Denmark gives go-ahead for Nord Stream 2

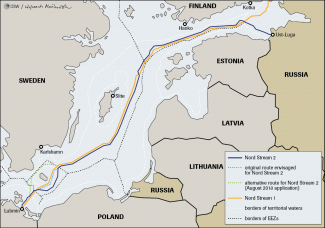

On 30 October the Danish Energy Agency (DEA) issued a permit allowing the construction of Nord Stream 2 in the Danish exclusive economic zone on the route that runs southeast from Bornholm, thereby rejecting the alternative route running northwest from the island. The agency based its decision on the Danish Continental Shelf Act and the UN Convention on the Law of the Sea. This decision, which had been expected for some time (the Russian side had suggested that it expected it at the end of October), comes two and a half years since Nord Stream 2 AG first applied for a permit for construction of the pipeline in Danish territorial waters, which fall within the territorial jurisdiction of the state. Further applications – for the gas pipeline to be laid along other routes in the Danish exclusive economic zone (EEZ, an area of the state’s limited jurisdiction) – were submitted in August 2018 (the route to the north-west of Bornholm) and April 2019 (the route proposed by the Danes running south-east of Bornholm). The company withdrew the original 2017 application in June 2019. The southern route that was eventually decided upon for Nord Stream 2 as the most advantageous from the point of view of Copenhagen’s interests, as it would have both a lower environmental impact and would see reduced disruption to maritime traffic. This route became possible due to the Polish-Danish Maritime Delimitation Treaty of 2018 being agreed and signed. With regard to pipelines that run through the Danish EEZ, unlike in the case of the original route, the Danish Foreign Ministry had no legal grounds to implement a procedure of assessment if the project was aligned with Danish foreign, security and defence policy interests. As a result, Copenhagen is portraying the current decision as of an administrative, and not political character.

To date, approximately 2,100 out of 2,466 km of Nord Stream 2 has been completed (each of two lines covering 1,233 km). To finalise construction of the pipeline, the route on Danish seabed has to be prepared, 147 km of pipeline has to be laid within the Danish EEZ, and the procedure of connection with the German part of the pipeline has to be completed. There is also a relatively short segment to be built in the German EEZ .

The delay in work on Nord Stream 2’s construction is one of the reasons for the increased expense of the project. According to media reports, as of August 2019, Nord Stream 2 AG had spent approximately EUR 9.5 bn, which was reported as being approximately 80% of the budget at the time (originally this was envisaged to be the entire cost of the project). Also in August, company representatives said that, since the procedure for obtaining a construction permit from Denmark had fallen behind schedule, the total cost of the project could increase by EUR 660 m.

Commentary

- The clearance given by Denmark has now de facto determined that Nord Stream 2 construction will be finalised. However, the rapid introduction of US sanctions directed against Nord Stream 2 could substantially complicate and further delay the completion of construction. At the moment, three sanctions bills have been introduced in US Congress, one of which is completely ready to be discussed in the Senate. In the current political climate, on the other hand, this does not seem very likely to happen.

- Completion of Nord Stream 2 by the end of 2019 as scheduled is no longer feasible. Although Denmark has granted the permit and Nord Stream 2 AG is taking measures to complete construction as soon as possible, work on the Danish shelf can commence four weeks from the moment the permit is issued, i.e. on 27 November, at the earliest. This is due to Danish legal requirements and the wording of the decision itself, and is designed to make it possible for the decision to be appealed or contested before the Danish Energy Board of Appeal. The review of potential complaints could further extend this process. According to the estimates of the Russian side, the construction of the Danish segment might only take around five weeks. However, according to Nord Stream 2 AG documentation, together with preparatory works on the Danish shelf, this might be as much as four months. The Danish Energy Agency’s decision also mentions a period of approximately 115 days. Offshore work could be hampered and slowed down by weather conditions in the Baltic in autumn and winter time. Finally, due to the conditions of the German environmental permit for building the pipeline in the German EEZ, construction of the entire Nord Stream 2 will not be completed before mid-May 2020. This permit forbids construction works between 31 October and 15 May in the area where the Danish and German segments are to be connected. The Nord Stream 2 AG application submitted to the DEA in April stated that construction in Danish waters would begin in early 2020 and be completed in the second half of the same year. According to the agency’s decision of 30 October, the investor is to provide an updated version of the schedule for the project and pipe-laying works before work commences. Nord Stream 2 will therefore be completed in mid-2020 at the earliest, possibly a few months later.

- Once construction of the pipeline is completed, tests on how it functions will have to be conducted and it will have to be gradually filled with gas. Given the capacities involved, this could take a few months. Future use of Nord Stream 2 will also depend on two conditions: first of all, on the legal requirements (if and in what degree the amended gas directive contested by Nord Stream 2 AG applies to the pipeline). Secondly – on infrastructural factors, above all the moment the onshore leg – the EUGAL pipeline - commences operation; the first line is due to be built by the end of 2019, and the second significantly later.

- The permit issued by Denmark comes at a particularly important time. On one hand, it has been issued just five days after the same agency issued a permit for the construction of Baltic Pipe between Denmark and Poland, which will intersect with Nord Stream 1 and 2 in the Danish EEZ. On the other it came two days after the failure of the last round of trilateral talks between the EU, Russia, and Ukraine on the future rules for Russian gas transit via Ukrainian pipelines. On January 1, 2020, the 11-year transit contract between Ukraine and Russia expires. The parties still fundamentally differ when it comes to the terms of the future transit contract. Ukraine and the EU (EC) share the view that this should be a 10-year contract for the capacity of approximately 60 bcm per year (the EU does not rule out decreasing it to 40 bcm). Meanwhile, Russia is seeking a short-term or temporary arrangement allowing it to bide its time until alternative Ukrainian export routes become operational, and for the lowest capacity possible. It has also set a range of additional conditions to be met before an agreement of any kind can be signed. Denmark’s permit for the construction of Nord Stream 2 brings the moment of completion of the pipeline closer and so weakens Ukraine’s negotiating position (it has been announced that the next round of trilateral talks is due at the end of November) and makes a long-term transit contract less likely. It is not clear whether this will prompt Ukraine to revise its current position or if it will hamper further talks.

- The president of Ukraine responded publicly to issuance of the permit for Nord Stream 2 by Denmark, saying that it made Russia stronger and weakened Europe. Naftogaz CEO Andriy Kobolyev stated however that Ukraine expected this decision to come because Copenhagen would not be able to withstand constant pressure from the parties in favour of the pipeline completion for long. In the current situation, it is vital for Ukraine to complete the reforms of the gas market as soon as possible, and to implement EU rules to its law, which is a precondition for any kind of transit contract to be signed in the future. The volume of Russian gas transited via the Ukrainian pipelines in 2018 was 86.8 bcm, and in 2019 (up until 28 October) 72 bcm. Revenue from transit fees plays a major role for the financial condition of Naftogaz. In 2018, this revenue was almost US$ 3 bn, which equals 2.3% of the country’s GDP, and in the first six months of 2019 it was US$ 1.54 bn (up 9.9% year on year).

- Denmark’s decision definitely strengthens Russian negotiating position in the ongoing trilateral (EU-Ukraine-Russia) talks on gas transit. Moscow will certainly use the now closer completion of Nord Stream 2 as an additional argument for signing a temporary transit agreement with Kyiv. Russia will also probably push even more strongly for a package approach as a solution to the current problems in its gas-related relationship with Ukraine and the EU – making the conditions for Russian gas transit through Ukraine (volume, duration of the new contract) dependent on: the arrangements on rules of use of alternative export routes; dropping Ukraine’s claims related to arbitration awards; and the resumption of direct purchases of gas from Russia. Some of Russia’s demands (related to dropping arbitration claims) have already been clearly rejected by Kyiv.

- Completion of the construction of Nord Stream 2 and the prospect of the implementation of the European leg of TurkStream would make Russia much more flexible in shaping its export strategy towards Europe in future. It is yet to be seen however when Russia will achieve this goal. In consequence, Gazprom will continue to rely on the Ukraine transit route at least for the next few years due to limited possibilities to use alternative routes. Firstly, a CJEU judgment on the OPAL pipeline somewhat limits the possibility of Gazprom to ship its gas using Nord Stream 1. Secondly, the probability that the amended gas directive will apply to Nord Stream 2 should reduce the capacities available to Gazprom. Thirdly, it remains unclear when and to what extent Moscow will be able to make use of TurkStream (especially its second line) as an alternative to the Ukrainian pipeline.

- The final stage of work on Nord Stream 2, discussions concerning implementing European law with regard to Nord Stream 2, and negotiations concerning the transit of Russian gas through Ukraine will be taking place at a time of change at the European Commission; this is a fragile time for the EU. In the coming weeks (originally planned for the beginning of November) a new EC, presided over by Ursula von der Leyen, is to start work. Among other things, this will mean new appointments to posts that are crucial for the gas-related talks and the rules for the future use of Nord Stream 2. It is unclear in particular who will replace the Vice-President of the European Commission, Maroš Šefčovič, who has long been the face of the EU’s actions and position in trilateral gas talks with Ukraine and Russia. It also remains to be seen what the position the new commissioners and the new president of the commission will be on the future of Ukraine’s gas transit or on the application of EU law to Nord Stream 2. All of this could obstruct the EU in effective and unequivocal action on both of these issues, and this could be another factor, following the Danish permit, weakening the EU’s position (and thus also Ukraine’s position) in the ongoing negotiations. It cannot be ruled out that one consequence of this is that Germany’s role in these negotiations will grow. Germany has been deeply involved for some time in both the promotion of Nord Stream 2 and in Russian-Ukraine transit talks. This is illustrated by regular consultations on gas issues between Vladimir Putin and Angela Merkel, as well as by the German government’s appointment of a special plenipotentiary for gas transit through Ukraine.

Map. Nord Stream 2 route