An attempt at a new start in energy cooperation between Belarus and Russia

On 19 February, Belarus and Russia signed an agreement to redirect exports of some Belarusian petroleum products from ports in the Baltic states to Russian ones. The three-year agreement covers the total handling of up to 9.8 million tonnes of fuel, and the first deliveries are scheduled for March this year. Minsk’s decision is political and a form of retaliation against the Baltic states, mainly Lithuania, for criticising the measures taken by the Belarusian government after the rigged presidential election in August 2020. The agreement does not determine in detail all terms of cooperation. However, for example the level of transhipment tariffs in Russian ports and transit based on the ship-or-pay formula favour Moscow. At the same time, this agreement, which is more favourable to Russia, is Minsk’s bargaining chip in the recent attempts to renegotiate the terms of Russian gas and oil supplies. An internationally isolated Belarus is risking an increase in its already deep energy dependence on Moscow and is trying to expand the scope of Russian subsidies. The shared threat of public unrest and Western sanctions is being used as an argument to support these moves.

The doubtful cost-efficiency of redirecting the exports to Russia

The issue of redirecting exports of Belarusian petroleum products to Russia has been raised in negotiations between the two countries for several years. Once the agreement on the transhipment of fuel was signed, Minsk also declared that it was possible to redirect the exports of potash fertilisers to Russian ports, although Belarus owns 30% of the cargo terminal in Klaipeda, which is currently the main port for this category of goods. In practice, despite the negative political context, Minsk is unlikely to completely discontinue collaboration with the Lithuanian, Latvian and – to a minimum extent – Estonian ports, for financial reasons. Furthermore, the deal with Russia concerns approximately 3 million tonnes of fuels annually, while the goods exported via the Baltic ports in recent years reached double the value, which accounted for approximately 50-60% of the total exports of petroleum products manufactured in Belarus (the rest was delivered by rail to Ukraine).

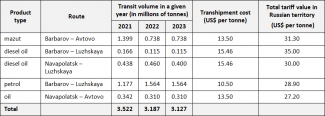

One of the reasons why Minsk is not ready to redirect the entire volume of exports to Russia is probably the reluctance of Russian operators to guarantee a competitive offer. The costs of transhipment of petroleum products in Russian ports are higher than in Klaipeda. According to the Interfax agency, the transhipment fee in Ust-Luga per tonne of low-sulphur petroleum products is 1,150 roubles (approximately EUR 12.6), while in Klaipeda it is EUR 5.7. High rates are also envisaged in the appendix to the intergovernmental agreement on the handling of petroleum products: for example, for diesel fuel it is US$15.46 (approximately EUR 12.8) per tonne, and for petrol US$10.5 (approximately EUR 8.7) per tonne. In addition, the greater distance separating Russian ports from the Belarusian fuel outlets will also increase the costs.

The agreement also stipulates that the detailed terms of cooperation in the field of the transport and transhipment of Belarusian petroleum products will be specified in trade agreements concluded between Russian and Belarusian companies. It is known that the state-owned Belarusian Oil Company and New Oil Company (a private company linked to Lukashenka’s inner circle) will be the partners of the Oil Terminal in St. Petersburg and the port in Ust-Luga. It is not yet clear whether, to what extent and for how long, Russian entities will prioritise their Belarusian partners. The only confirmed relief is the 50% discount set by Russian Railways on freight tariffs for Belarusian petroleum products transported to ports in the northwest of Russia, in force since 2016 (valid until 2025). However, entrusting the transport to the Russian carrier will be much less cost-efficient when compared to cooperation with Lithuania, where the main operator was a Belarusian forwarder.

Although the intergovernmental agreement does not specify the group of Russian entities that will sign contracts with Belarusian companies, it assumes that trade contracts will be based on the ship-or-pay formula. This means that Belarus will incur the costs of transhipment of the contracted volumes regardless of whether they are physically exported via Russian ports.

Attempts to increase the oil subsidies…

Minsk hopes that the Belarusian fuel export agreements, which are favourable to Moscow, will help it negotiate better conditions in other segments of energy cooperation. One proof of this is the fact that Lukashenka authorised the government in January and February to renegotiate oil supply contracts as well gas supply and transit contracts with Russia. Minsk is not satisfied with the current rates, especially in the oil sector. Given the reform of oil extraction taxation being implemented in Russia (the so-called tax manoeuvre), the price preferences for Belarusian importers have been gradually reduced year by year. As a result, the oil price for Belarus will reach 90% of the market value in 2021. Moreover, according to data from Argus agency, the current oil price for Belarus (US$61.3 per barrel) is higher than for other importers to whom Russian oil is supplied via the Druzhba pipeline (US$53 per barrel for Germany and US$53.3 per barrel for Poland, Slovakia and Hungary). Another problematic area is the issue of renewing the currently suspended mechanism of compensating Belarusian importers for oil suppliers’ premiums from the Russian budget, which was in place in 2020. As part of this, compensation of around US$5 per tonne of oil was offered. Hence, it can be assumed that Minsk will make efforts to ensure that at least the compensation for the margins of Russian oil companies (applicable in 2020) are reintroduced, and also that Moscow compensates for the growing costs associated with the tax manoeuvre.

…and the gas subsidies

Belarus has also been making efforts towards receiving a lower offer for the gas price, even though the rate of US$128.5 per 1000 m3 applicable this year is quite good, considering the upward trend on European markets. In mid-January this year, the prices at the TTF gas hub reached US$335 per 1000 m3, and the average price for that month was US$257 per 1000 m3. There are many indications that any possible modification of gas supply terms is still the subject of bilateral consultations. One proof of this was the meeting of Gazprom’s CEO with the Belarusian ambassador to Russia, which took place a few days before the Putin-Lukashenka summit in Sochi. Moscow has consistently held the position that the creation of a common fuel market (including gas) leading to a reduction in prices (which Minsk is insisting on) must be linked to building a common market in other areas, including the budget or tax system. It cannot be ruled out that Moscow would be inclined to offer a much higher gas price cut if Minsk agreed to make such concessions.

Conclusion

Since an increase in transport costs would adversely affect the competitiveness of Belarusian fuels on Western markets, in particular on the oil exchanges in London and Rotterdam, Minsk does not plan to completely withdraw from exporting them via the Baltic states and shift all shipments to Russian ports. The Belarusian government will try to balance both directions, using the agreement signed on 19 February as a specific example of close cooperation. Minsk will thus be able to use fuel transhipment as a bargaining chip in negotiations concerning priority areas, mainly those related to Russian oil and gas supplies. At the same time, it should not be considered likely that Moscow will be willing to make any major concessions on the terms of energy cooperation, unless Minsk makes further concessions, above all regarding progress in the integration processes both as part of the Union State and of the Eurasian Economic Union.

APPENDIX. Basic terms of shipment of Belarusian petroleum products via Russian ports

Source: Russian-Belarusian intergovernmental agreement on cooperation in the field of the transport and transhipment of petroleum products from Belarus intended for export to third countries via the ports of the Russian Federation (www.publication.pravo.gov.ru/Document/View/0001202102190032).