Belarus: a difficult start to oil supply diversification

On 15 May, Foreign Minister Uladzimir Makey announced that the US would start supplying Belarus with oil, with the first delivery to be made in June to the port in Klaipeda (Argus reports that this will be 90,000 tonnes) and then unloaded and transported to Belarusian consumers by rail. Since the beginning of the year, Belarus has purchased oil additionally from Norway and Azerbaijan (and through swap deals in Kazakhstan) and Saudi Arabia. Meanwhile, since January, it has reduced the level of deliveries envisaged for that period from Russia, which to date has monopolised supply to Belarus, by as much as 50%, as the intended level of import of Russian oil for 2020 was 24 million tonnes. As a result, in the first four months of this year, the refineries in Navapolatsk and Mazyr processed only 4.7 million instead of a minimum of 6 million tonnes, which was the level of supply last year. Most of the oil processed during this period was Russian (3 million tonnes) while the rest came from alternative sources (800,000 tonnes), its own output, and reserves. In Q I alone, the level of production at the two refineries combined fell by 40%, and the value of exports of crude oil products by more than 60%, to just over USD 500 million. To date, petrochemical production represented approximately 10% of Belarus’ GDP, 25% of its exports, and 20% of its budget revenue.

Commentary

- The oil supply diversification comes due to eruption of a dispute with Russia, which has been attempting to use the energy instrument to enforce Belarus to deeper integration within the Union State. The resulting search for alternative crude oil supplies begun at the beginning of the year is now primarily a tactical move on the part of Minsk, intended to reduce the pressure from Moscow by demonstrating that it has the capacity to develop its oil security. This is indicated by the provisional and short-term nature of the agreements signed with the individual suppliers (for a maximum of 3–4 tankers each of 80,000 tonnes of oil) and the fact that there is no information about the price at which the oil was purchased, even in official Belarusian import statistics. Experts on the sector estimate that Norwegian oil could cost as much as USD 67.6 per barrel, while oil from Azerbaijan or Kazakhstan was in the range of USD 27 to 36.5 per barrel. In any case, the price was higher than the applicable Russian rates at this time. In addition, complex logistics of alternative supplies, which entail marine transport, transfer of the load in ports belonging to neighbouring countries (up to now Klaipeda and Odessa) and – on the Lithuanian route – rail transport – means that this is much more expensive than import from Russia. This is a particularly important issue at a time of economic downturn, when low prices of oil and oil products do not balance transportation charges, which are less prone to changes on the market.

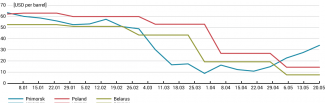

- Regardless of the dispute between Moscow and Minsk that lasted from January to March concerning terms for oil supplies, leading to a significant reduction in oil deliveries, Russia continued to be Belarus’ main supplier. In Q I, deliveries of Russian oil came to 1.55 million tonnes, which was just under 82% of Belarusian oil imports. Following the signing of contracts with key Russian producers, April deliveries came to 1.56 million tonnes, which was approximately 78% of monthly imports. In May, Rosnieft signed contracts with Belarus for purchase of up to 9 million tonnes of oil by the end of the year. The pricing conditions are more competitive than those of other partners, due among other things to Belarusian refineries being connected directly to the Russian pipeline network. Argus reports that the oil price delivered to Belarus via the Druzhba pipeline fell from USD 52.6 per barrel in January this year to USD 7.6 per barrel in May. Current prices on the spot markets are at more than USD 30 per barrel (WTI, Brent, Dubai). The price for Belarus is also lower than the value of a barrel of Urals oil offered on spot markets – reaching more than USD 34 on 20 May in Primorsk. At the same time, it is not clear whether the price for Belarus includes special discounts (bonuses) given by Russian firms or whether this is solely due to falling oil prices on the global markets.

- Until the end of the year, Russia will continue to be the main oil supplier to Belarus, and it is also likely, as the situation on the oil markets improves, that Moscow will again make supplies part of its policy towards Minsk. This is demonstrated by the current refusal on the part of the Russian Federation to revise the terms of gas supplies to Belarus. The Kremlin has said that a discount is conditional upon progress being made in talks on further integration of the two countries. A statement made by Vladimir Putin on 19 May at the Eurasian Economic Union summit confirmed this, when he emphasised that setting a single transportation tariff for deliveries of gas to Armenia or Belarus would require Minsk’s and Yerevan’s consent to establishment of an economic community, joint budget, and common Eurasian Economic Union tax policy.

- In spite of major concerns regarding whether alternative oil supplies are cost-effective, in the coming years diversification could prove a viable strategy for Belarus’ energy security, and could extend beyond the present back-and-forth in negotiations with Moscow. Even in January this year, President Alyaksandr Lukashenka recommended reducing the percentage of Russian oil to a maximum of 40% of imports, which would mean an unprecedented change in national energy policy. Although this was a statement of a primarily political nature, and a result of a severe crisis in Russian-Belarusian relations, it is Minsk – under pressure from Moscow – that is beginning to take specific measures to develop its own infrastructure. On 29 April, the President of Belarus signed an order for construction of the Gomel–Gorki pipeline in the years 2020–2023, with a capacity of 6 million tonnes. This venture, at a cost of USD 120 million, would connect the two Belarusian refineries, and would make distribution of oil obtained from sources other than Russia considerably more efficient and less expensive.

- Also significant are talks that have been underway with Poland for a number of months concerning organisation of supplies via the Gdansk Naftoport, and subsequently the reverse, via the Druzhba pipeline to the Mazyr refinery. The technical capacity on the Adamowo– Mazyr section is intended to be between 1.2 and 2.4 million tonnes. Although this issue has not been decided definitively (one of the hurdles is limited infrastructure) on the Belarusian side the prices for transmission of oil from Poland have now been officially approved. At the same time, PKN Orlen is looking at the option of reactivating the Mažeikiai – Navapolatsk pipeline, which would definitely lower the cost of oil supplies to Belarus from Lithuania. A decision to diversify oil supply permanently could mean a major increase in the purchase price of oil, and also require costly investment in the two refineries to render them capable of processing more types of oil other than Urals. The current decline in demand for oil products on the market will significantly reduce revenue for Mazyr and Navapolatsk, and this will hamper generation of funds for the investments. At the same time, Minsk is not presently ready to allow foreign investors access to its petrochemical sector.

Annex. Urals Russian oil prices January–May 2020.