The EUGAL project: the German branch of Nord Stream 2

Despite causing great controversy in the EU, plans to build the Nord Stream 2 gas pipeline are steadily being implemented. The project is opposed by some member states, and has been criticised by the European Parliament and the EC Commissioners responsible for energy policy. Despite this, in May, the operator of the pipeline network in the eastern Länder of Germany, the German-Russian company GASCADE, announced the start of preliminary planning procedures for the EUGAL project, the land branch of Nord Stream 2. The new gas links, which would be constructed with the substantial participation of German companies, are supposed to guarantee Germany the position of a key gas hub on the European market. In the absence of any sign of alternative branches, the planned flow capacity of EUGAL suggests that most of the gas from Nord Stream 2 could reach Central European markets and Ukraine, as well as the Balkans and Italy. Gazprom’s strategy of defending its share of the European market by competing on price supported by the planned infrastructure inter alia could thus undermine the profitability of projects to diversify sources of supply in Central Europe, such as regional LNG projects, and allow the transit of gas through Ukraine to be minimised.

The EUGAL project

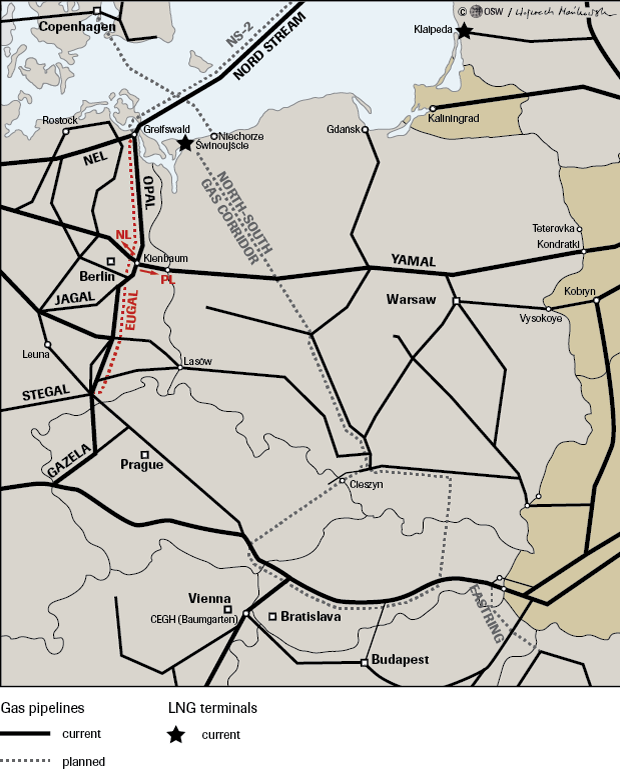

EUGAL is planned as an internal German land leg of the Nord Stream pipeline, which is to be created by Gazprom and European (including German) companies. The EUGAL pipeline should to a large extent run in parallel with the already-operational OPAL pipeline to the Czech-German border, and should have an additional exit point to the German network in Brandenburg. It is also, like the OPAL and NEL branches of Nord Stream 1, a project of the operator GASCADE, which is a joint venture between Gazprom and BASF/Wintershall. GASCADE has justified the planned capacity of EUGAL (up to 51 bcm) by a study they conducted of demand by participants on the markets of Germany and the neighbouring countries.

In May the initial phase of designing the pipeline started; GASCADE filed an application for permission to plan the route in Sachsen-Anhalt; on 7 June, meanwhile, a similar procedure began in Brandenburg. The presentation of the project in those areas where EUGAL is planned to run will take until the autumn, and the public consultation should be completed by mid-2018. According to GASCADE’s plans, EUGAL’s first branch should be built and put into service in the year 2019, and so it would be constructed in parallel with Nord Stream 2, while the second branch could be completed by 2020. The possible creation of EUGAL is thus closely linked with the future of Nord Stream 2.

The EUGAL concept is accompanied by a number of unknown factors. The estimated cost of the project has not been specified; nor is it clear how the operator intends to avoid restrictions on the use of the full capacity of the gas pipeline, in the light of the EU’s rules on third-party access (TPA). The lack of full exemption from TPA on the OPAL pipeline, which Germany has been soliciting for years (another reply from the EC in this matter is expected in June), means that only about 50% of its capacity is being used. It is possible that, in the absence of prospects for obtaining significant exemptions from TPA, EUGAL’s capacity will be offered at auction to third companies as well. In this way, the emergence of the new EUGAL project (which seems to be in fact another branch of the OPAL pipeline) can be considered as an attempt to create a new image of the planned gas pipeline, and as a symbolic break from the problems that plagued OPAL.

German support for new gas pipelines

In principle, there is no debate in Germany on the consequences of constructing the new gas pipelines. Admittedly, the opposition from Central Europe, Ukraine and Italy to Nord Stream 2 has been noticed in Germany, but the German government has not responded to the complaints raised, and has been constantly stressing the commercial nature of the project. Germany has invariably responded to the argument about the clash between the planned gas pipelines and plans to diversify energy supplies to the EU, as described in the EC’s document on the Energy Union, and in the EC’s gas package February 2016, by saying that the new gas pipelines will not lead to a restriction of security of energy supplies to Central Europe, or limit the role of Ukraine in the transit of gas to Europe.

However, the German government has not specified how it will be possible to maintain transit through Ukraine in the face of the stagnation in demand for gas in the EU, the clear redirection by Gazprom of ever larger amounts of gas for the Nord Stream, visible since 2014, and the increasing likelihood (if EUGAL is completed) that recipients whose gas had traditionally been sent via Ukraine (Central Europe, South-East and Italy) can be supplied via pipelines running through Germany. In this context, filling Nord Stream 2 with gas, at least in the short term, will require the transportation of gas which hitherto had been sent via Ukraine. Representatives of the German government have stated that Nord Stream 2 will be compatible with EU law. According to the German government, this pipeline should not be subject to the EU’s Third Energy Package, as it will not run over the territory of the EU, but only the exclusive economic zones of some member states.

In the German coalition there is a consensus as to the compatibility of the Nord Stream 2 and its new onshore branches with the interests of German companies and with the strategic interest of making Germany a key gas hub, thereby increasing its influence on the EU gas market. Moreover, Chancellor Angela Merkel has avoided making any public statements critical of the project, which can be considered as tacit acceptance of the plans to construct the pipeline. The project is being led by the deputy Chancellor and economy minister Sigmar Gabriel (SPD), who during a visit to Moscow in 2015 allegedly promised Russia that the European Commission would not interfere with the implementation of the project, as restricting Gazprom’s participation in it, what would reduce the profitability of the business. Isolated voices of opposition to the project were raised within the Christian Democratic party. Manfred Weber, the head of the People’s Party in the European Parliament, indicated in a letter to the German minister of the economy that the construction of Nord Stream would pose a threat to the supply of gas to Central and Eastern Europe. Also, the Greens have stated that it is difficult to reconcile the construction of new pipelines with German plans to reduce CO2 emissions and develop renewable energy sources. However, these arguments have not convinced the Federal Government.

Possible effects of the creation of EUGAL

The creation of EUGAL and Nord Stream 2 would strengthen Germany’s position on the European gas market as a key gas hub – both as a physical node, and also as a place for gas trading (including increasing influence on gas prices). The construction of a new gas pipeline would also strengthen the role on the German market of GASCADE, which is 50% owned by Gazprom, and its control of gas infrastructure in eastern Germany. The development of the gas network in the region would allow gas to be transmitted from the trans-Baltic route to the south and west of Germany (and the Netherlands) as well as to Central Europe, Ukraine, the Balkans and Italy (see Map). It is not clear to what extent the EUGAL project was consulted with the other participants and operators on the German market, or how it would fit into the publicly discussed need to ensure additional deliveries of Russian gas onto the domestic German market, in connection with its growing import needs resulting from falling gas production in the Netherlands and Germany.

The implementation of EUGAL in its maximum planned capacity would increase to 87 bcm physical capacities to send gas from Nord Stream 1 and 2 south to the Czech-German border, where some gas could reach southern Germany, but the majority would pass through the existing and emerging infrastructure in the Czech Republic and Slovakia and the Austrian CEGH hub to the Central European, Balkan and Italian markets, as well as to Ukraine. It could also supply 11 bcm to the Polish market (via the Kienbaum-Mallnow connection). Central Europe would thus become not only an export market, but also an important link in the further distribution of Russian gas flowing via the Baltic Sea to Germany. In particular, the transit importance of the Czech Republic would rise.

Nord Stream 2 and EUGAL would make it possible to marginalise the transit role of Ukraine, whose infrastructure could only be used for the transit of gas to Moldova and Turkey. At the same time, in conjunction with Gazprom’s strategy of defending its role on the EU gas market, and greater flexibility in pricing , the new pipelines would hinder not only new diversification projects in Central Europe, but also the supply of gas from sources other than Russia via the already existing infrastructure. The new gas connections would also change the direction of gas flow and the shape of regional integration in Central Europe, increasing the role of connections to the German market, and of German exchanges in the gas trade. In particular, increased north-south transfers by Germany would restrict the chances for a North-South Corridor to emerge in its currently planned form, in which transit via Poland was supposed to play a large part.

Map

Appendix

Description of the Nord Stream 2 and EUGAL projects

Nord Stream 2

- route: about 1200 km along the bottom of the Baltic Sea, running for the most part in parallel to Nord Stream, from St. Petersburg to Germany (Greifswald)

- capacity: 55 bcm (2 branches)

- project’s executor: Nord Stream 2 AG, registered in Zug, Switzerland

- shareholders: Gazprom (50%), BASF/Wintershall, Uniper, ENGIE, OMV, Shell (10% each)

- cost estimated at €9 billion

- estimated completion date: end of 2019

EUGAL

- route: 485 km from Vierow near Greifswald to Deutschneudorf on the Czech border

- additional entry point: Kienbaum in Brandenburg, from which gas connections run to Mallnow on the German-Polish border and Oude Statenzijl on the German-Dutch border

- capacity: maximum of 51 bcm (2 branches)

- project’s executor: GASCADE Gastransport GmbH (a joint venture between BASF/Wintershall and Gazprom)

- shareholders: Gazprom and BASF/Wintershall (50%) through the WIGA group (which also controls NEL and OPAL)

- cost: no estimates

- estimated completion date: 1st branch by the end of 2019, the 2nd by 2020