Russia: natural gas production continues to fall

Although data about hydrocarbon production in the Russian Federation has not been made public since April, information about the gas sector’s output was included in the industrial production indicators published by the Russian statistics office. According to these statistics, the country’s gas sector continues to record significant production declines, such as have been occurring since the second quarter of last year.

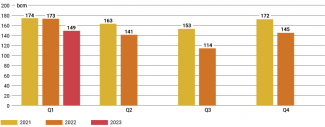

Natural gas production – both dry and wet (i.e. condensate gas, produced together with crude oil) – ran at around 175 bcm in Q1, 12% less than the corresponding period in 2022. As for dry gas alone, 149 bcm of crude was produced in the same period (down 14% year-on-year). Production also fell in April this year, from 53 bcm last year to 44 bcm. For the whole of the previous year, natural gas production (dry and wet) amounted to 672 bcm (down 12% y/y).

Chart 1. Quarterly dry natural gas production in the Russian Federation in 2021–2023

Source: Rosstat.

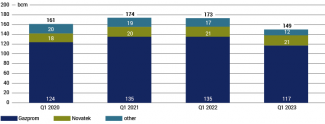

The production of natural gas in Q1 was mainly reduced by Gazprom (down 18 bcm y/y). The reductions over the same period were negligible for other companies while some even recorded increases in production. Russia’s main LNG producer Novatek produced 1% more gas in Q1 this year compared to last year, while Rosneft increased its crude production by 70% (mainly because the new Rospan project started operation).

Chart 2. Dry gas production in Q1 2020–2023

Sources: Rosstat, Gazprom, Novatek.

Commentary

- The drop in gas production in Q1 this year is mainly a consequence of the Kremlin’s political decision to cut pipeline supplies to the EU. Russian natural gas production fell by 24 bcm compared to the same period last year, as reflected in the export figures from the Russian Federation to EU customers. According to Bruegel, some 22 bcmless of the commodity was delivered in the first three months of this year compared to Q1 2022. The relationship between Gazprom’s Russian production and the amount of gas exported showed similar dynamics throughout 2022: at that time, the company sold nearly 85 bcm less to the ‘far abroad’ than it did in 2021, while its overall production fell by more than 100 bcm.

- The significant scale of the decline in Russian gas production recorded since Q2 last year is due to the high production levels prior to this period (the so-called ‘base effect’): in April 2022, two months after launching the full-scale invasion of Ukraine, the Russians intensified the reduction of gas supplies to the EU which they had begun in 2021. The most drastic cut in exports to the EU occurred between Q2 and Q3 last year (a drop of around 12 bcm), which was reflected in a reduction in production. This suggests that from this summer onwards Russian production levels will adapt to the new reality. They will then reach a relatively stable (albeit low) level, similar to those of last summer (around 37–38 bcm per month), and they will rise as the heating season approaches. Overall natural gas production in 2023, both dry and wet, could fall within the range of 630–640 bcm, representing a decrease of 30–40 bcm from last year.

- The Kremlin’s instrumentalisation of gas supplies has mainly had a negative impact on the output of Gazprom, as it is the only company which exports crude via pipelines. The current situation is therefore obliging the company to look for other markets to replace its customers in the EU. However, this task remains difficult in the short term due to the size of the ‘lost’ volume (up to 120 bcm on an annual basis this year, compared to the pre-invasion exports in 2021), infrastructure constraints, as well as uncertainty about the levels of demand among potential buyers. Assuming that the levels of supply to Europe remain unchanged, at the moment we know about a rise in pipeline exports towards China (by about 7 bcm via Siberian Force-1, thanks to an increase in the pipeline’s capacity to 22 bcm) and Central Asia (thanks to an agreement with Uzbekistan to supply nearly 3 bcm annually, implemented from Q4 this year for a period of two years). The existing contract for supplies to Azerbaijan expired in March this year and has not been renewed, although both parties are conducting negotiations on the subject. Meanwhile, it remains uncertain whether sales to other foreign destinations will rise: the Russians have so far failed to make the plan to increase deliveries to Turkey a reality; nor is it clear to what extent the new connections in the east of the country will materialise (see ‘The Power of Siberia-2 gas pipeline remains in the design stage’).

- The cuts in exports to the EU are taking their toll on both Gazprom’s and the Russian Federation’s revenues. The corporation’s net profit for 2022 was only 750 billion roubles (less than a third of last year’s figures), due in part to additional tax burdens. Gazprom is also incurring costs related to the maintenance of its production fields, while a prolonged halt in production at these facilities raises the risk of the destruction of deposits, and subsequent difficulties in restoring production capacity. The reduction in supplies to the EU has also affected the amount of the regular gas revenues to the Russian budget, which dropped significantly in the second half of last year. For comparison, in April only around 101 billion roubles was received, a third of the figure from the same period last year (see ‘Russia: funding the war eases the consequences of sanctions’).

- Representatives of the Russian gas sector are discussing what alternatives they may have to Gazprom’s plan to develop different export destinations that could mitigate the loss of the European market and enable increased production. In this context, the topic of liberalising the internal market – that is, allowing Gazprom to sell gas at market prices to domestic consumers – is being raised once again. It is worth noting, however, that the company has been pushing the idea of market reform for at least two decades, while the government is still showing a great deal of uncertainty about implementing this plan. Another possibility being discussed is the partial ‘freeing’ of commodity exports: Gazprom currently has a monopoly on its sales via pipelines. The option of allowing a wider ‘connection’ of the pipeline network to LNG plants, where the gas supplied would be liquefied and then exported by sea, is under discussion. However, this concept remains an uncertain prospect, for reasons including the high infrastructure costs as well as the technological difficulties. One project of this kind is the Murmansk LNG plant, announced at the end of May; it should be able to produce 20.4 million tonnes of LNG annually. The plant is expected to come onstream in 2027, but the investment itself is currently at a very early stage of design.