which have forced local governments to ration power to businesses and the general public. The problem worsened from 2021–22 when demand for electricity soared as a result of high temperatures while production from hydroelectric sources decreased. At that time, the country’s coal-fired power plants failed to meet the soaring demand due to factors such as a widening gap between the rising costs of producing energy and its low, administratively regulated sales prices, official targets for reducing electricity consumption and stricter mine safety regulations and environmental standards.[7]

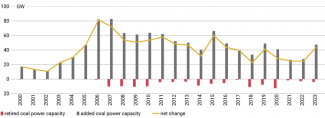

As a result, China has softened its stance: it has increased domestic production of coal and its imports from abroad while ramping up its investment in the coal energy sector. In 2022, the government approved the construction of nearly 90 GW of new coal power capacity, compared to less than 20 GW the previous year.[8] In 2023, China accounted for 95% of all such power plants under construction worldwide.[9] The pace at which it has been commissioning new coal-fired power plants is far greater than the rate at which it has been phasing out its old units. However, due to the use of advanced technologies, the new facilities emit less pollution and are more energy efficient.

Chart 3. Added and retired coal power capacity in China from 2000–23

Source: author’s own compilation based on data from the Global Coal Plant Tracker.

In the coming years, as the production of ‘green energy’ increases in China, its coal consumption should start falling. Coal-fired power plants, as a more reliable source, will stabilise the energy system at times when renewable sources cannot provide enough energy, for example during windless days, droughts and at night. In turn, changes in road transport will drive down the demand for oil. Today, one in two passenger cars sold in China has an electric or hybrid engine.[10] The demand for oil will be sustained by air and sea transport and the production of plastics. Fossil fuels currently account for about 87% of China’s total energy consumption. DNV’s analysts have predicted that this figure will drop to 40% by 2050.[11]

Despite its efforts to boost domestic production, China will still have to import most of its oil from abroad. In order to mitigate the resulting national security risks, its government could diversify oil sources and supply routes, build up crude stocks and ramp up imports from its allies, most notably Russia. The Chinese government is likely to use oil and gas purchases as a tool of its foreign policy by rewarding those exporters who will endorse China’s actions on the international stage.

The green revolution

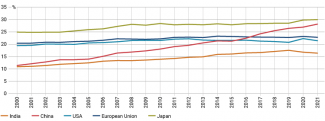

China is the world’s top emitter of carbon dioxide and continues to spend most heavily on expanding its coal power capacity, but it also tops the list of countries that have invested the most in renewable energy sources. Its massive investments in developing conventional and ‘green’ sources are justified by the rising demand for electricity amid the rapid electrification of its growing economy which is heavily based on industry. Electricity now accounts for nearly 30% of total final energy consumption, up fromjust over 10% in the early 2000s. In this respect, China has already surpassed the US and Europe; according to DNV’s projections, it will catch up with today’s global leader, Norway (47%), within a quarter of a century.[12]

Chart 4. The share of electricity in total final energy consumption from 2000–21

Source: author’s own compilation based on data from the IEA and Eurostat.

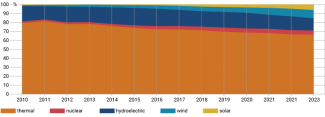

The rapid electrification is helping to strengthen China’s energy security as the country generates almost all of its electricity from domestic sources. The thermal power industry, mainly coal, plays a leading role here, accounting for 66% of the country’s total electricity production.[13] However, for more than a decade now, its share has been gradually falling while the importance of renewable and nuclear sources has been growing. In 2023, renewable sources generated 29% of the country’s electricity, compared to only 17% in 2011. This upward trend is expected to accelerate as investment in renewable energy development continues to surge. The International Energy Agency (IEA) has projected that almost half of China’s electricity will come from renewable energy sources by the end of this decade.[14] DNV has estimated that this ratio will exceed 90% by 2050.[15]

Chart 5. The share of individual sources in China’s electricity production from 2010–23

Source: author’s own compilation based on data from China’s statistical office.

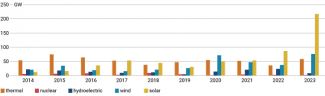

The growing role of renewable energy sources is the result of massive investment. In 2023, China installed more than 300 GW of new capacity and accounted for around 60% of global renewable growth. China’s total installed capacity from renewable sources reached almost 1.5 TW at the end of last year and surpassed the installed capacity from thermal power for the first time.[16]

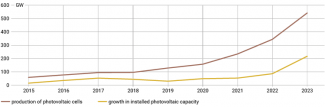

Photovoltaics has been growing at the fastest rate. Last year, the capacity of cells connected to the Chinese grid was greater than the total solar capacity installed in any other country to date.[17] Wind power generation also surged by a record margin. In both cases, the growth in new capacity was more than double that in 2022. Against this backdrop, the hydropower sector (which has been plagued by extreme weather events in recent years) and the nuclear sector registered only moderate growth in capacity.[18] According to the IEA’s forecasts, China will install almost four times as much renewable capacity as the EU and five times as much as the US between 2023 and 2028.[19]

Chart 6. Growth in installed capacity from individual sources in China from 2014–23

Source: author’s own compilation based on data from China’s National Energy Administration.

In the face of this rapid growth in new capacity, managing the electricity system poses a challenge. Official data shows that wind and solar power curtailment rates were 2.7% and 2% respectively in 2023, compared to 17% and 10% respectively;[20] this was forced by the excess of electricity relative to the grid’s absorption capacity. However, analysts from Fitch Ratings have signalled a rise in these figures in the first quarter of this year to 3.9% and 4%.[21] At the same time, it is unclear what percentage of wind and photovoltaic farms remain.[22]

It also seems reasonable to ask whether energy has become another area where overinvestment has led to a waste of resources owing to guidelines from Beijing and rivalries between provinces. Local governments have been promoting the development of renewable energy sources in order to stimulate economic growth, increase their tax revenues and create jobs, but they have failed to consider the local demand for energy and the possibility of transferring it to other regions.

In order to make more efficient use of this new capacity, China needs to expand its transmission and distribution networks and develop energy storage facilities. China covers a vast territory: its north-eastern and north-western parts have the greatest potential for generating power from renewables, while demand is mainly concentrated in the eastern and southern coastal regions, which are more populous and better developed.

Developing renewable energy sources also comes with security challenges. Photovoltaic and wind farms as well as hydroelectric power plants use local renewable sources, but constructing them requires raw materials that China does not produce in sufficient quantities. It remains dependent on imports of key raw materials, such as silver powder for photovoltaic panels and nickel, lithium and cobalt for batteries. To secure access to these resources, Chinese companies have been investing heavily in foreign mines, planning to double their number from 40 to 89.[23] Regarding lithium, they acquired ten of the 20 large mines that were sold from 2018–22 for around $8 billion.[24] They have also invested billions of dollars in the mining sector in the Democratic Republic of the Congo, the world’s top cobalt producer.[25] According to data from Benchmark Mineral Intelligence, Chinese companies process (both at home and abroad) 75% of the world’s cobalt, 67% of lithium and 58% of nickel. In all these cases, their share has increased by about 20 percentage points between 2016 and 2024.[26]

Critics have also pointed out that the production of equipment for generating energy from renewables has contributed to environmental pollution as it requires large amounts of electricity, which China currently obtains mainly from coal. However, this is a short-sighted perspective. As analyst Lauri Myllyvirta from the Asia Society Policy Institute has noted, over the past year the production of photovoltaic panels accounted for an estimated 140 Mt of CO2, or just over 1% of China’s total CO2 emissions. However, these cells are expected to generate around 640 TWh per year and allow the country to avoid annual emissions of 600 Mt if they substitute coal power or 260 Mt if they substitute gas power.[27]

The driving force for the economy

Renewable energy sources are expected to replace coal as the cornerstone of China’s energy security within 25 years, though coal will remain a stabilising force in the system. Currently, however, renewables are emerging as a crucial driver of economic activity, especially in light of the real estate market crisis and sluggish consumption growth following the government’s abandonment of the ‘zero COVID’ strategy.[28] The IEA’s analysts have estimated that in 2023 clean energy[29] accounted for more than a fifth of China’s GDP growth, which stood at 5.2% according to official figures. Experts from the Centre for Research on Energy and Clean Air have suggested that clean energy’s contribution was as high as around 40%.[30]

The Chinese government also sees renewable energy technologies as an engine for the country’s development and modernisation that provides cheap domestic energy in huge quantities, thus giving local industries another competitive advantage over their foreign rivals. China’s current ruling elite believes that expanding ‘new quality productive forces’ based on domestic scientific and technological innovation will enable the country to reduce its dependence on foreign countries and transform its increasingly inefficient economic model.

China’s clean technologies are also a clear demonstration of their economic and technological success, which until recently was associated with the production of cheap, low-quality goods. China accounts for more than 80% of global manufacturing capacity in 11 clean technologies, including the production of photovoltaic modules, solar cells, silicon wafers, polysilicon, battery cells, cathodes, anodes, electrodes, battery separators, lithium, cobalt sulphate and nickel sulphate. The country holds a dominant position in the production of nacelles for wind turbines and hydrogen electrolysers.[31]

The ‘new trio’ of electric vehicles, batteries and solar panels plays a special role. In 2023, China accounted for 68%, 74% and 86% of the global production of these respectively. The majority of this output went to the domestic market, but exports also grew rapidly. More than 1.5 million electric vehicles (compared to less than one million the previous year), $65 billion worth of batteries (compared to $51 billion in 2022) and photovoltaic modules with a total capacity of 220 GW (up by one third) were sold abroad. In all these cases, the European market was the main customer.[32] Manufacturers operating in China have gained an advantage over their foreign competitors due to several factors, including massive investment and production scaling, fierce competition, a pro-innovation mindset, an integrated local supply chain, a well-developed transport network, relatively cheap energy, low labour costs, lax environmental standards and state support in the form of subsidies and loans on preferential terms.

Chart 7. The production of photovoltaic cells and growth in installed solar capacity in China between 2015 and 2023

Source: author’s own compilation based on data from China’s statistical office.

The industrial clash of interests with the West

In developed countries, the energy and automotive industries are regarded as sectors of strategic importance with development potential. Therefore, Chinese expansion in these areas has raised understandable objections and fears of a second ‘China shock’[33] that would make these countries dependent on the Chinese-controlled source of supply, even if this expansion helps to achieve global climate goals in the short term. In 2023, the European Commission launched an anti-subsidy investigation into electric cars imported from China; in April 2024, it opened three investigations targeting Chinese manufacturers of solar panels and wind turbines. In May, US President Joe Biden decided to raise tariffs on electric vehicles (from 25% to 100%), solar cells (from 25% to 50%) and lithium-ion batteries (from 7.5% to 25%) imported from China. The EU and US governments have also been implementing measures aimed at strengthening domestic clean technology industries, such as the European Economic Security Strategy[34] and the Inflation Reduction Act in the US.

Former Italian Prime Minister Mario Draghi has warned that “China is aiming to capture and internalise all parts of the supply chain in green and advanced technologies and is securing access to the required resources. This rapid supply expansion is leading to significant overcapacity in multiple sectors and threatening to undercut our industries”.[35] Similar voices have been heard from other prominent Western politicians and independent analysts. The Chinese government has pushed back against the narrative about overcapacity in China by pointing to the immense growing global needs associated with the energy transition.[36] In this way, it has been using climate-related arguments to promote its own industry. However, the economic nature of this problem is secondary to the priorities of economic policy. The US and EU governments have been trying to protect their domestic markets from the influx of Chinese goods in order to maintain the competitiveness of their strategic industries and avoid becoming dependent on Chinese supplies. However, they face the challenge of implementing these measures in a manner that does not impede the process of green transformation.

[1] Estimates based on data from the International Energy Agency (IEA) and the International Monetary Fund (IMF).

[2] Author's own calculations based on data from China's customs office and the IEA.

[3] J. Jakóbowski, ‘Green economy or coal ‘counter-revolution’? Challenges to China’s economic reform process’, OSW Commentary, no. 220, 29 July 2016, osw.waw.pl.

[4] China accounts for more than half of the global coal consumption. See ‘Coal Information. Overview’, the International Energy Agency, iea.org.

[5] China First NDC (updated submission), United Nations Framework Convention on Climate Change, 2022, unfccc.int.

[6] In April 2024, President Xi Jinping addressed the problem by stating publicly: “We must neither slow down the development of green and low-carbon technologies, nor be too idealistic; first and foremost, we must guarantee the energy supply”. See an article from 26 April 2024 at in-en.com.

[7] M. Kalwasiński, ‘Kryzys energetyczny w Chinach’, Bankier.pl, 28 September 2021.

[8] ‘Energy Transition Outlook China 2024’, DNV, 2024, dnv.com.

[9] ‘Boom and Bust Coal 2024’, Global Energy Monitor, April 2024, globalenergymonitor.org.

[10] M. Andrews, ‘China’s EV sales now over 50%’, CarNewsChina.com, 20 April 2024.

[11] ‘Energy Transition Outlook China 2024’, op. cit.

[12] Ibid.

[13] Author's own calculations based on data from China's statistical office.

[14] Renewables 2023. Analysis and forecast to 2028, The International Energy Agency, January 2024, iea.org.

[15] ‘Energy Transition Outlook China 2024’, op. cit.

[16] Author's own calculations based on data from China's National Energy Administration.

[17] I. Yin, E. Yep, ‘Infographic: China’s solar capacity growth in 2023 sets new record’, S&P Global, 8 February 2024, spglobal.com.

[18] According to DNV, 55 nuclear power plants with a total capacity of 57 GW operated in China in February 2023. There were also 22 reactors under construction, which will add 24 GW of capacity within a few years. In addition, there are plans for more than 70 new reactors and another 85 GW in nuclear capacity, which will make China the global leader in nuclear power.

[19] Renewables 2023…, op. cit.

[20] See a tweet by Lauri Myllyvirta, 5 February 2024, x.com/laurimyllyvirta.

[21] ‘China’s Wind and Solar Curtailment Rises on Record-High Capacity Growth’, Fitch Ratings, 10 May 2024, fitchratings.com.

[22] In official publications, state institutions use the term “installed grid-connected capacity”, which suggests that the data quoted in this text refers to sources that are part of the electricity system. There are doubts regarding the difference between the higher growth rate of installed renewable capacity and the lower growth in the share of renewable energy in power generation. See J. Chen, ‘Grid Bottlenecks and the Clean Energy Transition: Lessons Learned from China’, ISS Insights, 19 February 2024, insights.issgovernance.com.

[23] P. Bindman, ‘Weekly data: China seeks to extend its critical minerals dominance with overseas investment surge’, Energy Monitor, 21 August 2023, energymonitor.ai.

[24] E. Fowler, ‘China buys half of the lithium mines on the market’, Financial Review, 27 August 2023, afr.com.

[25] M.J. Kavanagh, ‘DRC Strikes New $7 Billion Mine Road-Financing Deal With China’, Bloomberg, 27 January 2024, bloomberg.com.

[26] J. Emont, ‘China Is Winning the Minerals War’, The Wall Street Journal, 21 May 2024, wsj.com.

[27] See a tweet by Laurio Myllyvirta, 20 April 2024, x.com/laurimyllyvirta.

[28] See M. Kalwasiński, ‘Security trumps growth. China’s economy heading into 2024’, OSW, 5 March 2024, osw.waw.pl.

[29] Defined as the production and deployment of clean energy technologies and the sale of electric vehicles and heat pumps. See L. Cozzi et al., ‘Clean energy is boosting economic growth’, The International Energy Agency, 2024, iea.org.

[30] Defined as renewables, nuclear power, electricity grids, energy storage, electric vehicles and railways. See L. Myllyvirta, Q. Qi, ‘Analysis: Clean energy was top driver of China’s economic growth in 2023’, Carbon Brief, 25 January 2024, carbonbrief.org.

[31] J.A. Dlouhy, ‘China Extends Clean-Tech Dominance Over US Despite Biden’s IRA’, Bloomberg, 16 April 2024, bloomberg.com.

[32] J. Zhang, C. Nedopil, China Green Trade Report 2023, Griffith Asia Institute, Griffith University, April 2024, griffith.edu.au.

[33] The first 'China shock' came after the country joined the World Trade Organisation in 2001, when China's exports soared, undermining the competitiveness of industries in other countries and leading to local job losses and social problems.

[34] See P. Uznańska, M. Kalwasiński, ‘Technologiczny de-risking. Europejska lista technologii krytycznych’, OSW, 9 October 2023, osw.waw.pl.

[35] Mario Draghi’s speech at the conference on the European Pillar of Social Rights in Brussels on 16 April 2024.

[36] ‘“China overcapacity” narrative to impact global recovery, green transition: commerce ministra’, Xinhua, 16 May 2024, per: en.ce.cn.