The G7 has reached a political deal concerning a price cap on Russian oil and petroleum products

On 2 September, the finance ministers of the G7 countries agreed to impose a price cap on Russian crude oil and petroleum products. Although the details concerning the new limits are not yet known, it is extremely difficult to assess the scale of the impact the new restrictions will have against Russia because the proposed solution has no historical precedent. Nor is it known how many non-G7 countries will join the deal and whether it will be possible – and to what extent – to obtain the consent of EU member states. The effectiveness of the new restrictions will also depend on the level of the final price limits, the readiness and determination of Western countries (mainly the USA) to enforce the new solutions, and Moscow's response. There are many indications that the Kremlin may decide to react strongly by limiting the production and export of oil (as well as gas), hoping that in the near future this will exacerbate the problems on the energy market and force Western countries to revise their policy towards Russia.

The content and the goals of the agreement

The arrangements adopted during the meeting of finance ministers of the G7 countries are, for the time being, purely political, and their content is general. France, Germany, Japan, Canada, Italy, the USA and the United Kingdom (the members of the G7) have agreed to introduce a price cap on Russian oil and petroleum products. The level of this cap is, though, to be the subject of further negotiations. The ministers also agreed that it will be possible to provide insurance and transport services for the export of crude oil and petroleum products on condition that they are sold at prices within the established limits. However, there is no information yet on the possible legal consequences for entities violating the restrictions. The timetable for introducing the price cap is to be synchronised with the schedule for implementing the EU embargo on imports of Russian oil (5 December this year) and petroleum products (5 February 2023).

At this stage, it is not clear whether and to what extent the proposal adopted by the G7 will affect the sixth package of sanctions against Russia agreed by the European Union at the beginning of June this year. It was then decided to impose an embargo on imports of Russian crude oil delivered by sea and a ban on importing petroleum products. Imports of oil from Russia via the Druzhba oil pipeline (mainly to the Czech Republic, Slovakia and Hungary, but also to Poland and Germany) have been excluded from the restrictions. In addition, Bulgaria has also been exempted from the ban on the import of Russian oil by sea until the end of 2024. Furthermore, the sixth package prohibits the provision, directly and indirectly, of technical assistance, brokering services and financing related to transport (including insurance and reinsurance) to third countries (including ship-to-ship transfer) of crude oil or petroleum products originating in and exported from Russia.

After the meeting of G7 ministers there were no signs suggesting that the EU wants to withdraw from the implementation of the embargo on imports of Russian oil and petroleum products. However, permitting EU companies to provide transport and insurance services in the case of exports of Russian oil supplied to third countries, provided that the established price limits are respected, would entail the need to modify the restrictions imposed as part of the sixth package of sanctions.

The indirect objective of the G7 arrangements is to limit Russia’s revenues from the sale of energy resources, in particular crude oil and petroleum products. In 2021, the export of these goods generated 80% of revenues from the entire oil and gas sector of the Russian Federation. If gas and oil prices remain so high this year, this could lead to an increase in the value of oil and gas exports from US$ 240 billion in 2021 to nearly US$ 338 billion at the end of 2022. The main objective of the agreement is to limit Russia's ability to finance its aggressive foreign policy, in particular the war with Ukraine.

The conditional effectiveness of the new restrictions

Although the details of the new restrictions have not yet been agreed, it is known that their effectiveness will depend on many factors. This currently makes it difficult to determine their potential impact on the Russian economy and, consequently, on its aggressive foreign policy.

Firstly, it is difficult to assess how effective the new mechanism will be because no similar restrictions have ever been applied to a single country in history. Moreover, the proposed restrictions apply to a country whose share in the global oil market is very significant. According to data published in June this year by BP, the share of the Russian Federation in 2021 in global oil production amounted to 12.2%, making it, together with Saudi Arabia, the world’s second largest oil producer (the United States being the leader with a share of 18.5%). Russia is also the second largest exporter of crude oil in the world, after Saudi Arabia.

Secondly, the effectiveness of the price cap will directly depend on the number of countries that are willing to join the decision taken by the G7. Although the member states of the European Union, the USA, Canada and Japan have imposed an embargo on Russian oil or stopped purchasing it, some countries have increased their purchases. This applies in particular to China, which even before Russia's invasion of Ukraine was the largest recipient of Russian oil (in 2021, the volume of supplies reached almost 80 million tonnes, and their share in crude oil exports from Russia was 35%). In 2022, India and Turkey have also been increasing their purchases of Russian oil. For the time being, nothing suggests that these countries are interested in joining the restrictions adopted by the G7. French Finance Minister Bruno Le Maire said before the group meeting that the success of the new solution would require a broad international commitment. Developing a political decision within the European Union will be a separate problem. The discussions on the sixth package of sanctions against Russia (the embargo on imports of oil and petroleum products) have revealed the difficulties in achieving the unanimity which is necessary for making such decisions.

Thirdly, although the level of the price cap has not yet been determined, the options considered in the public space will not necessarily lead to negative consequences for Moscow. On the one hand, the range of US$ 40–60 per barrel, which is mentioned most often in discussions within the energy sector, would mean that Russia would have to sell crude oil at much lower prices than at present. According to data published by the Argus agency, at the end of August, Russian Urals oil cost between US$ 70 and US$ 96 per barrel, depending on the place of delivery (for example, in Primorsk it costs US$ 70 dollars per barrel, and in the case of supplies to Belarus its price was US$ 96 per barrel). The price within these ranges would also be lower than assumed in the forecasts of the Central Bank of Russia for the next two years. It predicts that in 2022 the price will reach US$ 80 per barrel and US$ 70 one year later. However, a price limit within the range of US$ 40–60 per barrel will keep the prices above the cost of oil production in Russia and could encourage Moscow to keep production and sales abroad at the current level. It is estimated that Russian oil exports could still be profitable at a price of US$ 25–30 per barrel. On the other hand, however, if the supply of Russian oil on the global market becomes limited, a significant increase in global oil prices cannot be ruled out, which would compensate Moscow for the decrease in sales volumes. According to some forecasts, oil prices on the world market could rise to as much as US$ 140–200 per barrel. In a moderate scenario, on the other hand, assuming that the price cap would not be set excessively low, demand for Russian oil could increase as its price would most likely be more competitive compare to oil from other sources. This option would be possible, if the introduced price cap meant that Western countries would simultaneously lift or ease the embargo on imports of Russian oil and petroleum products.

Fourthly, the restrictions on insurance and transport services could potentially affect Russia most severely. According to sources within this sector, 85–90% (and according to some agencies even 95%) of companies handling Russian oil exports are located in the USA, the EU and the UK. Although representatives of the government in Moscow have provided assurance (for example, statements by former president, Dmitry Medvedev) that Russia is ready to replace the certificates issued so far by insurance companies with state guarantees for importers, it is not clear whether such a solution would be accepted by importers and entities administering transport routes. According to media reports, India has issued relevant certificates for about 80 ships belonging to the Dubai-registered subsidiary of the Russian company Sovcomflot. However, the extent to which that type of guarantees could solve the systemic problem resulting from Western restrictions on transport and insurance services is unknown. At the same time, the G7 proposal for these services is less restrictive than the solutions adopted by the EU in the sixth sanctions package. While the EU decision provides for a total ban on the provision of transport and insurance services related to the export of Russian oil and petroleum products to third country markets, the G7 proposal allows the provision of these services, as long as the price limits are respected. The implementation of the G7 proposal would de facto mean a relaxation of the EU sanctions regime adopted in June.

Fifthly, we do not know the extent to which Western countries will be ready and determined to enforce the new solutions. The implementation of the mechanism agreed by the G7 would require political will, especially from the US, to introduce so-called secondary sanctions, i.e. restrictions on entities from third countries that do not comply with the new restrictions adopted by the G7. The signals so far do not indicate that the US administration would be ready to make these decisions towards entities from countries such as India and China. Furthermore, media reports show that at least some EU member states would not be interested in introducing these solutions.

What will Moscow do?

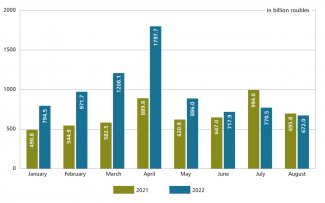

There are many indications that, if the new restrictions are introduced, Russia will decide to completely suspend oil exports to countries which have implemented these restrictions. It is possible that this may happen preemptively, i.e. before the new mechanism enters into force. This solution was directly hinted at by Deputy Prime Minister Alexander Novak. This would fit in with the escalation of the measures taken in the energy sector, which Russia has been consistently carrying out for many months, including restrictions on gas exports to the EU market (stopping transit via the Yamal-Europe gas pipeline, reducing and then suspending transmission via the Nord Stream 1 pipeline). Moscow is aware that its share in oil production and exports is so high that any radical actions may disrupt energy problems on a regional and global scale in the short term. The Russian government's calculation is also most likely based on the fact that the large revenues from the oil and gas sector generated this year (especially in the first half of the year, see chart) will help it cope with the higher costs of its aggressive policy in the following months of this year.

It should also be assumed that, if price limits are introduced for Russian oil and petroleum products, Russia will try to circumvent the restrictions. One of the possibilities is to increase the value of transactions in other areas in relations with the trade partners buying Russian oil (e.g. inflating prices in arms exports to a specific country as an equivalent of the reduced price of oil supplies).

Chart. Russia’s oil and gas revenues in January–August 2021–2022

Source: author’s own calculations based on data published by the Ministry of Finance of the Russian Federation.