Russian gas on the EU market: increased transmission and continuing uncertainty

According to President Vladimir Putin's instructions, Gazprom began filling its European gas storage facilities on 8 November. According to information from the company, on 9 November a plan to pump gas into five facilities began implementation; however it is not known which of them Gazprom intends to fill, at what pace and to what extent. A day earlier, the transmission of Russian gas via the Yamal–Europe route towards Germany was resumed. Transit through Ukraine has also increased.

The increase in transmission and the commencement of filling up the storage sites are important signals calming the tense situation on the European market. Their impact on gas prices in the coming months will depend on the sustainability of Russia's actions and on how soon the winter weather begins and how harsh it is. At the same time, the market situation related to the shortage of Russian gas remains extraordinary. Since August, Gazprom has been sending significantly less gas to the EU and, even after increasing the volume in recent days, the supply volume is still lower than in previous years. The company's European storage sites, including important facilities in Germany and Austria, are filled to a record-low level, and during the heating season gas is being pumped into them and out of them at the same time. Therefore, it is not possible to accumulate the equivalent amount of gas in them to that in previous years. In addition, the experience of recent months shows that the level of gas supplies from Russia has become unpredictable, volatile and largely independent of the available transmission capacity. Nor is it known whether it will stabilise in the long term. Combined with the difficult situation on global markets and the outflow of LNG to Asia, this does not bode well for significant price reductions in the coming months. It also shows the market power of Gazprom, whose changes in their modus operandi strongly affect the situation in the EU and may contribute to stabilising or aggravating the crisis on the gas market.

Russian gas transmission to the EU

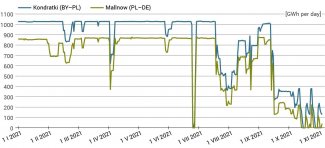

On 8 November in the evening, transmission via the Yamal–Europe gas pipeline, which runs through Poland en route to Germany was resumed. According to the estimate for 10 November, the daily transmission volume was expected to reach 30 mcm on that day. Russian gas supplies in this direction through the Mallnow border point were de facto discontinued on 31 October ( transmission was resumed temporarily and small volumes of gas were sent only on 4–5 November). At that time, the flow was physically reversed on the Yamal gas pipeline, resulting in gas transmission from Germany to Poland.

Chart 1. Russian gas transmission via the Yamal gas pipeline in 2021 (Kondratki and Mallnow points)

Source: ENTSOG.

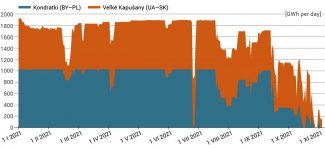

Furthermore, gas transit via the route running through Ukraine and the Veľké Kapušany point on the Ukrainian-Slovak border has been higher since 9 November than on the preceding days. At the same time, the transmission volume on both land routes from Russia to Europe has remained reduced since August this year, and in the following months it further decreased and became increasingly volatile and unpredictable. The transmission reached record-low levels in November. Transmission via the Yamal pipeline is the lowest ever - it dropped to zero for a few days and is now at a level that is four times lower than a year ago. Transit via Ukraine is also very small. After redirecting supplies to the TurkStream gas pipeline to Turkey, Romania, Bulgaria, Greece, Serbia, Bosnia and Herzegovina, North Macedonia and Hungary, the transmission via Slovakia is also increasingly variable. The average volumes of transit in November (68.7 mcm per day) are lower than the average October volumes (74.5 mcmper day) and the capacity reserved by Gazprom under a five-year contract in Ukrainian gas pipelines (110 mcmper day, of which approximately 92 mcm per day via Slovakia). On 9 November, total Russian gas exports to Europe via the Yamal pipeline, Ukraine and Nord Stream amounted to approximately 280 mcm, which is more than a third lower than on the same day in 2020 (approximately 435 mcm). Moreover, Gazprom has still not reserved additional capacity via auctions.

Chart 2. Accumulated Russian gas transmission via Poland (Kondratki point) and Slovakia (Veľké Kapušany point) in 2021

Source: ENTSOG.

How full are Gazprom’s storage facilities in the EU?

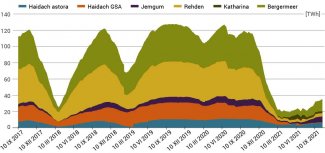

The intensified gas transmission from Russia to the EU has created the opportunity to begin filling up the storage facilities. From 9 November relatively small volumes of gas had begun being pumped into the German Rehden, Jemgum and Katharina storage facilities (these are co-owned by Gazprom). Earlier, the Etzel EKB facility in Germany and (on 23 October) Bergermeer facility in the Netherlands started to be filled. However, gas is still not being supplied to the Haidach site in Austria (neither into its part owned by Astora nor GSA) or to Dambořice in the Czech Republic. At the same time, since the autumn and winter season has begun and insufficient amounts of gas are available on the market, gas began to be withdrawn from a number of storage facilities. It is being drawn from the Etzel EKB, Jemgum, Haidach and Bergermeer tanks.

It should also be noted that the storage facilities in the EU, of which Gazprom is a co-owner or partner, are still filled to a record-low level. Currently, the amounts of gas being pumped in are not large, and there is no information from Gazprom as to which of the five storage facilities are to be filled, at what rate, for what time and to what level.

Chart 3. Accumulated level of filling of Russian gas storage facilities in the EU from September 2017 to October 2021

Source: AGSI+ for Haidach, Jemgum, Katharina and Rehden storage facilities which are co-owned by Gazprom and Bergermeer, where it is a partner and has the right to 42% of its volume.

Traditionally, the storage facilities are filled in the summer season so that enough gas is stored in them before the heating season that begins in October. Under the current circumstances, it is unlikely that they could be significantly filled before winter, even if Gazprom started pumping larger volumes of gas to all of its European storage facilities in the coming days.

The record-low level of gas stored by Gazprom in the EU, the lower and variable transmission via the Ukrainian and Yamal pipelines, as well as the high degree of uncertainty about the future moves from Russia are factors that will continue to contribute to maintaining anxiety on the market and have an impact on gas prices in the EU.